By Type (5)

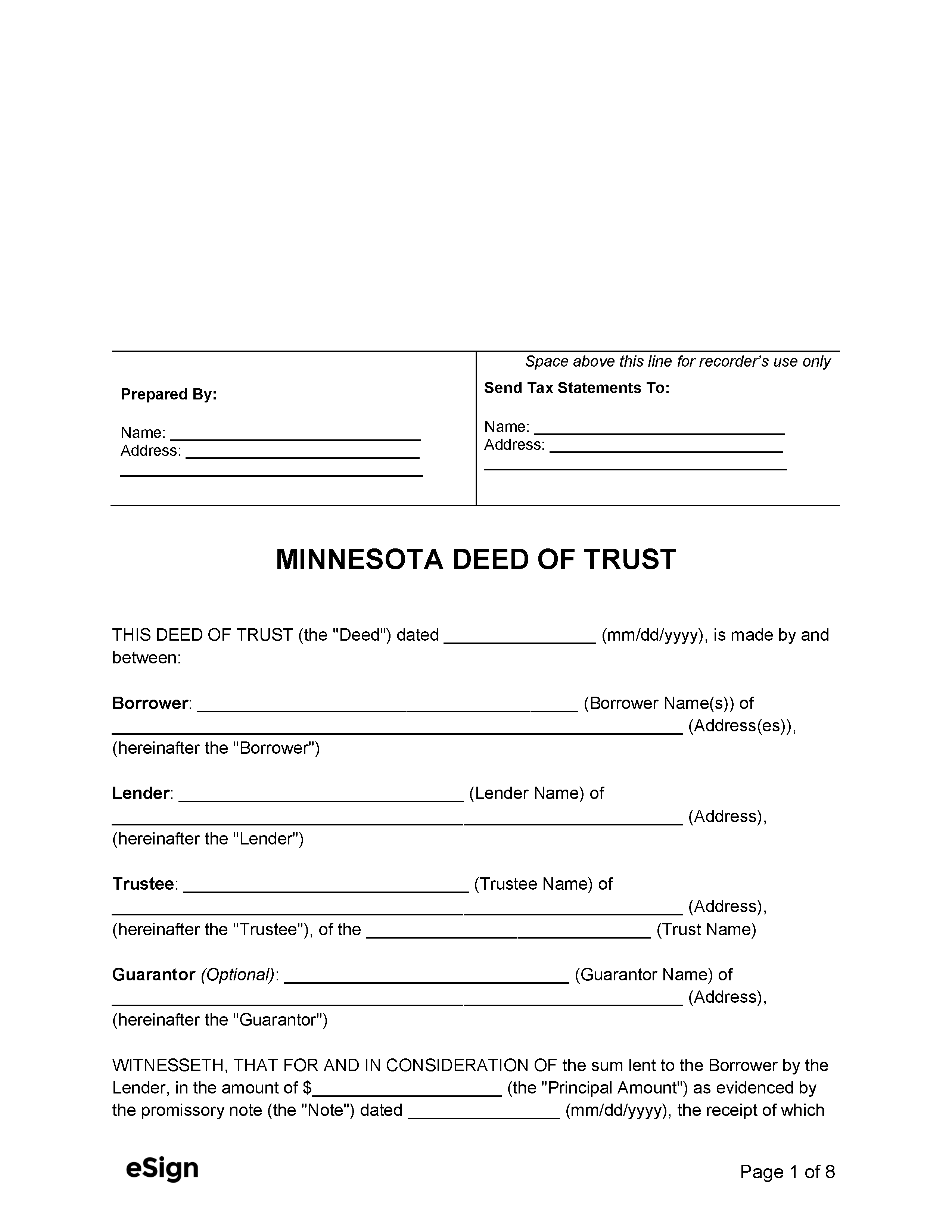

Deed of Trust – Used when a buyer takes out a loan to purchase property. The deed transfers ownership to a trustee until the debt is paid. Deed of Trust – Used when a buyer takes out a loan to purchase property. The deed transfers ownership to a trustee until the debt is paid.

