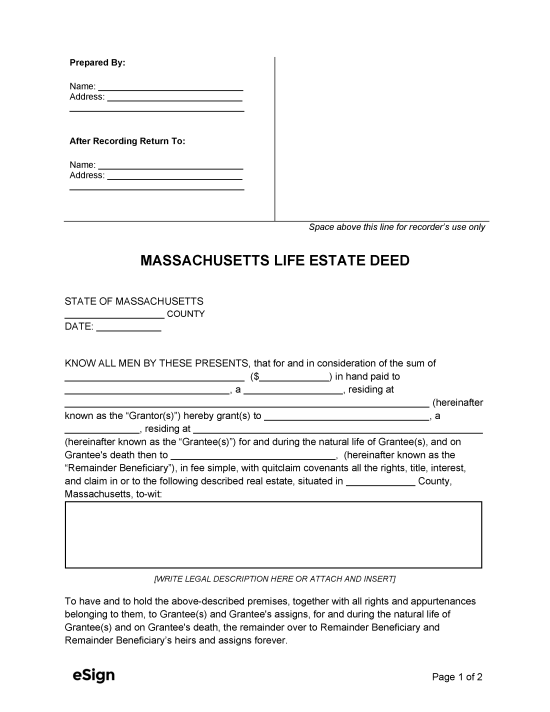

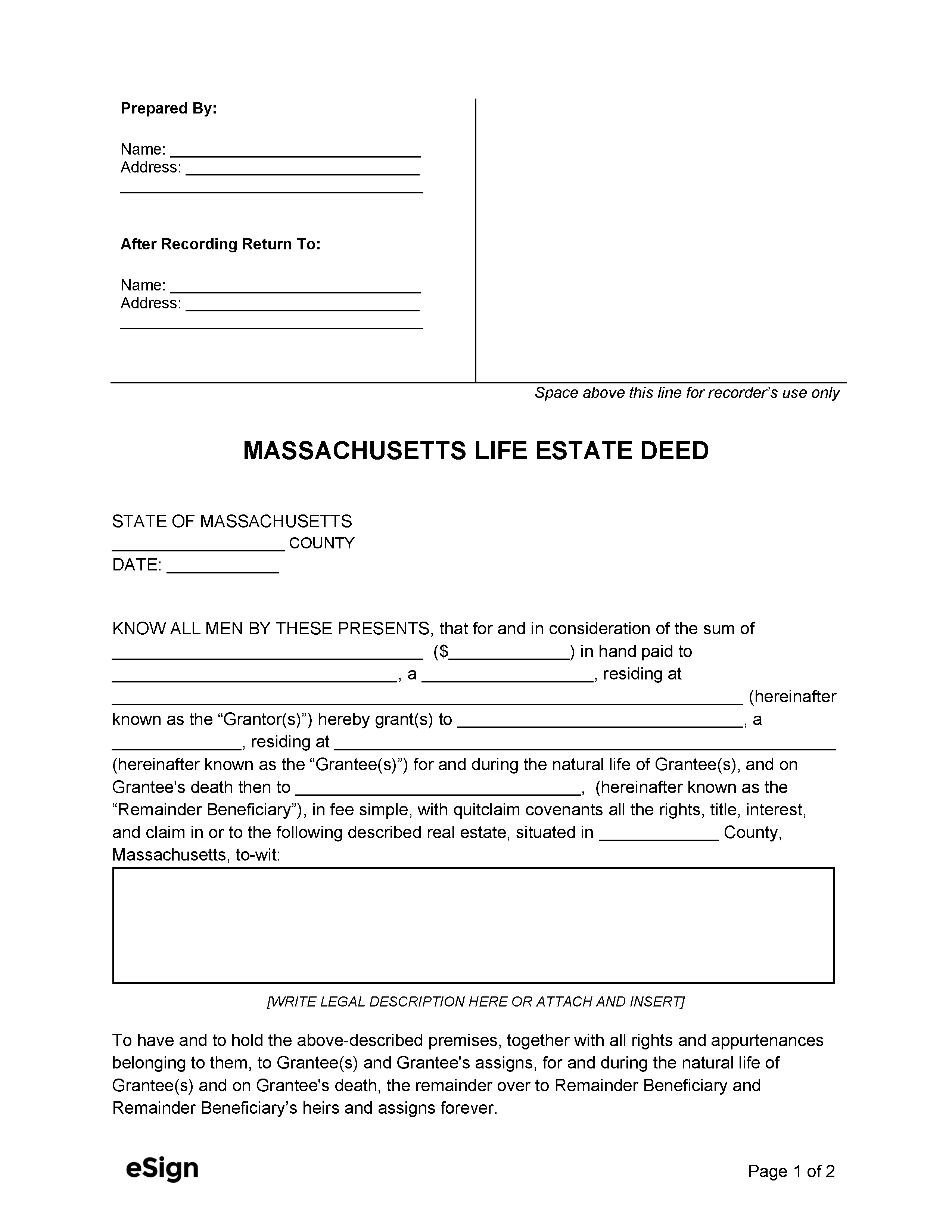

Recording a Life Estate Deed

Before having a deed recorded with the Registry of Deeds Office for the property’s location, the grantor or their representative must sign the deed and have it acknowledged by a notary public.[1]

The deed recording fee at the time of this writing is $155.[2]

Life Estate Statutes – Ch. 183 § 46, Ch. 184 § 5

Formatting Standards

The Registry of Deeds has the following standards for recorded deeds[3]:

- The typeface must be large enough and sufficiently dark to be legible when scanned.

- The paper must be 8.5″×14″ or smaller, white, and single-sided.

- There must be an empty space 3″ from the top edge and 3″ from the right edge of the front page.