By Type (4)

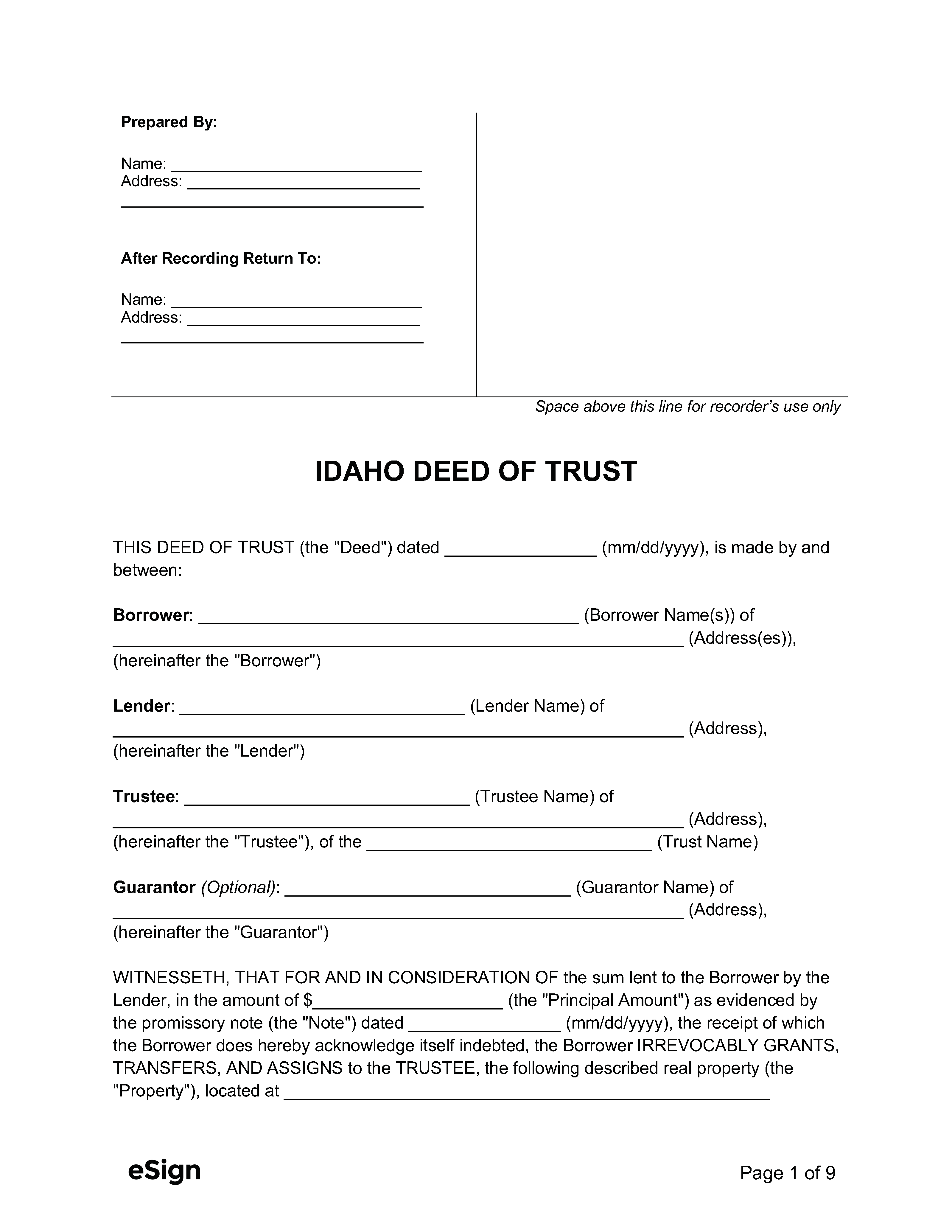

Deed of Trust – Transfers property interest to a third-party trustee as security for a loan. Deed of Trust – Transfers property interest to a third-party trustee as security for a loan.

