By Type (4)

What’s Included

Real estate letters of intent can be used to demonstrate the interest of a buyer or future tenant looking at either commercial or residential property. While each scenario would require terms that are specific to that particular transaction, most real estate LOIs will contain the following information:

Introductory Paragraph

An LOI is a formal letter and should, therefore, begin with an introductory paragraph that establishes the purpose of the document.

Identification of the Parties

The letter should include the contact information of both the buyer/lessee and the property owner/landlord.

Financial Terms

The proposed financial terms of the future agreement between the parties need to be provided (e.g., the base rent or purchase price).

Purchase/Lease Conditions

- Purchases – An LOI to purchase must establish the terms of the property transfer and conditions that must be met for the transaction to be completed. The parties often agree to a standstill (also known as an option or contingency period).

- Leases – The letter includes conditions such as expenses, late fees, deposits, pets, and other requirements and permissions.

Signatures

Although most provisions aren’t binding, having both parties sign the document affirms their commitment to reaching an agreement. It’s particularly important for the seller to sign a purchase LOI to ensure good faith negotiations and help prevent them from negotiating with other buyers.

How It’s Used

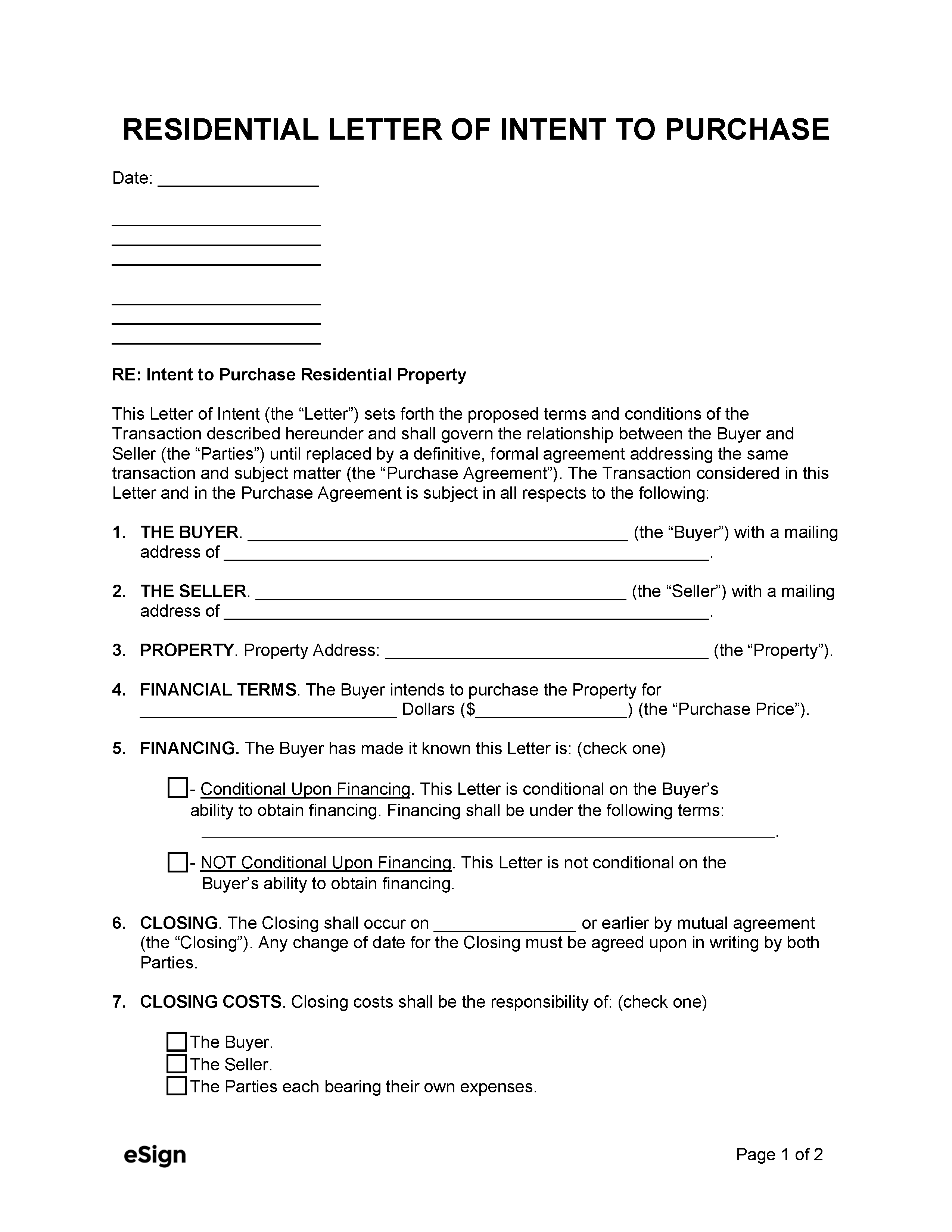

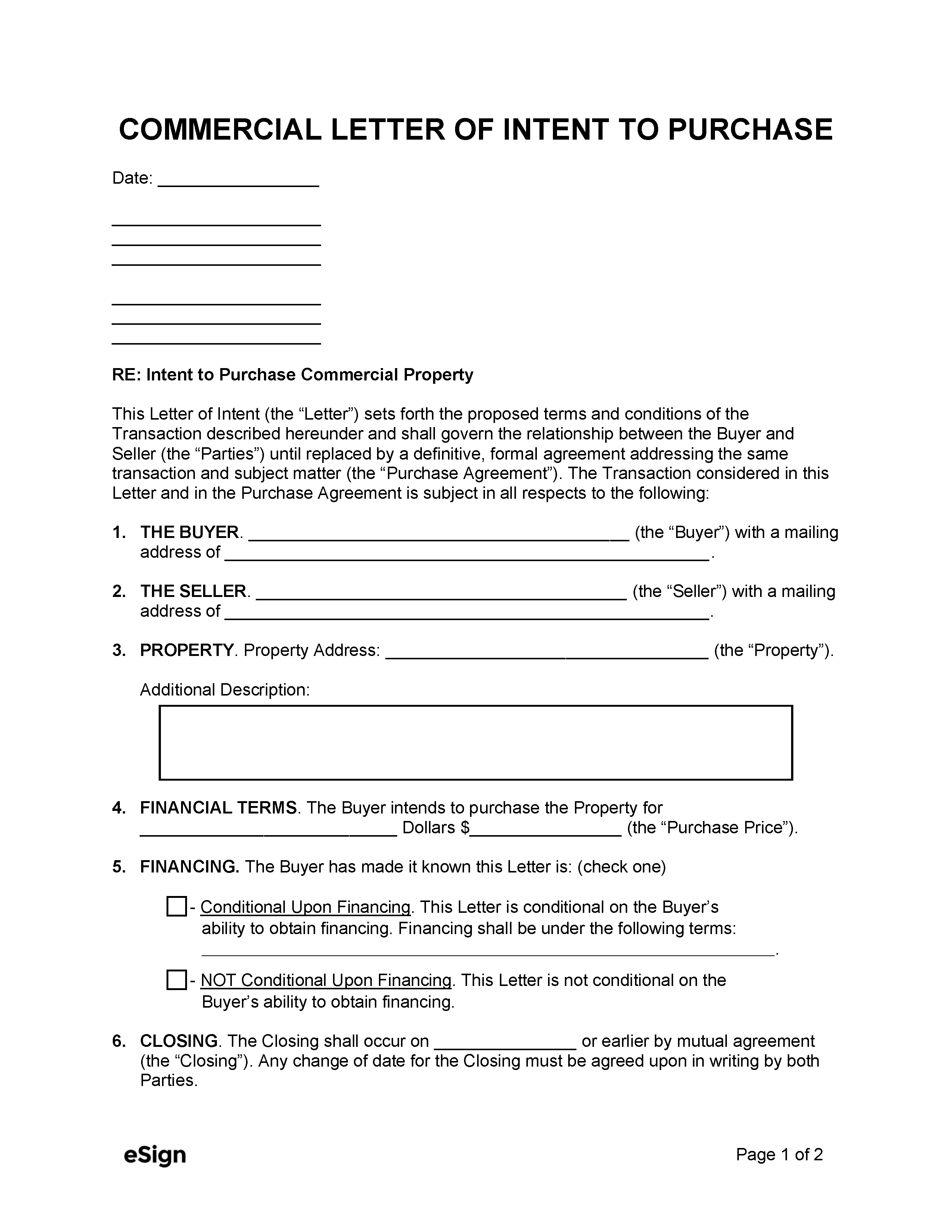

LOI to Purchase Property

An LOI to purchase real estate is often drafted by the buyer following a viewing of the property and a discussion of terms with the seller. Once the letter has been delivered to the seller, the parties can negotiate, and the buyer can clarify terms as needed.

