By Type (5)

Beneficiary Deed – Generally used to avoid probate, this deed transfers title to a beneficiary when the property owner passes away. Beneficiary Deed – Generally used to avoid probate, this deed transfers title to a beneficiary when the property owner passes away.

|

Deed of Trust – Used to secure real estate financing by transferring the property title to a third-party trustee until the loan is repaid. Deed of Trust – Used to secure real estate financing by transferring the property title to a third-party trustee until the loan is repaid.

Download: PDF |

General Warranty Deed – Guarantees that the grantor holds the title to the property and that it has no liens or encumbrances. General Warranty Deed – Guarantees that the grantor holds the title to the property and that it has no liens or encumbrances.

|

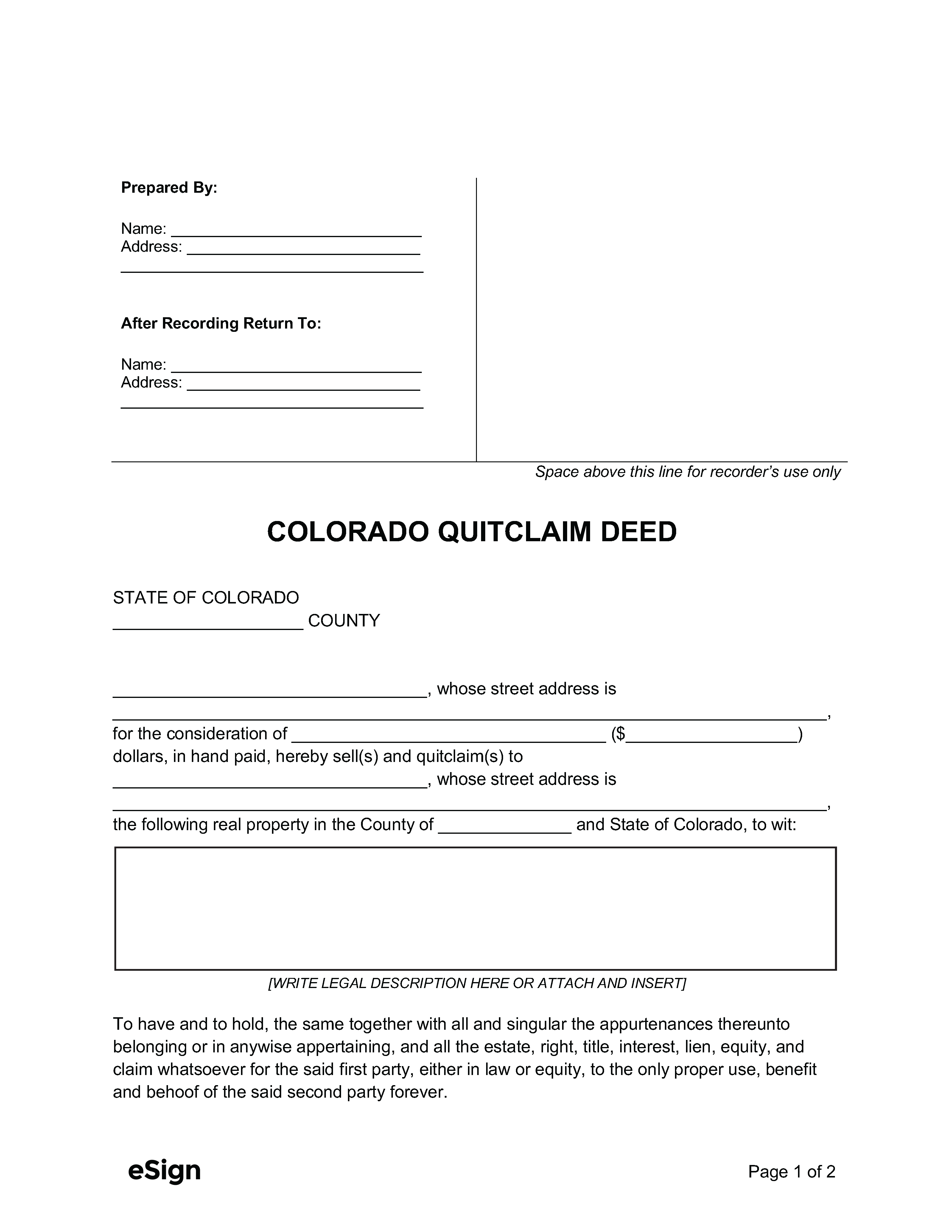

Quit Claim Deed – Transfers property without any guarantee of a clean title or the legitimacy of the grantor’s ownership. Quit Claim Deed – Transfers property without any guarantee of a clean title or the legitimacy of the grantor’s ownership.

