Types (2)

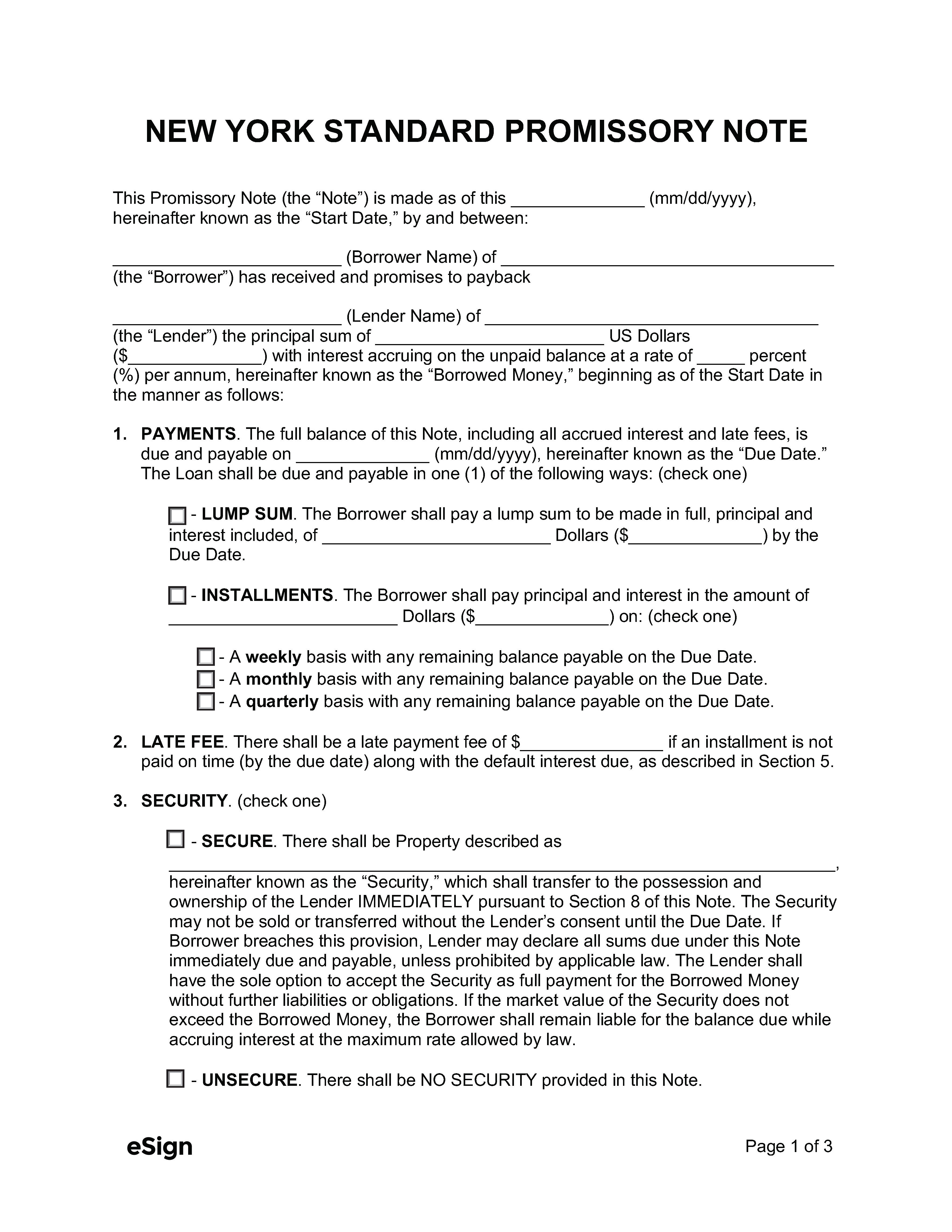

Download: PDF, Word (.docx), OpenDocument

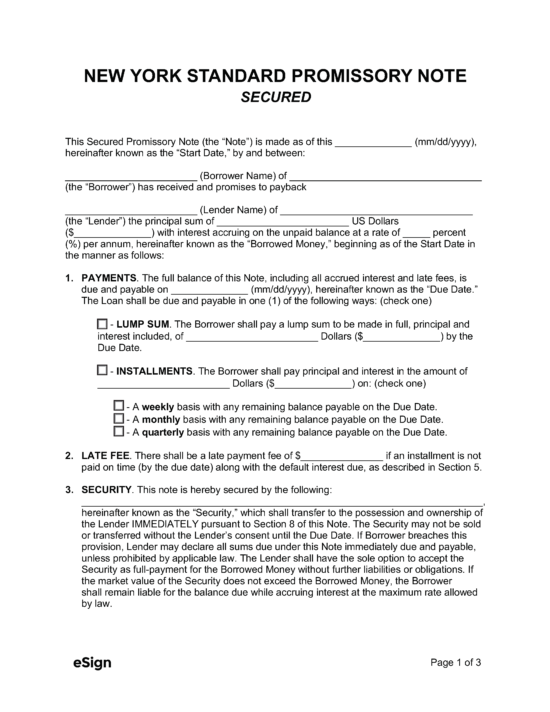

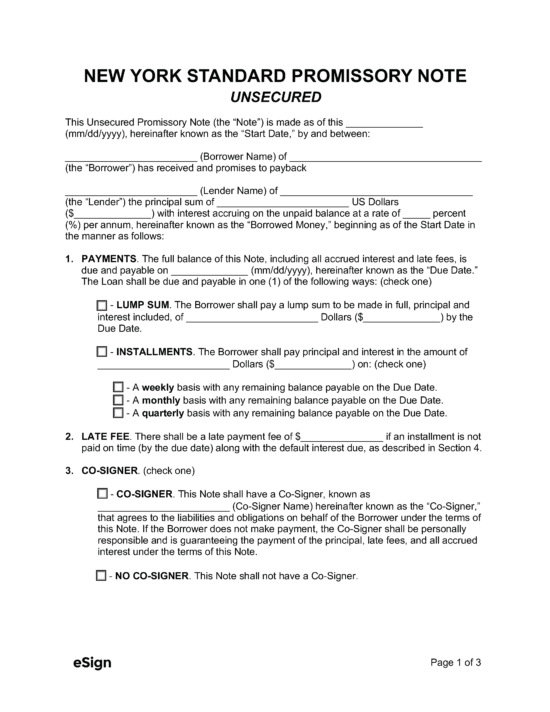

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 2 – Banking & Title 5 – Interest and Usury; Brokerage On Loans

- Usury Rate in General (Banking §14-A): 16%

- Usury Rate for Registered Broker/Dealer Debit Balances (§ 5-525): Prime rate on short-term business loans + 8% if the debit balance is payable on demand and secured.

- Usury Rate for Monetary Judgments (§ 5004): 9%