By Type (4)

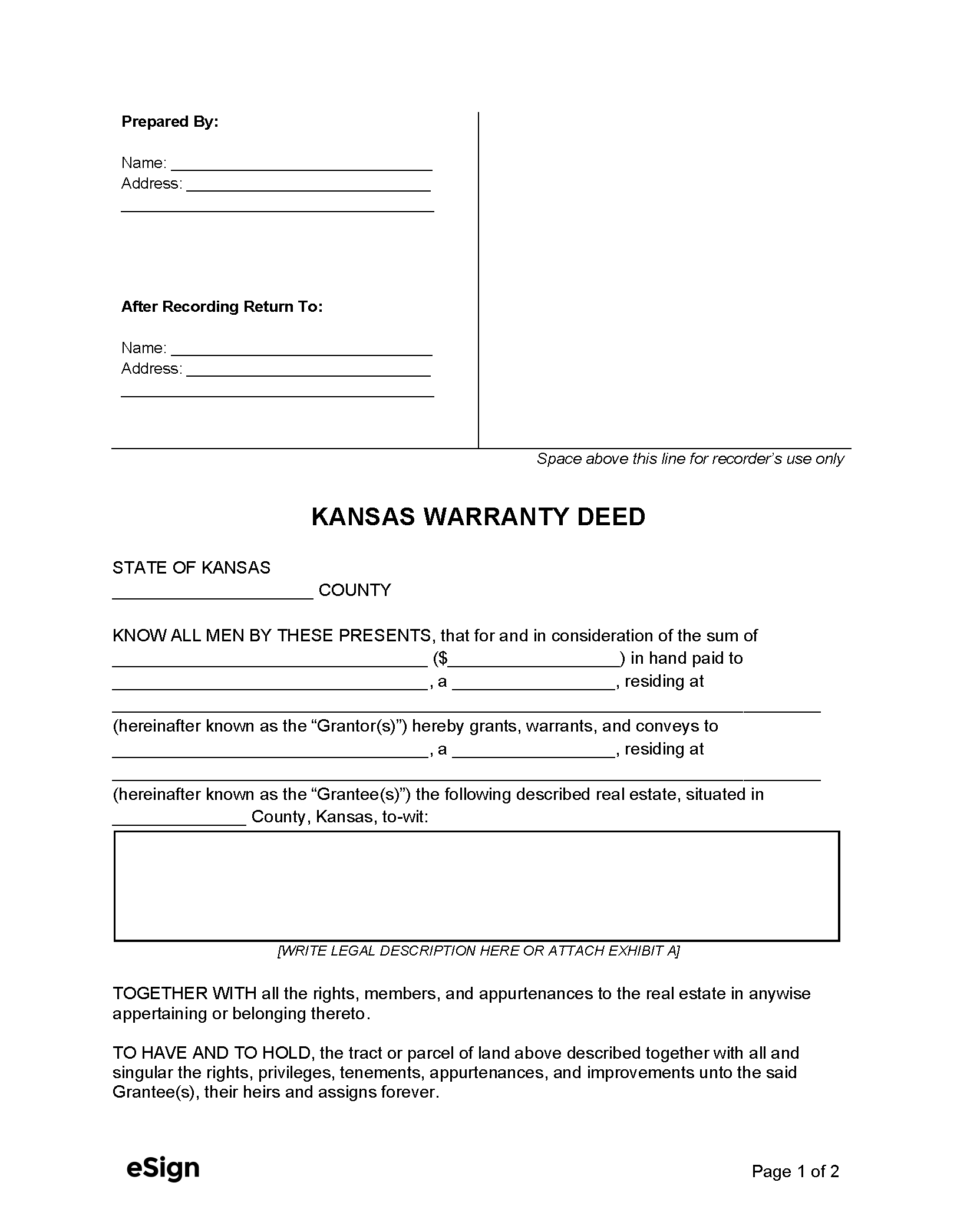

Warranty Deed – Warrants that the title is free and clear of any encumbrances. Warranty Deed – Warrants that the title is free and clear of any encumbrances.