|

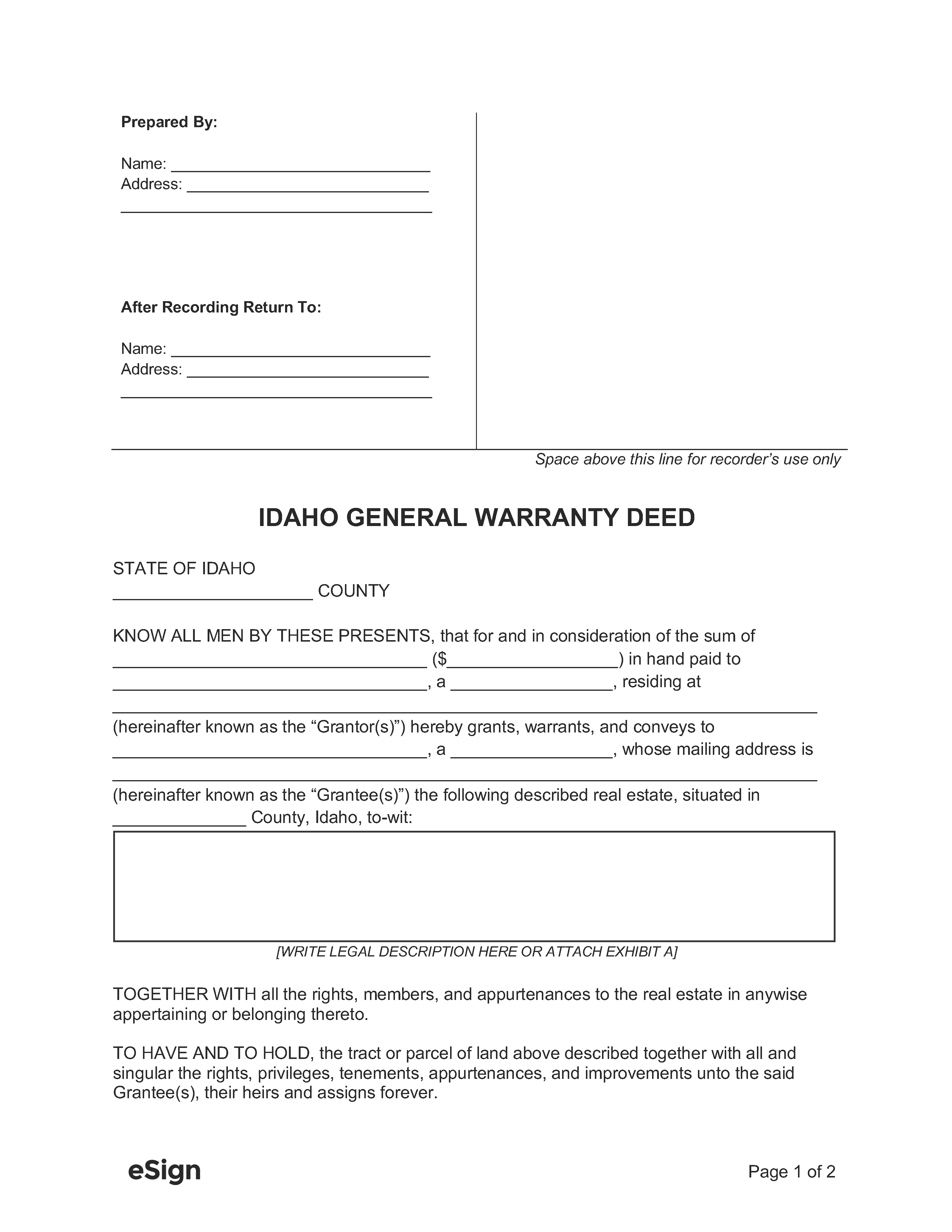

General Warranty Deed – Gives the grantee warranties that the property title has no encumbrances or liens. General Warranty Deed – Gives the grantee warranties that the property title has no encumbrances or liens.

