By Type (5)

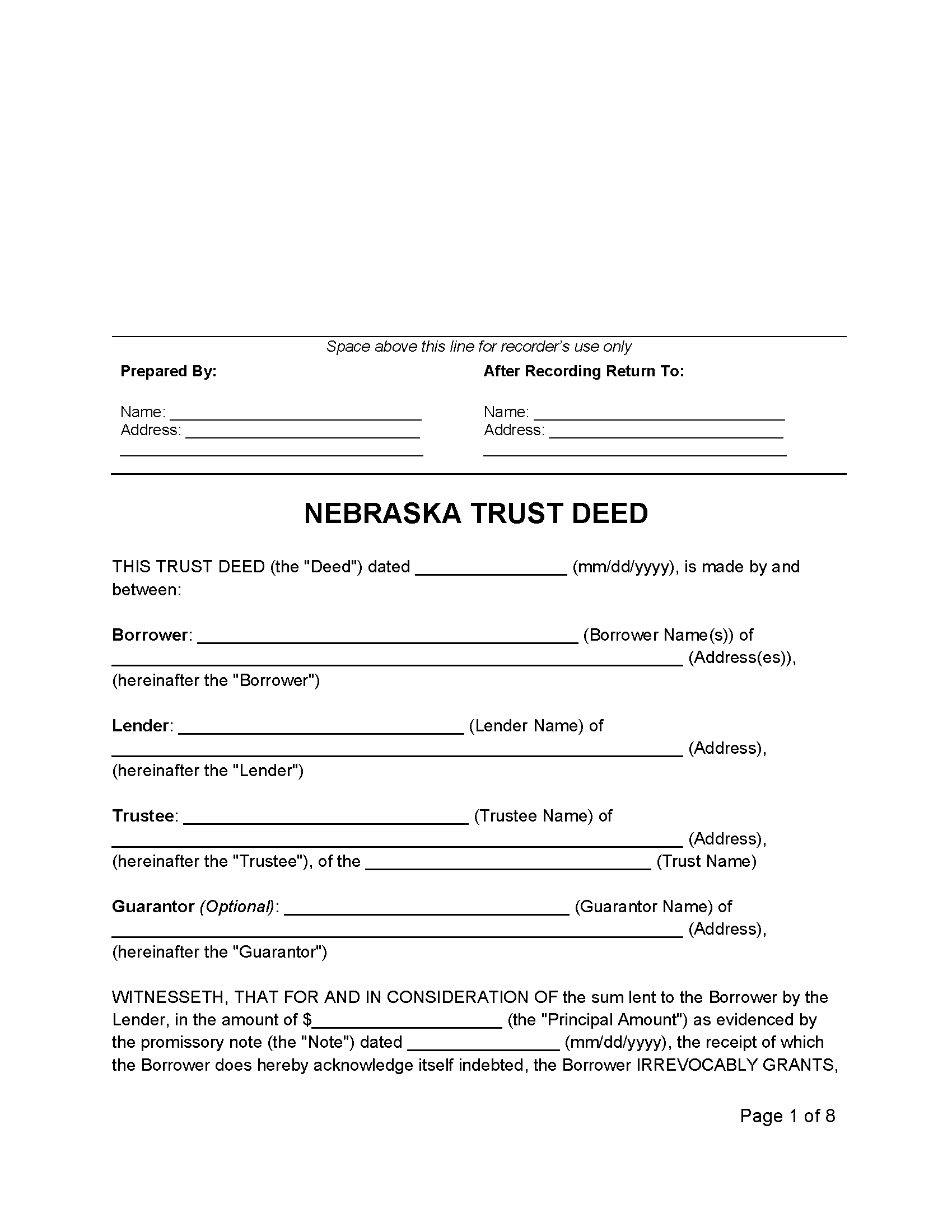

Deed of Trust – Transfers legal title to a trustee as loan security to be held until fulfillment. Deed of Trust – Transfers legal title to a trustee as loan security to be held until fulfillment.