|

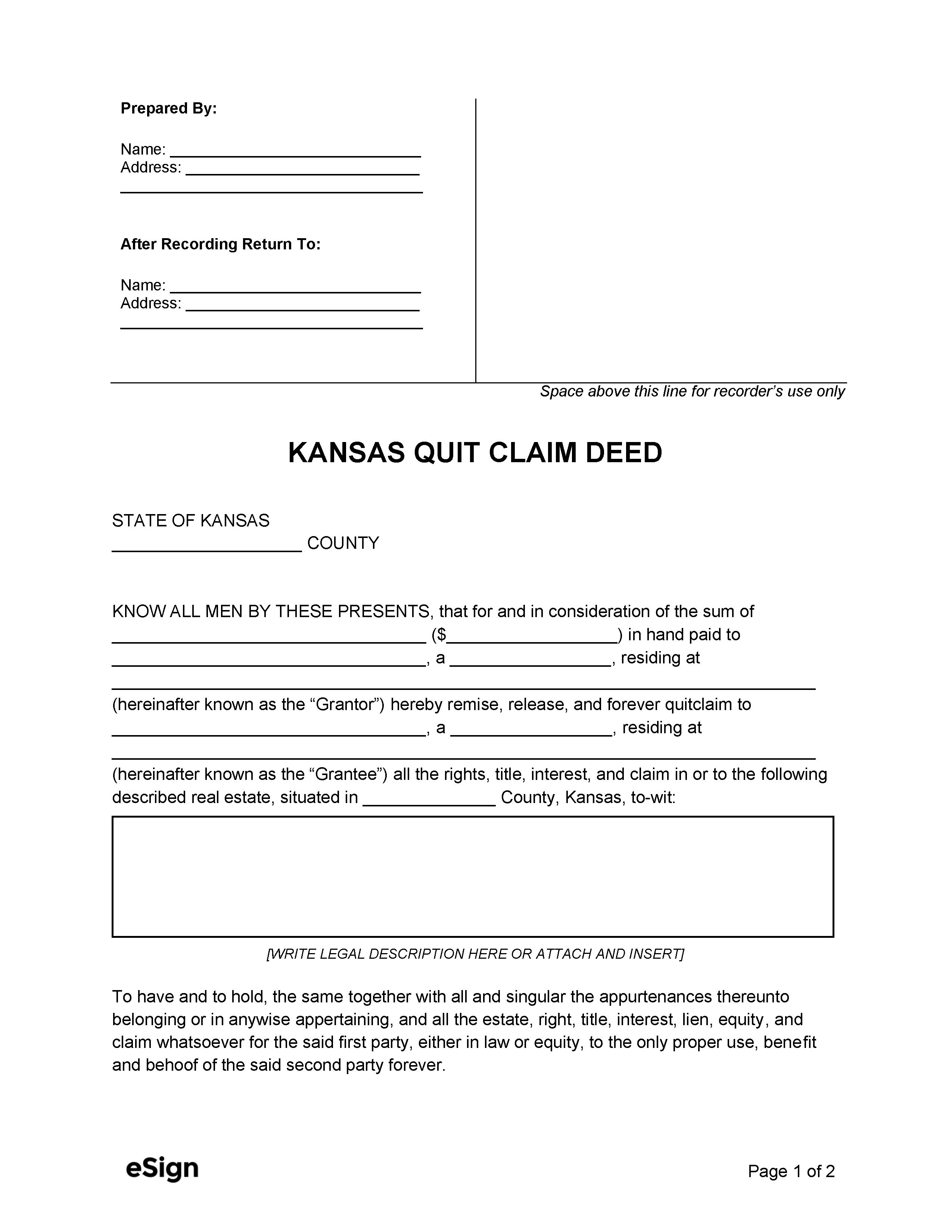

Quit Claim Deed – Transfers real estate between two parties without any guarantee that the property is free of encumbrances. Quit Claim Deed – Transfers real estate between two parties without any guarantee that the property is free of encumbrances.