|

|

|

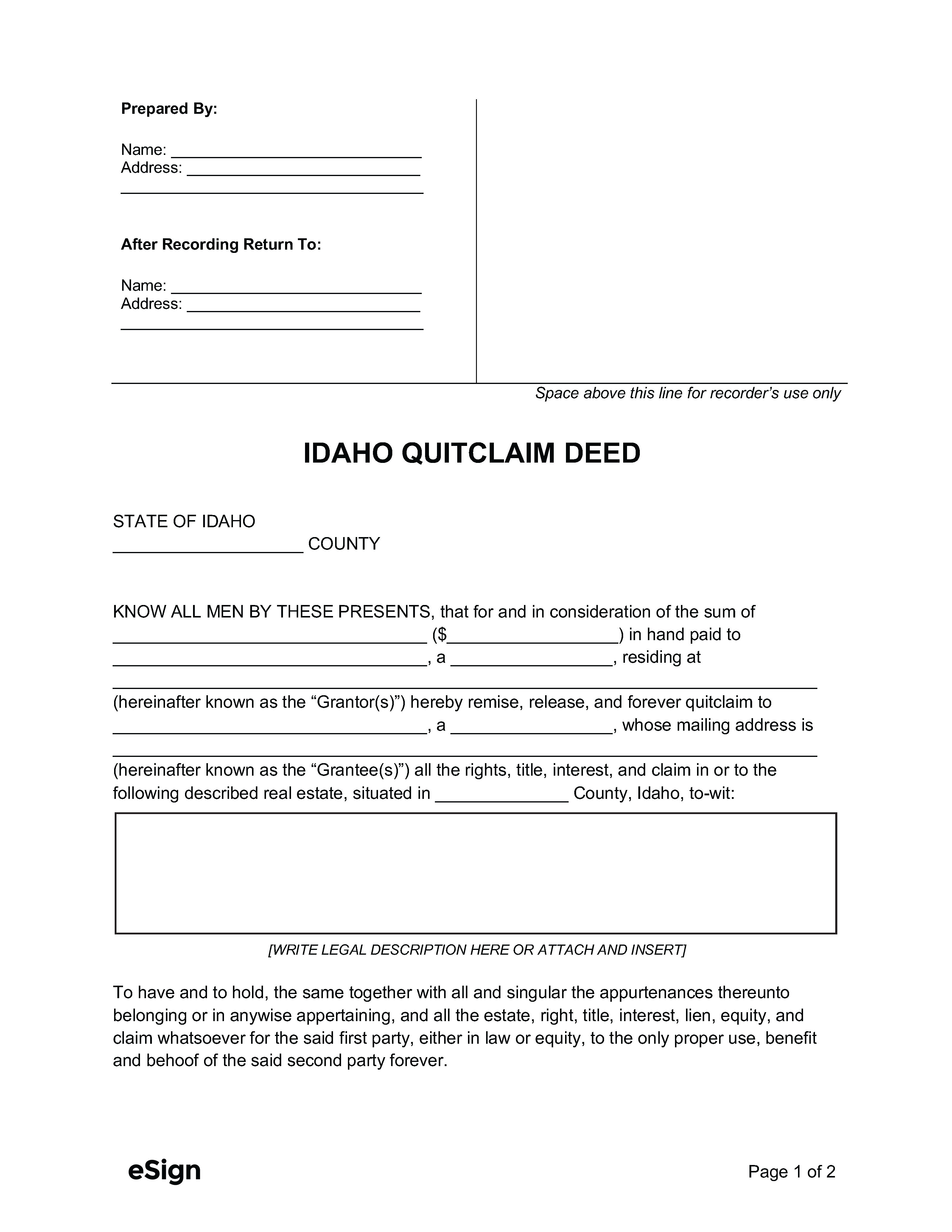

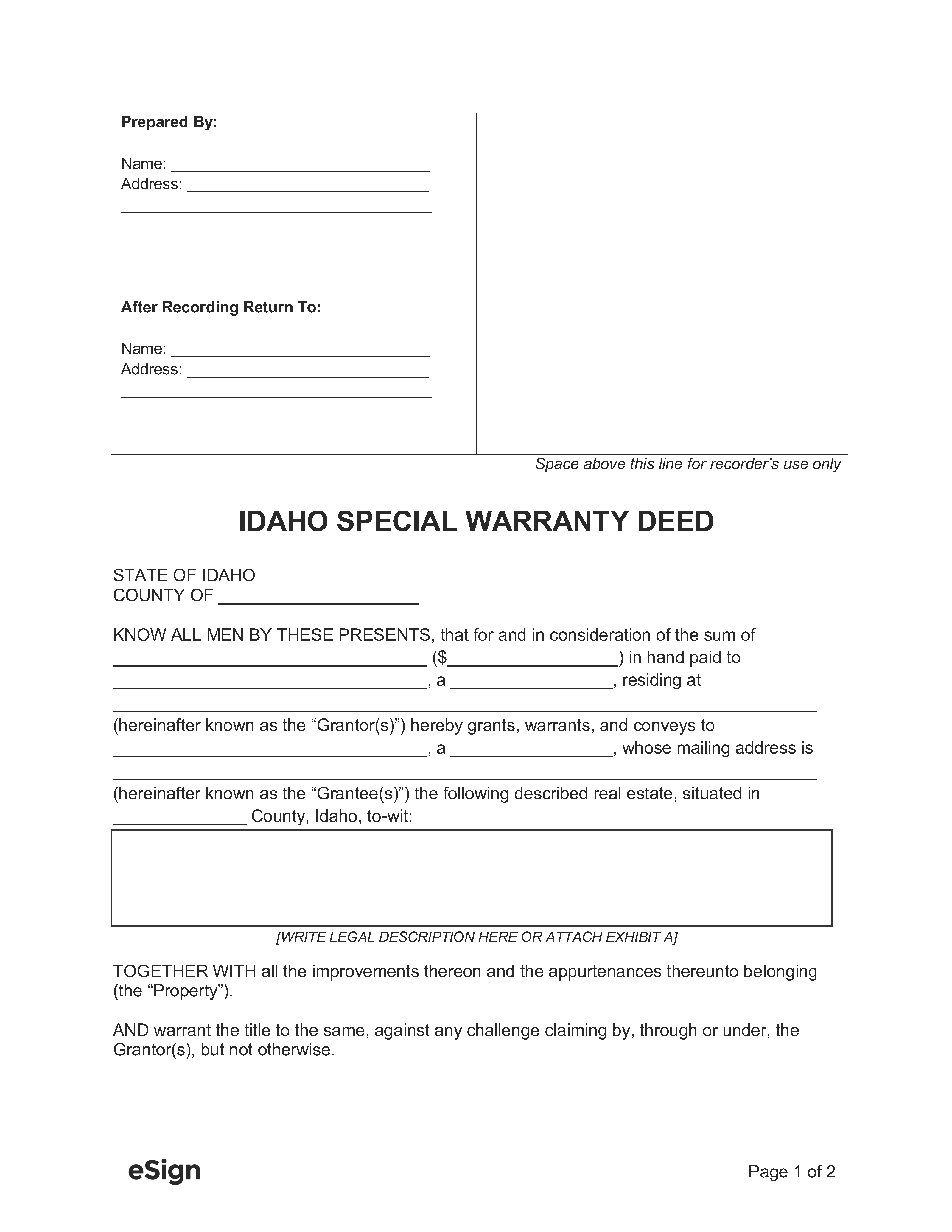

Special Warranty Deed – Only guarantees that the deed has no encumbrances from the grantor’s ownership. Special Warranty Deed – Only guarantees that the deed has no encumbrances from the grantor’s ownership.

|

Recording

Signing Requirements – The grantor’s signature must be notarized.[3]

Where to Record – Deeds must be recorded by the County Recorder.[4]

Cost – Recording fees are as follows (as of this writing)[5]:

- Deeds – $15 for the first 30 pages, $3 per additional page

- Trust Deeds – $45 for the first 30 pages, $3 per additional page