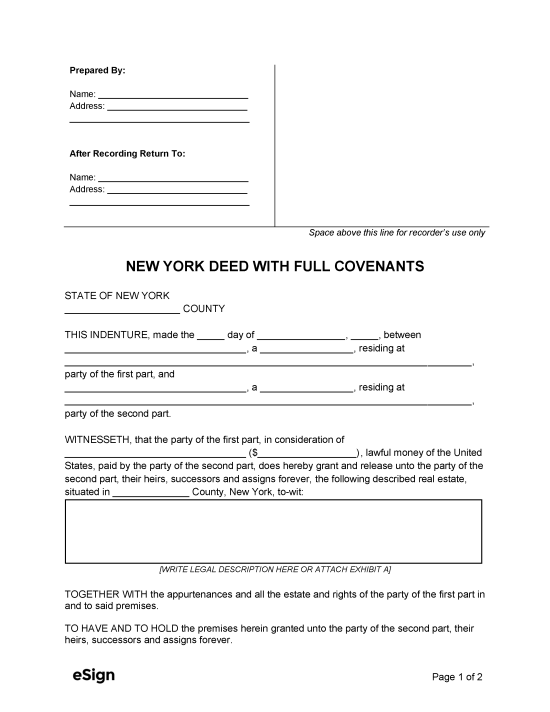

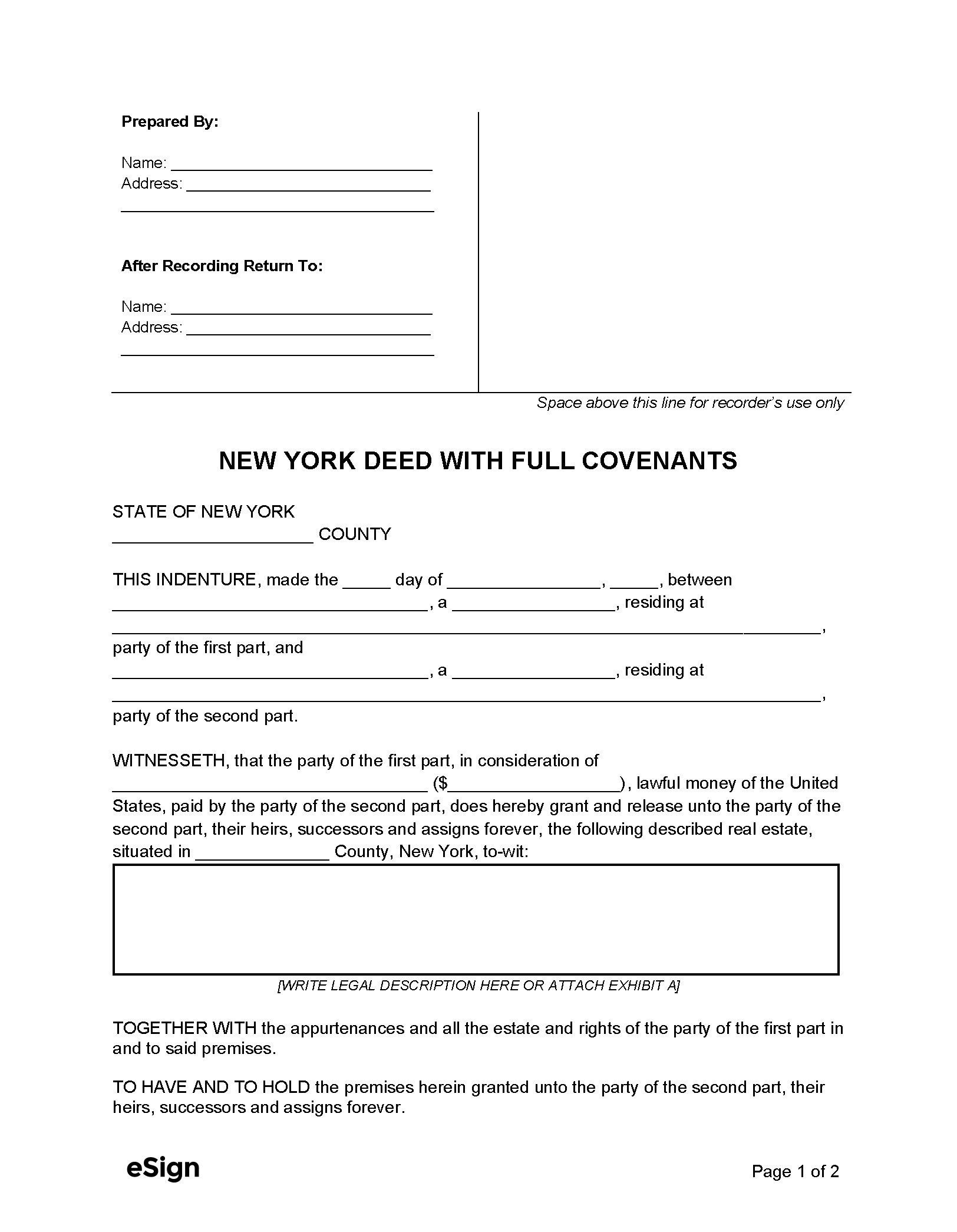

How to Format

Layout

New York does not have any uniform formatting standards. However, individuals should check with their County Clerk or City Register to see if local formatting standards apply.

Signatures

A notary public must confirm the grantor’s signature.[1]

Recording

Deeds for properties outside of NYC must be recorded with the County Clerk.[2] Within NYC, they must be taken to the City Register for recording. Residents of Staten Island must record with the Richmond County Clerk’s office to file in person.

Individuals living in Staten Island and the other NYC boroughs may file deeds online.

The following forms may be required to file with the deed. Individuals should verify with their local office to see if other additional forms are required.

Inside New York City:

- Form TP-584-NYC – A transfer tax return that must be filed no later than 15 days after the deed is recorded.

- RP-5217NYC – Used to document real property transfers in NYC (see instructions).

Outside New York City:

- Form TP-584 – A form required to submit a property transfer tax return.

- RP-5217-PDF – Records the real estate transfer between individuals (see instructions).

- Form IT-2663 – Must be completed by grantors who reside outside of New York State to report personal income tax on the gain from the sale of property.