|

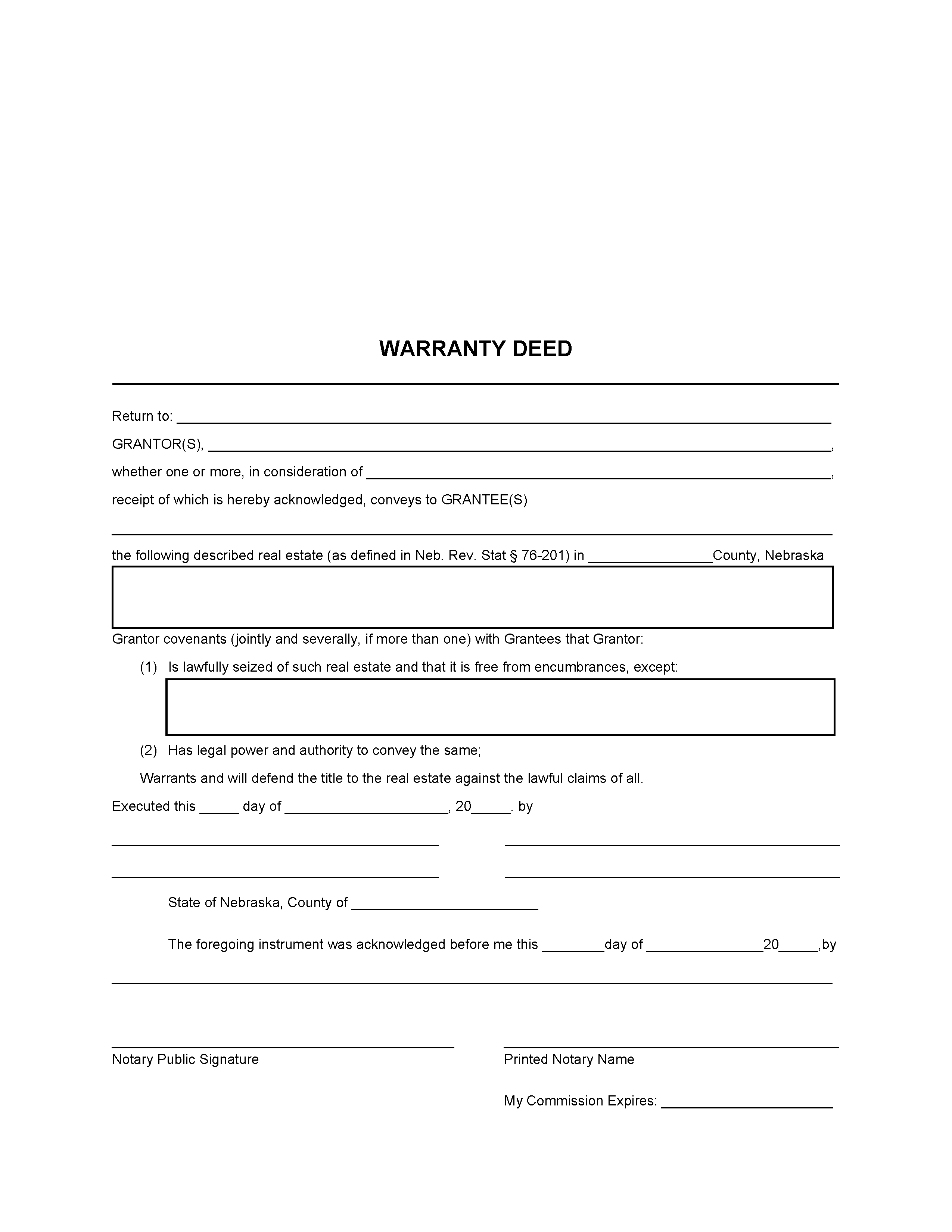

General Warranty Deed – Holds the grantor liable for title issues arising before and during their ownership. General Warranty Deed – Holds the grantor liable for title issues arising before and during their ownership.

