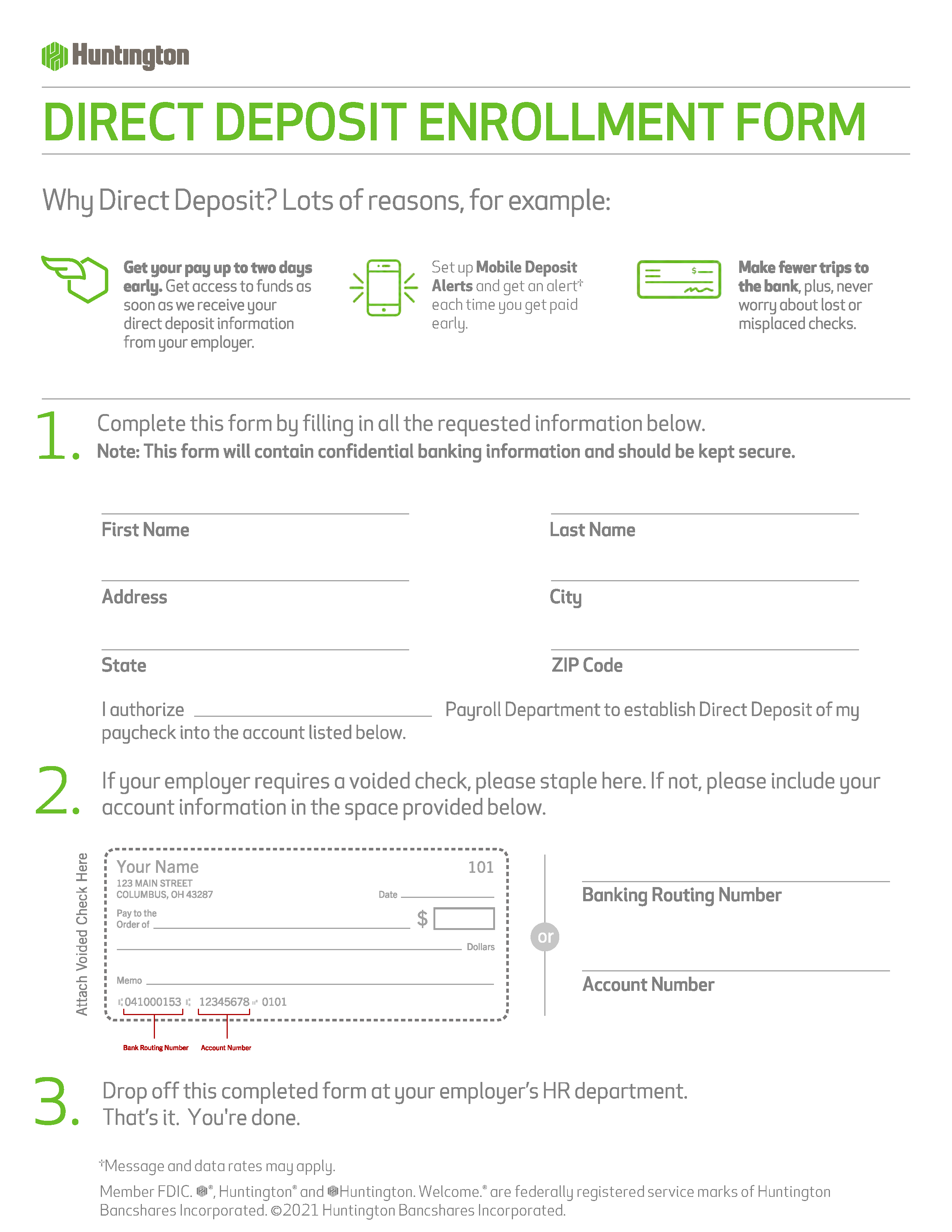

Benefits of Direct Deposit Enrollment

- Eliminates the need for paper checks.

- Funds are typically available on payday without delays.

- Electronic transfers reduce the risk of lost or stolen payments.

- Convenience for employers and employees (no need to visit the bank).

By Type (40)

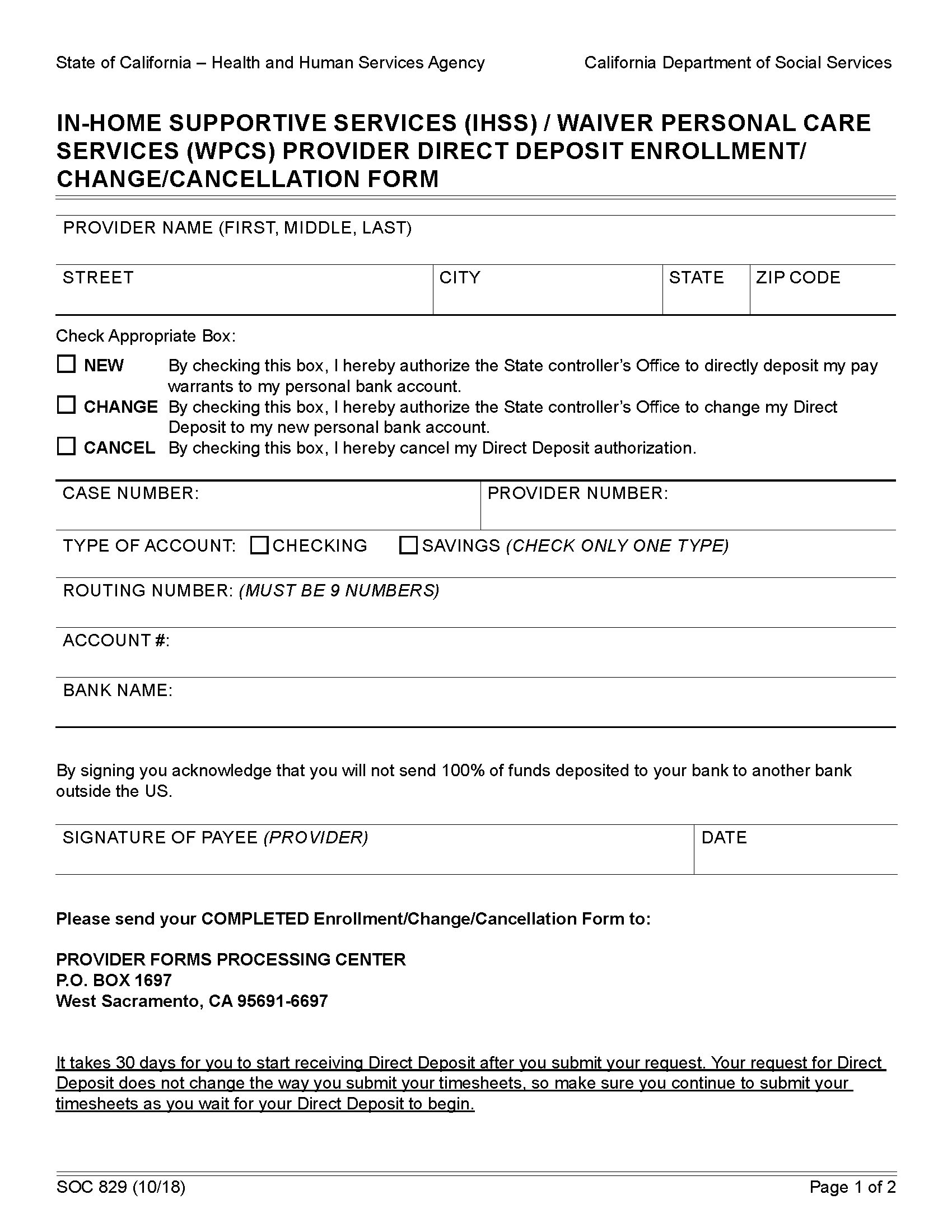

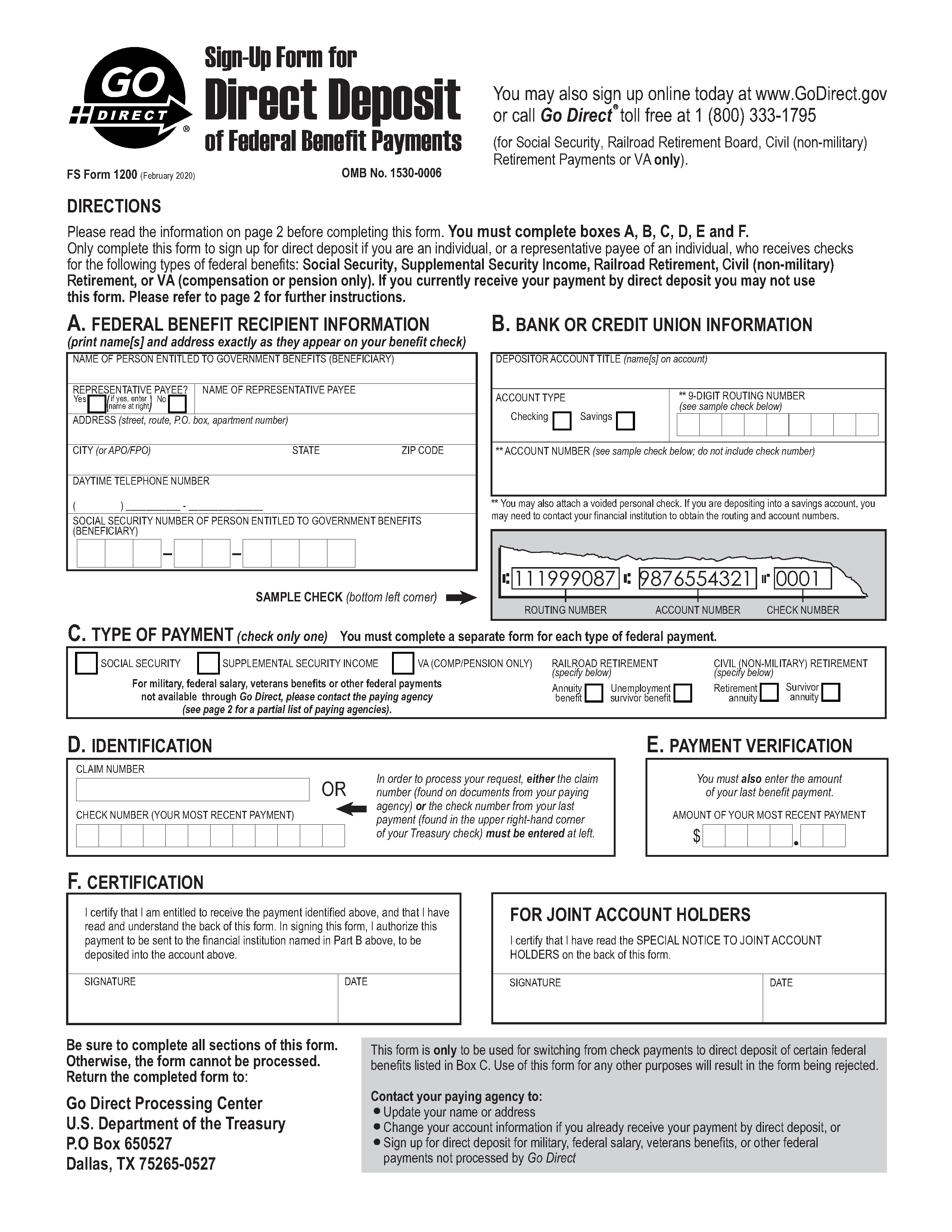

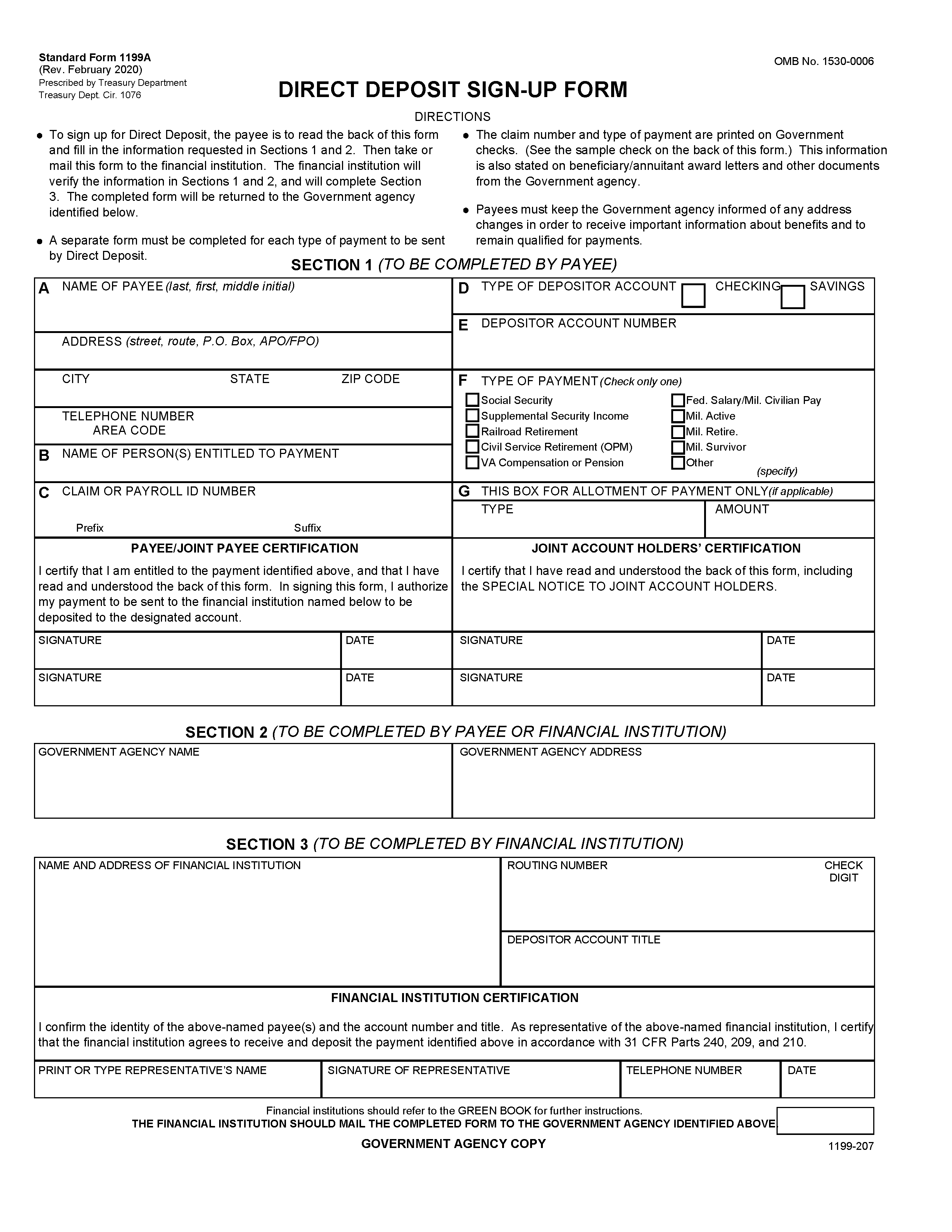

When to Use a Direct Deposit Form

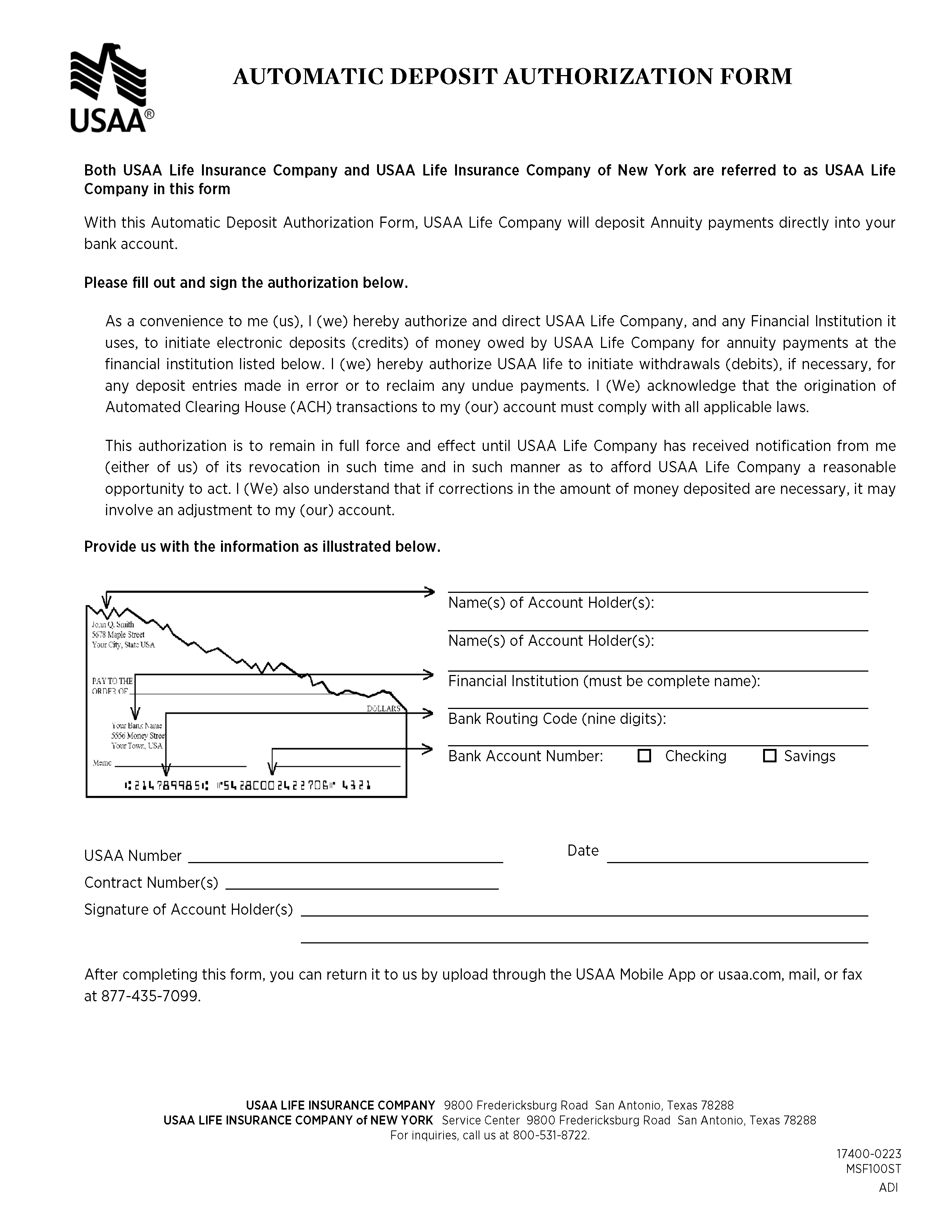

A direct deposit authorization form is used when someone wants recurring payments deposited directly into their bank account. While it most commonly applies to employee payroll, it’s also suitable for electronic transfers of:

- Child support.

