By Type (5)

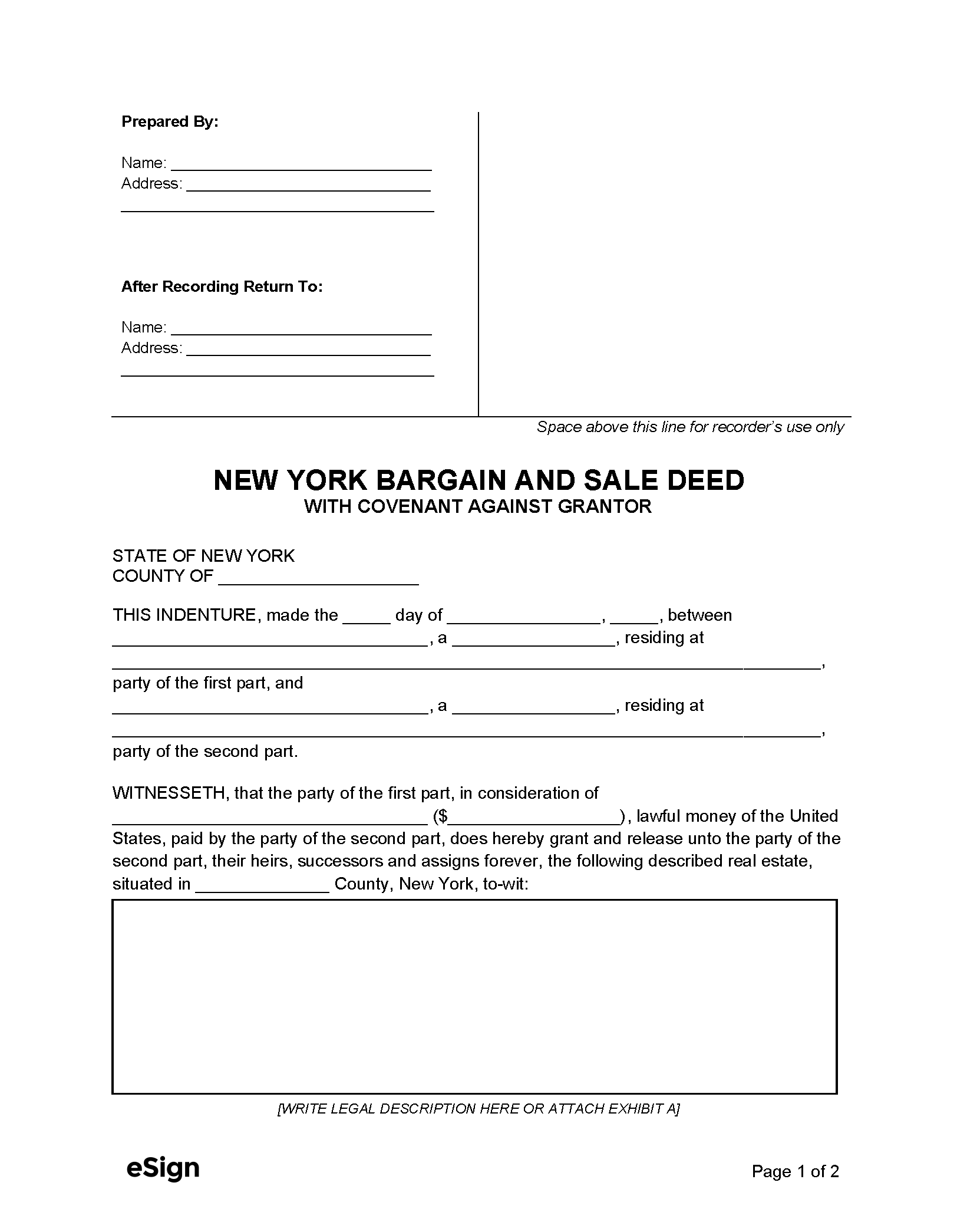

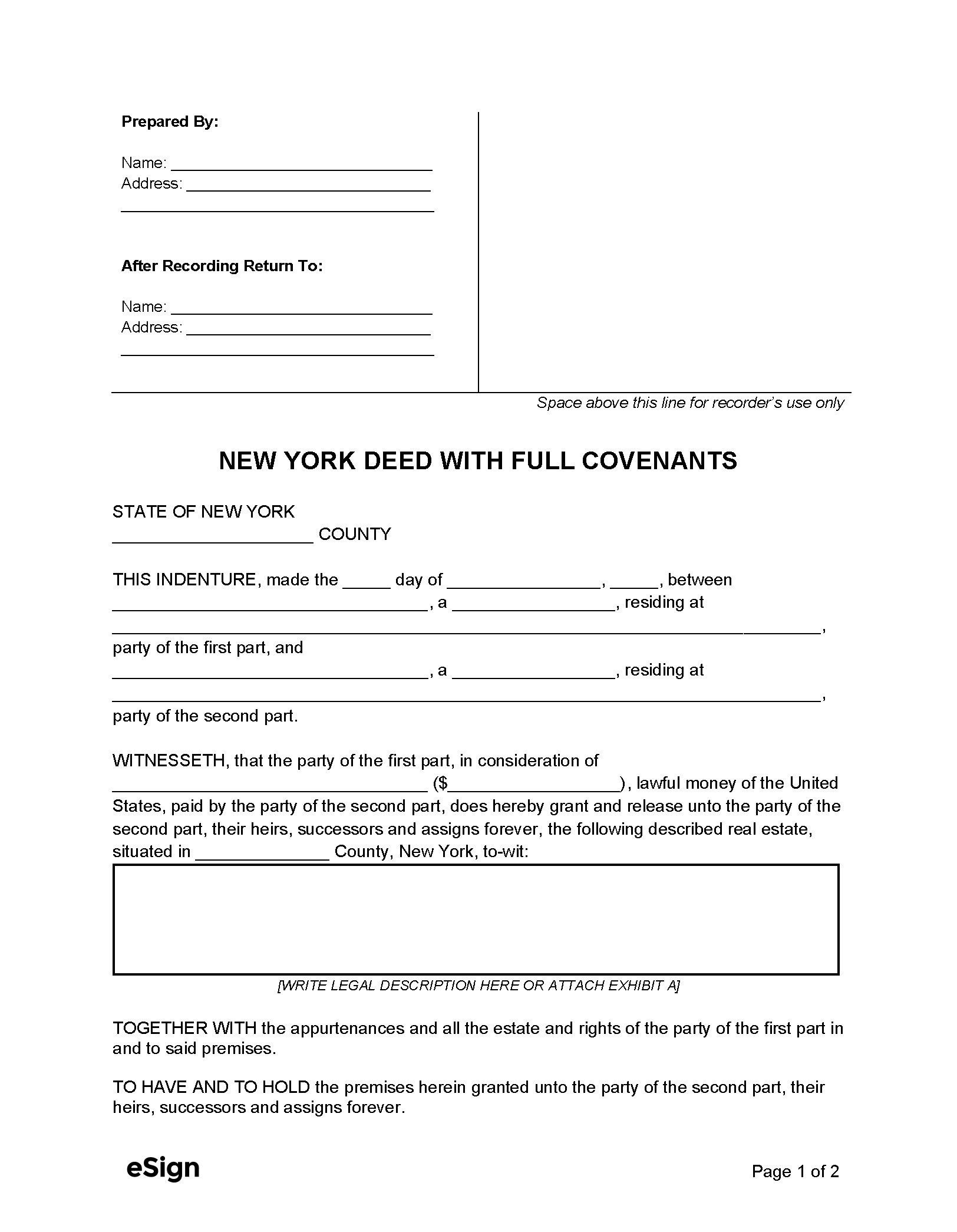

Bargain and Sale Deed With Covenant – Guarantees that the grantor has title rights and hasn’t encumbered the title during their ownership. Bargain and Sale Deed With Covenant – Guarantees that the grantor has title rights and hasn’t encumbered the title during their ownership.

