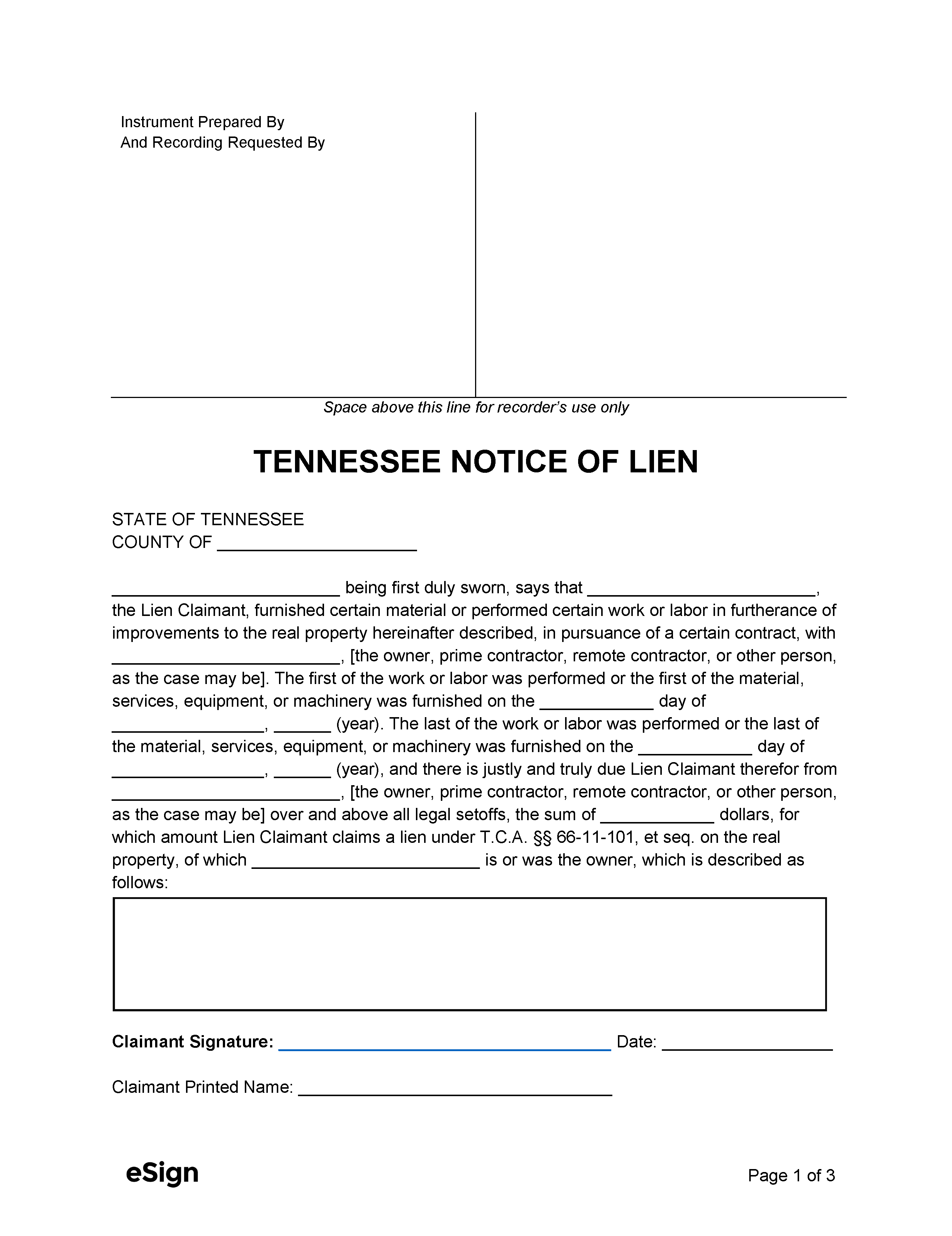

In Tennessee, contractors, subcontractors, and suppliers can file a lien on most types of projects, which is a claim made on the property in case they do not get paid for their work. Residential projects of 1-4 units are the exception as only those dealing directly with the owner (direct claimants) can file a mechanic’s lien (unless the owner is also the prime contractor or they do not intend to occupy the residence).

Technically, the law does not require direct claimants to file a lien in order to reserve their right to enforce a lien, although it is advisable that they do so. Failure to record and file the lien could mean that third parties who have also filed a lien against the property will be able to enforce theirs before the contractor gets the chance to initiate their lawsuit. Indirect claimants (those not in contract directly with owner) must file a Notice of Nonpayment before they file a Notice of Lien.

Laws & Requirements

- Laws: Title 66, Chapter 11

- Signing Requirements (§ 66-11-112(d)): Notary Public

- Time Limit for Recording Lien (§ 66-11-112(a)): Although direct claimants are not required to record a lien in order to enforce one, it is common practice to do so. Therefore, both direct and indirect claimants shall file a Notice of Lien within ninety (90) days of completion of the project.

- Deadline for Enforcing Lien (§ 66-11-106 and § 66-11-115(b)): One (1) year for direct claimants; ninety (90) days for indirect claimants.