Contents |

Realtor Version

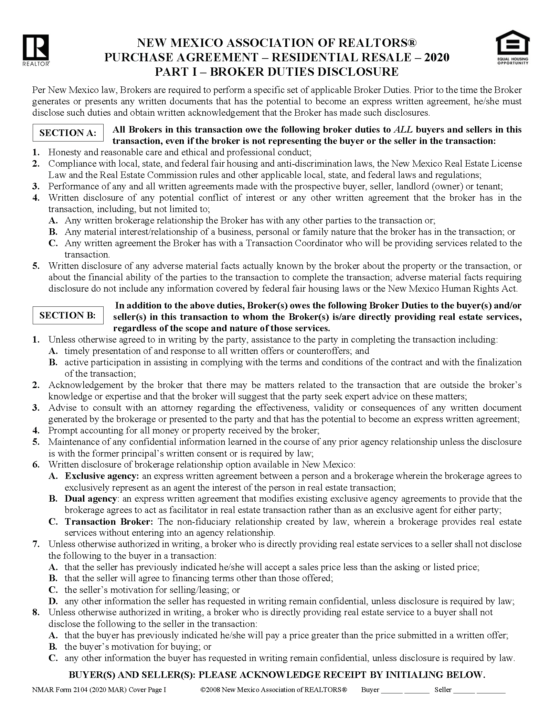

New Mexico Association of REALTORS® Purchase Agreement – This detailed agreement was created by the New Mexico Association of Realtors and may be used by realtors and brokers to handle real estate purchase transactions.

New Mexico Association of REALTORS® Purchase Agreement – This detailed agreement was created by the New Mexico Association of Realtors and may be used by realtors and brokers to handle real estate purchase transactions.

Download: PDF

Required Disclosures (5) |

| 1) Homeowners’ Association Disclosure

If the property is subject to the Homeowners Association Act, this disclosure must be provided to a buyer no later than seven (7) days before closing. The seller has the right to cancel the purchase within seven (7) days of receiving this disclosure.

|

| 2) Lead-Based Paint

In accordance with federal law, seller’s must provide a lead-based paint disclosure statement to potential buyers if the property being sold was built prior to 1978.

|

| 3) Property Disclosure Statement

Real estate agents and brokers must inform potential buyers of any known defects or issues affecting the property and its value.

|

| 4) Property Tax Levy Disclosure

Before the seller may accept a purchase offer, they must have the local county assessor provide a written estimate of the property tax levy. |

| 5) Public Improvement District

If the property is located in a Public Improvement District, the seller cannot accept an offer without providing certain written notices to the buyer as outlined in the state statute.

|