By Type (5)

Deed of Trust – Conveys the title to a trustee as loan collateral. After loan repayment, the title is returned. Deed of Trust – Conveys the title to a trustee as loan collateral. After loan repayment, the title is returned.

|

General Warranty Deed – Guarantees that the grantor has the right to sell and that the title is unencumbered. General Warranty Deed – Guarantees that the grantor has the right to sell and that the title is unencumbered.

|

Quit Claim Deed – Transfers a property title “as is,” with no protection against title issues. Quit Claim Deed – Transfers a property title “as is,” with no protection against title issues.

|

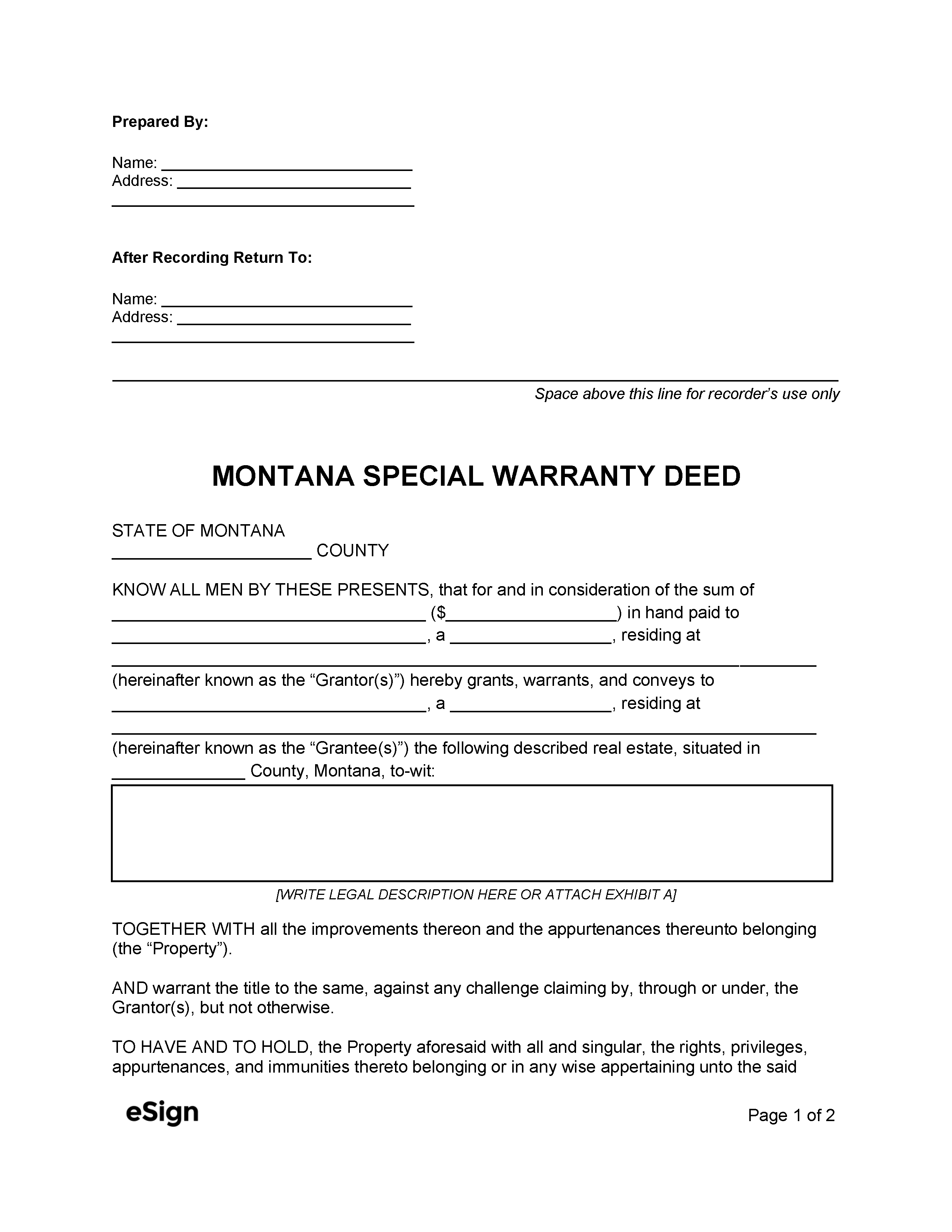

Special Warranty Deed – Provides a guarantee against title issues arising from the grantor’s ownership only. Special Warranty Deed – Provides a guarantee against title issues arising from the grantor’s ownership only.