|

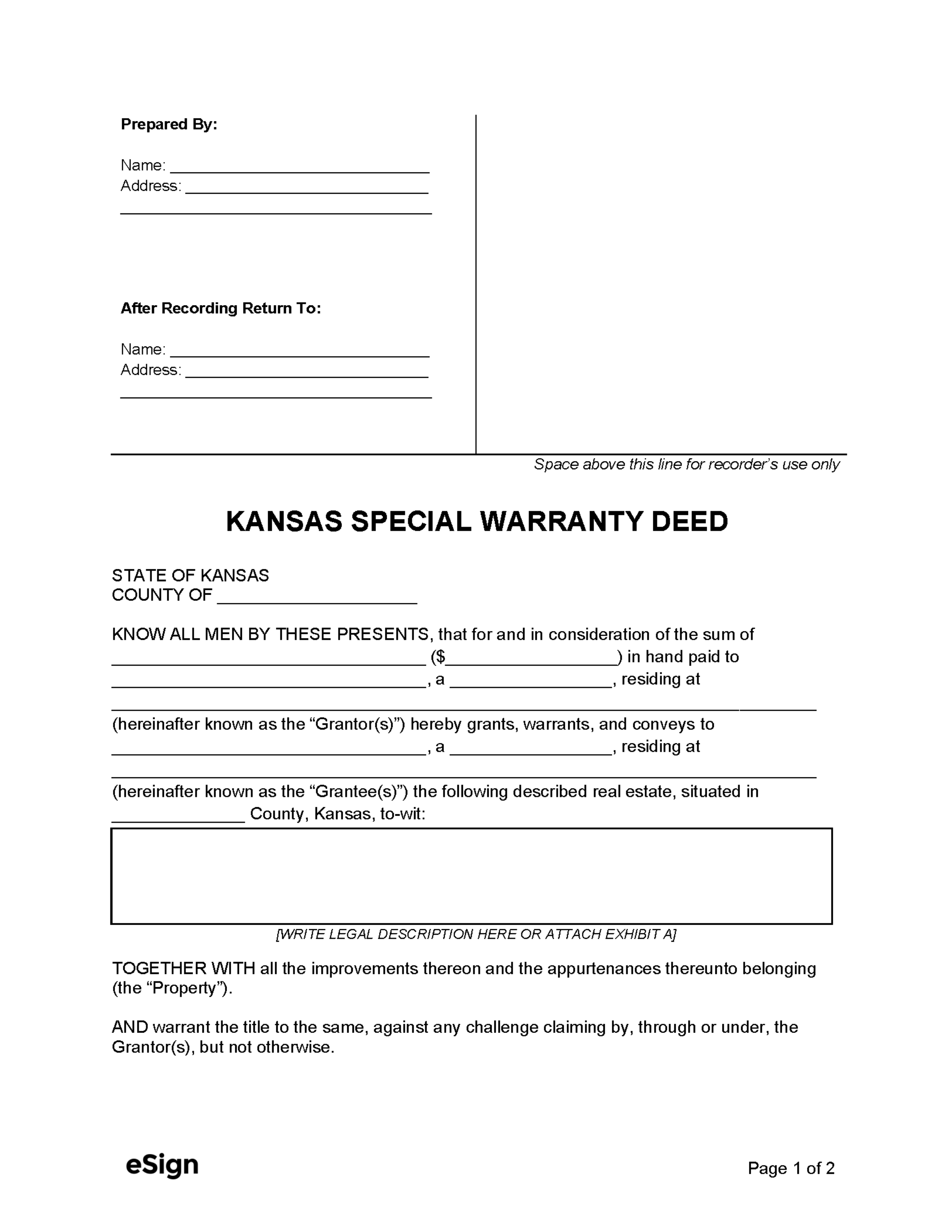

Special Warranty Deed – Conveys property to a grantee with the warranty that there are no claims or encumbrances from the grantor’s ownership period. Special Warranty Deed – Conveys property to a grantee with the warranty that there are no claims or encumbrances from the grantor’s ownership period.

