By Type (4)

General Warranty Deed – Transfers real property to a grantee with the full assurance that it is free of claims and encumbrances. General Warranty Deed – Transfers real property to a grantee with the full assurance that it is free of claims and encumbrances.

Download: PDF |

Quit Claim Deed – A deed that conveys property without giving the grantee any title protection. Quit Claim Deed – A deed that conveys property without giving the grantee any title protection.

Download: PDF |

Special Warranty Deed – Warrants that no title issues were caused by the grantor, but doesn’t protect against previous owners. Special Warranty Deed – Warrants that no title issues were caused by the grantor, but doesn’t protect against previous owners.

|

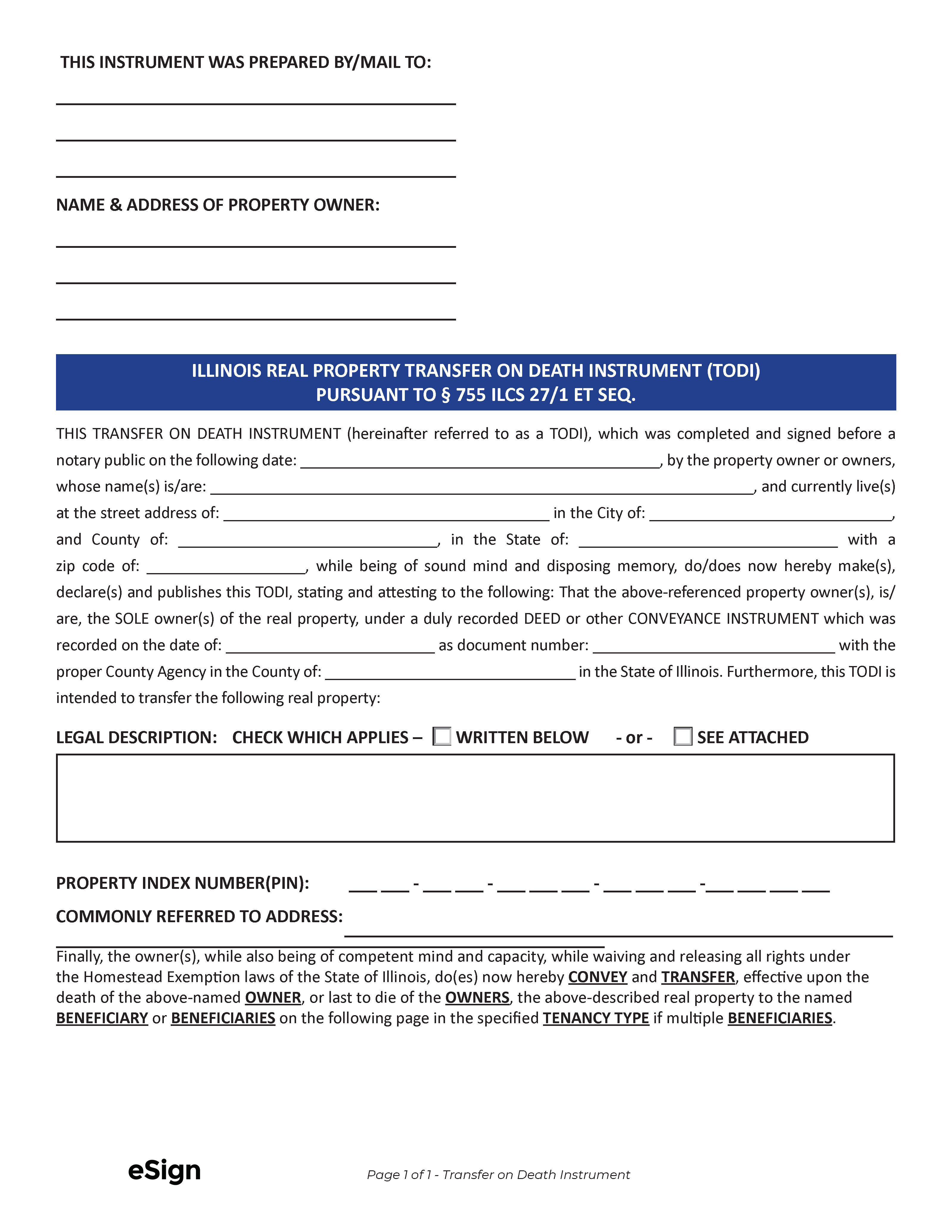

Transfer on Death Deed – Allows a property owner to convey real estate to a beneficiary after their death. Transfer on Death Deed – Allows a property owner to convey real estate to a beneficiary after their death.

Download: PDF |

Formatting

Paper – 8.5″ x 11″

Margins – 3″ x 5″ blank space top right corner of first page, all margins at least 1/2″

Font – Black ink[1]

Recording

Signing Requirements – The grantor must sign and acknowledge the form before a notary public.[2]

Where to Record – Deeds are recorded by the County Recorder’s Office in the property’s jurisdiction.[3]

Cost – Fees vary by county.

Additional Forms

Form PTAX-203 (Online) – Calculates the conveyance’s transfer tax. Unless exempt, this form must be filed with the deed.[4]

Form PTAX-203-A – For non-residential transfers if the sale price was over $1 million.

Form PTAX-203-B – For beneficial interest transfers.

Form PTAX-203-NR – For non-recorded transfers.