- Social Security.

- Government benefits.

- Pension income.

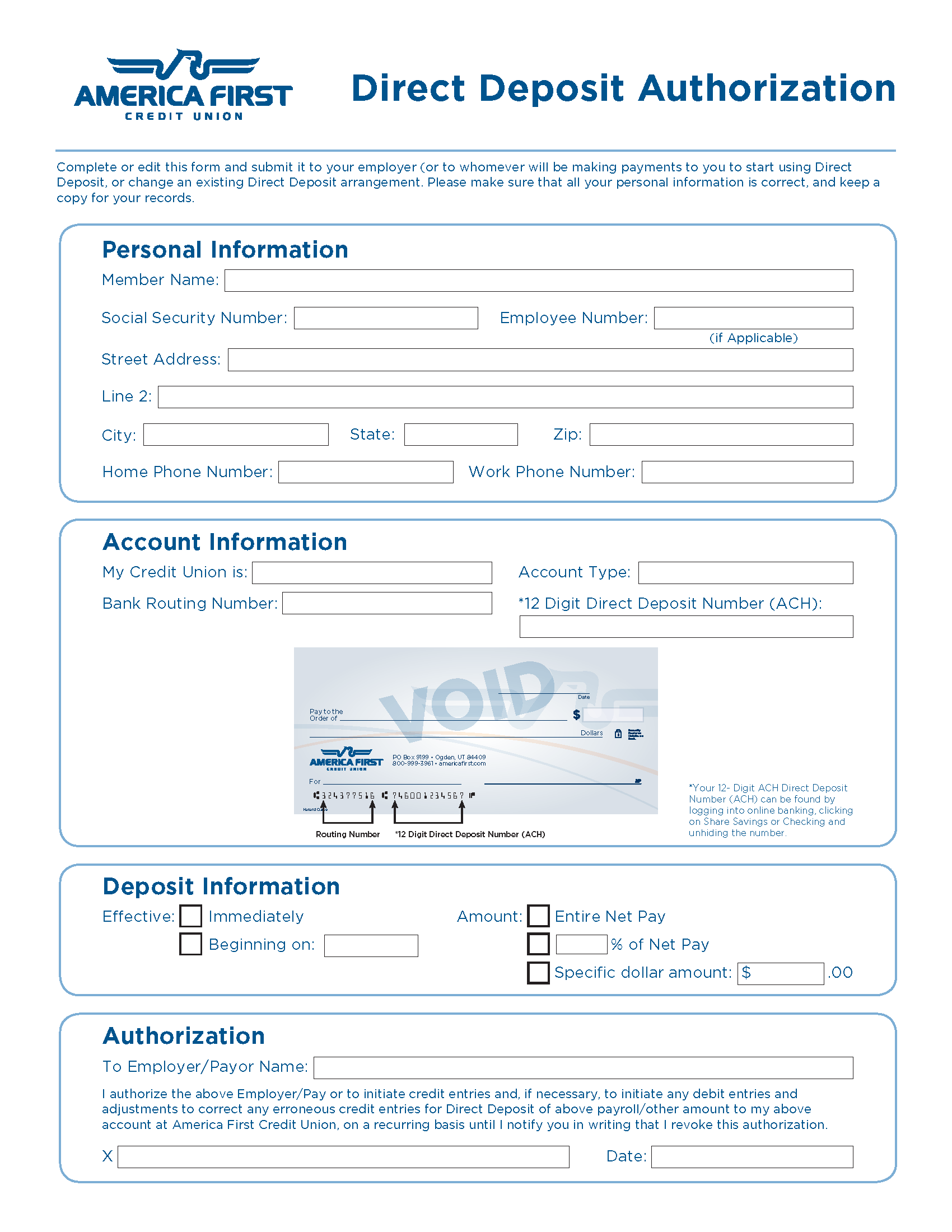

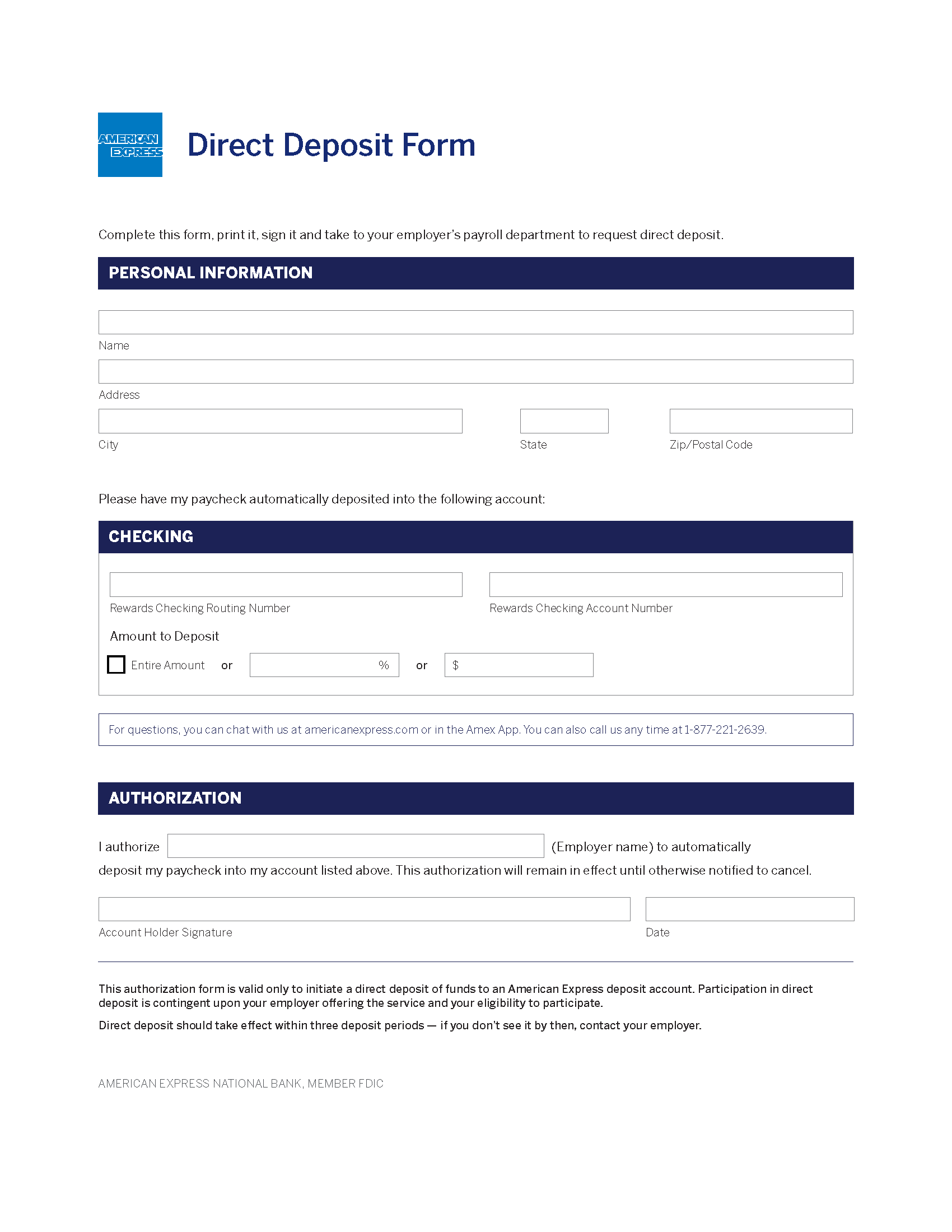

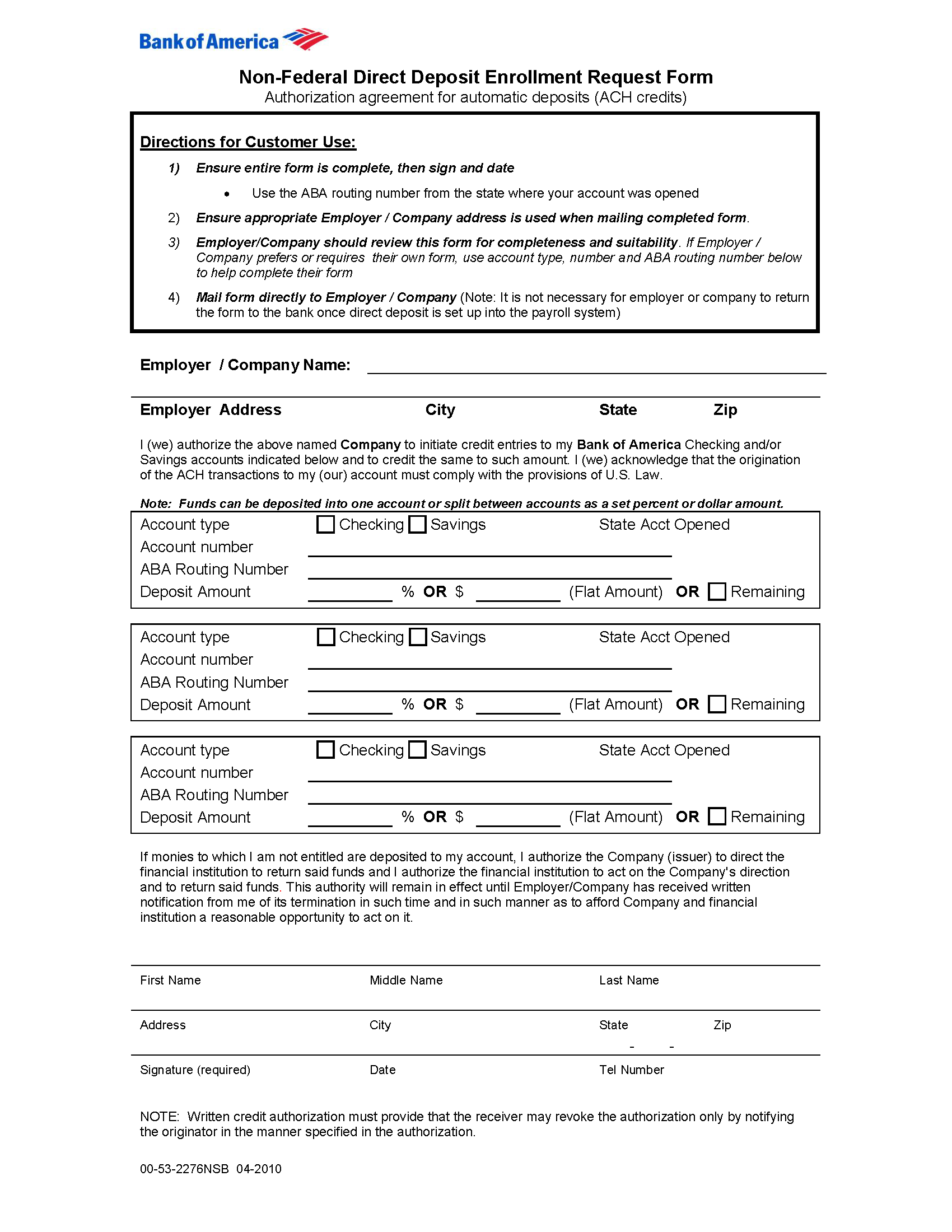

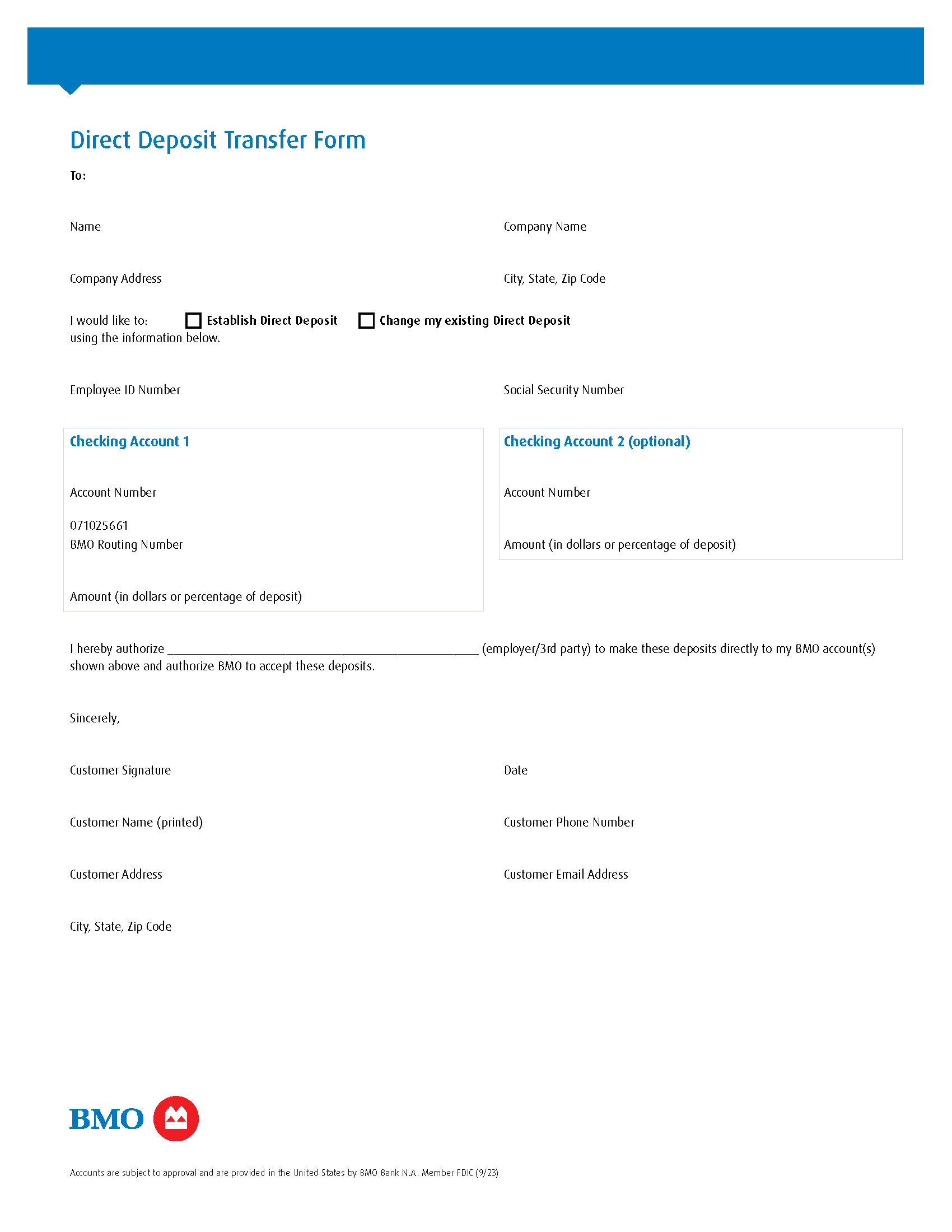