|

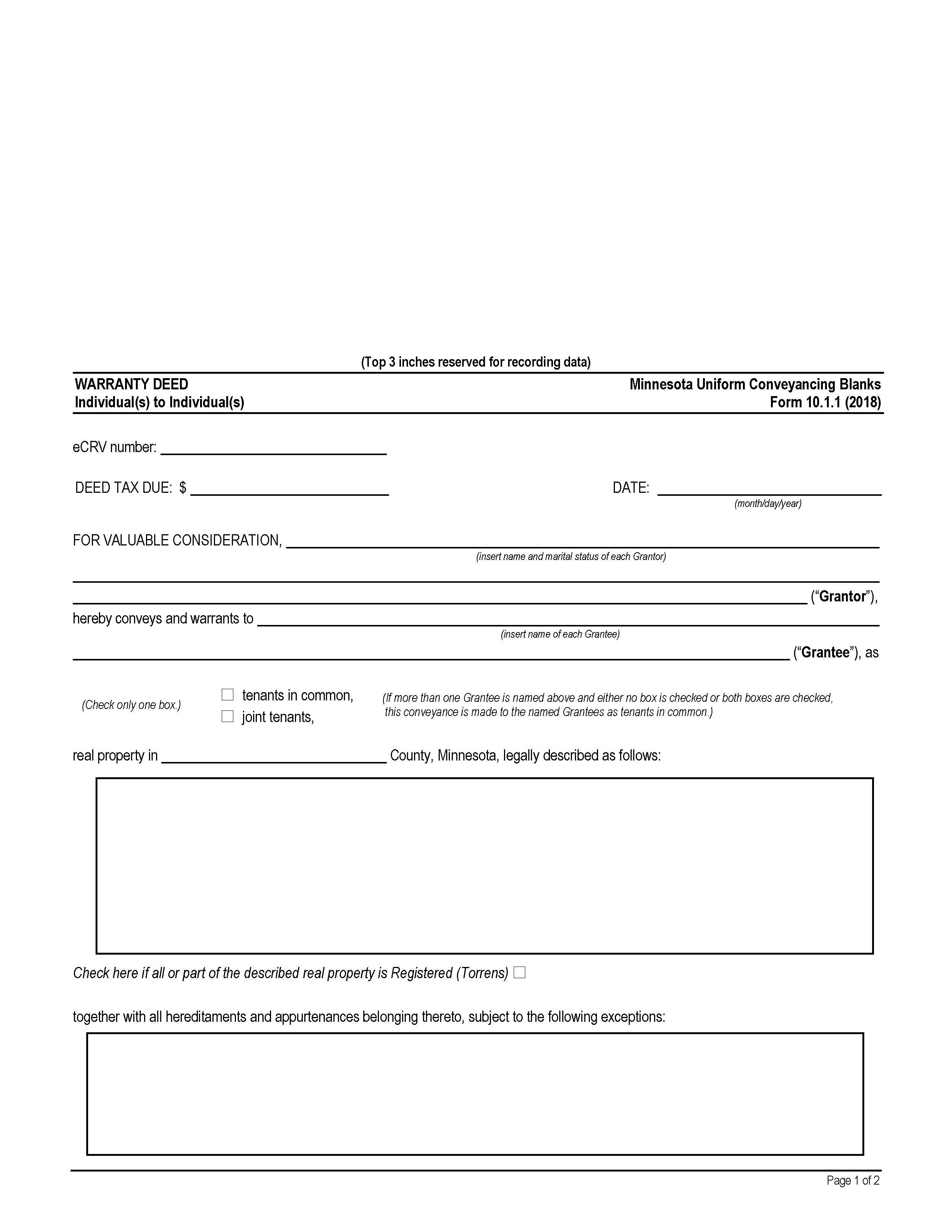

General Warranty Deed – Fully protects the buyer against any title defects discovered after purchasing property. General Warranty Deed – Fully protects the buyer against any title defects discovered after purchasing property.

