Types (2)

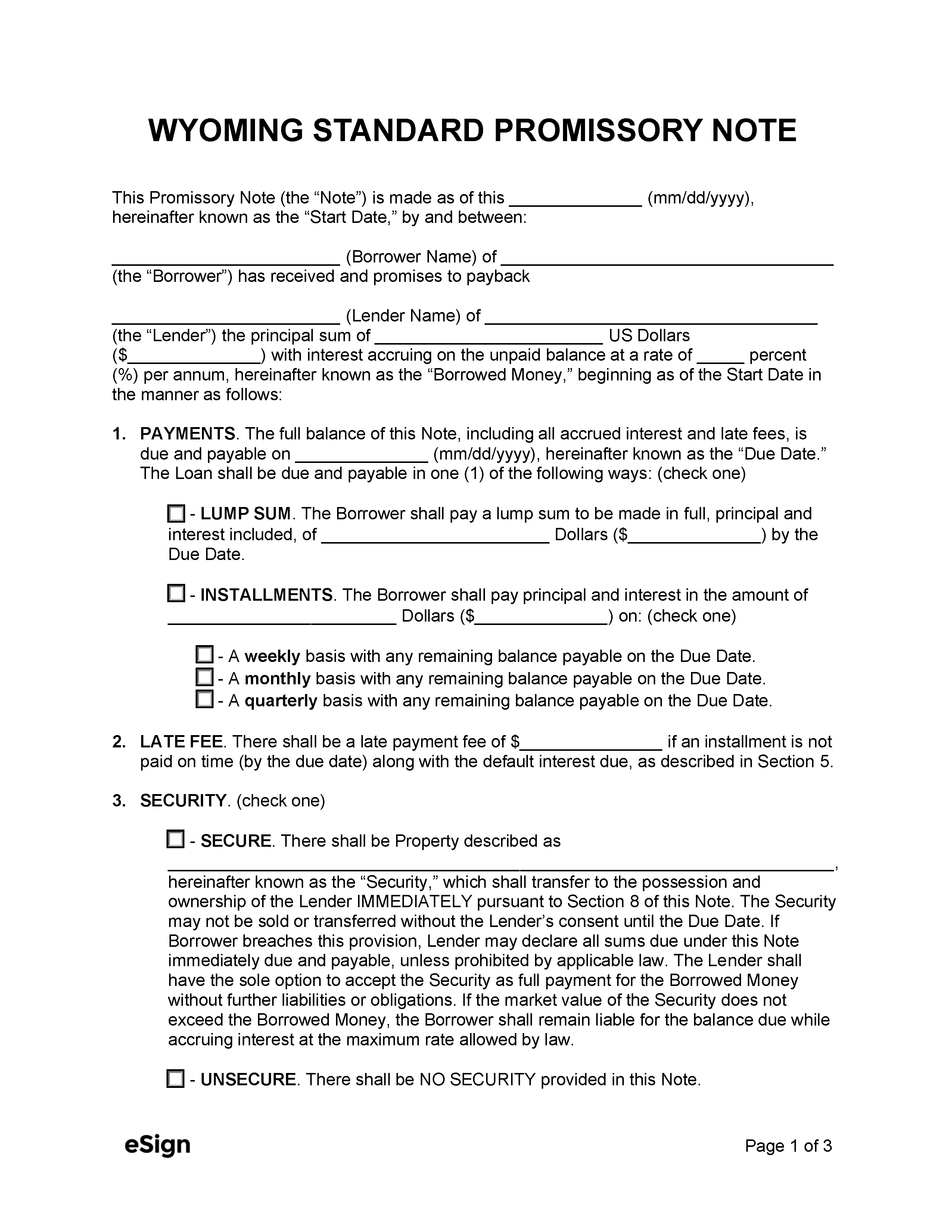

Download: PDF, Word (.docx), OpenDocument

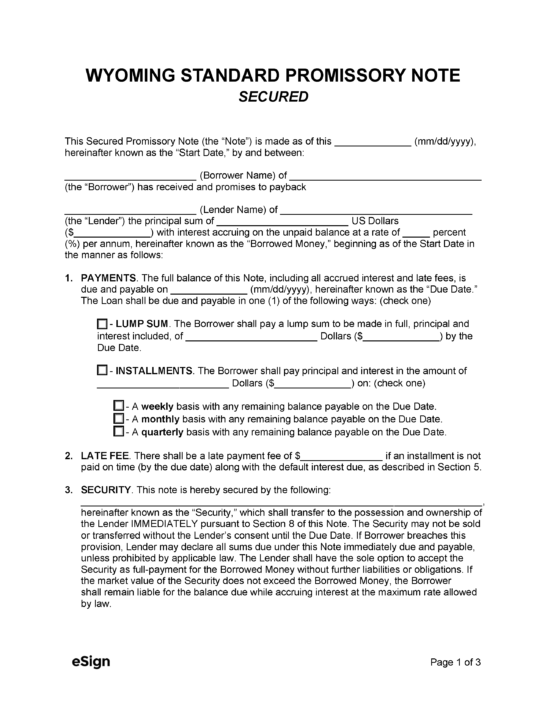

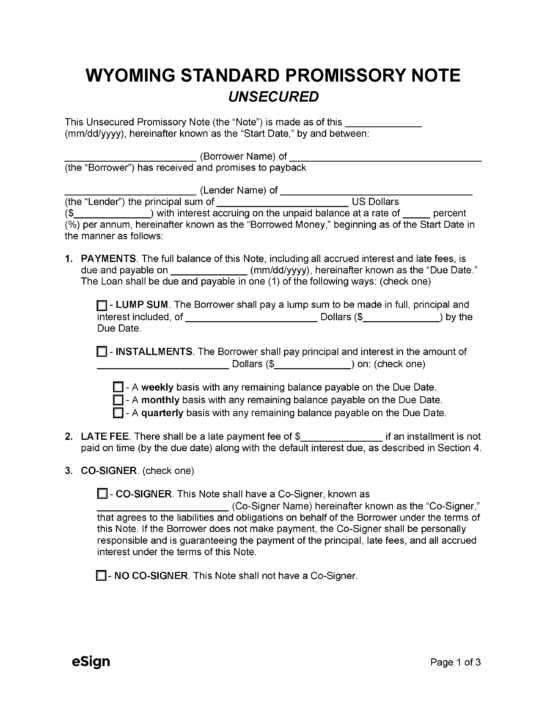

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 14 – Wyoming Uniform Consumer Credit Code

- Usury Rate with Contract: Not mentioned in state statutes.

- Usury Rate without Contract (§ 40-14-106(e)): 7%

- Usury Rate for Judgments with Contract (§ 1-16-102(b)): The rate will be the same as in the contract.

- Usury Rate for Judgments without Contract (§ 1-16-102(a)): 10%

- Usury Rate for Child Support/Maintenance Judgments (§ 1-16-102(c)): No interest