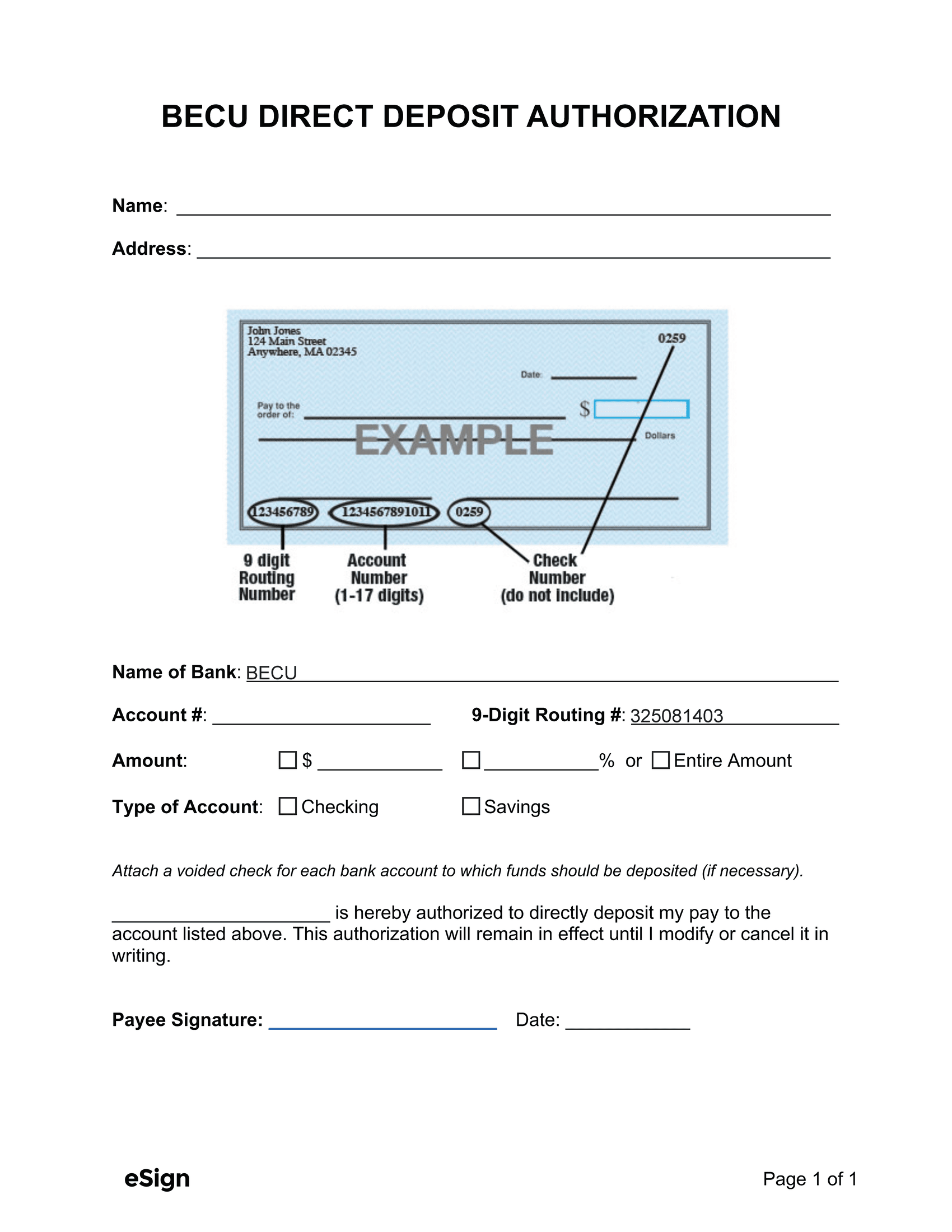

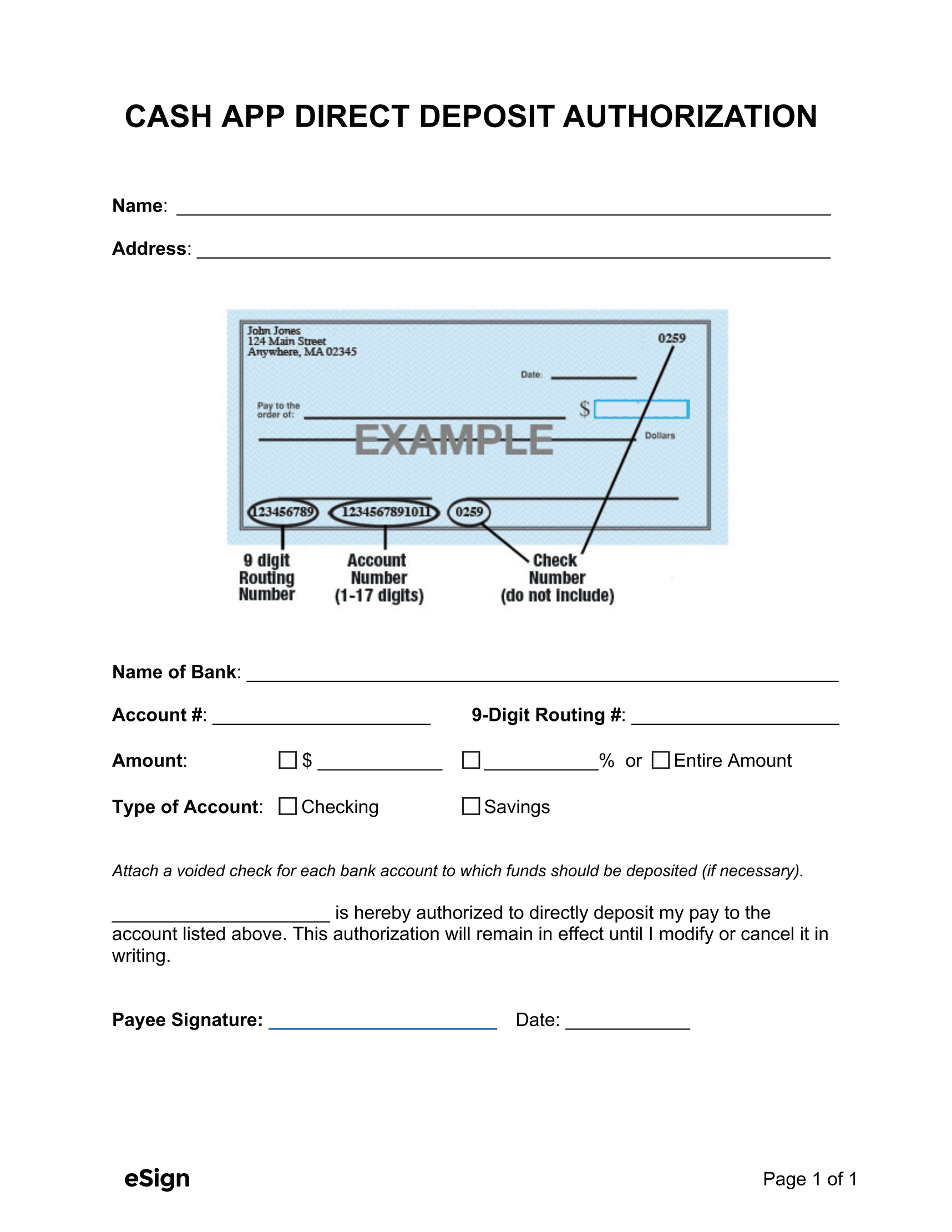

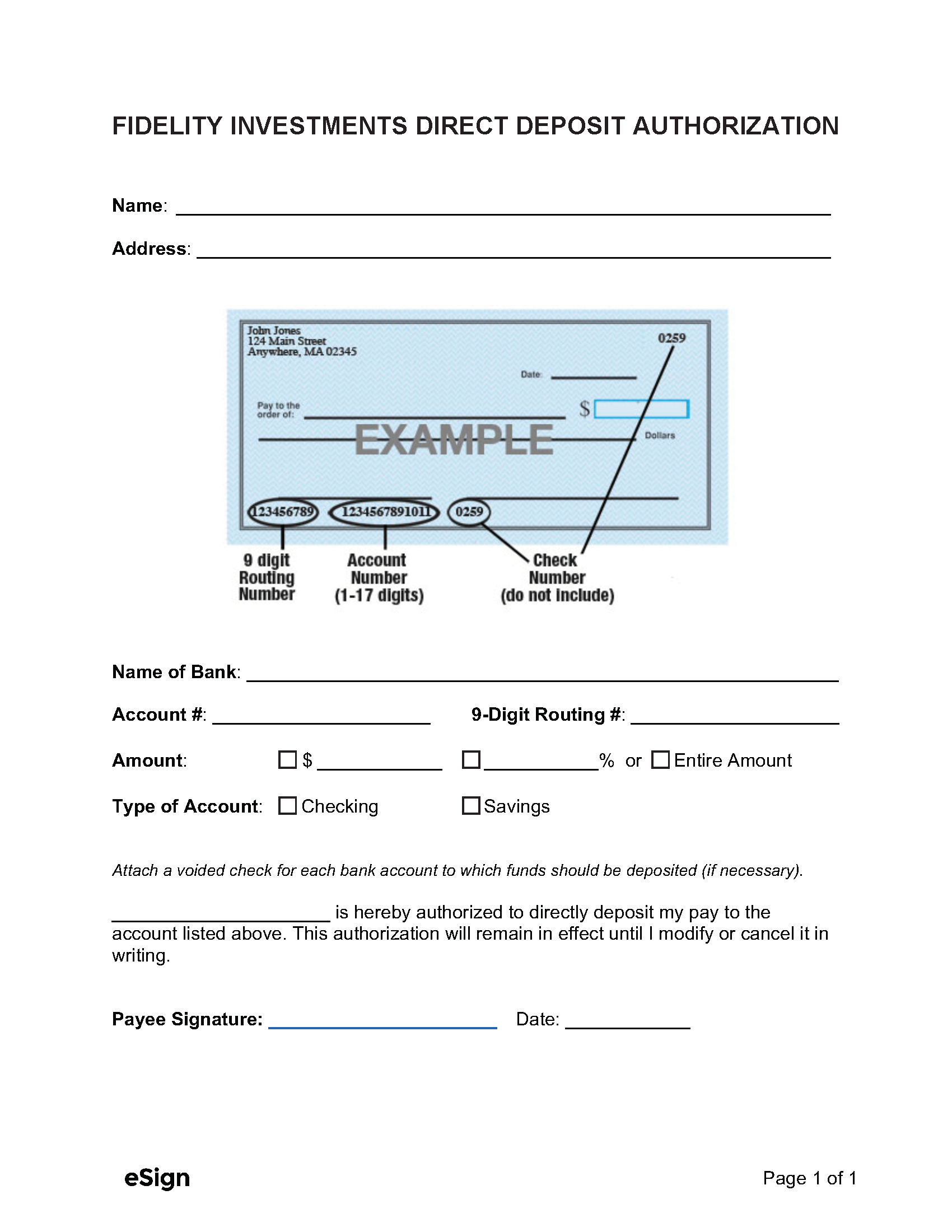

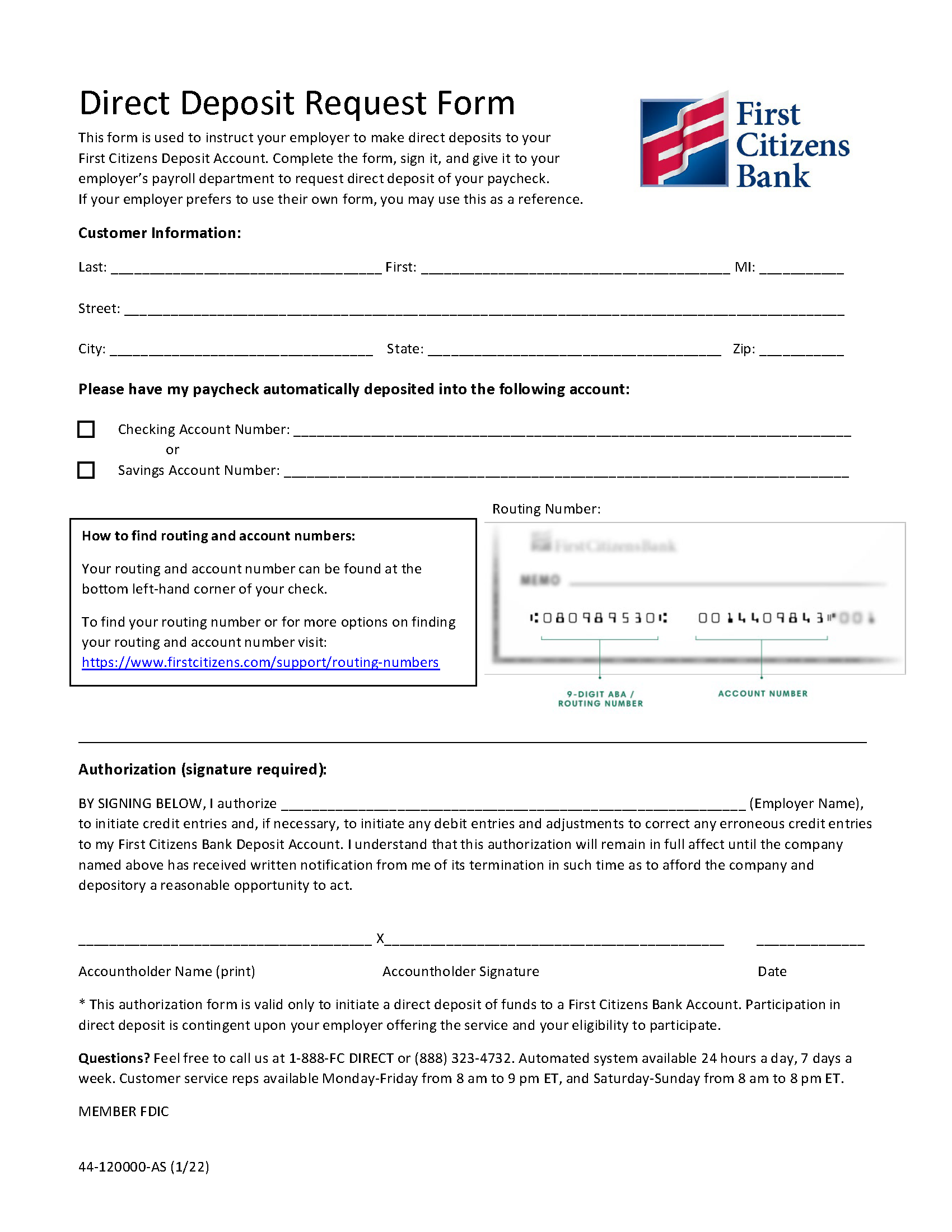

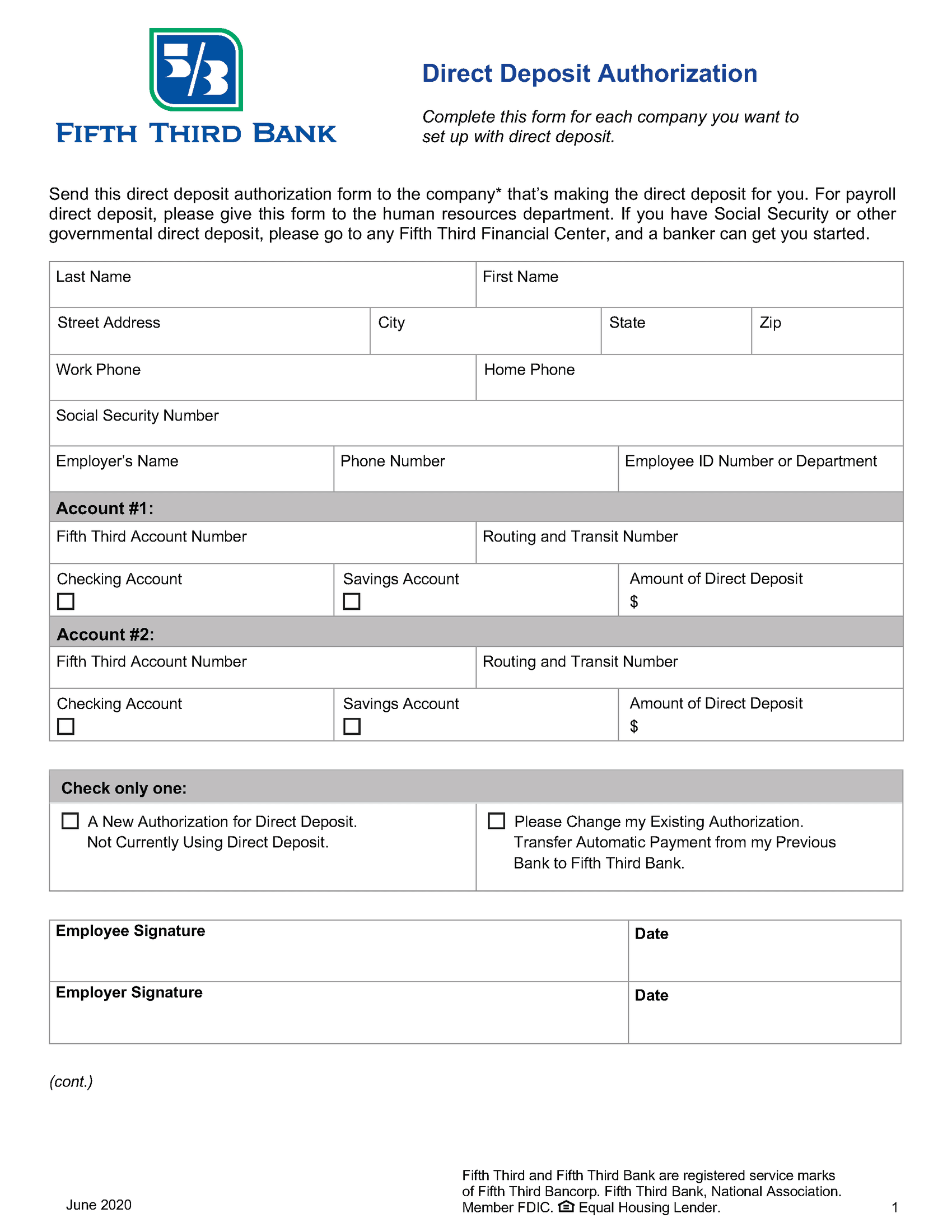

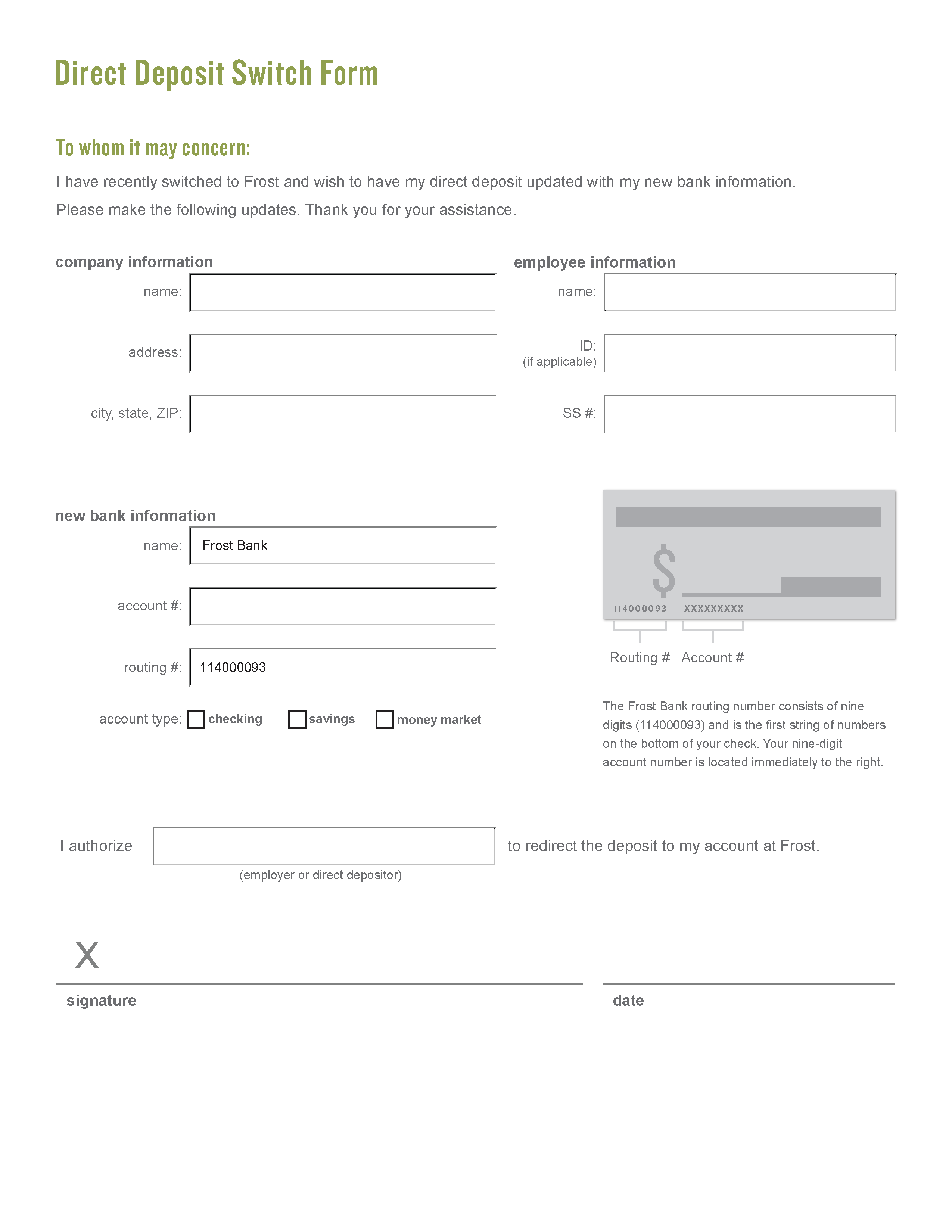