|

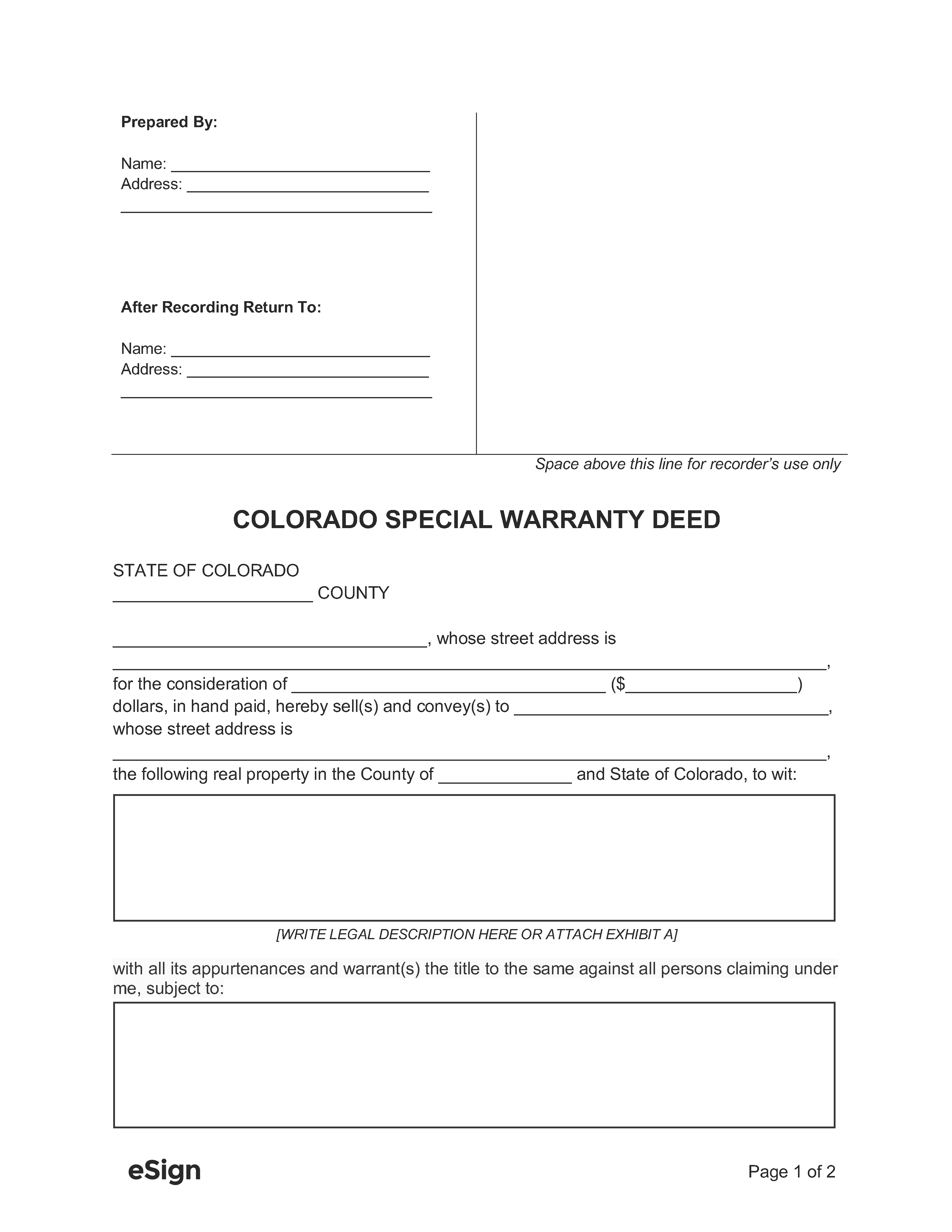

Special Warranty Deed – Similar to the general warranty deed, except the warranty does not extend beyond the grantor’s period of ownership. Special Warranty Deed – Similar to the general warranty deed, except the warranty does not extend beyond the grantor’s period of ownership.

|

Formatting

Margins – Top margins at least 1″, all other margins at least 1/2″[1]

Recording

Signing Requirements – The grantor must sign the deed with a notary acknowledgment.[2]

Where to Record – Once a deed has been properly executed, it must be filed at the County Clerk and Recorder’s office.[3]

Cost – $13 for the first page, $5 for each additional page (as of this writing).[4]

Starting July 1st, 2025, the recording cost will be a flat fee of $43.[5]