Download: PDF |

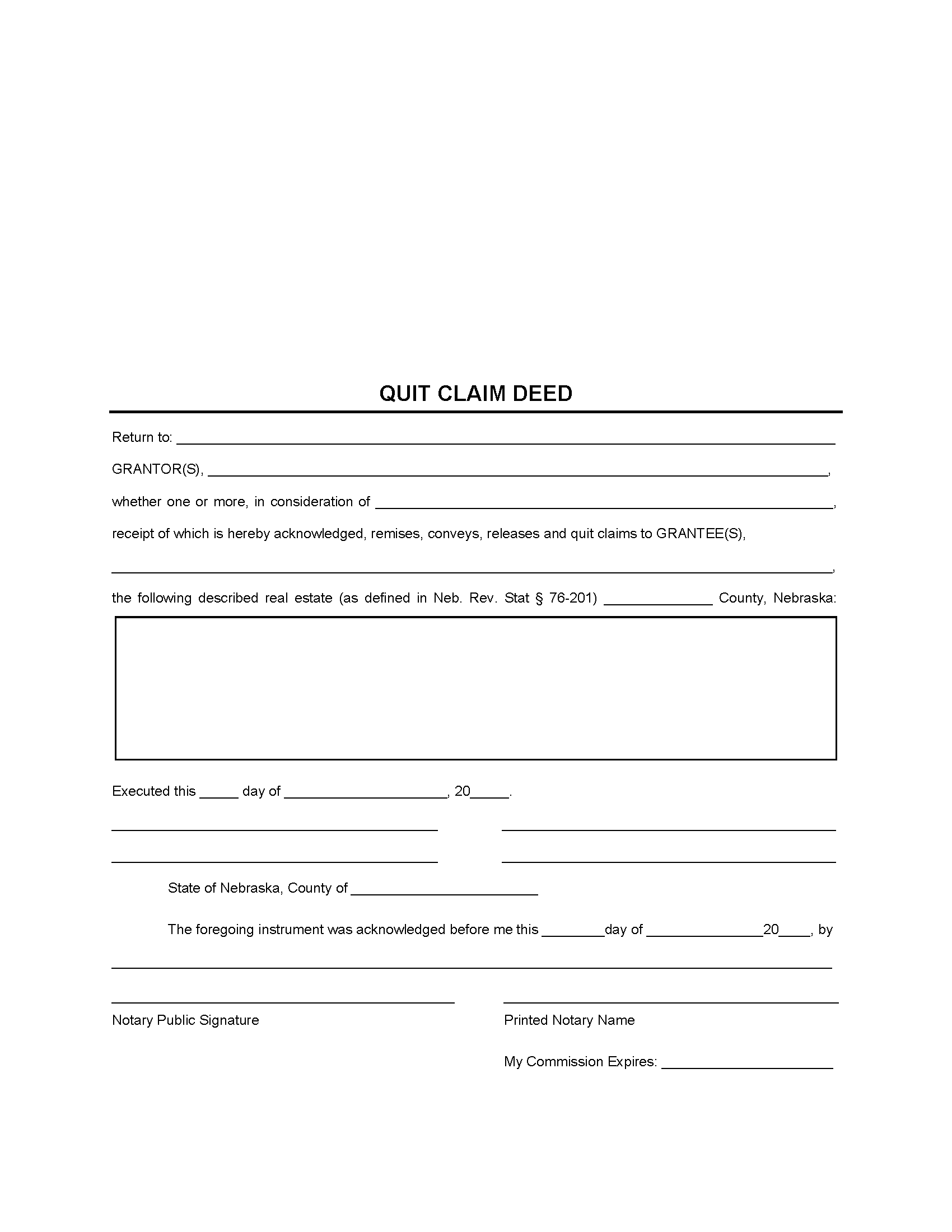

Quit Claim Deed – A deed that transfers ownership without title warranties. Quit Claim Deed – A deed that transfers ownership without title warranties.

