By Type (5)

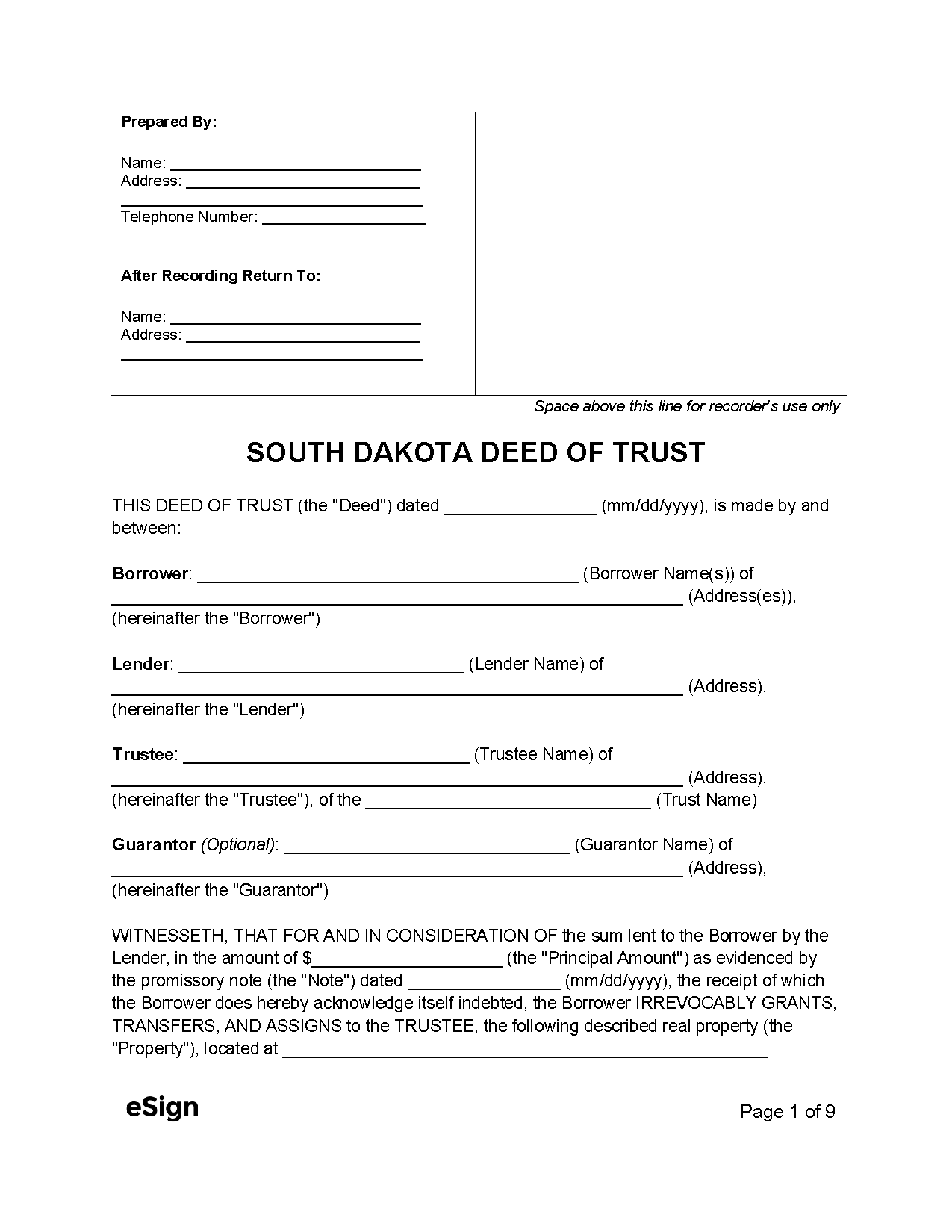

Deed of Trust – Grants ownership to a trustee who holds the title until the owner/borrower repays a loan. Deed of Trust – Grants ownership to a trustee who holds the title until the owner/borrower repays a loan.

|

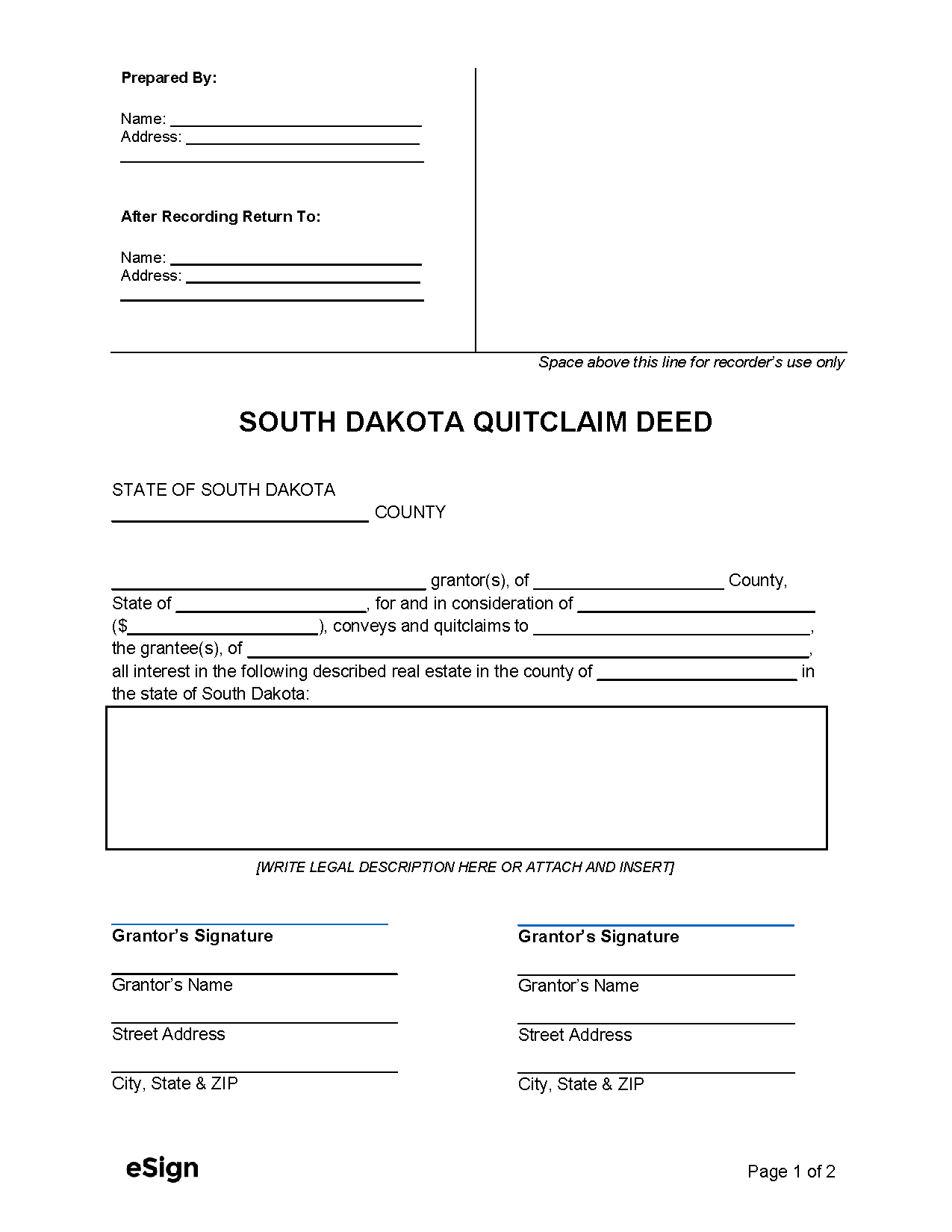

Quitclaim Deed – Provides no title protection and does not warrant that the grantor is a legal owner. Quitclaim Deed – Provides no title protection and does not warrant that the grantor is a legal owner.

|

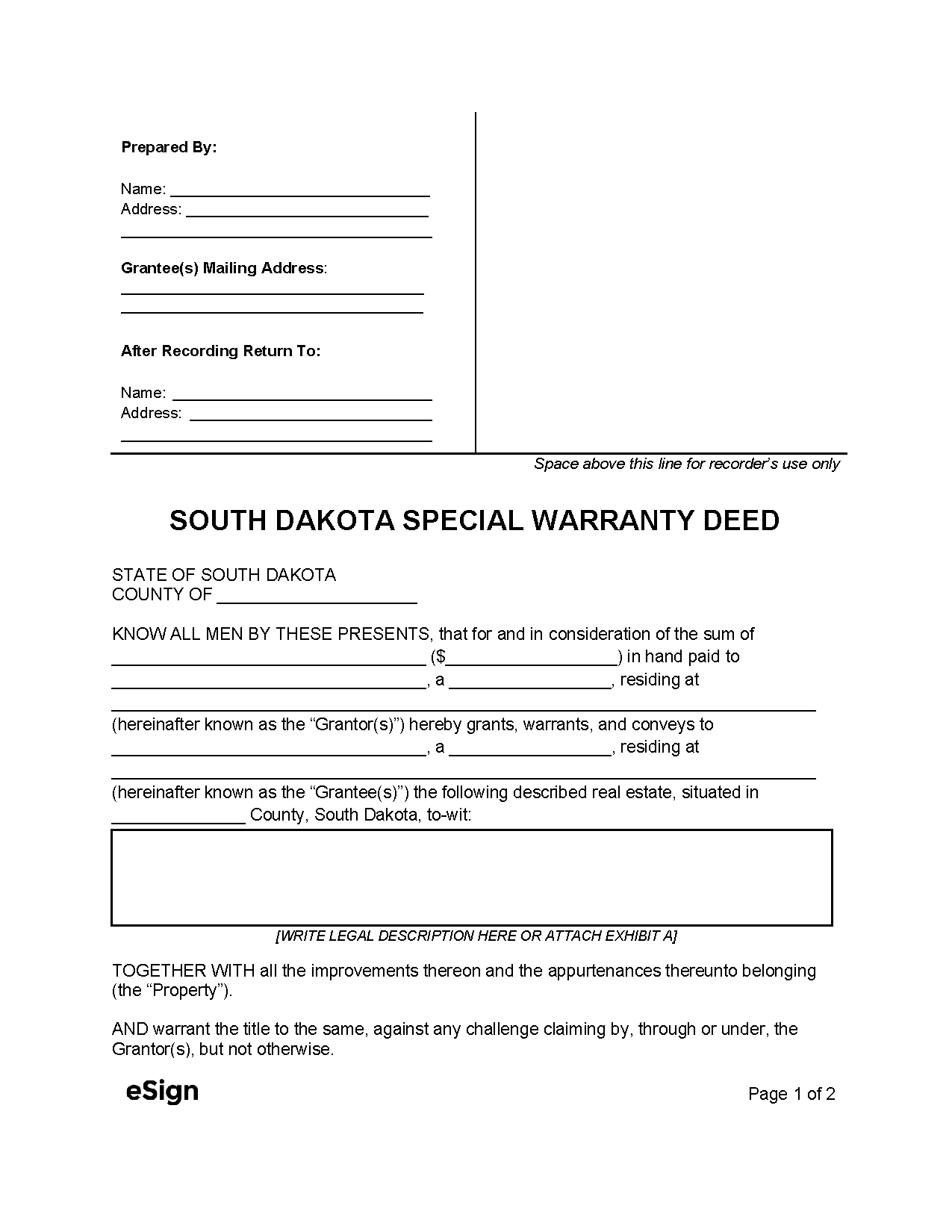

Special Warranty Deed – Only protects the title against encumbrances resulting from the grantor’s ownership period. Special Warranty Deed – Only protects the title against encumbrances resulting from the grantor’s ownership period.

|

|

|

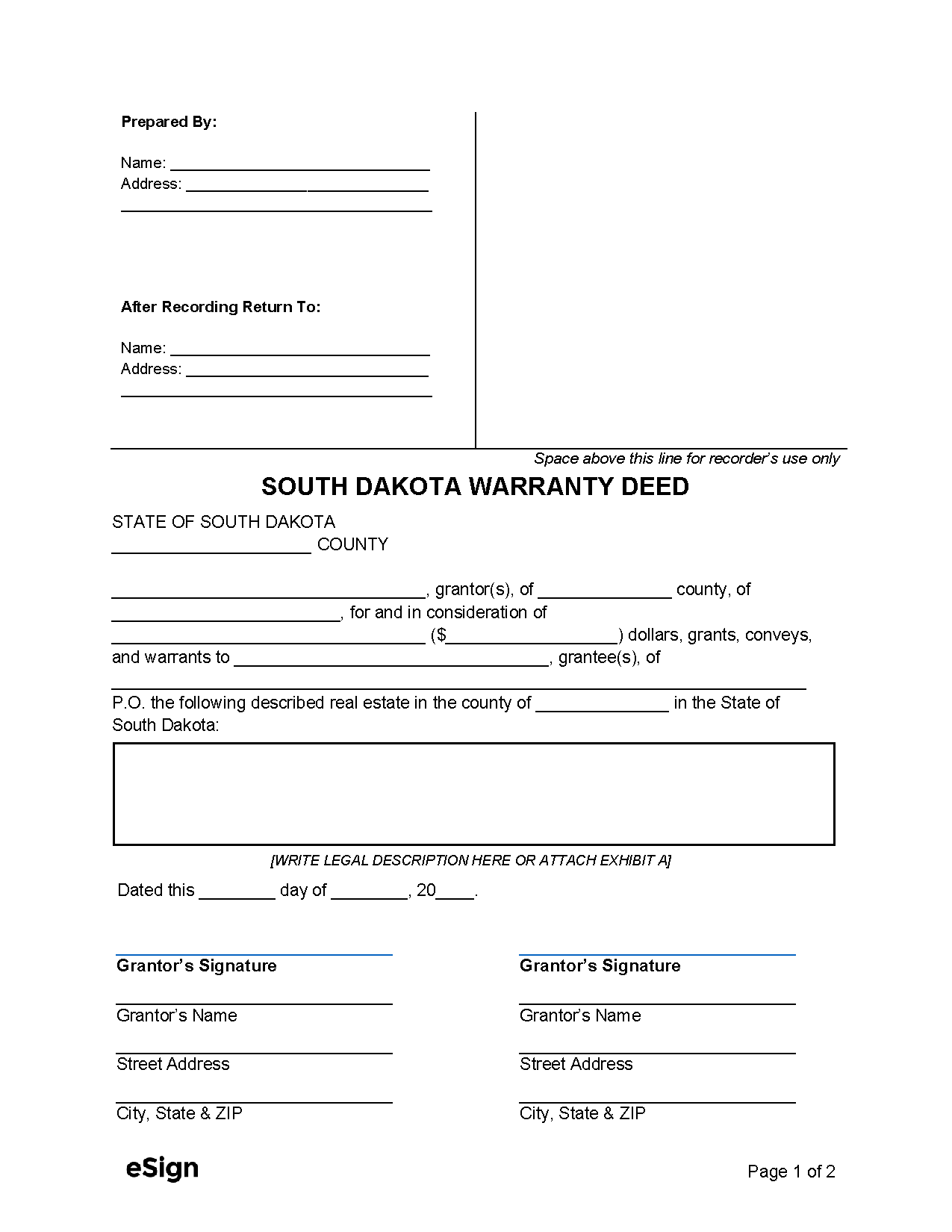

Warranty Deed – Holds the grantor responsible for all title encumbrances, including those caused by past owners. Warranty Deed – Holds the grantor responsible for all title encumbrances, including those caused by past owners.

|

Formatting

Paper – White paper only, at least 20-pound weight, sized 8.5″ x 11″ to 8.5″ x 14″

Margins – 3″ space across the top of the first page, 1″ spaces everywhere else

Font – Min. 10-point font in black ink (signatures may be black or dark blue)[1]

Recording

Signing Requirements – The grantor’s signature must be acknowledged before a notary public.[2]

Where to Record – Deeds need to be recorded at the County Register of Deeds Office in the same county where the property is located.[3]

Cost – $30 for the first 50 pages, $2 for each additional page (as of this writing)[4]

Additional Forms

Certificate of Real Estate Value (Form PT-56) – Must be included when filing a deed to disclose certain transaction details, such as the names and addresses of the parties, their relationship, and the consideration exchanged.[5]