By Type (4)

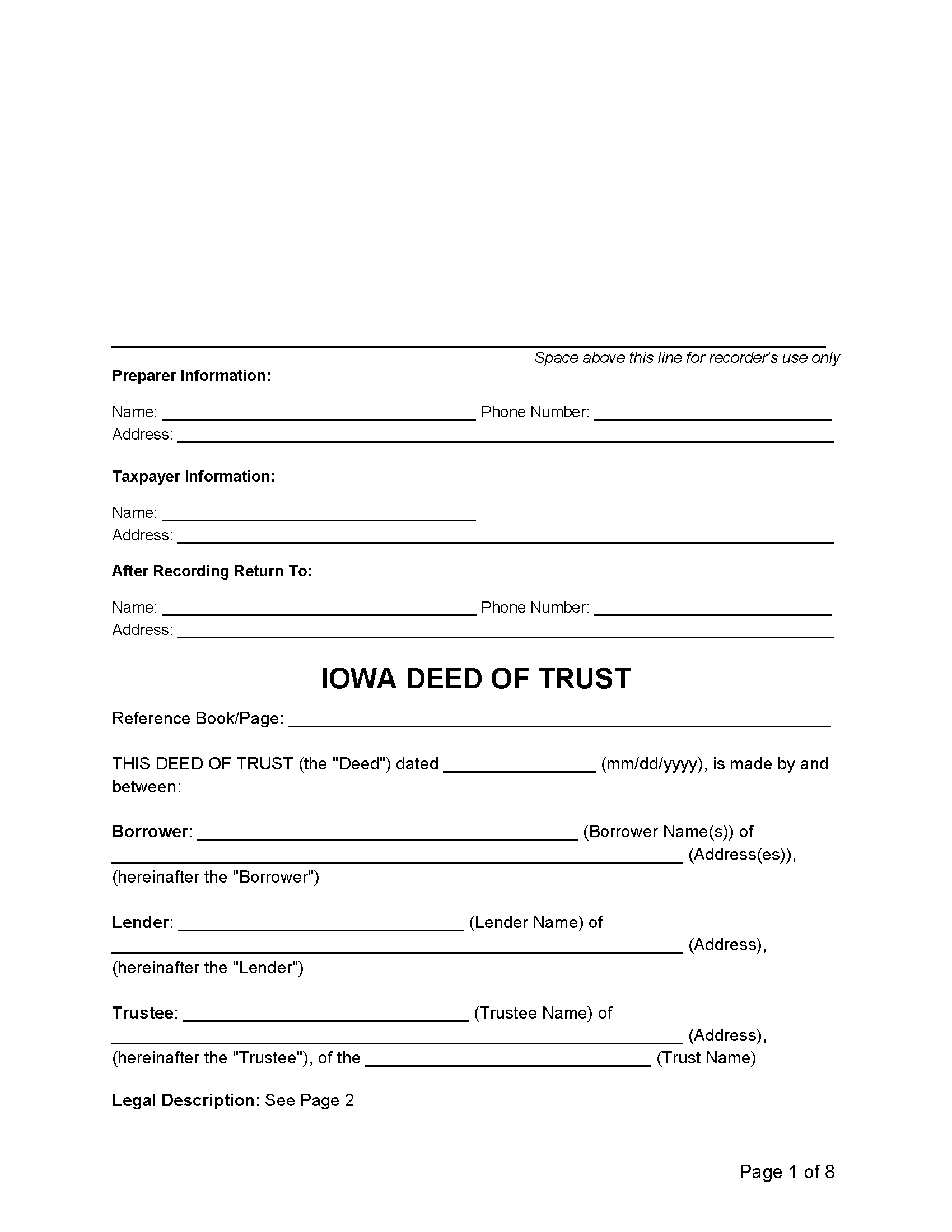

Deed of Trust – Puts a property title under the care of a trustee as security on a lender’s expense to a borrower. Deed of Trust – Puts a property title under the care of a trustee as security on a lender’s expense to a borrower.