|

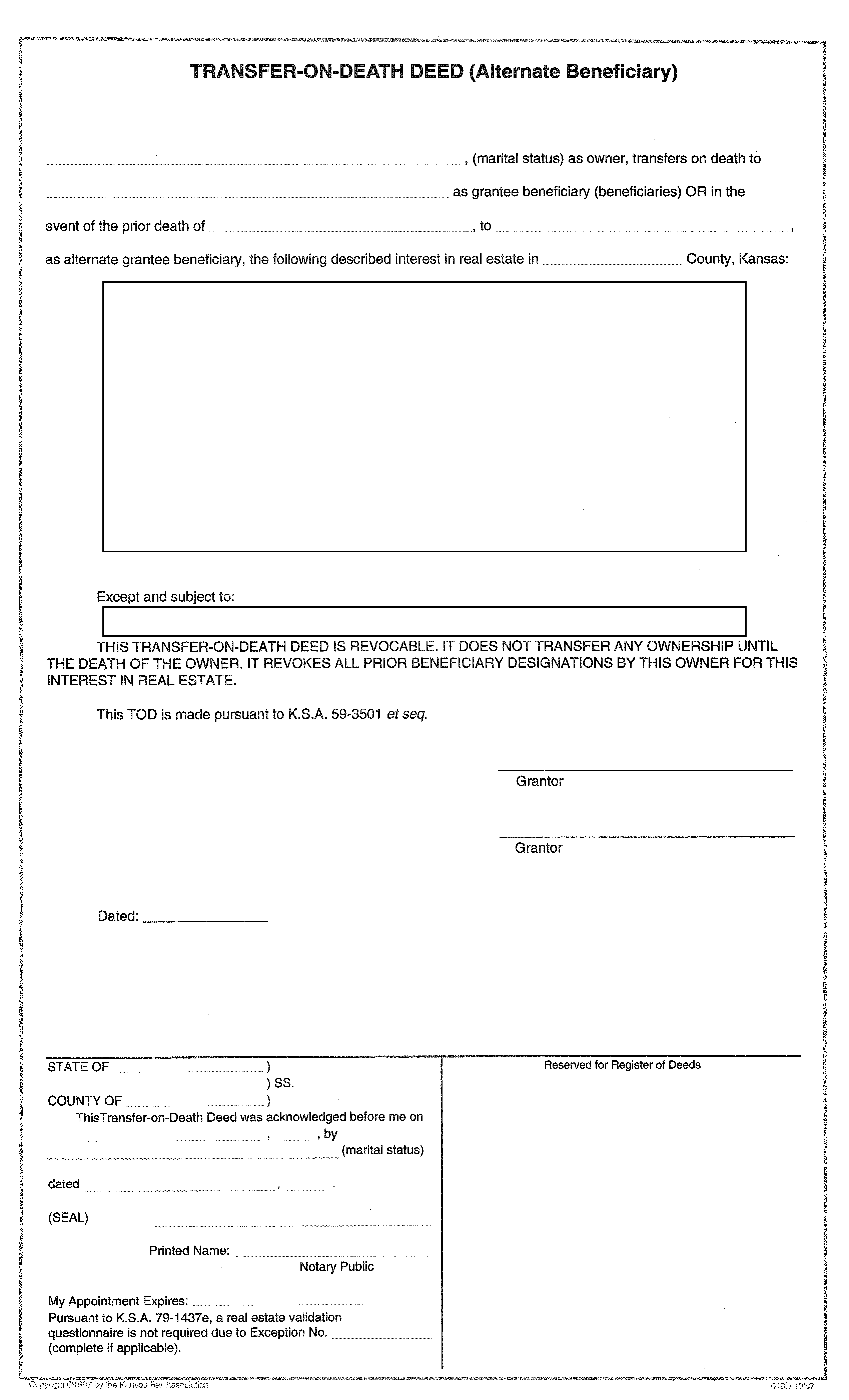

Transfer on Death Deed – Transfers a property’s ownership to a beneficiary while allowing the grantor to maintain full property rights during their lifetime. Transfer on Death Deed – Transfers a property’s ownership to a beneficiary while allowing the grantor to maintain full property rights during their lifetime.

Download: PDF |

Formatting

Paper – Maximum dimensions: 8.5″ x 14″

Margins – No state-wide standard; some counties may have specific margin requirements.[1]

Recording

Signing Requirements – The grantor must have their signature notarized by a notary public, county clerk, register of deeds, mayor, or city clerk.[2]

Where to Record – The completed deed is filed at the Register of Deeds in the property’s jurisdiction.[3]

Cost – $21 for the first page and $17 for each subsequent page (as of this writing)[4]

Additional Forms

Sales Validation Questionnaire (SVQ) – This form must accompany all deeds unless they are exempt and the exemption is stated in the deed.[5]