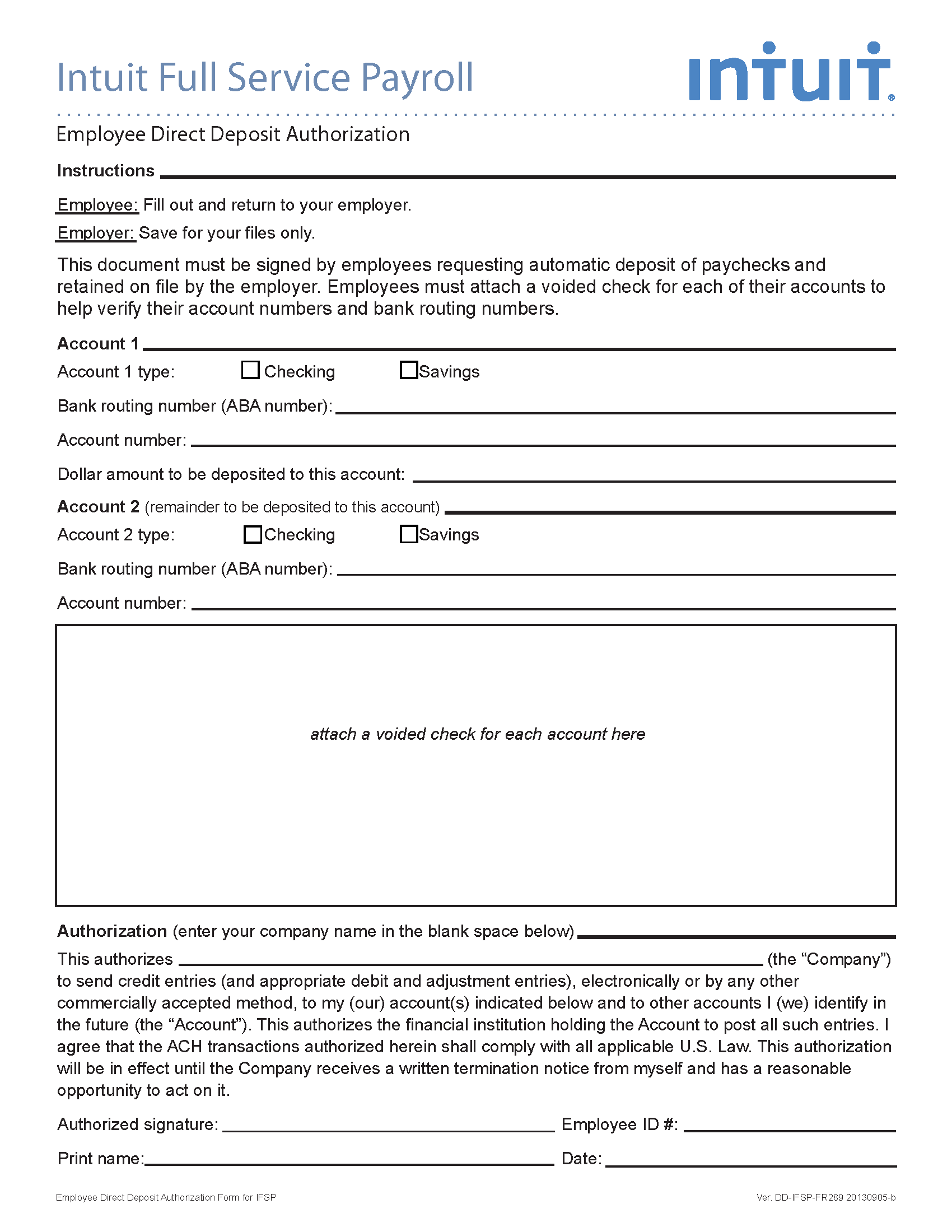

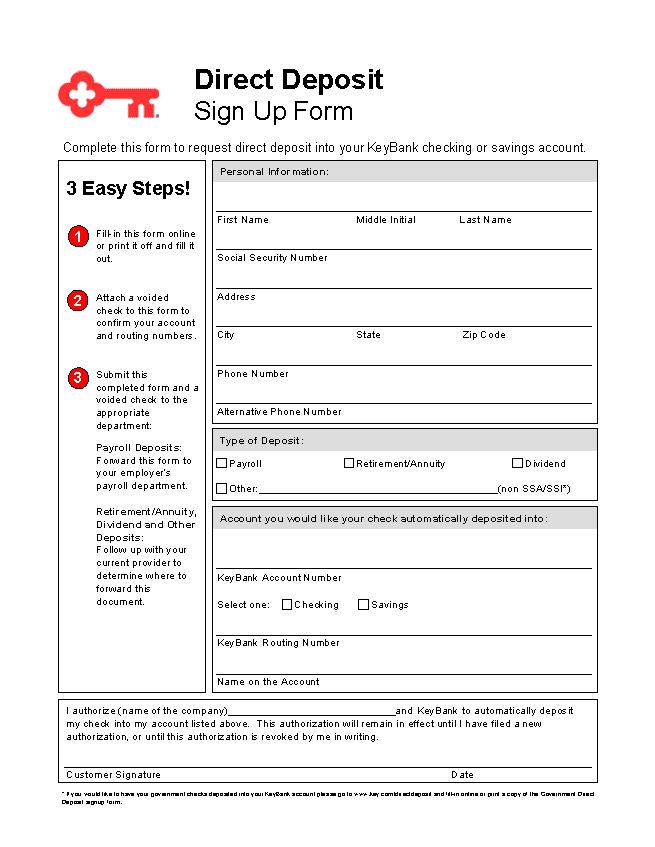

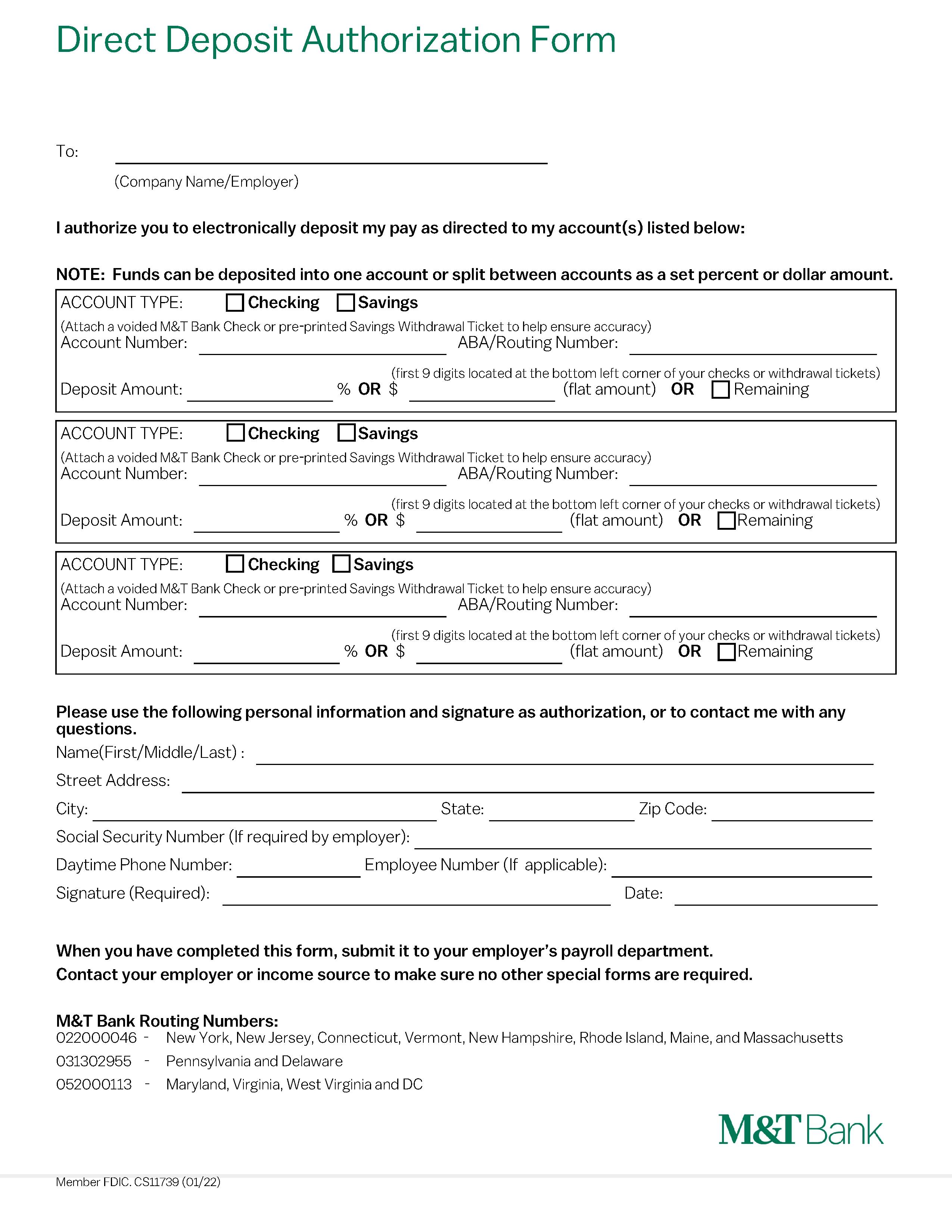

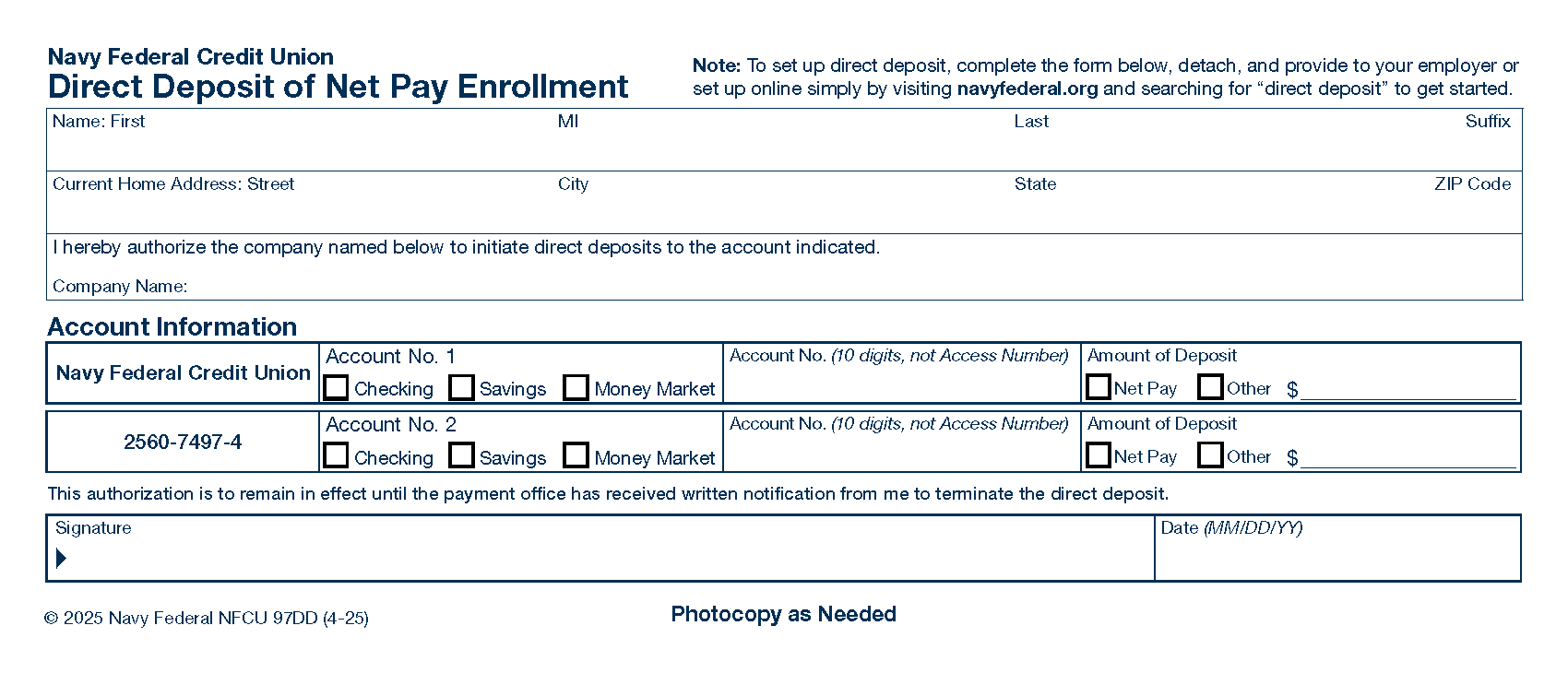

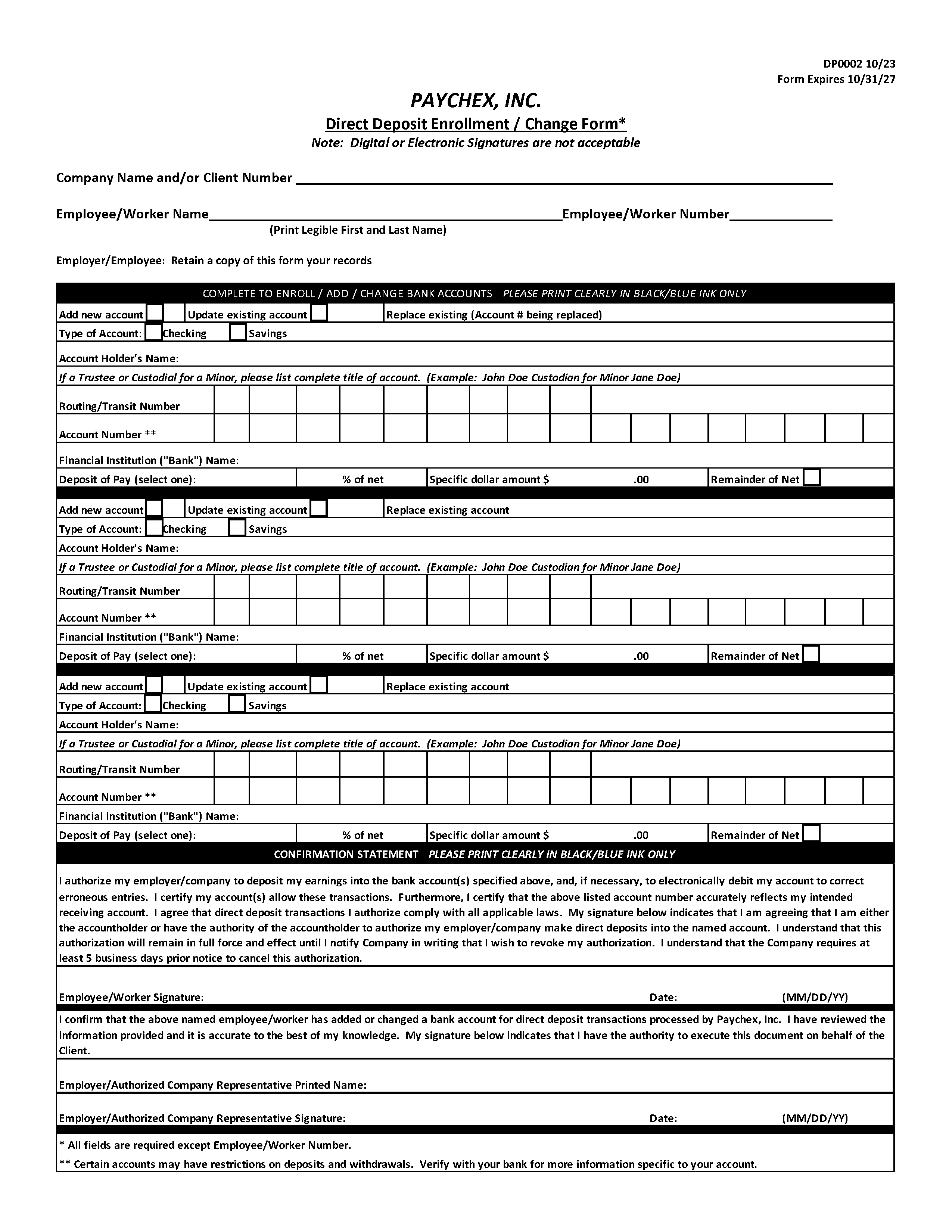

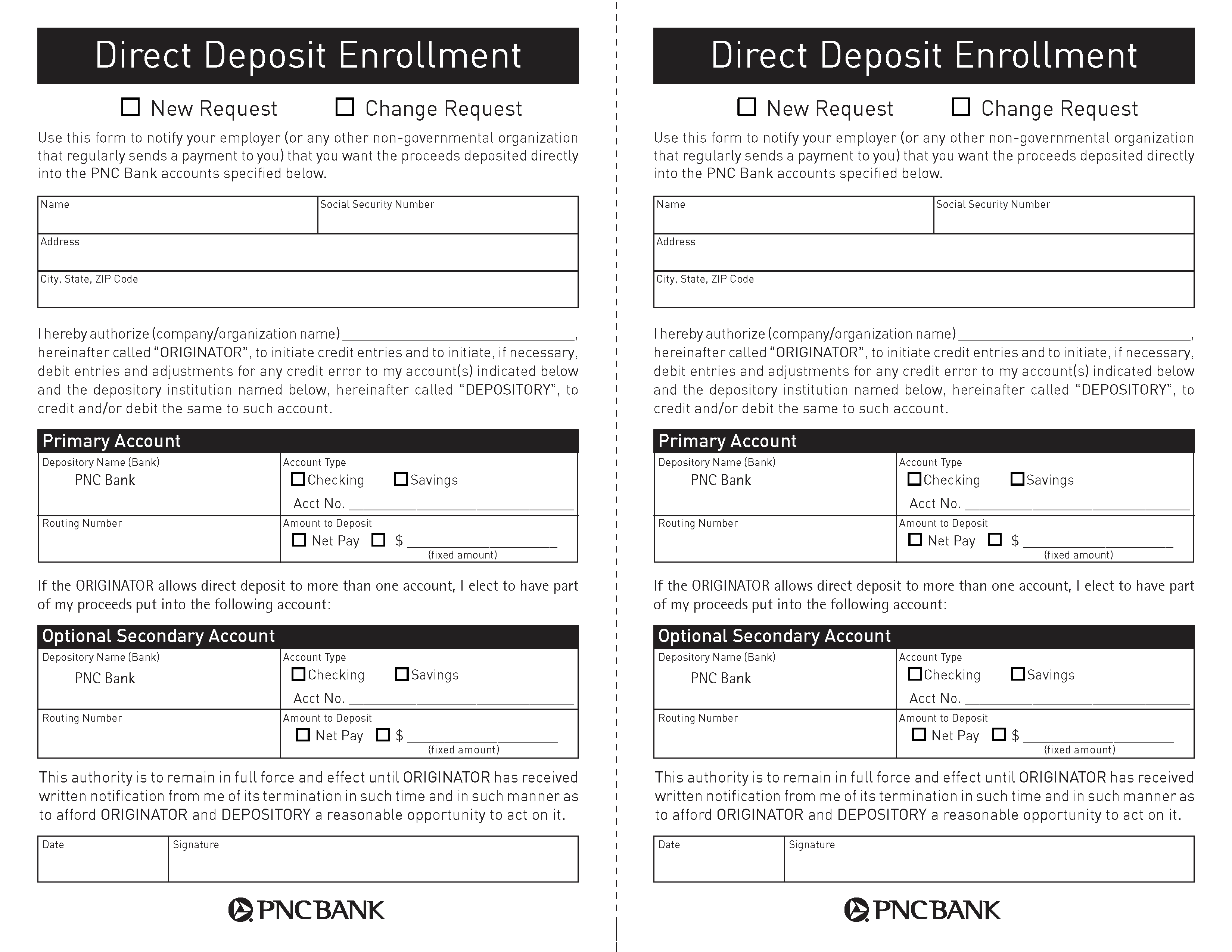

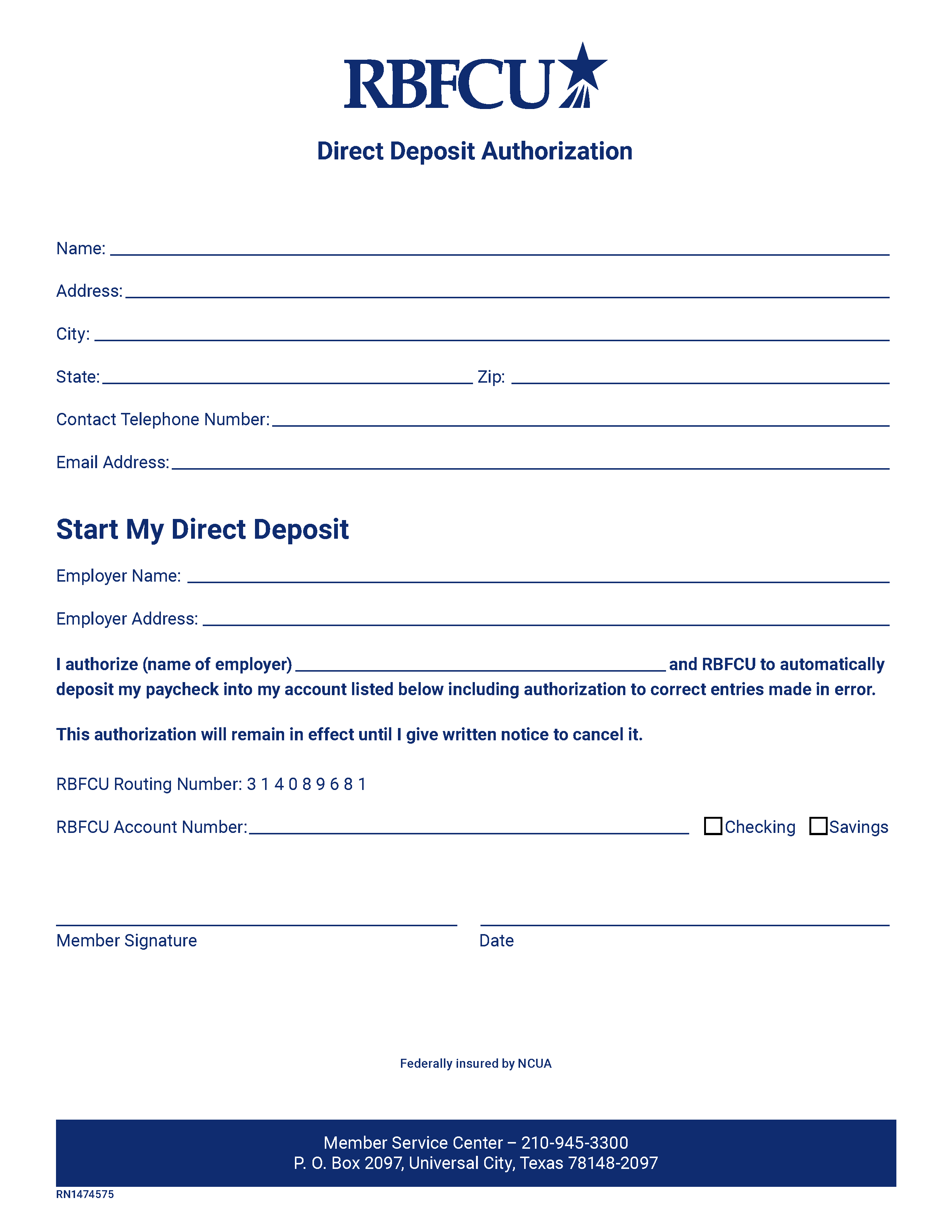

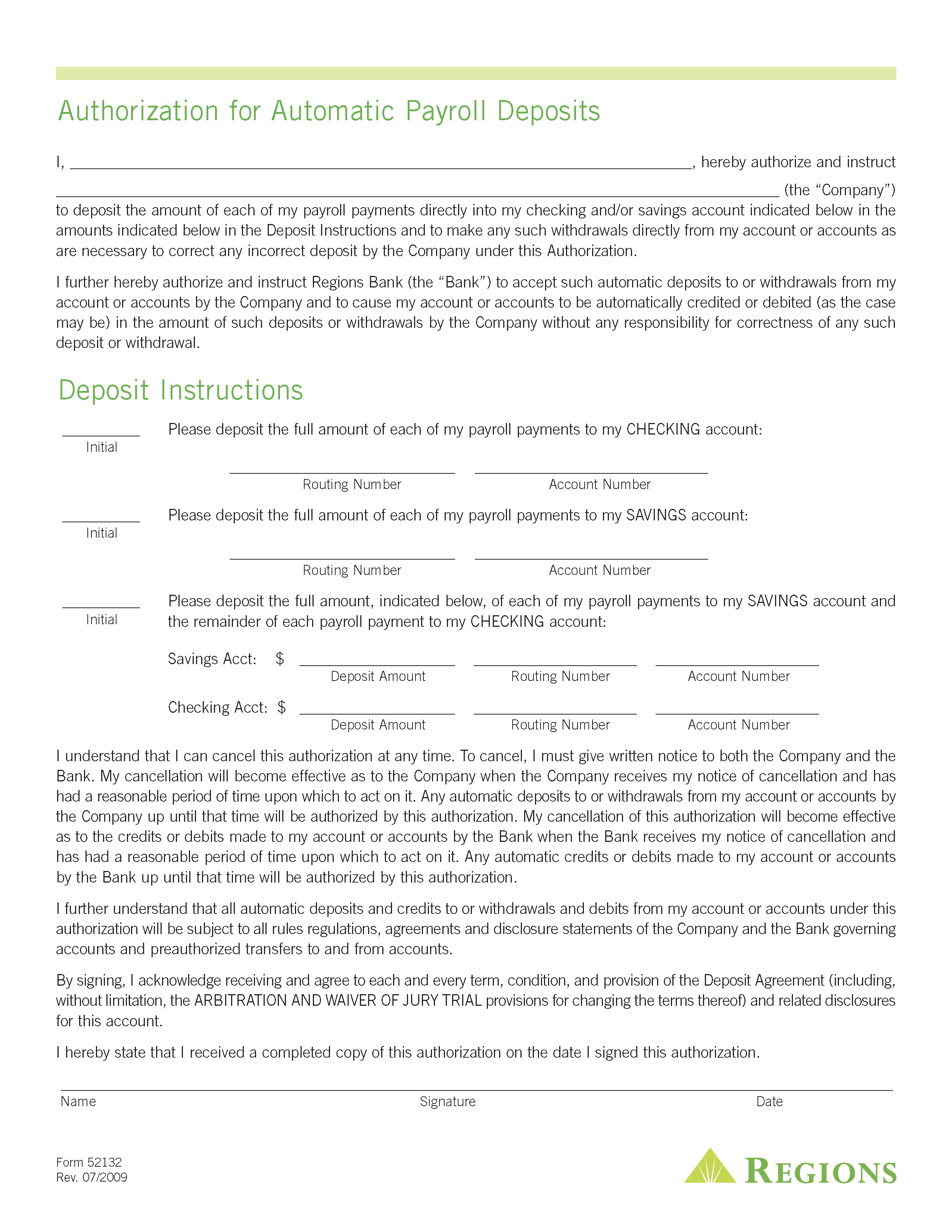

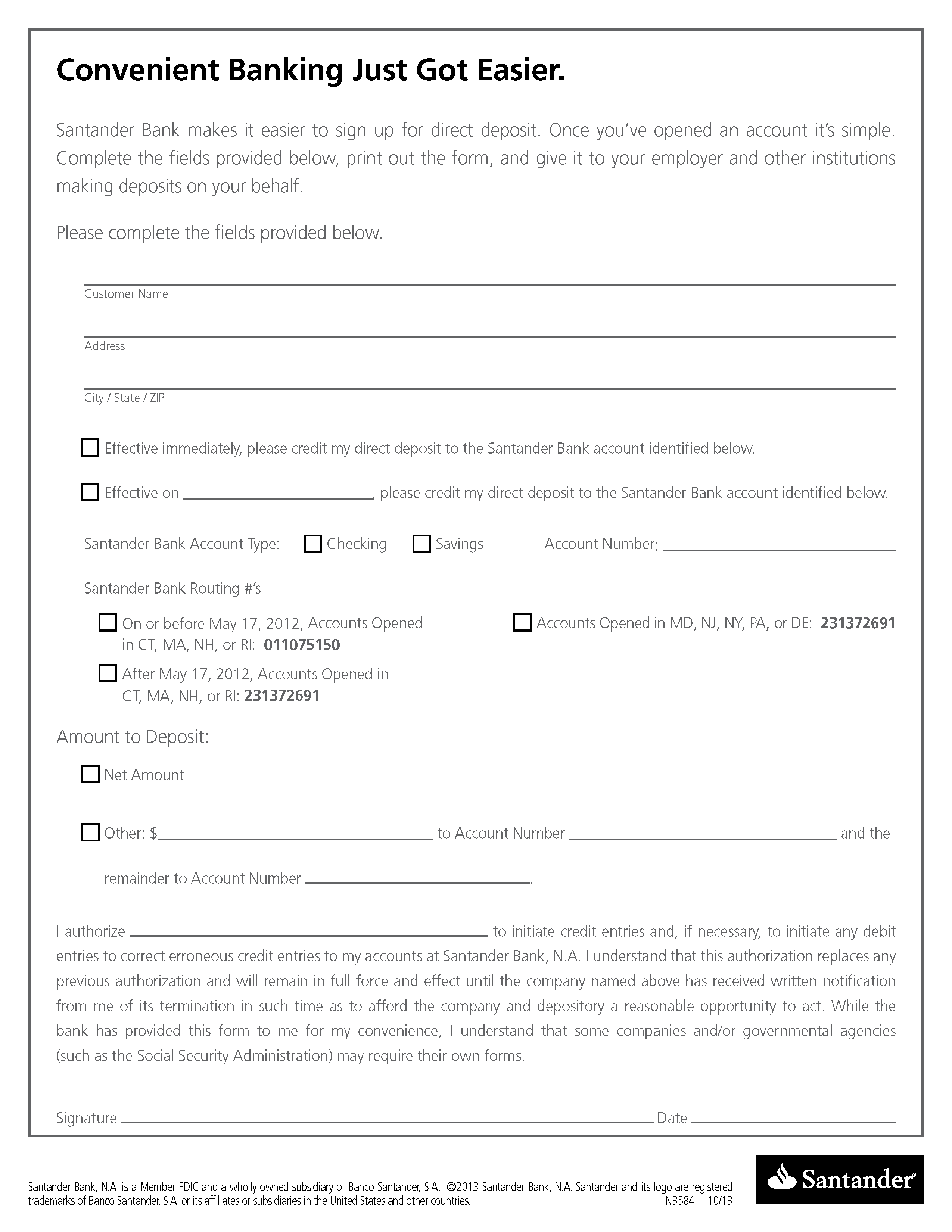

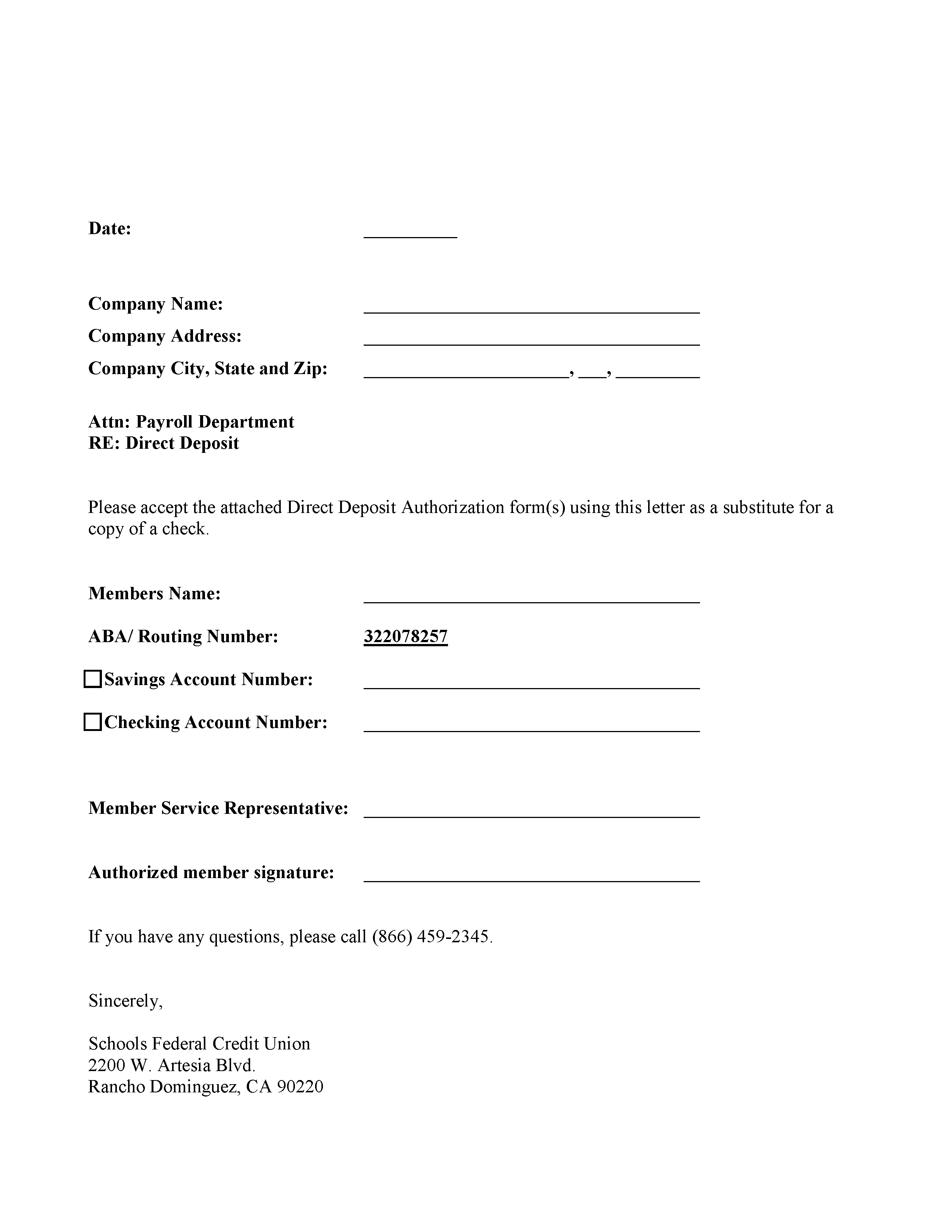

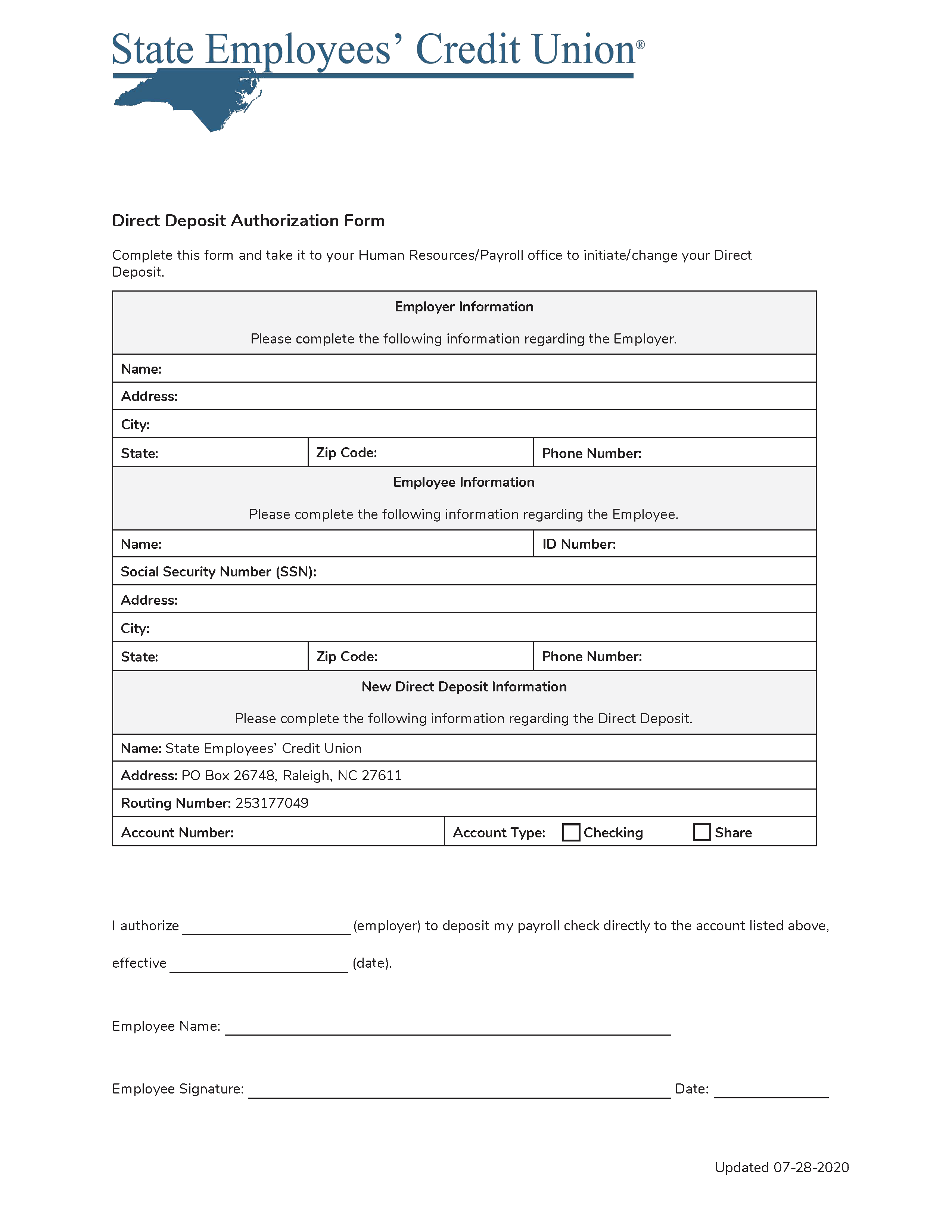

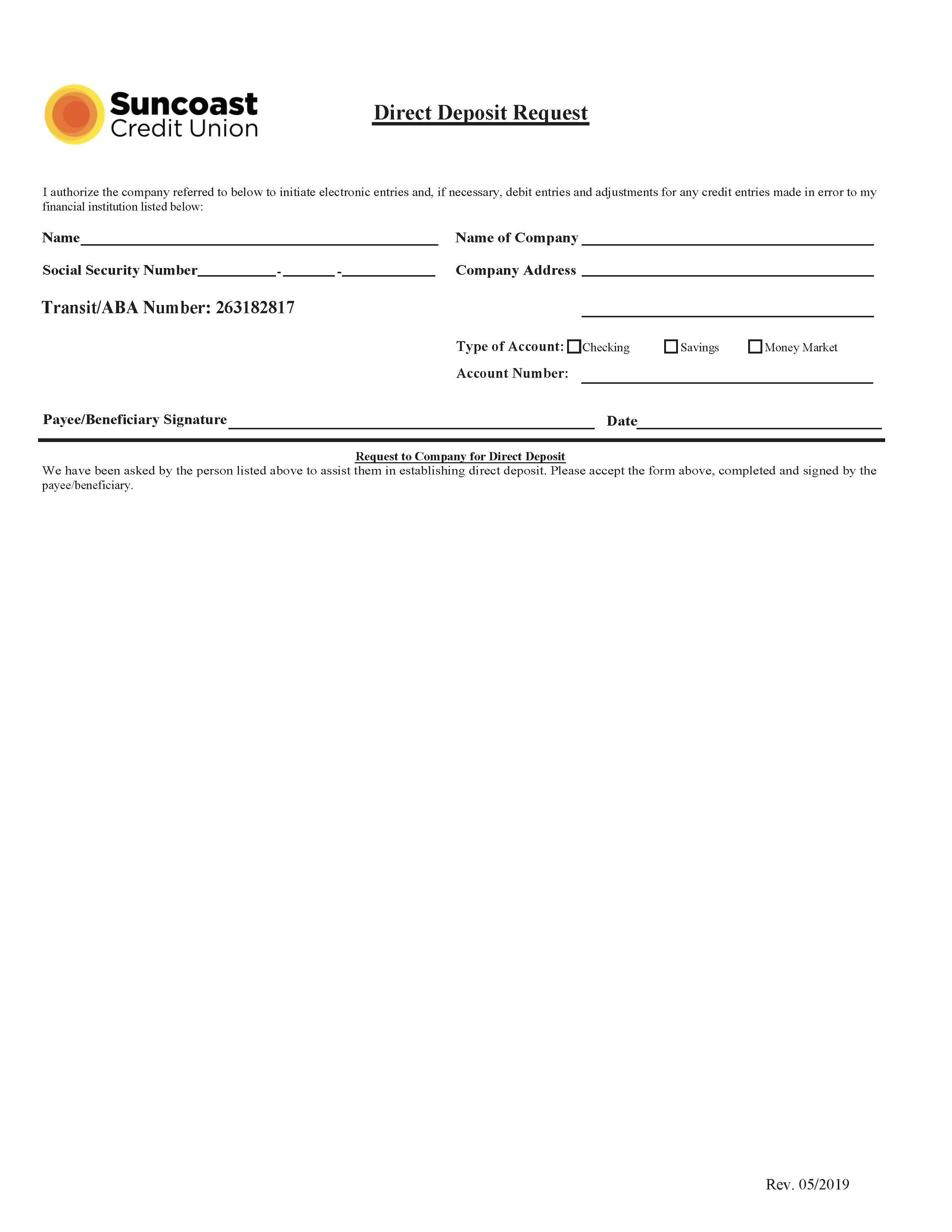

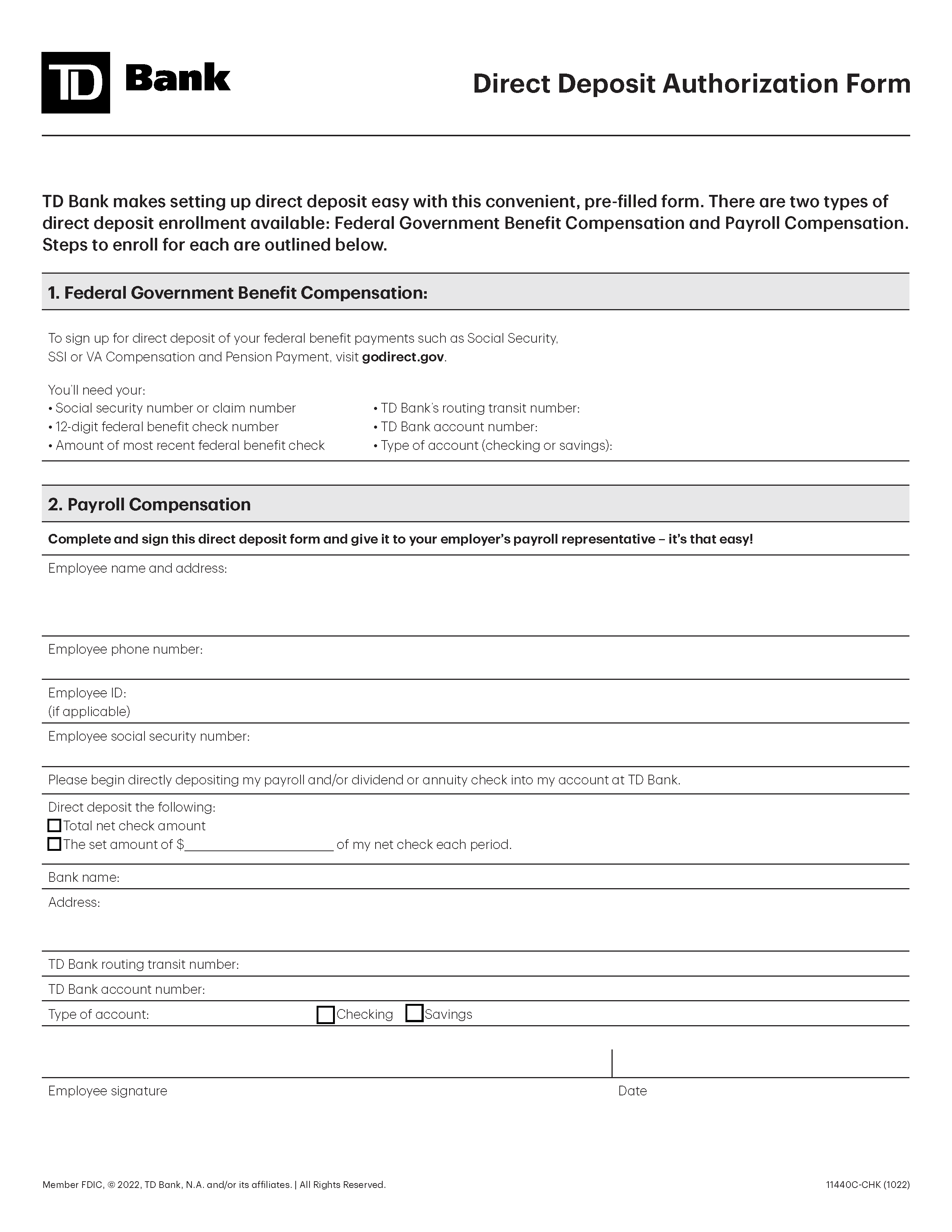

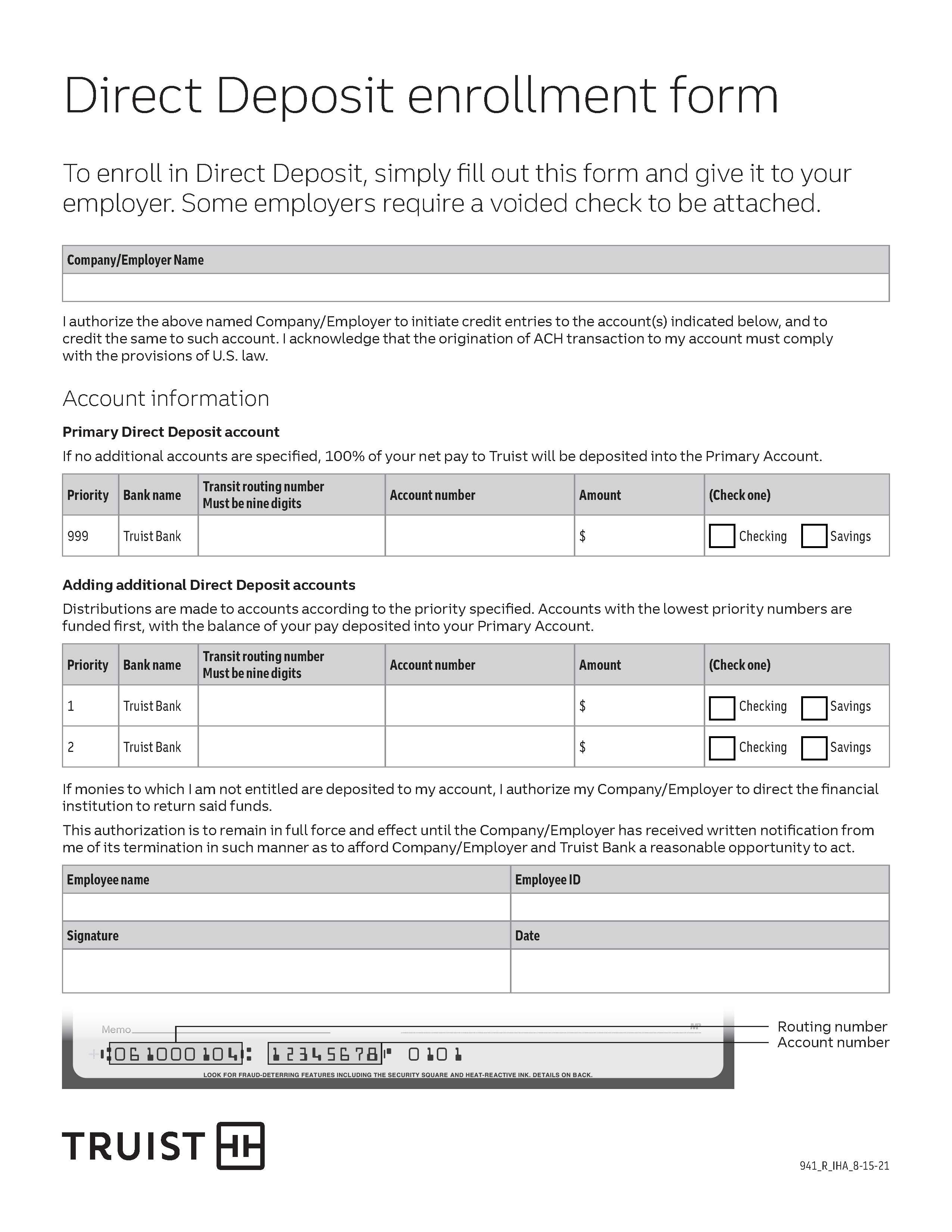

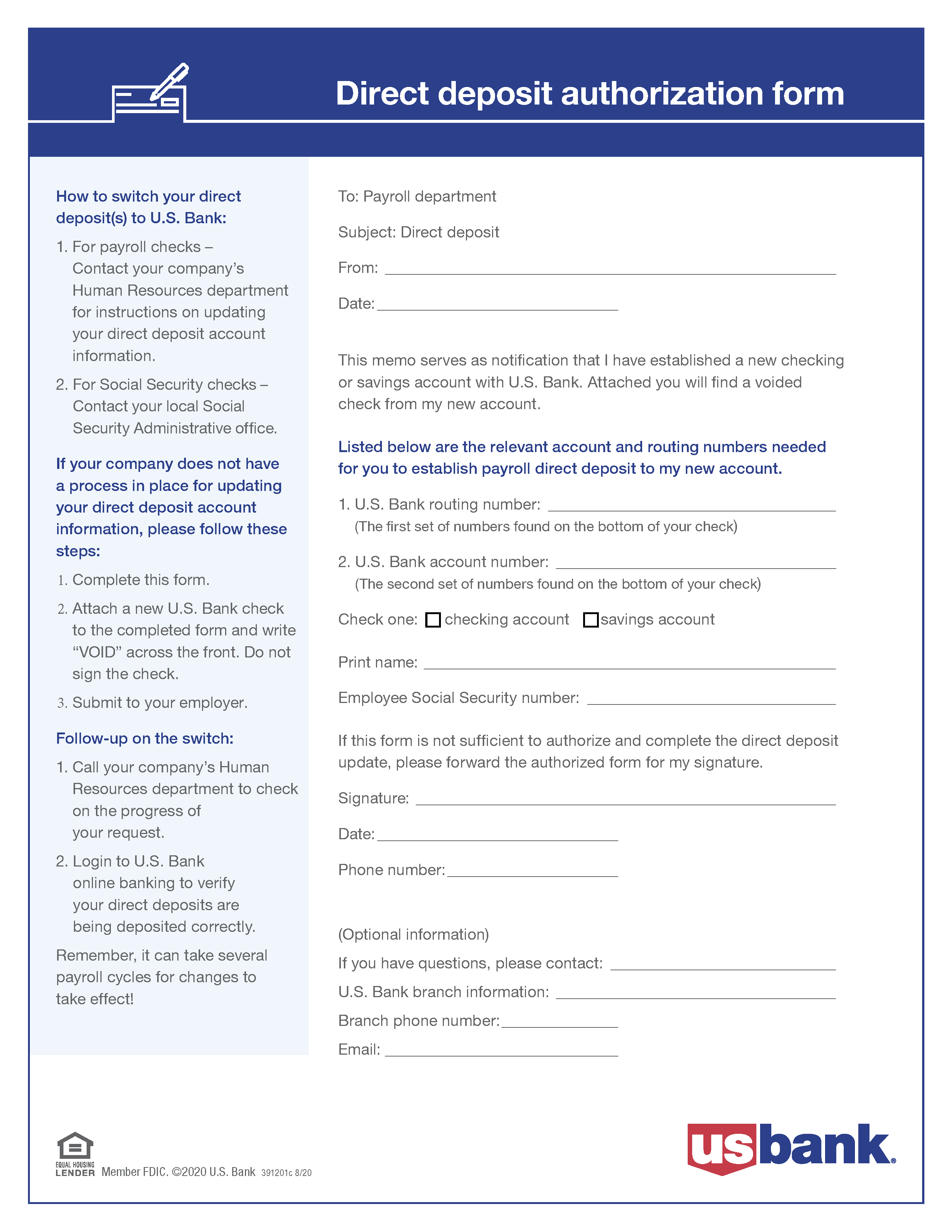

How to Fill Out a Direct Deposit Form

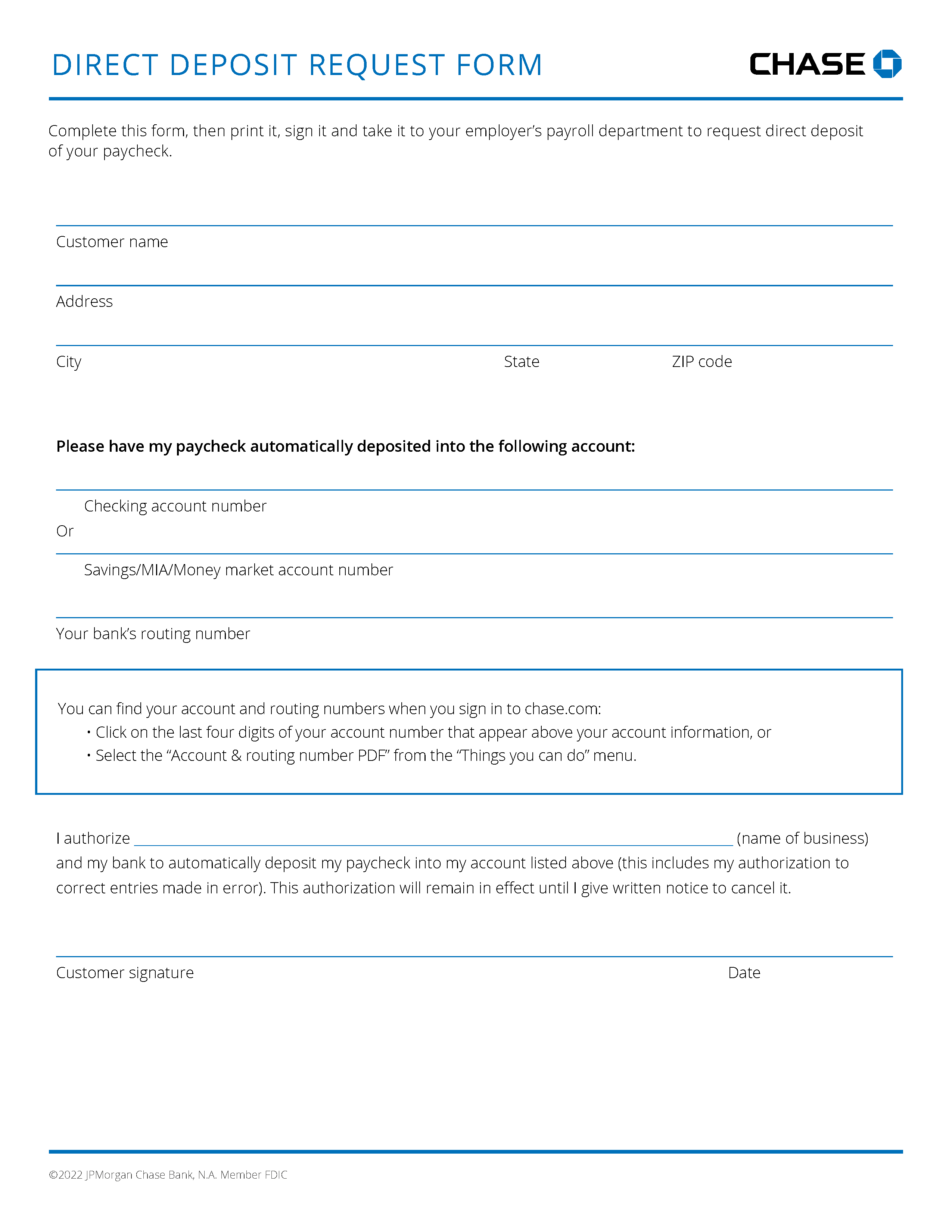

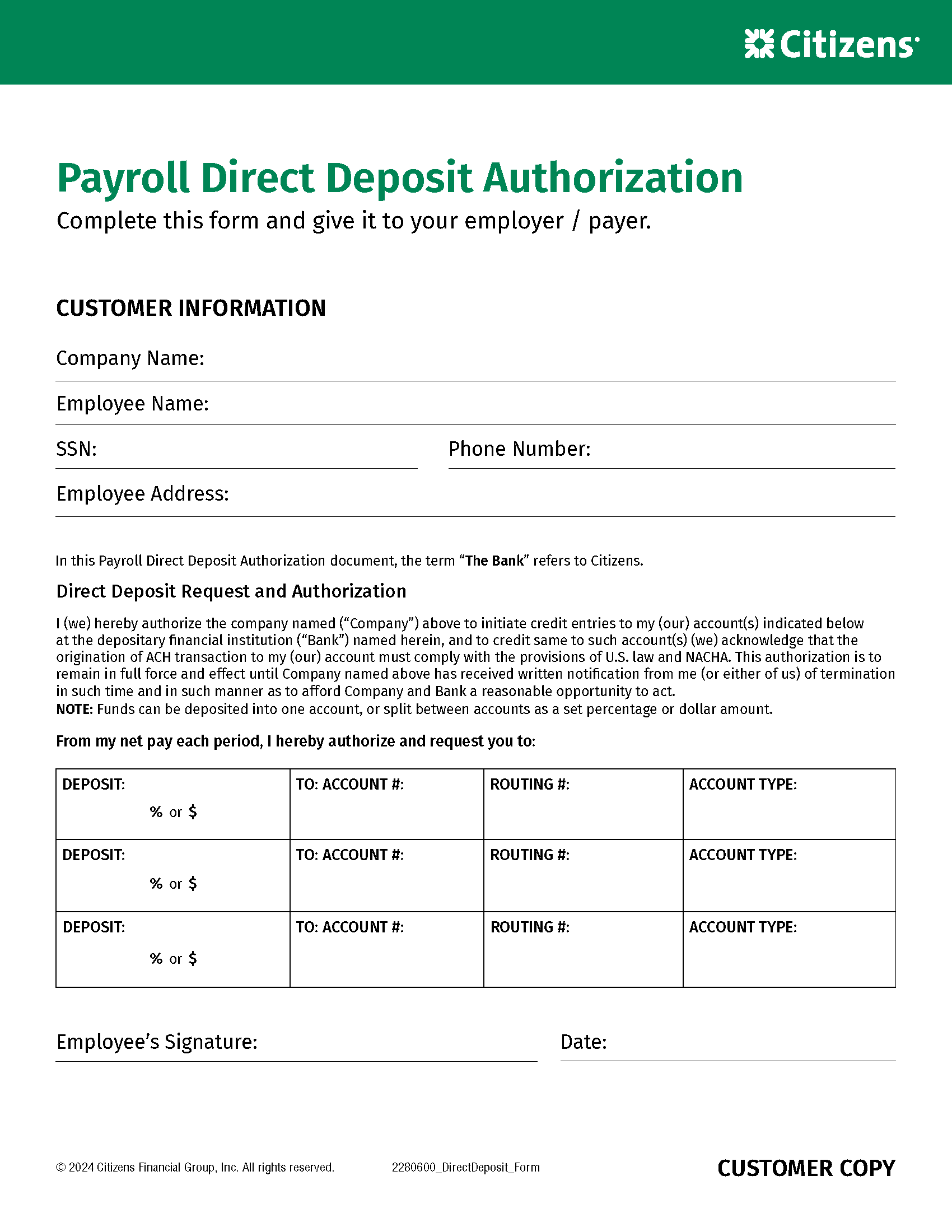

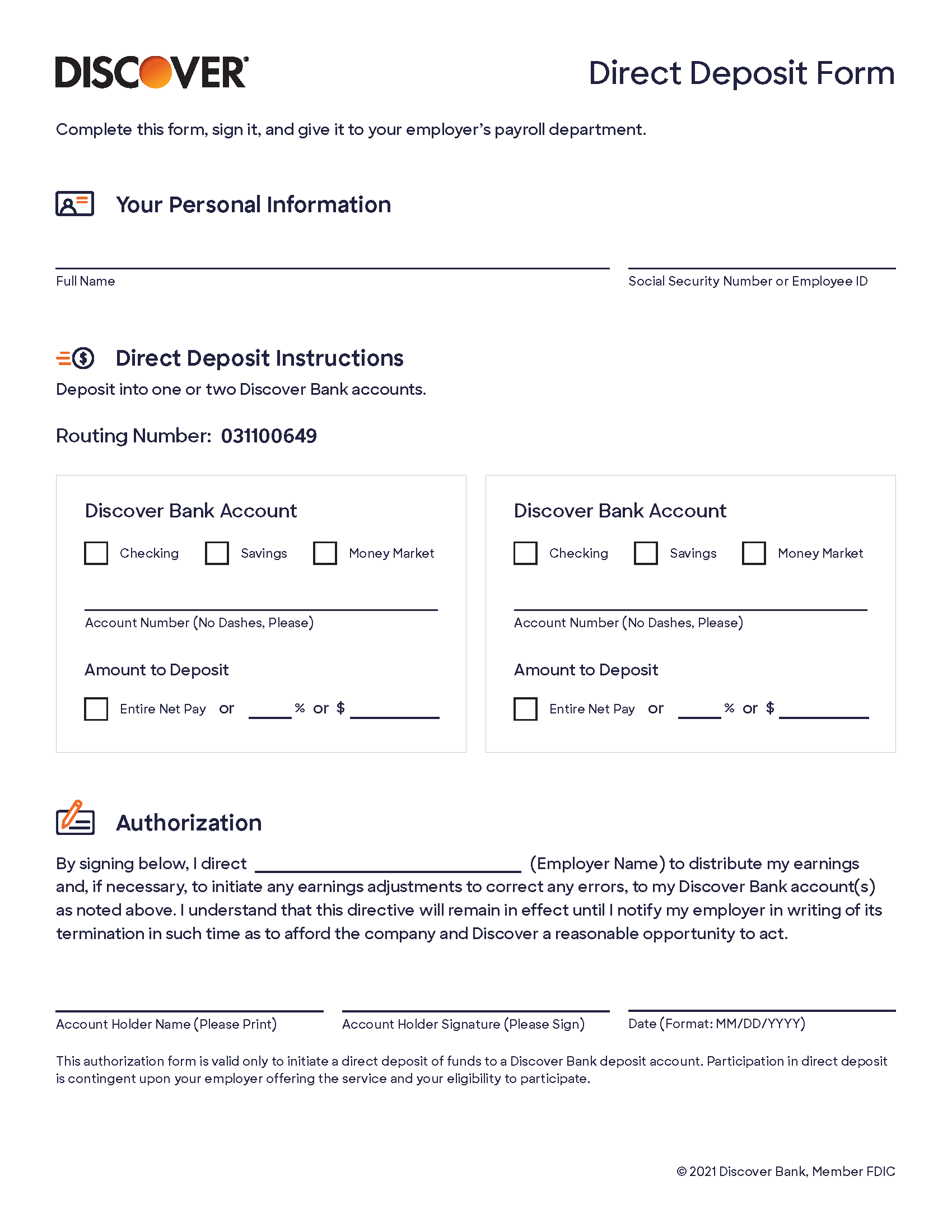

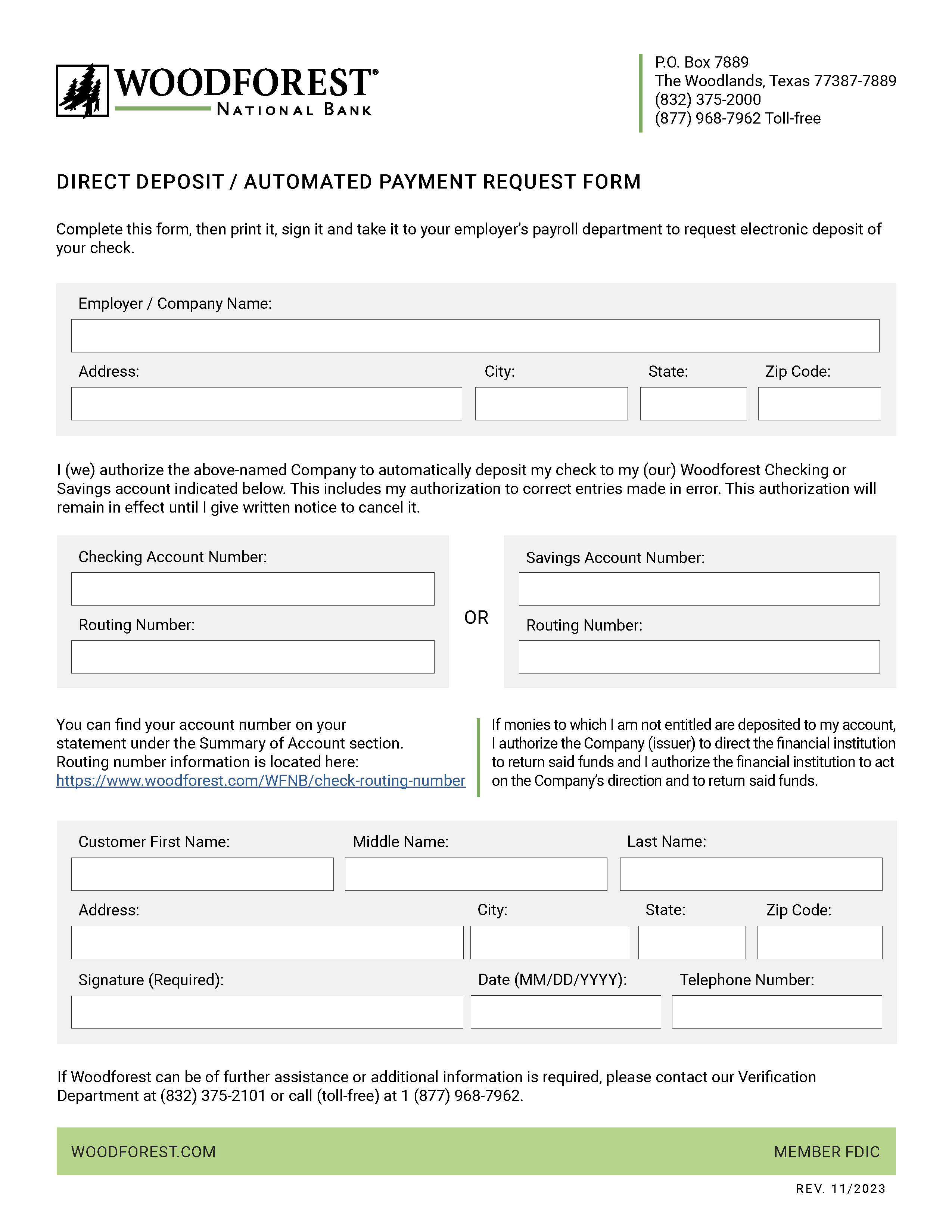

- Provide Personal Information – The payee’s name, address, and employee ID or Social Security number (if required) should be provided.

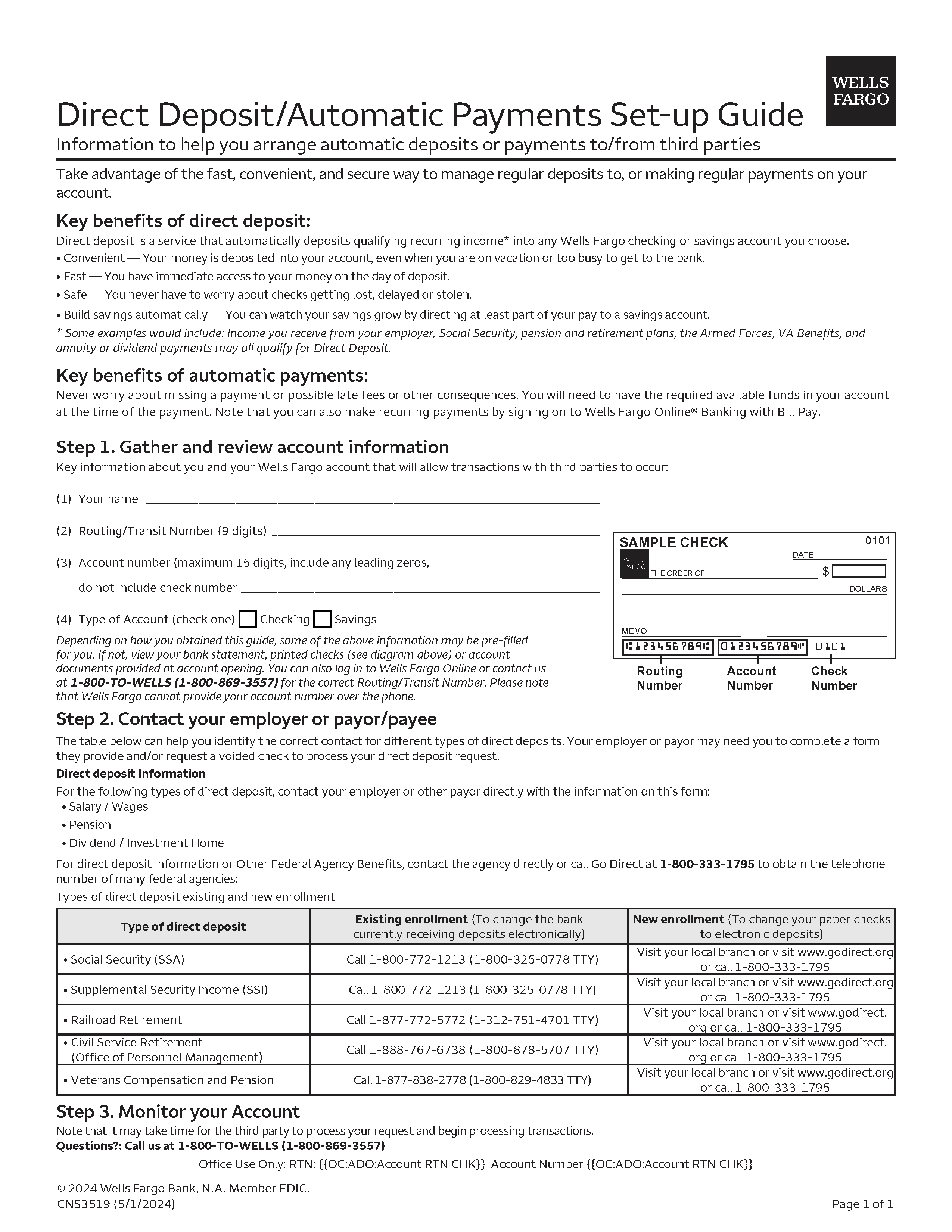

- Describe Bank Account – A few banking details are needed:

- Name of financial institution

- Type of bank account (checking, savings, money market, etc.)

- Routing and account numbers

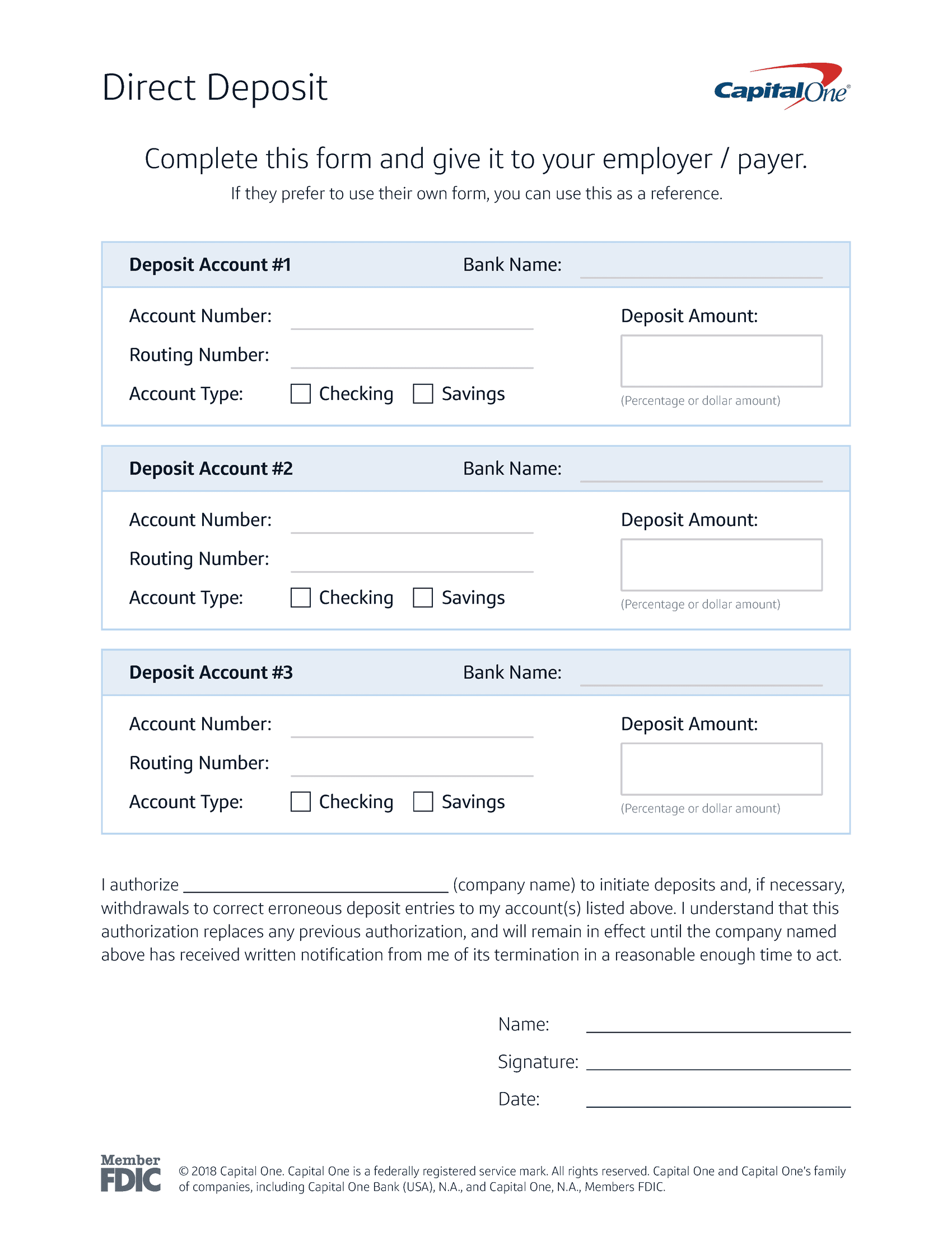

- Enter Deposit Instructions – Payees can deposit the full amount, a portion, or split the payment between multiple accounts (if the payor allows it).

- Identify Payor – Deposit forms must identify the employer or other organization issuing payments.

- Sign and Date – A dated signature is needed for authorization.

Sample

Download: PDF, Word (.docx), OpenDocument

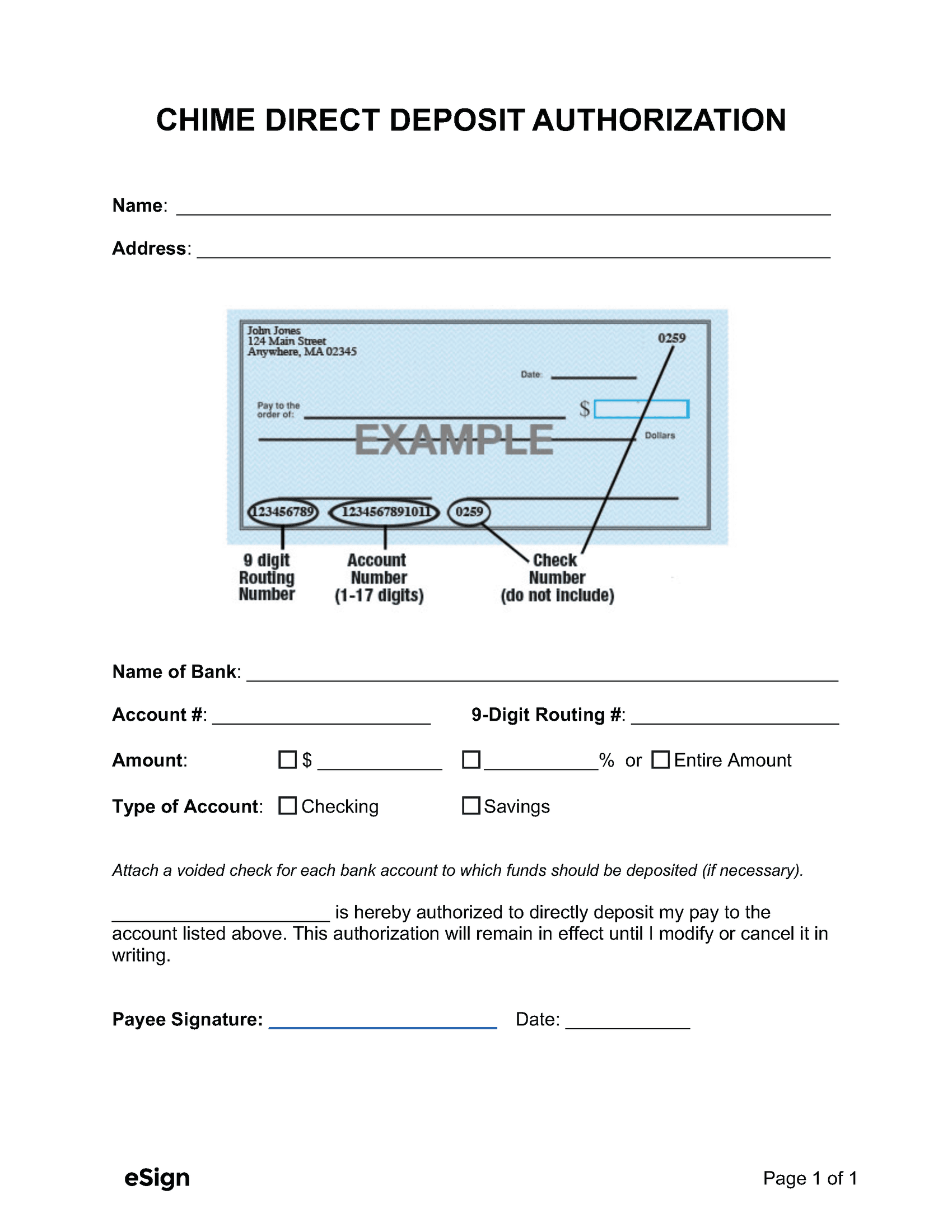

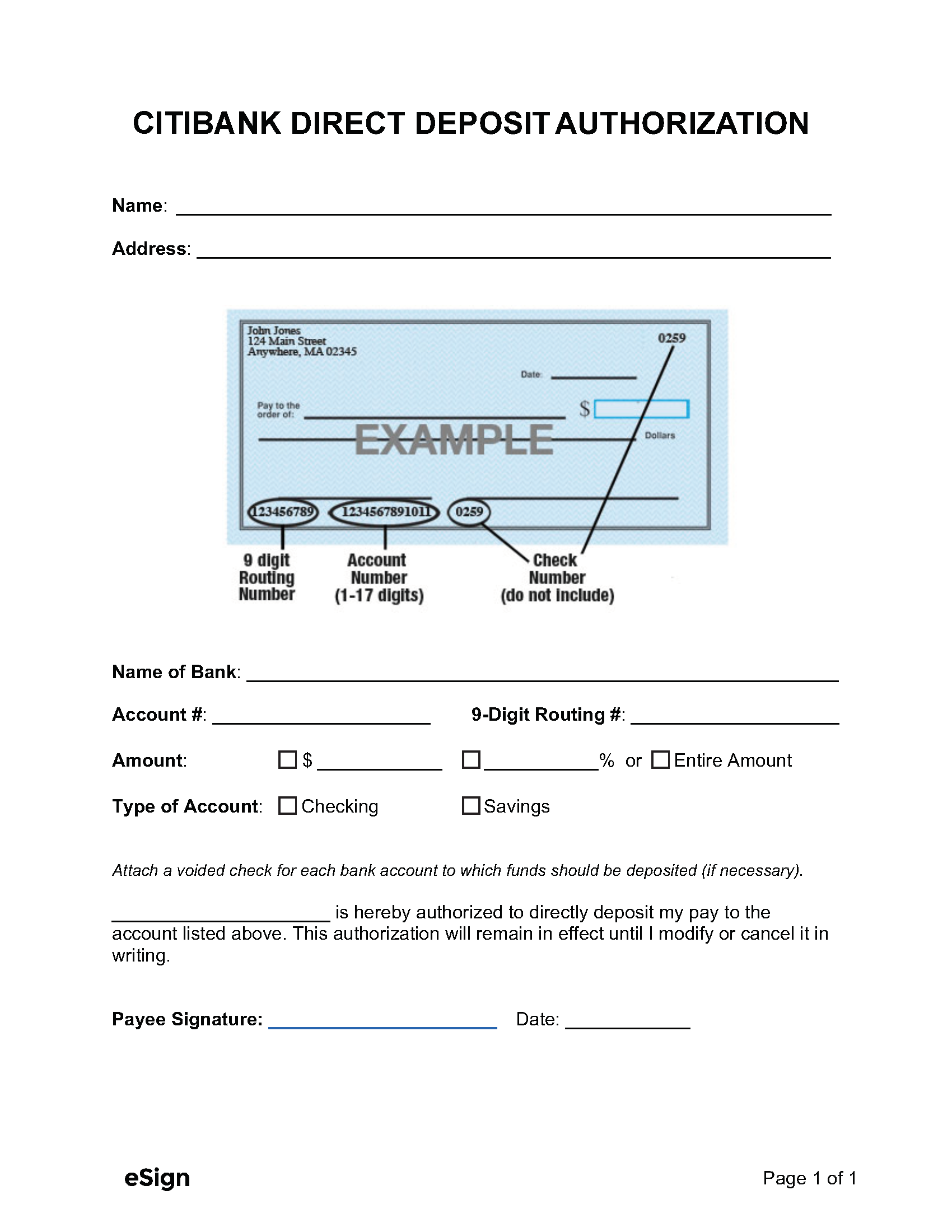

DIRECT DEPOSIT AUTHORIZATION

Name: [PAYEE NAME] Address: [PAYEE ADDRESS]

Name of Bank: [NAME OF BANK]

Account #: [ACCOUNT NUMBER]

9-Digit Routing #: [ROUTING NUMBER]

Amount: ☐ $ [DOLLAR AMOUNT] ☐ [PERCENTAGE] % or ☐ Entire Amount

Type of Account: ☐ Checking ☐ Savings

Attach a voided check for each bank account to which funds should be deposited (if necessary).

[PAYOR NAME] is hereby authorized to directly deposit my pay to the account listed above. This authorization will remain in effect until I modify or cancel it in writing.

Payee Signature: ______________________ Date: [MM/DD/YYYY]