|

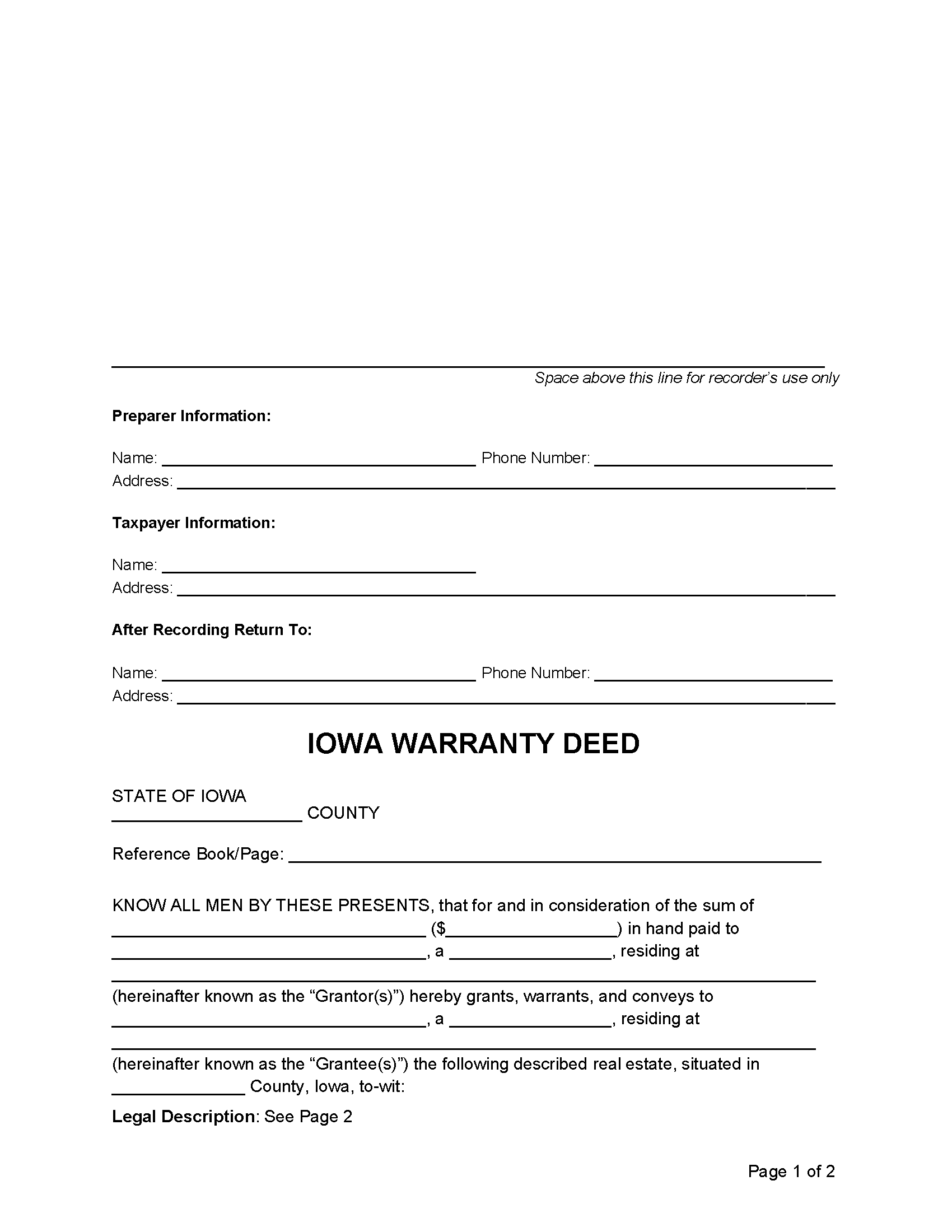

General Warranty Deed – Guarantees the quality of the property’s title, meaning that it is free of any claims. General Warranty Deed – Guarantees the quality of the property’s title, meaning that it is free of any claims.

