By Type (4)

General Warranty Deed – Ensures a clear title, free from all liens, judgments, and other encumbrances. General Warranty Deed – Ensures a clear title, free from all liens, judgments, and other encumbrances.

|

Quit Claim Deed – Transfers property without assuring that the grantor holds title or that the title is clear. Quit Claim Deed – Transfers property without assuring that the grantor holds title or that the title is clear.

Download: PDF |

Special Warranty Deed – Protects the title from defects linked to the grantor’s time of ownership, not before. Special Warranty Deed – Protects the title from defects linked to the grantor’s time of ownership, not before.

|

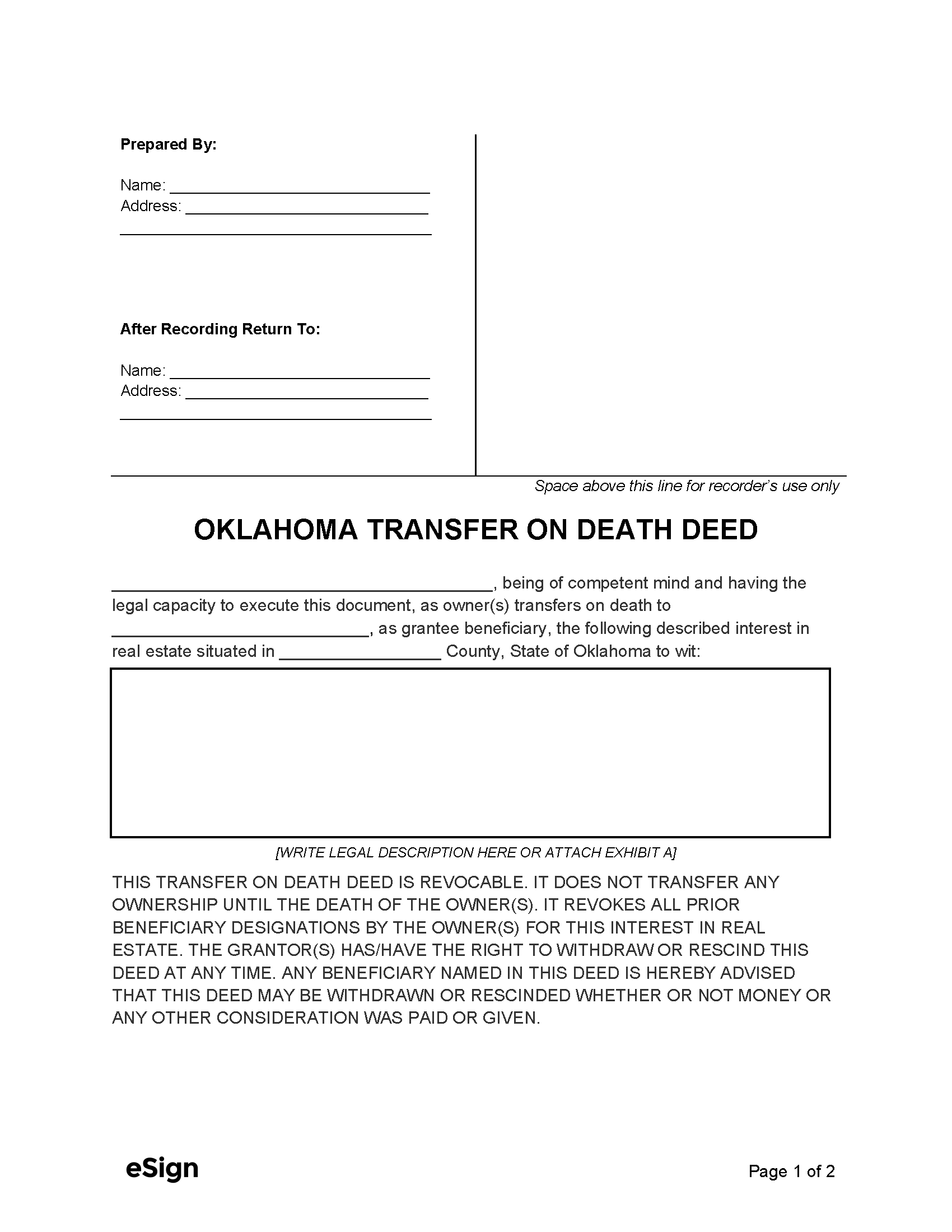

Transfer on Death Deed – Grants ownership automatically to a beneficiary following the grantor’s death. Transfer on Death Deed – Grants ownership automatically to a beneficiary following the grantor’s death.

|

Formatting

Paper – Maximum size of 8.5″ by 14″

Margins – 2″ at the top, 1″ on the sides and bottom, with enough space for stamps and recording details

Font – Dark ink[1]

Recording

Signing Requirements – Deeds need to be signed by the grantor and notarized.[2] The grantor’s spouse must also provide a notarized signature if the property is a homestead.[3]

Where to Record – A deed must be recorded with the register of deeds in the office of the County Clerk.[4]

Cost – At the time of this writing, the recording fee is $18 ($8 for the first page + $10 preservation fee) and $2 for each additional page.[5]