|

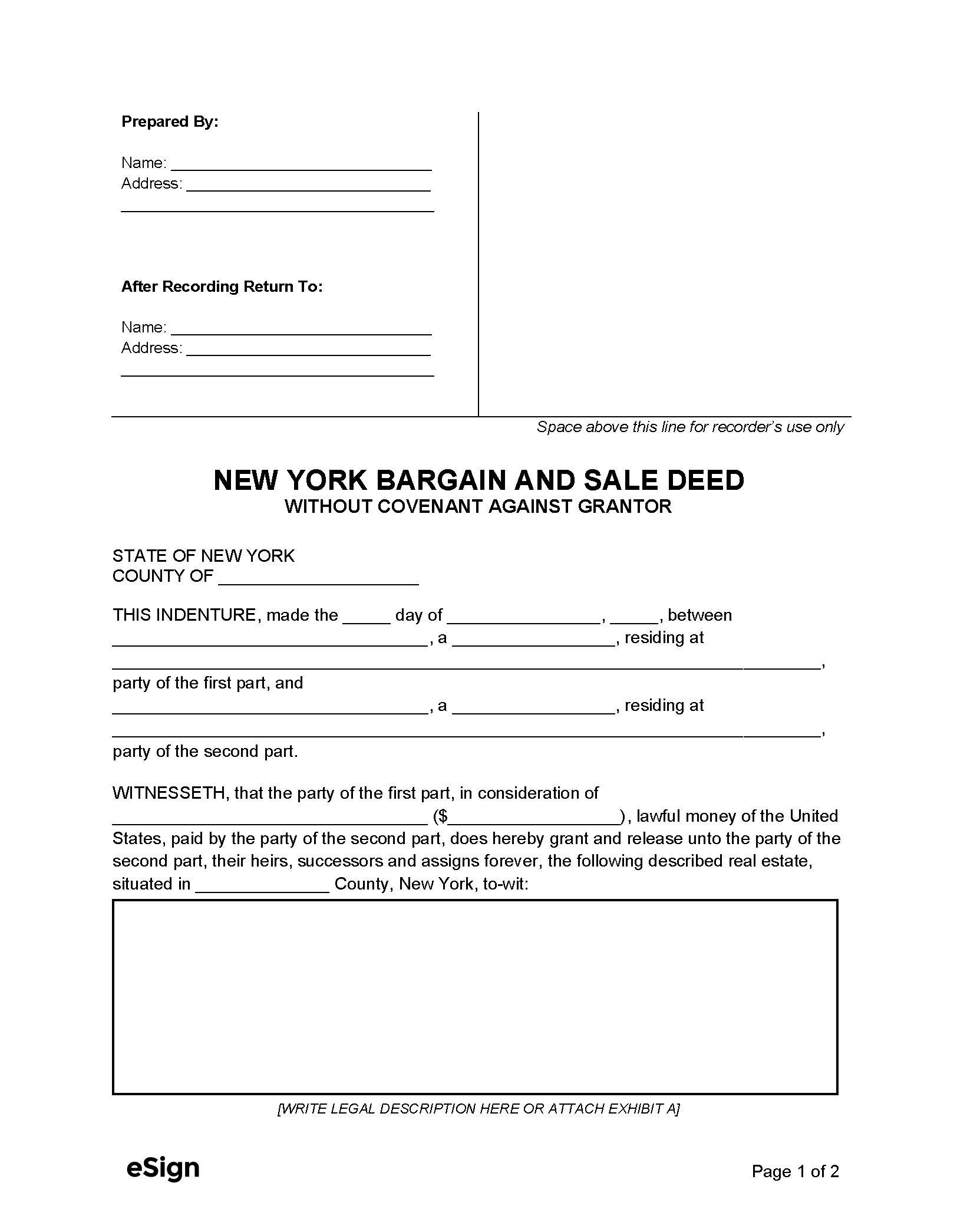

Bargain and Sale Deed Without Covenant – Promises that the grantor has title rights, but does not warrant the title against encumbrances. Bargain and Sale Deed Without Covenant – Promises that the grantor has title rights, but does not warrant the title against encumbrances.