Download: PDF |

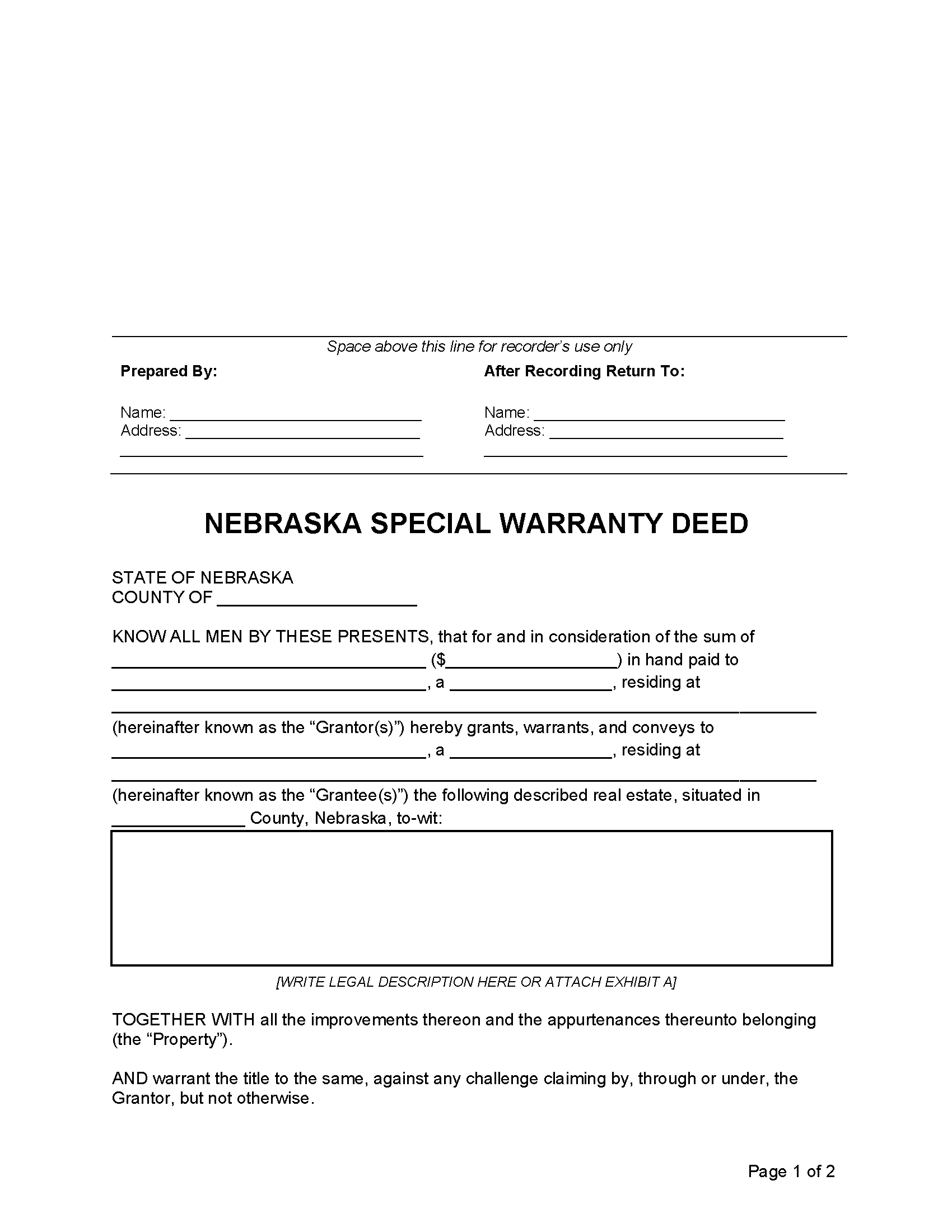

Special Warranty Deed – Protects the grantee against title issues from the grantor’s ownership period only. Special Warranty Deed – Protects the grantee against title issues from the grantor’s ownership period only.