Download: PDF |

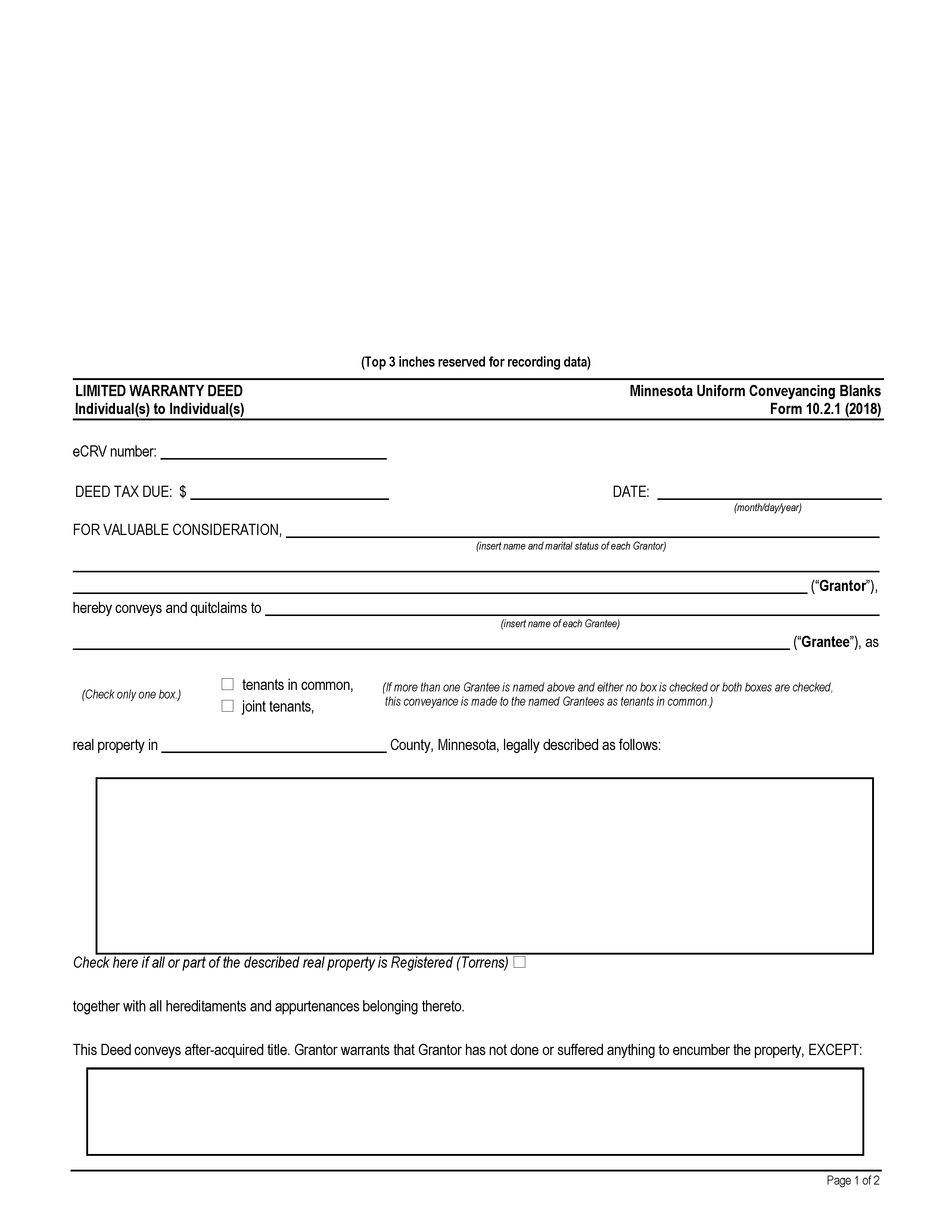

Limited Warranty Deed – Protects the buyer against title defects from the seller’s period of ownership. Limited Warranty Deed – Protects the buyer against title defects from the seller’s period of ownership.