|

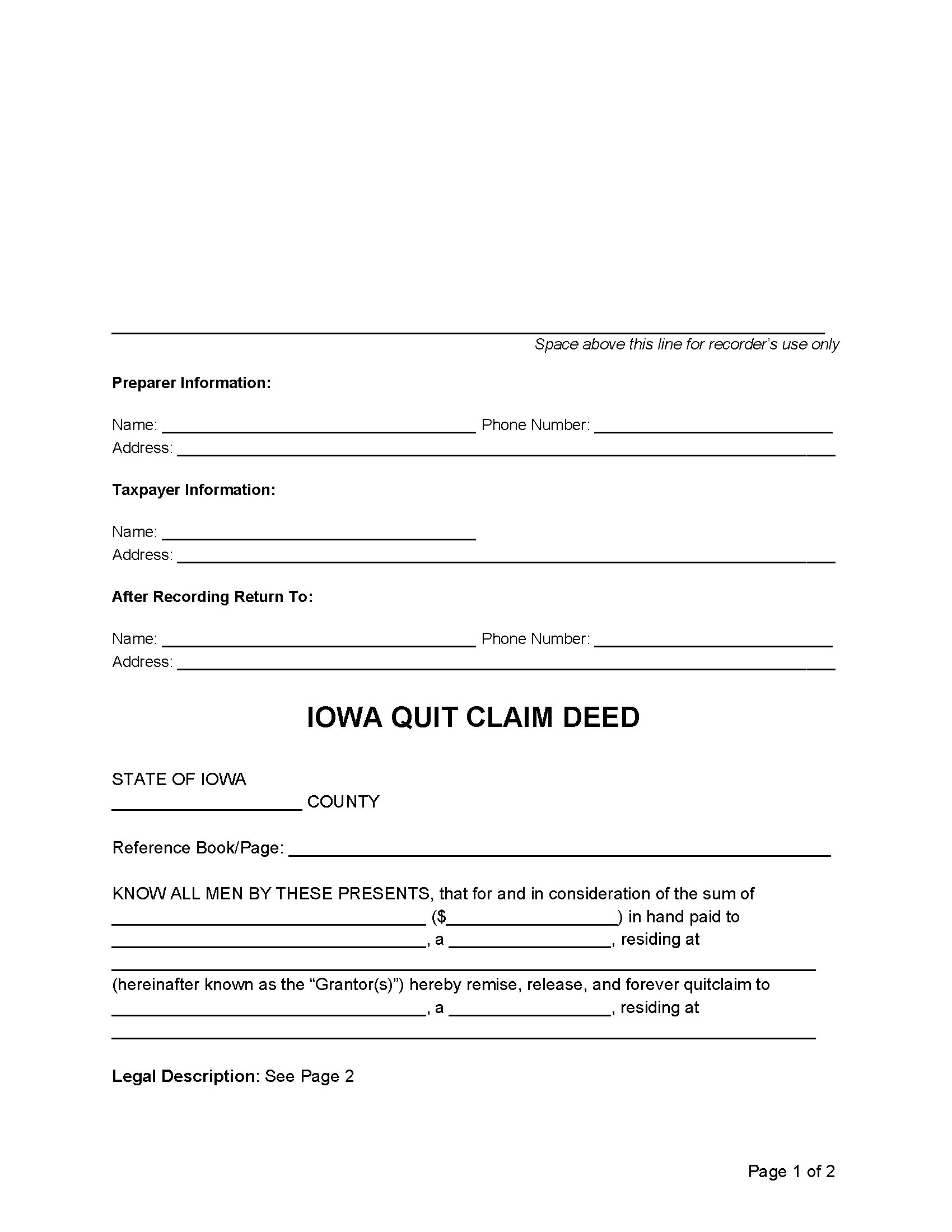

Quit Claim Deed – A deed that provides no warranty to the grantee regarding the property’s title. Quit Claim Deed – A deed that provides no warranty to the grantee regarding the property’s title.

