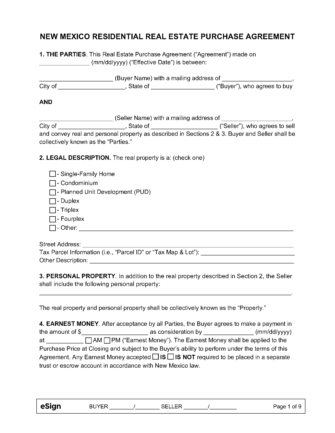

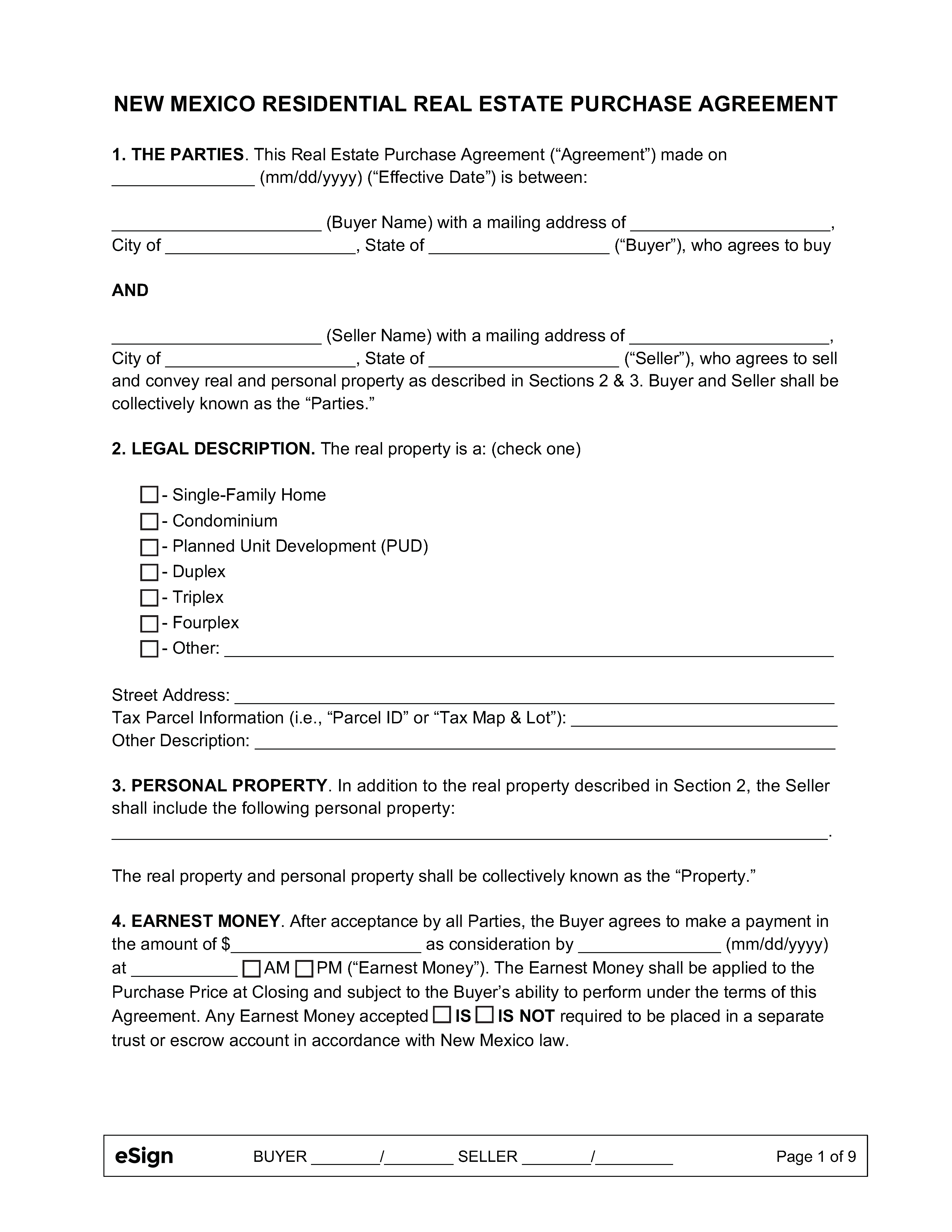

The New Mexico residential purchase and sale agreement is a contract that helps a homebuyer and a seller complete a residential real estate transaction. The document will relay a description of the property in question including the proposed purchase price. The agreement effectively serves to make an offer on the property, and the seller has the right to refuse the offer or negotiate it until the terms are agreeable.

Unlike some other states, New Mexico law specifically does not require the seller or broker to disclose certain information about the property including if a person died on the premises, if there was a felony committed on the site, or if it was occupied by a person infected with the human immunodeficiency virus (§ 47-13-2). It is up to the buyer to do their due diligence and ensure they are comfortable occupying the premises.

Contents |

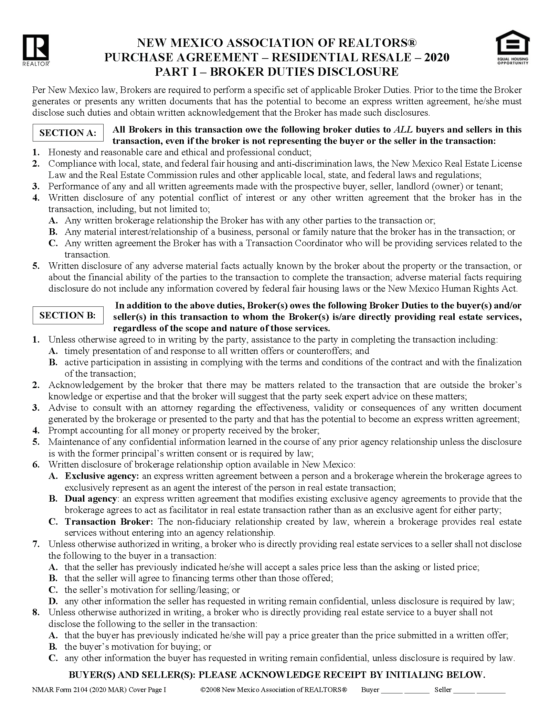

Realtor Version

Download: PDF

Required Disclosures (5) |

|

1) Homeowners’ Association Disclosure If the property is subject to the Homeowners Association Act, this disclosure must be provided to a buyer no later than seven (7) days before closing. The seller has the right to cancel the purchase within seven (7) days of receiving this disclosure.

|

|

In accordance with federal law, seller’s must provide a lead-based paint disclosure statement to potential buyers if the property being sold was built prior to 1978.

|

|

3) Property Disclosure Statement Real estate agents and brokers must inform potential buyers of any known defects or issues affecting the property and its value.

|

|

4) Property Tax Levy Disclosure Before the seller may accept a purchase offer, they must have the local county assessor provide a written estimate of the property tax levy. |

|

5) Public Improvement District If the property is located in a Public Improvement District, the seller cannot accept an offer without providing certain written notices to the buyer as outlined in the state statute.

|