The form should be used with debt collectors only, as financial institutions and other major creditors are less likely to entertain settlement offers. Before issuing the settlement offer, the debtor must verify the balance by mailing the creditor a debt validation letter.

Sample

Download: PDF, Word (.docx), OpenDocument

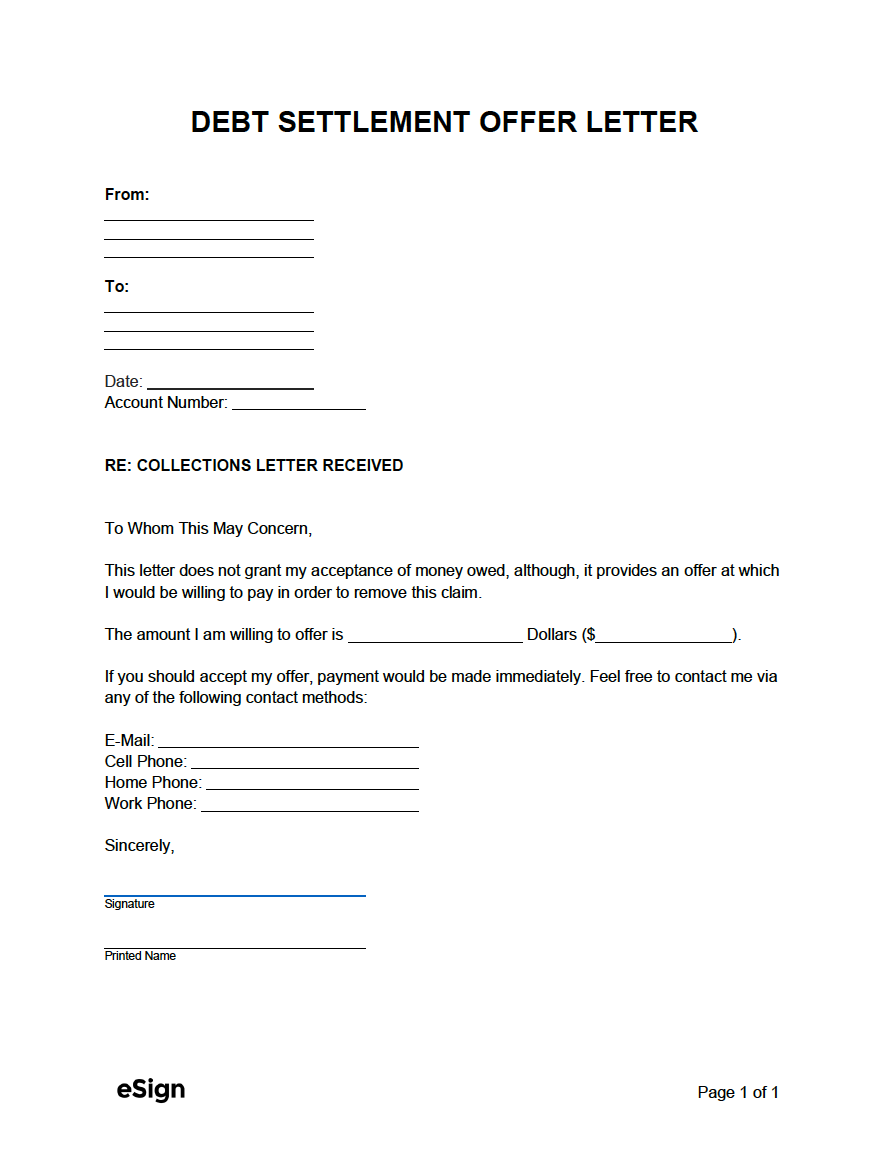

DEBT SETTLEMENT OFFER LETTER

From:

[DEBTOR (SENDER) NAME]

[DEBTOR ADDRESS LINE 1]

[DEBTOR ADDRESS LINE 2]

To:

[CREDITOR (RECIPIENT) COMPANY]

[CREDITOR ADDRESS LINE 1]

[CREDITOR ADDRESS LINE 2]

Date: [MM/DD/YYYY]

Account/Reference Number: [#####]

RE: COLLECTIONS LETTER RECEIVED

To Whom This May Concern,

This letter does not grant my acceptance of a supposed debt, but serves as an offer in which I would be willing to pay to remove this claim.

The amount I am willing to offer is [AMOUNT (IN WORDS)] Dollars ($[AMOUNT (NUMERICALLY)].

Should you accept my offer, payment will be made immediately. Feel free to contact me via any of the following contact methods:

E-Mail: [DEBTOR EMAIL ADDRESS]

Cell Phone: [DEBTOR CELL PHONE]

Home Phone: [DEBTOR HOME PHONE]

Work Phone: [DEBTOR WORK PHONE]

Sincerely,

___________________________

Signature

[DEBTOR NAME]

Debt Settlement Tips

While sending a debt settlement letter may seem worthwhile to lower one’s debt balance, the debtor should be aware of some important considerations.

Ensure the proposed settlement amount is affordable. If the creditor accepts the proposed terms, they’ll set a deadline for the final lump sum payment. If the debtor doesn’t pay within this time frame, the deal will be “off the table,” and the debtor will owe the total outstanding balance.

Confirm the debt is accurate. Debt can be sold multiple times from one collection agency to another. Each exchange of information can result in a distortion of the debt balance. One should never pay a debt unless they have confirmed it is legitimate. To confirm a debt is real, send a debt validation letter to the creditor via certified mail.

Be prepared for tax implications. The IRS considers absolved debt of $600 or more as income, requiring the debtor to pay taxes on the full balance forgiven.

Identify the age of the debt. Debt older than seven (7) years is removed from one’s credit report. And if it isn’t removed, a credit report dispute letter can be sent to the creditor to remove it. If the debt is close to the seven (7) year mark, it may be worth waiting until this time period is reached. It’s important to note that each state has its own statute of limitations for debt; if the appropriate expiration date has been reached, the debtor will have a valid reason for leaving the debt unpaid should the collector sue.