By Type (6)

Deed of Trust – Transfers a borrower’s title rights to a trustee until a home loan is repaid to a lender. Deed of Trust – Transfers a borrower’s title rights to a trustee until a home loan is repaid to a lender.

|

General Warranty Deed – Guarantees that the title is unencumbered and that the grantor will be liable for any title defects past and current. General Warranty Deed – Guarantees that the title is unencumbered and that the grantor will be liable for any title defects past and current.

|

Special Warranty Deed – Guarantees the title is clear from the grantor’s time as owner, with no guarantees regarding former owners. Special Warranty Deed – Guarantees the title is clear from the grantor’s time as owner, with no guarantees regarding former owners.

|

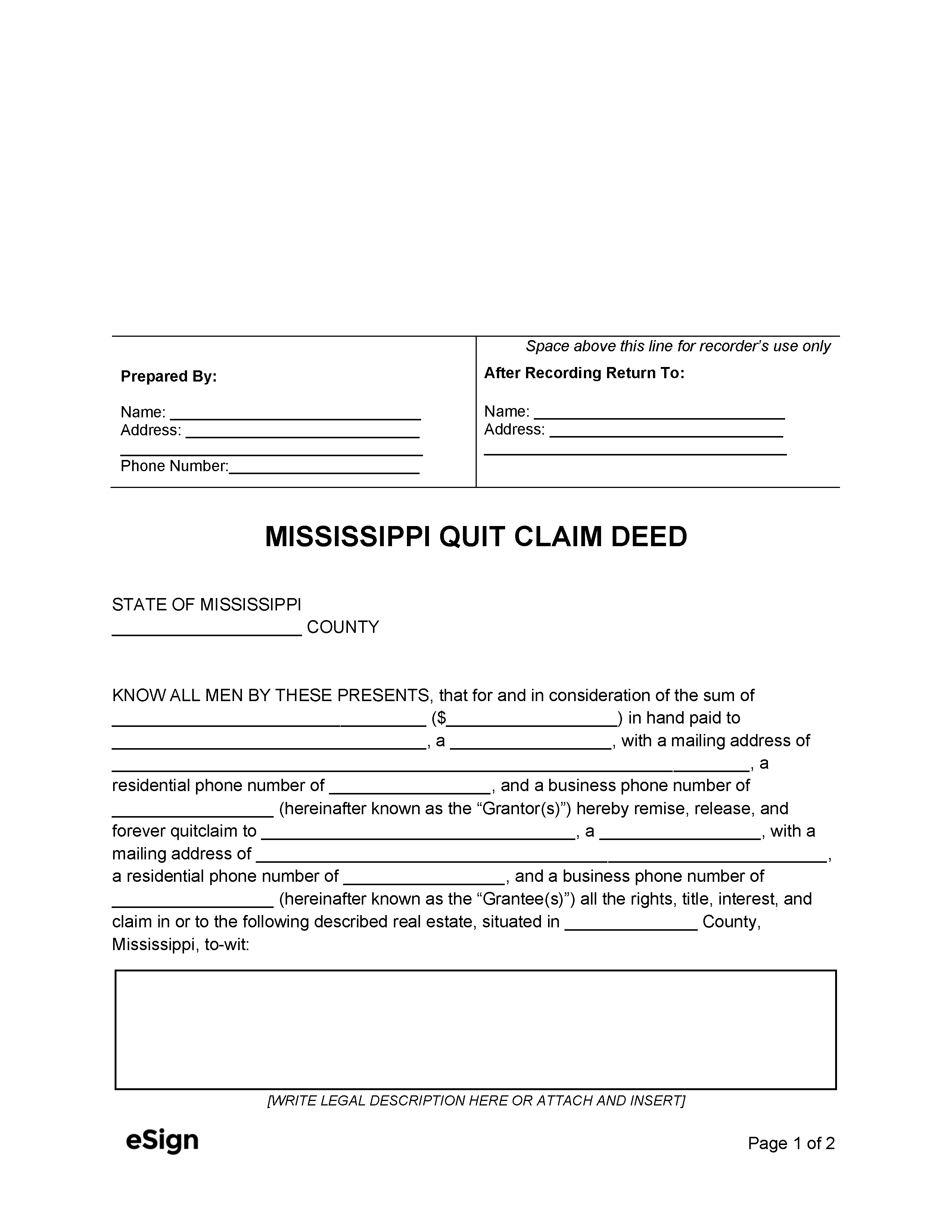

Quit Claim Deed – Conveys a property title to the grantee without guarantee of the grantor’s ownership or a clean title. Quit Claim Deed – Conveys a property title to the grantee without guarantee of the grantor’s ownership or a clean title.

