By Type (5)

Deed of Trust – Used to transfer the real estate title to a trustee until the property owner has repaid the lender. Deed of Trust – Used to transfer the real estate title to a trustee until the property owner has repaid the lender.

|

General Warranty Deed – Gives the grantee a guarantee that there are no claims against the property they are purchasing. General Warranty Deed – Gives the grantee a guarantee that there are no claims against the property they are purchasing.

|

Quit Claim Deed – Conveys the title of a property without any assurance that it is free of third-party claims. Quit Claim Deed – Conveys the title of a property without any assurance that it is free of third-party claims.

|

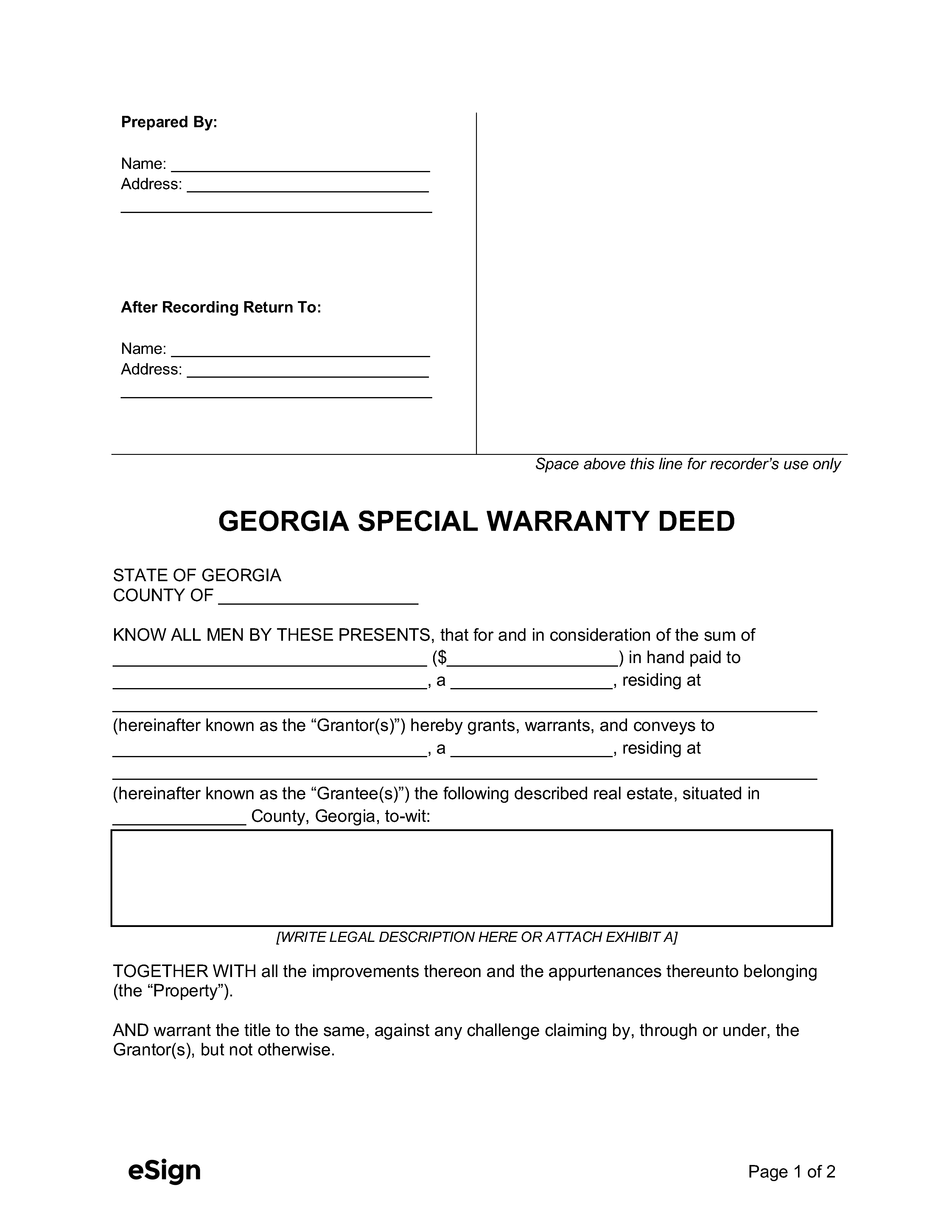

Special Warranty Deed – Only guarantees that there are no claims against the property from the current owner’s period of ownership. Special Warranty Deed – Only guarantees that there are no claims against the property from the current owner’s period of ownership.

|

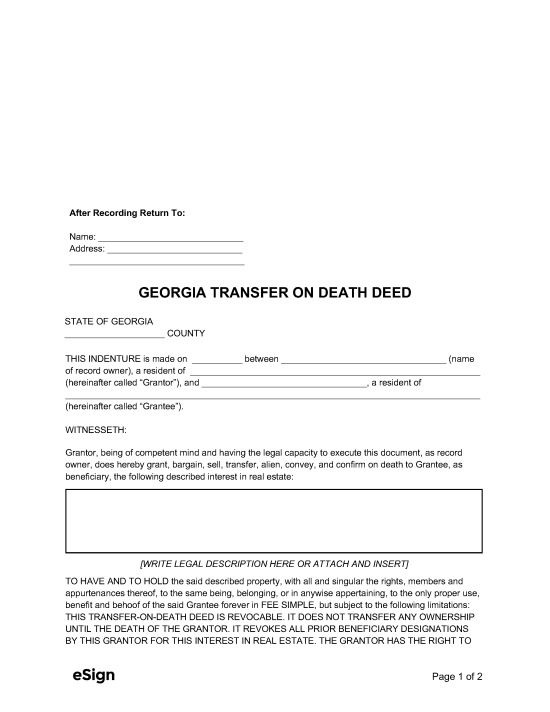

Transfer on Death Deed (TODD) – Transfers ownership to a beneficiary upon the owner’s death. Transfer on Death Deed (TODD) – Transfers ownership to a beneficiary upon the owner’s death.

|

Formatting

Paper – 8.5″ x 11″ or 8.5″ x 14″

Margins – 3″ blank margin at the top of the first page[1]

Recording

Signing Requirements – The grantor’s signature must be attested by a notary public or other qualifying officer and one other witness.[2]

Where to Record – Deeds are filed with the Superior Court, either online if self-filing or in person if submitted by a third party.[3]

Cost – $25 (as of this writing)[4]

Additional Form

Form PT-61 – Must be completed, attached to, and filed with the deed to calculate the transfer tax.[5]