Recording and Resources

Formatting

- Paper: 8.5″ x 14″ max.

- Margins: 2” top, 1” side and bottom

- Font: Dark ink[1]

Signing and Recording

- Signing Requirements: Notary, two witnesses, and spouse for homesteads[2]

- Where to Record: County Clerk[3]

- Recording fees: $18 for the first page, $2 for each additional page (as of this writing)[4]

Resources

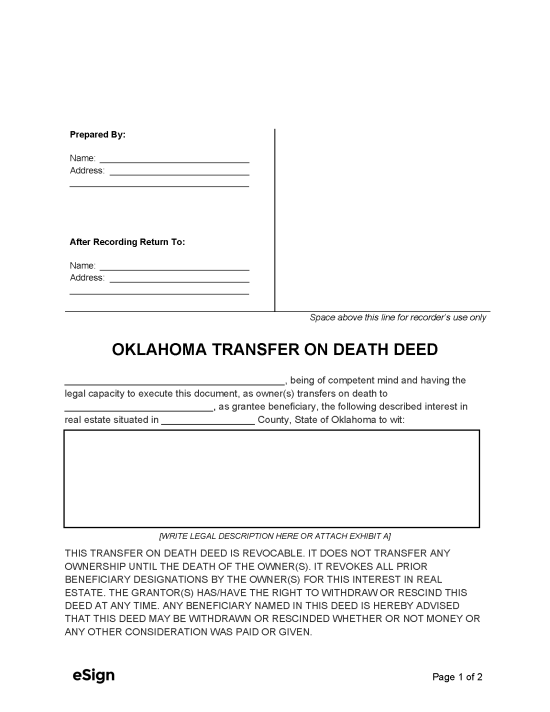

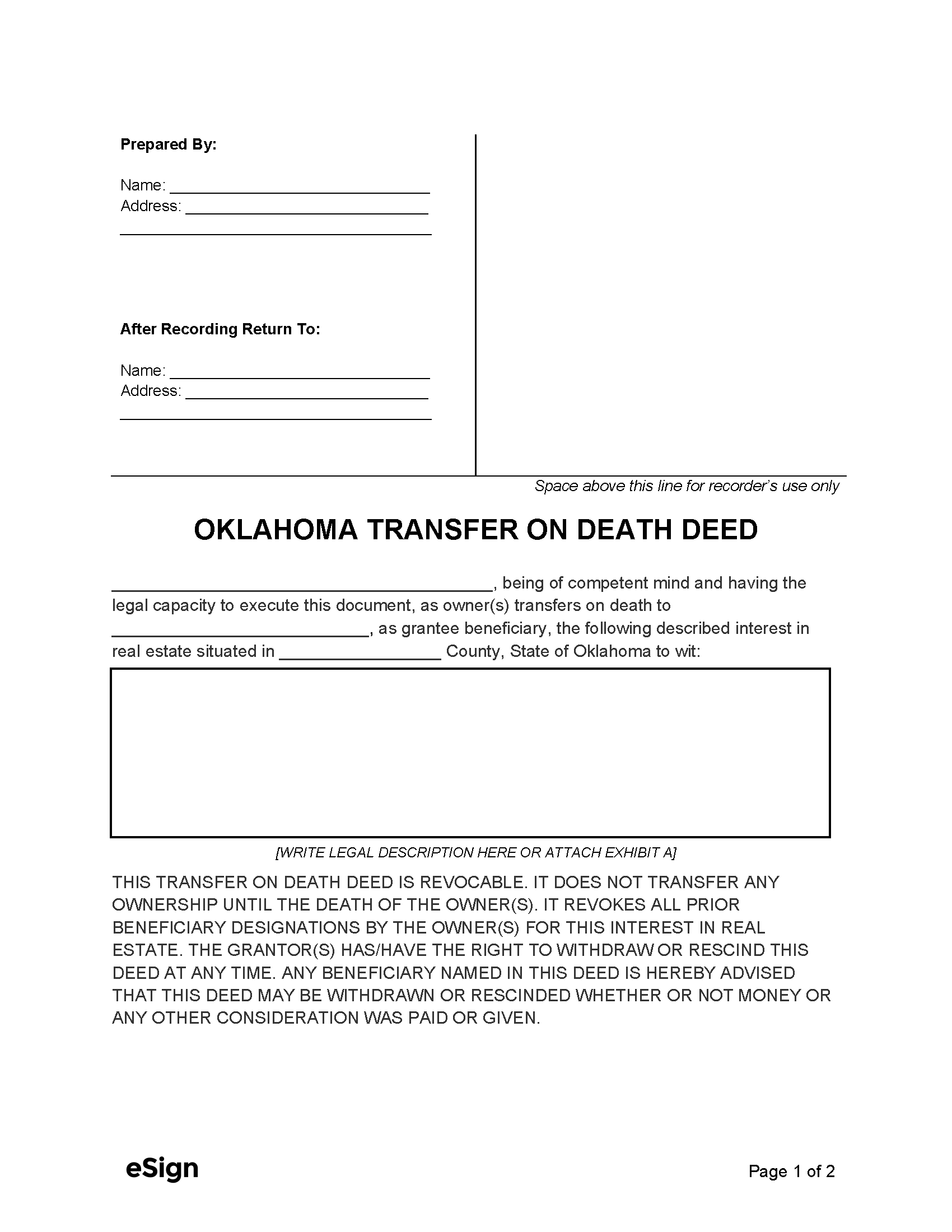

TOD Deed Preview

Transfer on Death Affidavit – Must be recorded by the beneficiary to be transferred the property.[5]