Download: PDF |

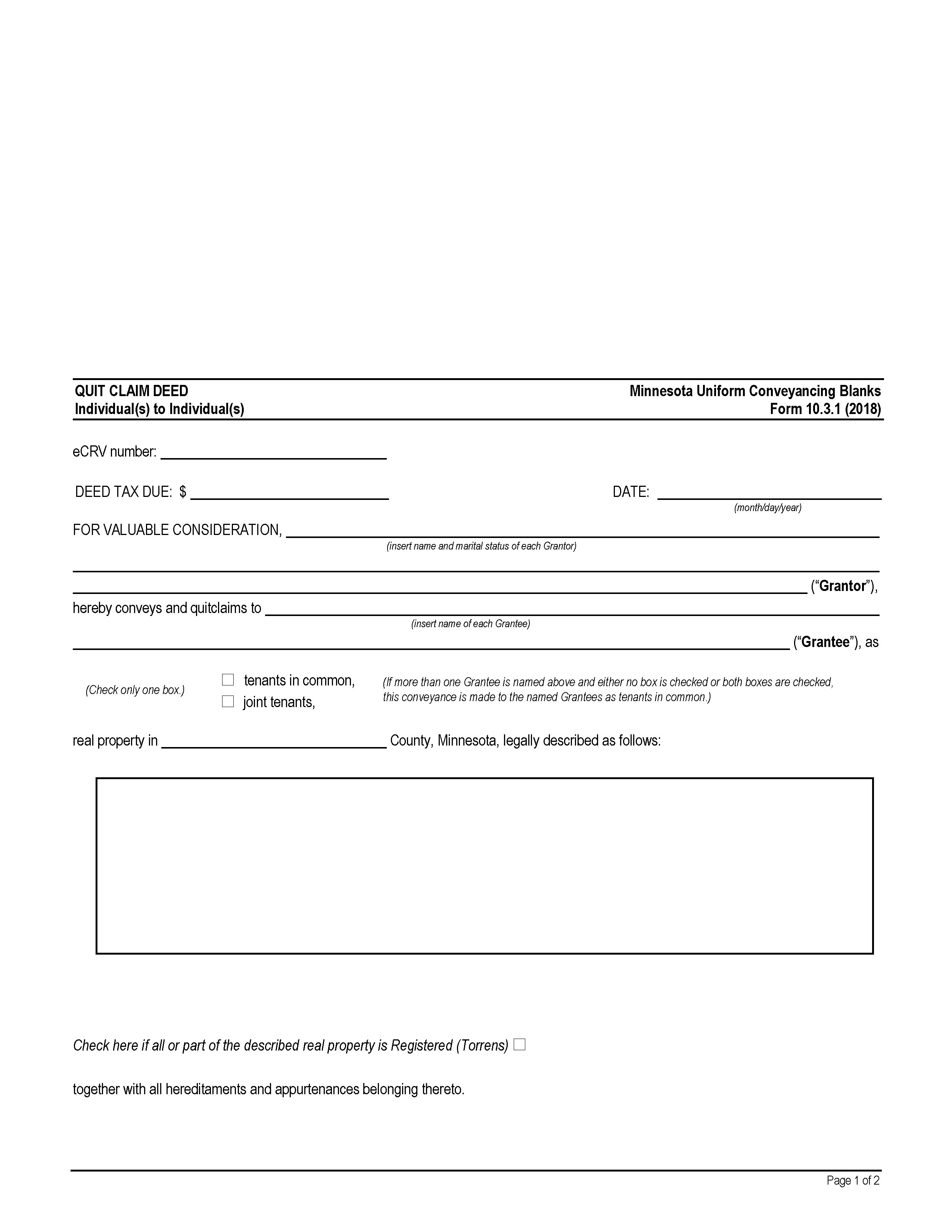

Quit Claim Deed – Provides no warranties or title assurances to the grantee. Quit Claim Deed – Provides no warranties or title assurances to the grantee.