|

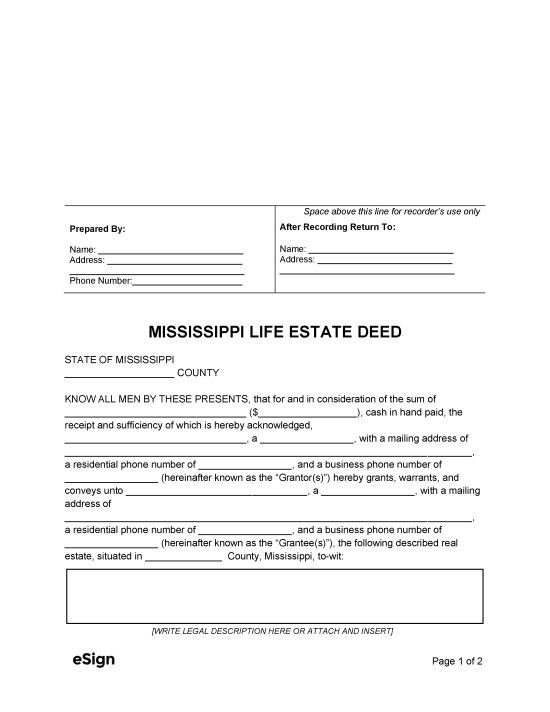

Life Estate Deed – Retains the grantor’s interest in their lifetime, transferring to the grantee after death. Cannot be revoked by the grantor. Life Estate Deed – Retains the grantor’s interest in their lifetime, transferring to the grantee after death. Cannot be revoked by the grantor.

|

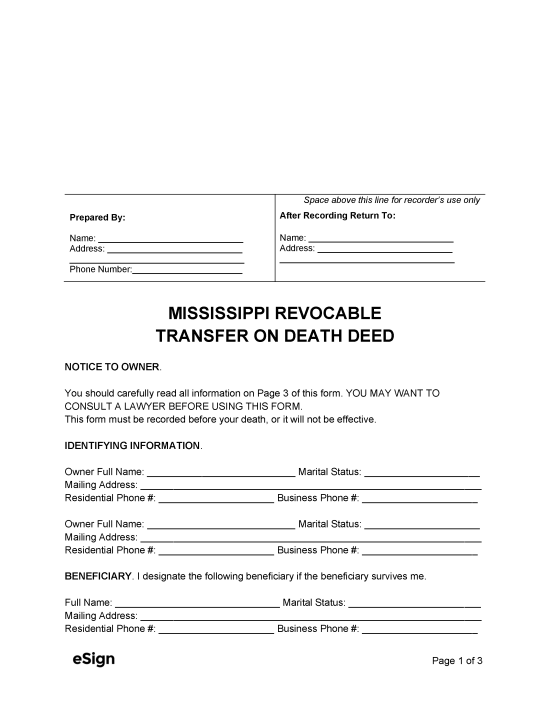

Transfer on Death Deed – Grants property to one or more beneficiaries following the grantor’s death. Can be revoked by the grantor. Transfer on Death Deed – Grants property to one or more beneficiaries following the grantor’s death. Can be revoked by the grantor.

|

Formatting

Paper – White, 20lb weight minimum, single-sided, unbound, no stapled attachments

Margins – 3″ top margin on first page, 0.75″ minimum for all other margins

Font – At least 10pt size, signatures in blue or black ink[1]

Recording

Signing Requirements – The grantor’s signature requires notary acknowledgment to be recorded.[2]

Where to Record – Deeds are filed with the local Chancery Clerk’s Office.[3]

Cost – $25 for the first 5 pages, $1 for each additional page (as of this writing)[4]