|

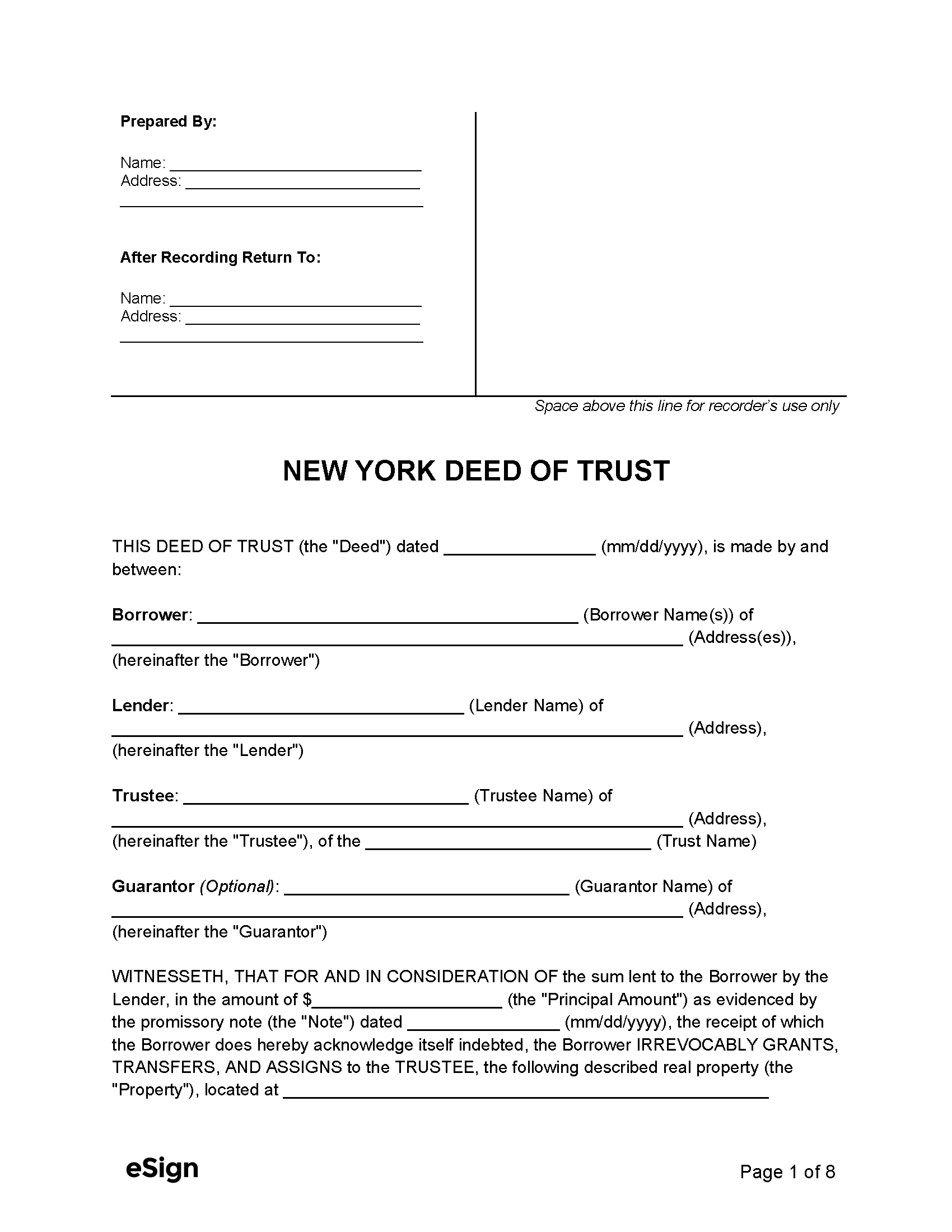

Deed of Trust – Grants property to a third party to hold as security until a borrower repays a loan.

|

General Warranty Deed – Guarantees that the grantor has the right to transfer and that the title is clear of all encumbrances. General Warranty Deed – Guarantees that the grantor has the right to transfer and that the title is clear of all encumbrances.