Download: PDF |

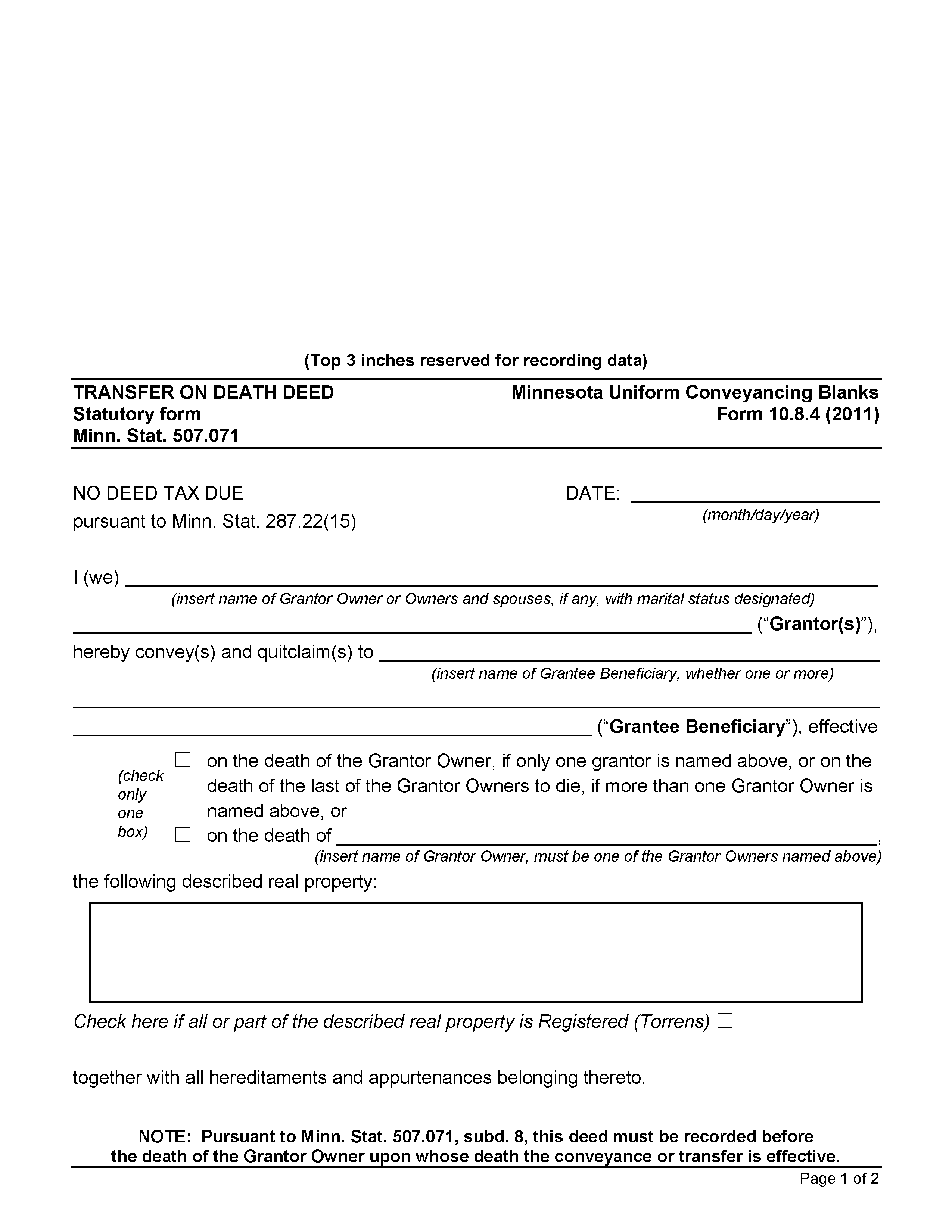

Transfer on Death Deed – Allows the grantor to name a beneficiary to receive property upon the grantor’s death. Transfer on Death Deed – Allows the grantor to name a beneficiary to receive property upon the grantor’s death.

Download: PDF |

Formatting

Paper – White, 20lb weight minimum, no larger than 8.5″ x 14″

Margins – 3″ top margin on first page, 0.5″ minimum for all other margins

Font – Black ink, 8pt minimum[1]

Recording

Signing Requirements – Deeds must include the grantor’s notarized signature.[2]

Where to Record – Deeds are recorded with the County Recorder for the county where the property is located.[3]

Cost – $46 (as of this writing)[4]

Additional Forms

Electronic Certificate of Real Estate Value – Required for properties sold for more than $3,000.[5]

Well Disclosure Certificate (Online)– Required if there are one or more wells on the property that were not previously recorded.[6]