|

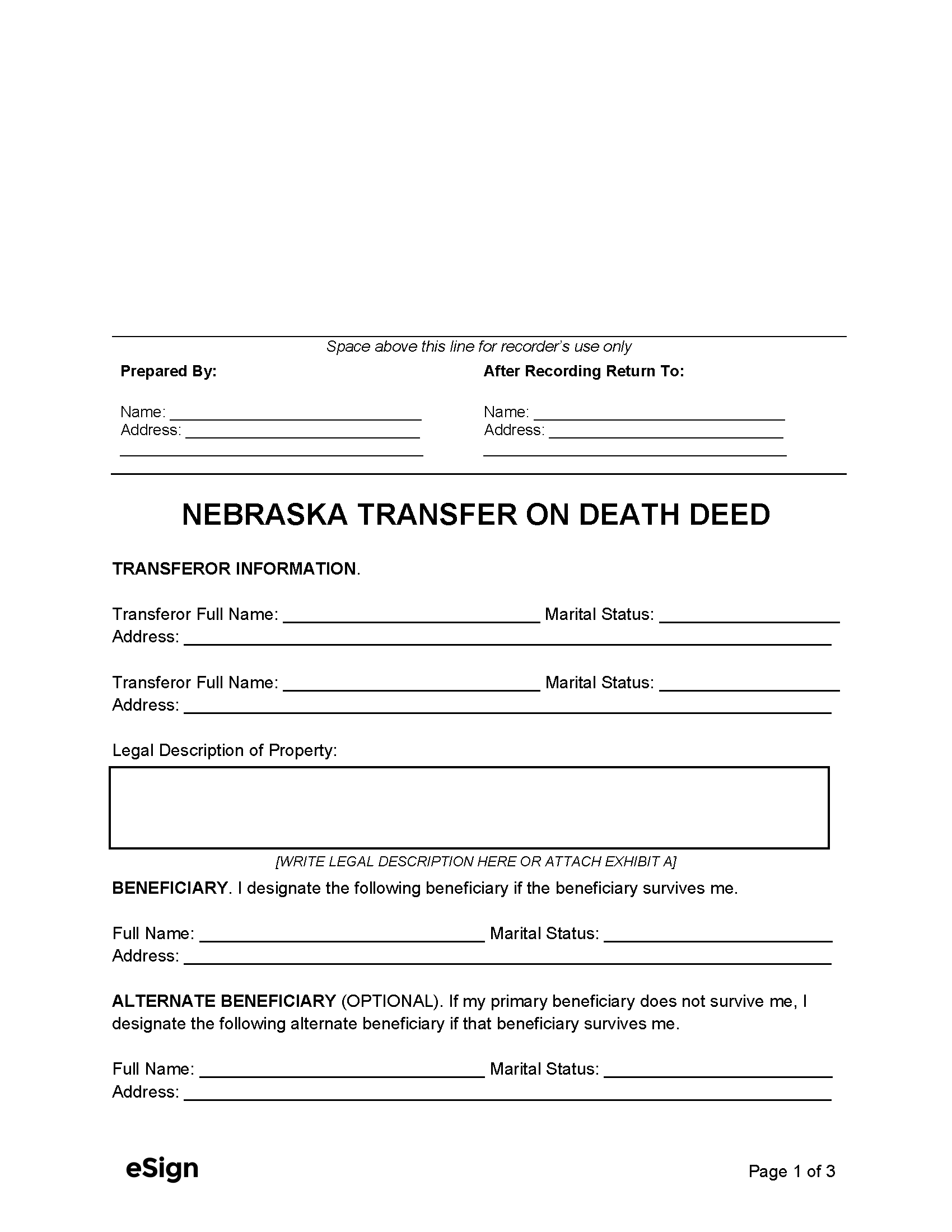

Transfer on Death Deed – Allows a beneficiary to inherit property when the grantor dies. Transfer on Death Deed – Allows a beneficiary to inherit property when the grantor dies.

|

Formatting

Paper – White 20lb paper, no smaller than 8.5″ x 11″ and no larger than 8.5″ x 14″

Margins – 3″ margin on top of the first page, 1″ margin everywhere else

Font – 8pt font, black ink[1]

Recording

Signing Requirements – Deeds require the grantor’s signature and notarization.[2]

Where to Record – Once signed and notarized, the deed must be recorded with the Register of Deeds.[3]

Cost – $10 for the first page and $6 for each additional page (as of this writing)[4]

Additional Forms

Real Estate Transfer Statement (Form 521) – Must be filed by the grantee when recording a property deed to disclose the purchase price and other transaction details.

Certificate of Exemption – Used by the grantor to request an exemption from the documentary stamp tax.[5]