|

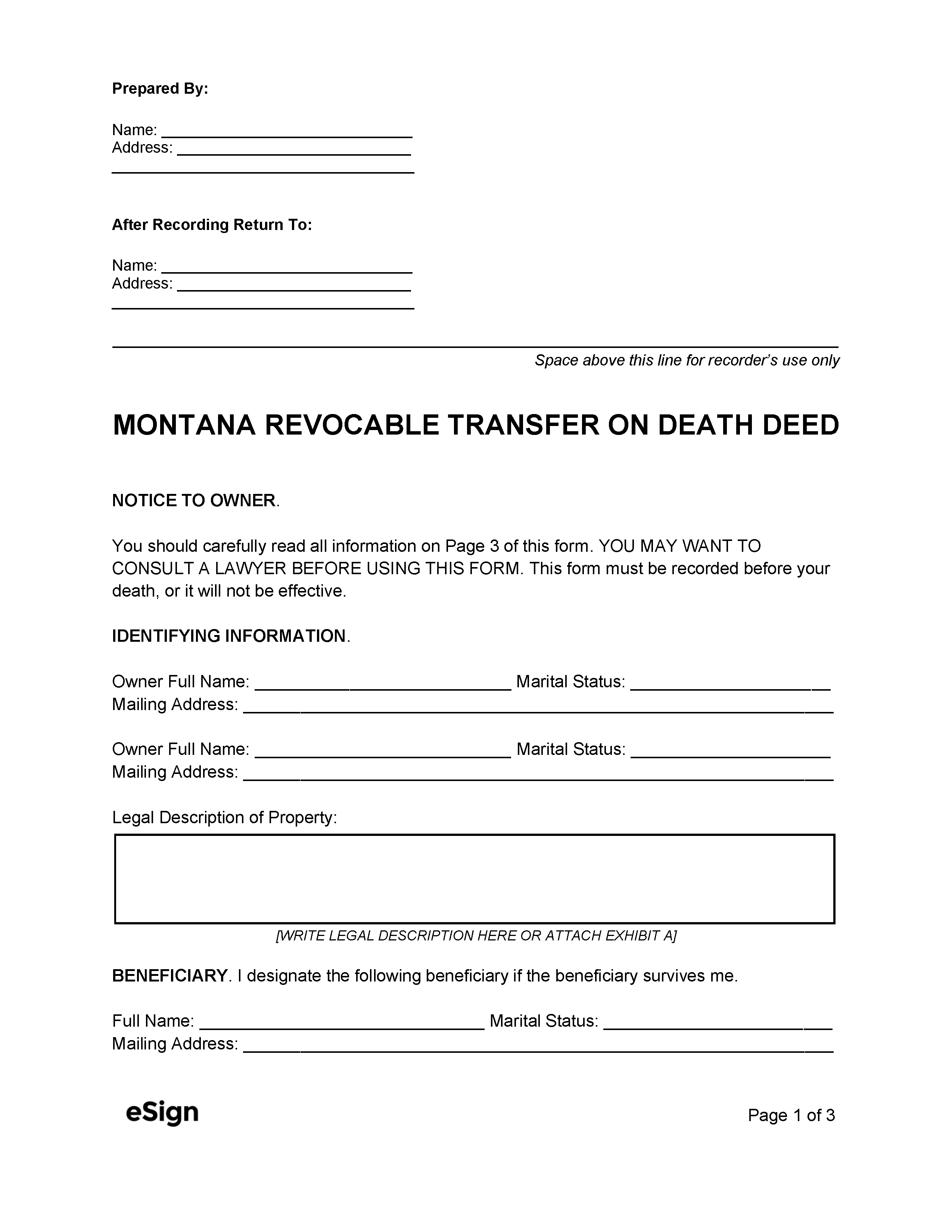

Transfer on Death Deed – A revocable deed that transfers property to a beneficiary upon the grantor’s death. Transfer on Death Deed – A revocable deed that transfers property to a beneficiary upon the grantor’s death.

|

Formatting

Paper – White paper sized 8.5″ x 11″ or 8.5″ x 14″

Margins – 3″ on top of the first page, 1″ on top of all other pages, 1″ on all bottoms, 0.5″ on all sides

Font – Blue or black ink[1]

Recording

Signing Requirements – Montana deeds must contain the grantor’s notarized signature.[2]

Where to Record – Each deed must be recorded with the County Clerk and Recorder in the county where the property is located.[3]

Cost – $8 per page (as of this writing)[4]

Additional Forms

Realty Transfer Certificate – The grantor must provide this form to the County Clerk and Recorder to declare the sales price for tax assessment purposes.[5]