|

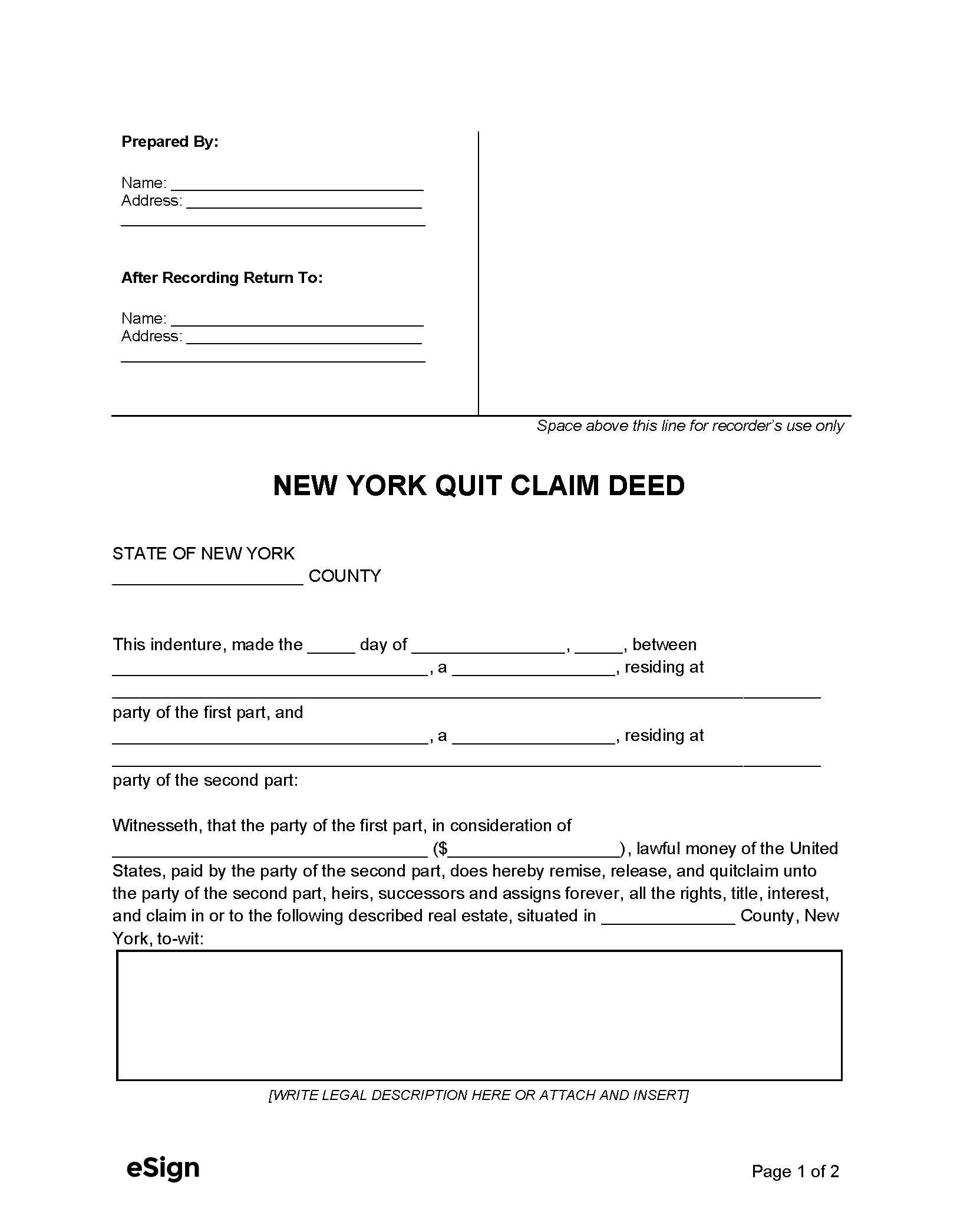

Quit Claim Deed – Conveys the grantor’s interest in real estate, if any, with no warranties to protect the property title. Quit Claim Deed – Conveys the grantor’s interest in real estate, if any, with no warranties to protect the property title.

|

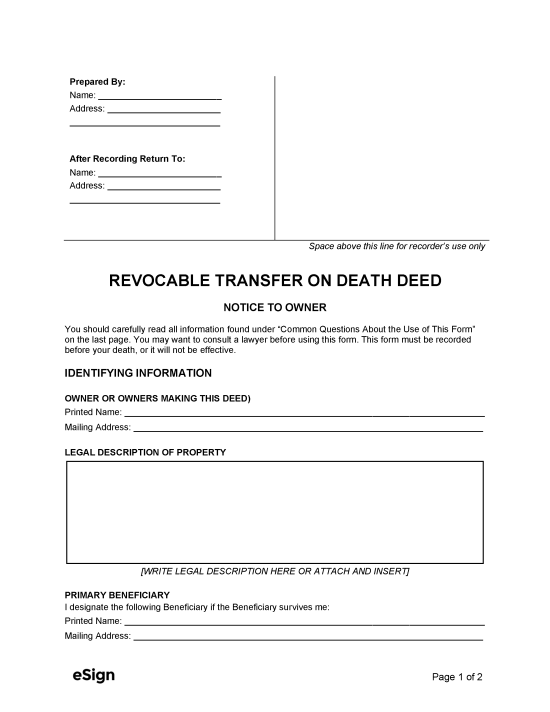

Transfer on Death Deed (TODD) – Names a beneficiary to receive the grantor’s property after their death. Transfer on Death Deed (TODD) – Names a beneficiary to receive the grantor’s property after their death.

|

Formatting

No statewide formatting standards for deeds. Individuals can contact their County Clerk or City Register for local requirements.

Recording

Signing Requirements – The grantor must sign and have their signature notarized.[1]

Where to Record – A signed and notarized deed must be recorded with the County Clerk or City Register (Outside NYC – Inside NYC).[2]

- Online recording is available for Staten Island and all other NYC boroughs.

Cost – Recording fees vary depending on the county and the number of pages recorded.

Additional Forms

Additional forms may be needed at the time of recording. Grantors can contact the County Clerk or City Register beforehand to confirm which forms are required.

- RP-5217-PDF – For property transfers outside New York City.

- RP-5217NYC – For property transfers inside New York City.

- Form IT-2663 – Required if the grantor is not a resident of New York State.

- Form TP-584 – Used to pay the transfer tax on properties outside New York City.

- Form TP-584-NYC – Used to pay the transfer tax on properties inside New York City.