Life Estate Benefits

Life estate deeds offer the following benefits for the homeowner to consider:

- Names a beneficiary of the real estate (overrides will)

- Avoids probate

- Grants owner use of home as a “life tenant”

- Can protect the property from Medicaid estate recovery

- May lessen tax burden on the beneficiary

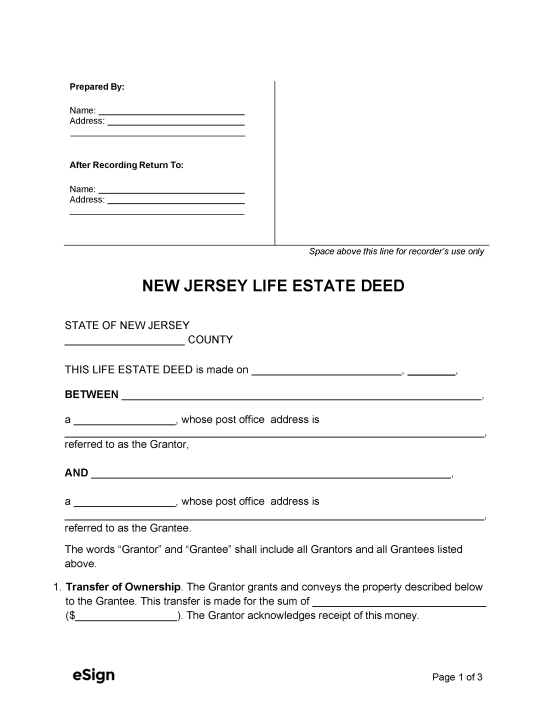

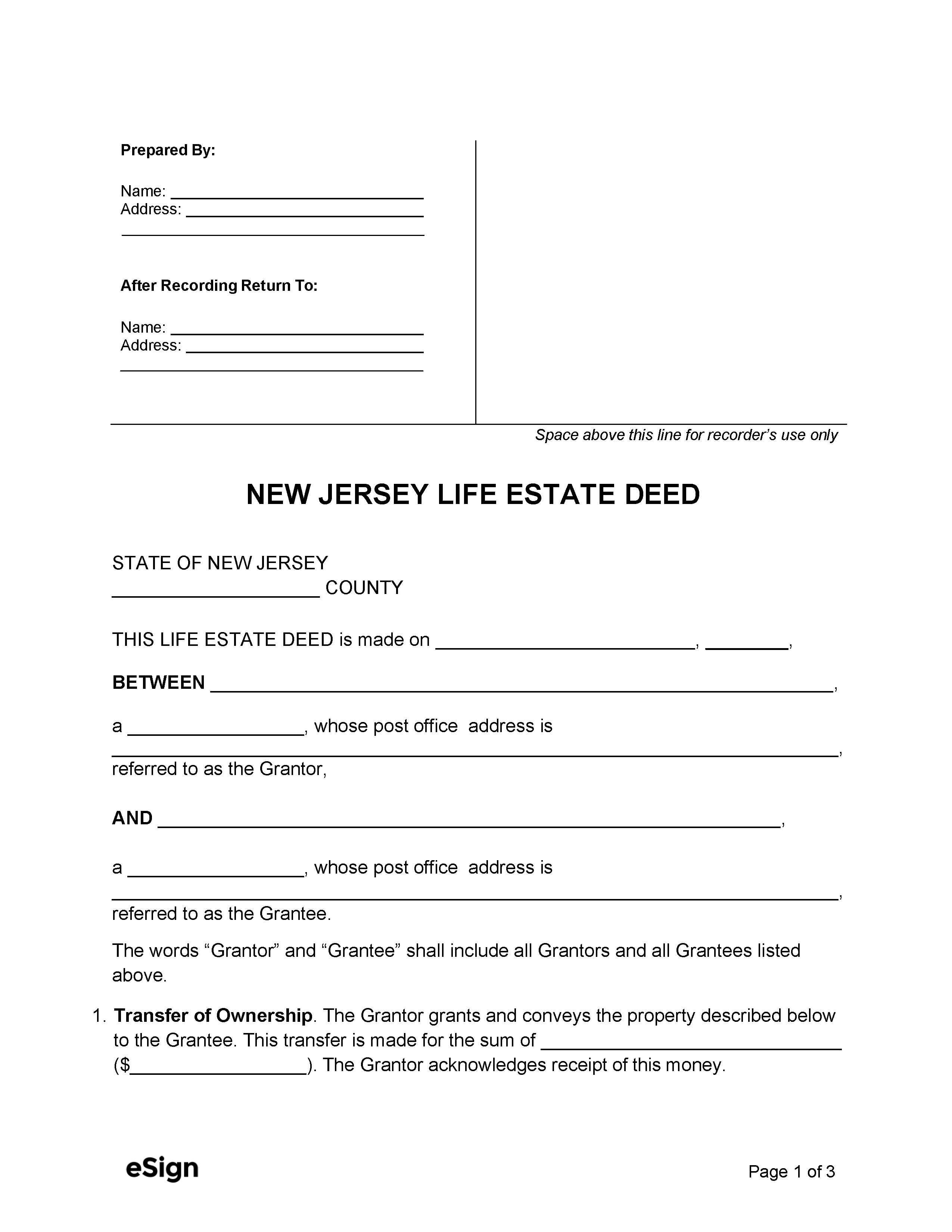

Recording Deeds in New Jersey

Before being recorded with the County Clerk, New Jersey deeds must be printed on paper 8.5″ x 14″ or smaller and signed by the grantor and notarized.[1]

At the time of this writing, recording fees are $30 for the first page and $10 for each additional page.[2]

Required Attachments

All recorded documents in New Jersey must be submitted with a cover sheet (available at the County Clerk’s office).[3]

When a property is transferred for consideration under $100, the grantor must complete an Affidavit of Consideration for Use By Seller (RTF-1) to be attached to and filed with the deed.

Additionally, the following forms must be completed and filed with the deed to determine if an Estimated Gross Income Tax payment is required from the grantor[4]: