Key Points on Life Estate Deeds

- The life tenant can live in, care for, and use the property for life.

- All expenses and responsibilities tied to the property rest with the life tenant.

- Upon the life tenant’s death, the property passes to the remainderman without going through probate.

- The life tenant cannot sell the property or remove the remainderman without their consent.

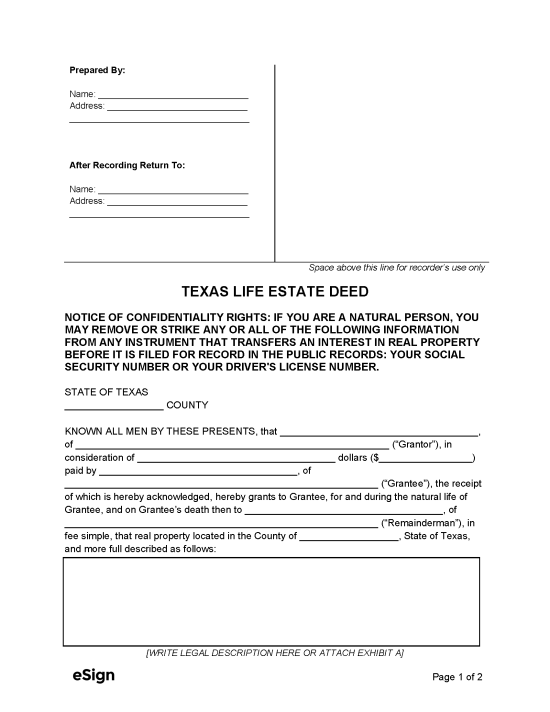

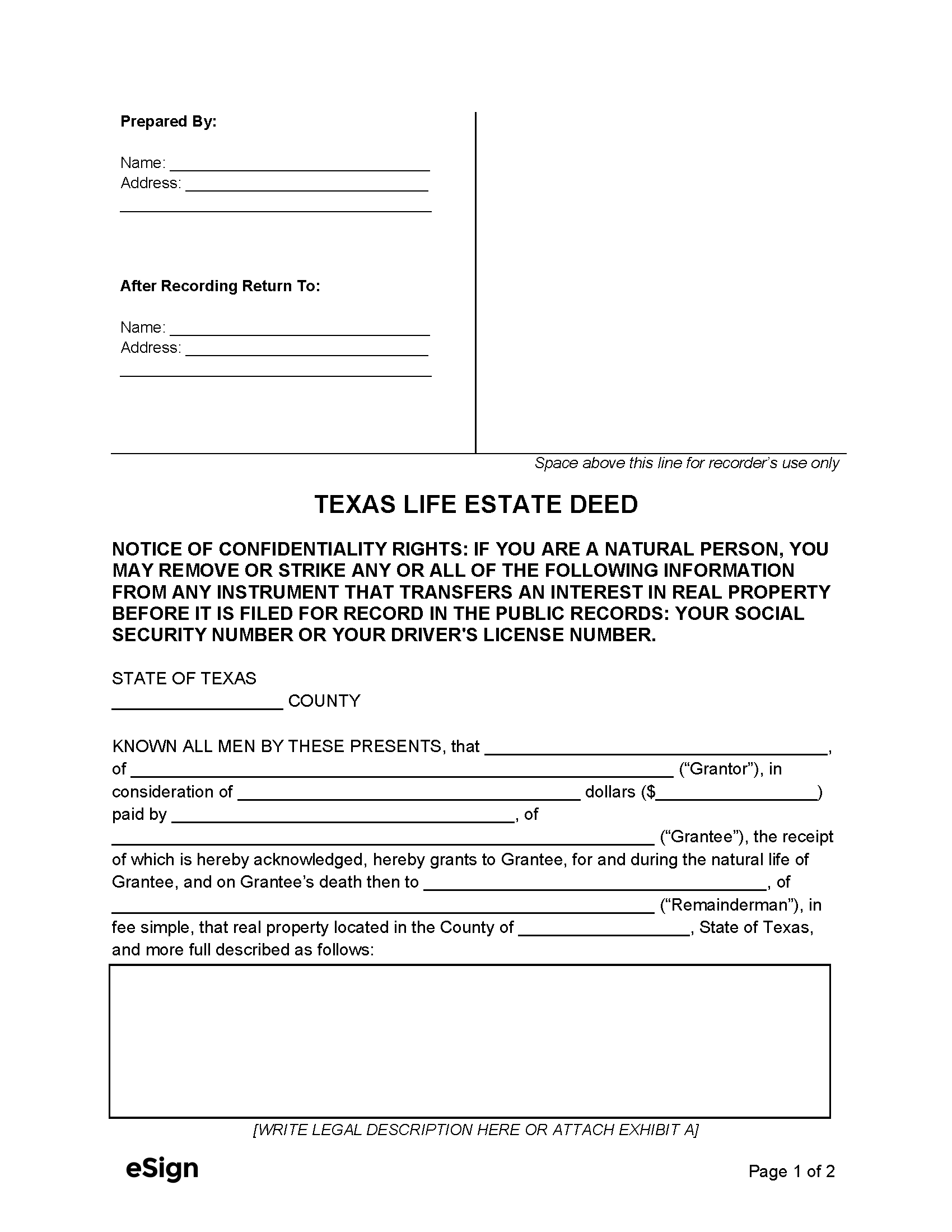

Deed Recording Requirements

Deeds are filed with the County Clerk’s Office in the county where the real estate is located.[1] For the deed to be recorded, it must be:

- No bigger than 8.5 inches wide and 14 inches long.[2]

- Written in a font no smaller than 8 points.[3]

- Signed by the grantor (old owner) and either notarized or signed by two credible witnesses.[4]

Recording Fees – The county clerk’s recording fees are (at the time of this writing) $5 for the first page and $4 for each additional page.[5] A $10 records management fee and a $10 records archive fee are typically charged in addition to the base fee.[6]