|

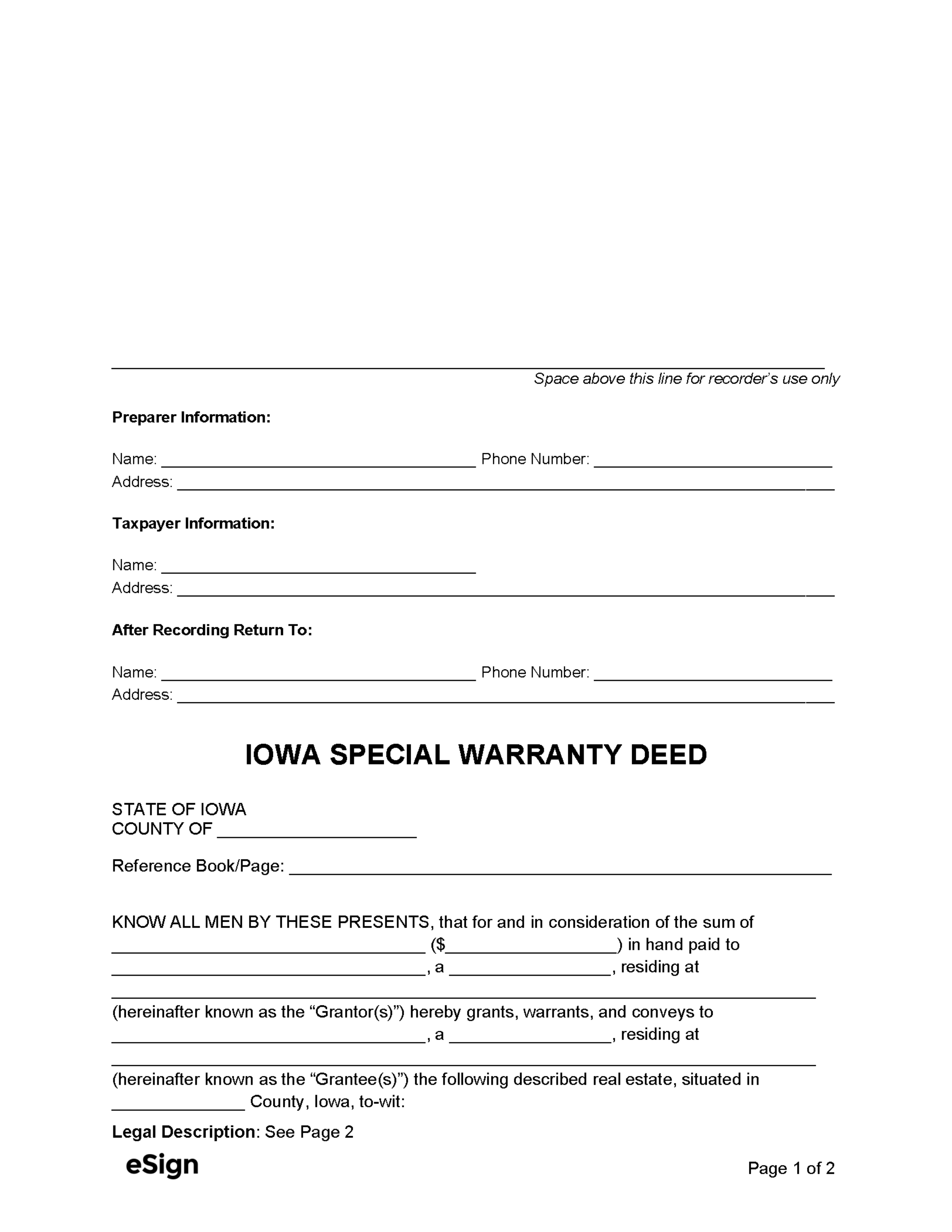

Special Warranty Deed – Only warrants that there are no title defects from the current owner’s time as title holder. Special Warranty Deed – Only warrants that there are no title defects from the current owner’s time as title holder.

|

Formatting

Paper – White, 20lb weight minimum, no watermarks, no larger than 8.5″ x 14″

Margins – 3″ top margin of first page, all other margins at least 3/4″

Font – Pre-printed text: at least 8pt. Inputted text: at least 10pt.[1]

Recording

Signing Requirements – The deed must be acknowledged by a notary public.[2]

Where to Record – Deeds are filed at the County Recording Office for the county where the property is located.

Cost – $7 for one page, $5 for each additional page (as of this writing). Other fees and transfer taxes may also apply.[3]

Additional Forms

Declaration of Value – Discloses the property value, type of sale, classification, and assessment. Required unless transfer is exempt (see instructions).[4]

Groundwater Hazard Statement – Disclose whether any groundwater hazards are present on the property. Must be attached to Declaration of Value unless exempt.[5]