Revocation of Beneficiary Deed – This document terminates the beneficiary deed.

Recording and Resources

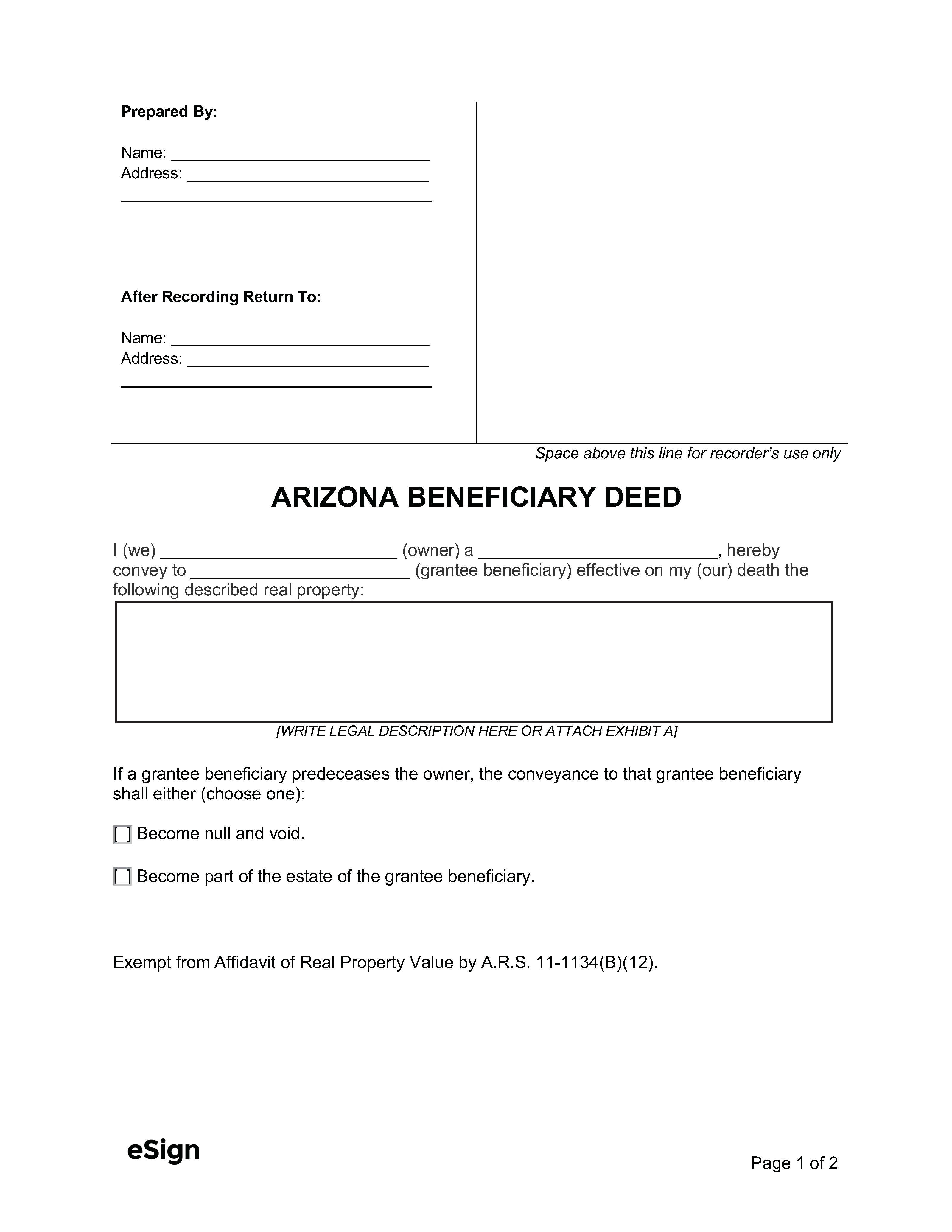

Formatting

- Paper: White, max. 8.5″ x 14″

- Margins: 2″ top of the first page, 0.5″ all other sides and pages

- Font: Min. 10pt[1]

Signing and Recording

- Signing Requirements: Notarization[2]

- Where to Record: County Recorder’s Office[3]

- Recording fees: $30 (as of this writing)[4]

Resources

- Laws: Beneficiary Deeds