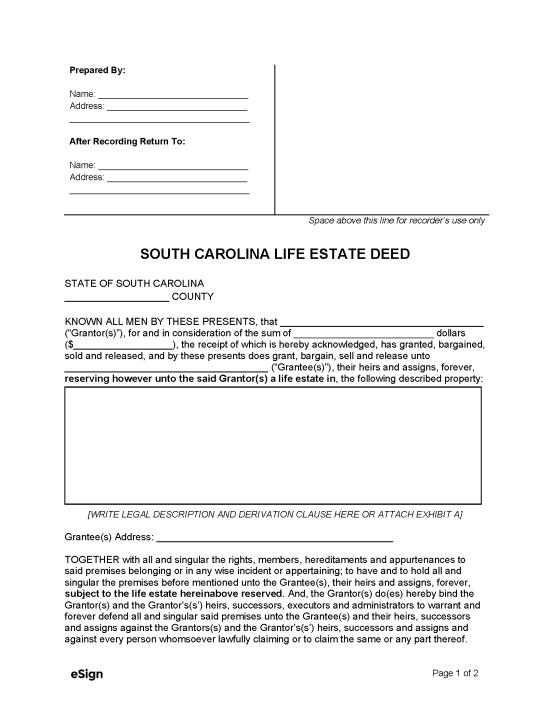

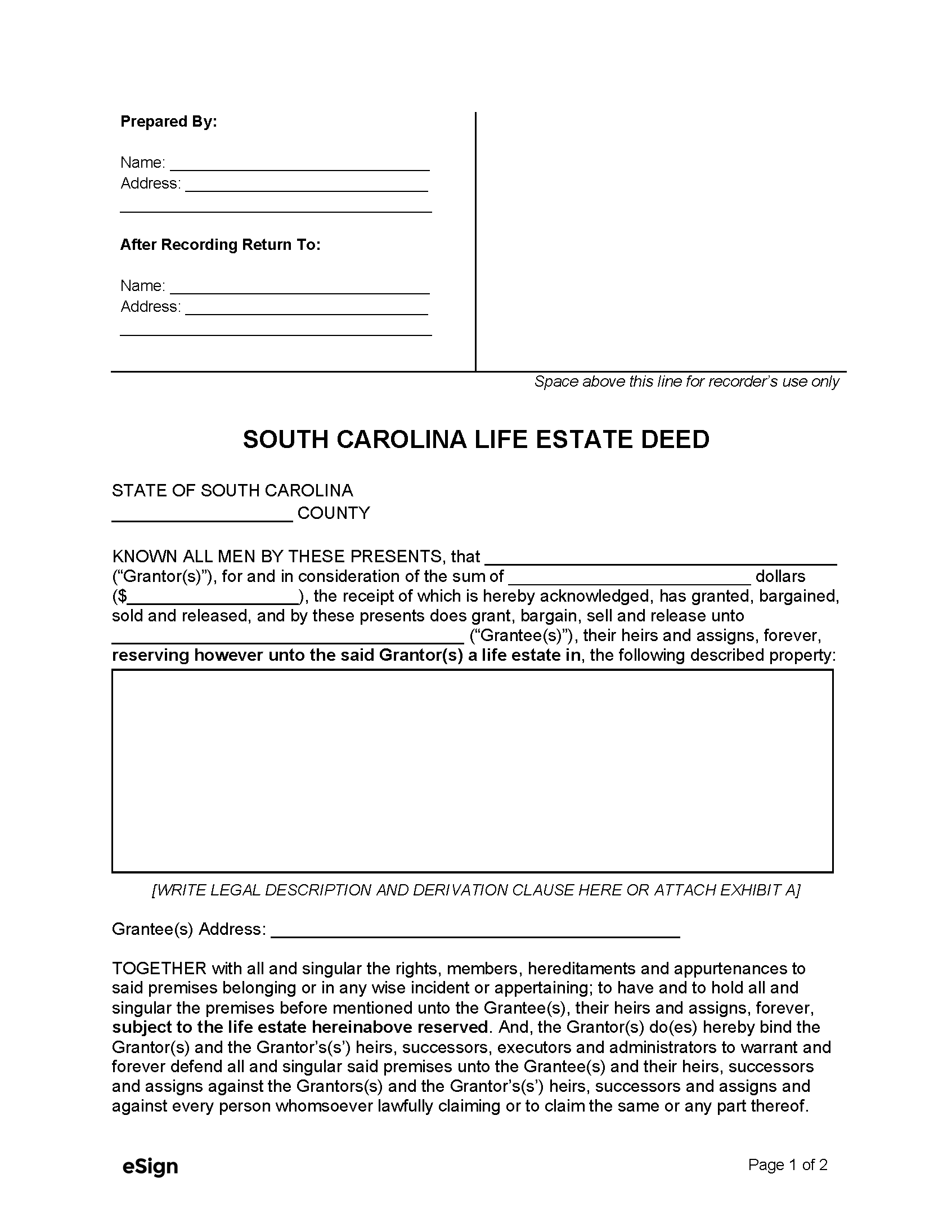

Life Estate Deed: Explained

A life estate deed gives the “life tenant” use of a property for their lifetime, with the “grantee” or “remainderman” receiving full ownership only upon the life tenant’s death.

While alive, the life tenant remains responsible for insurance, repairs, and related expenses, and cannot sell or mortgage the property without the remainderman’s consent.

Requirements for Deed Recording

Signatures – The deed must be signed by the grantor, notarized, and witnessed by two individuals (the notary can serve as one of the two witnesses).[1]

Formatting – There aren’t any state-specific formatting standards for deeds. However, formatting requirements may be imposed on a county level (see Greenville County).

Recording & Fees – Completed deeds must be filed with the County Register of Deeds.[2] The recording fee (as of this writing) is $15.[3]

Affidavit for Taxable or Exempt Transfers – When recording a deed, this affidavit must be completed to specify the transfer tax amount or the reason for exemption.[4]