When both parties agree to the basic terms of the revised letter, they will sign the document and draft a purchase agreement.

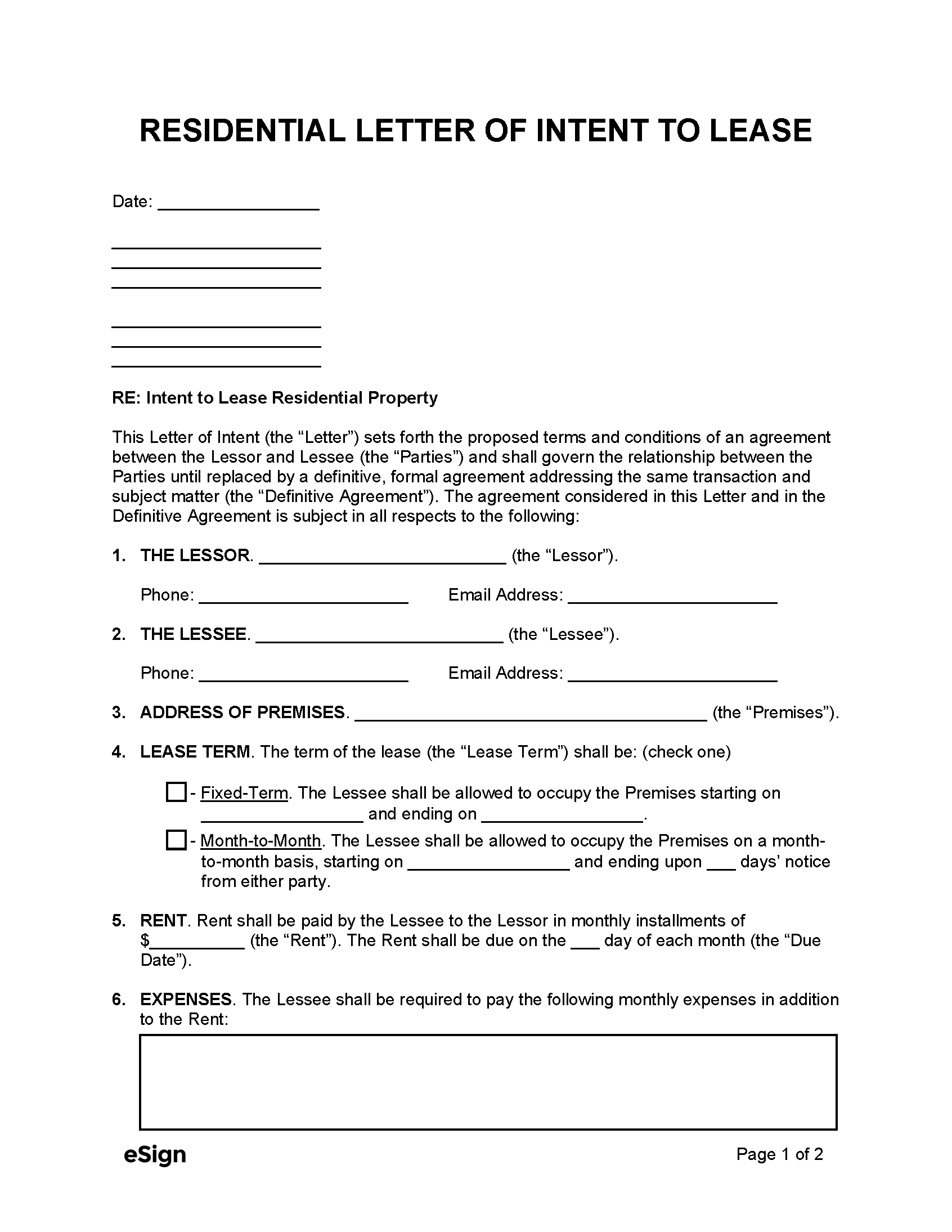

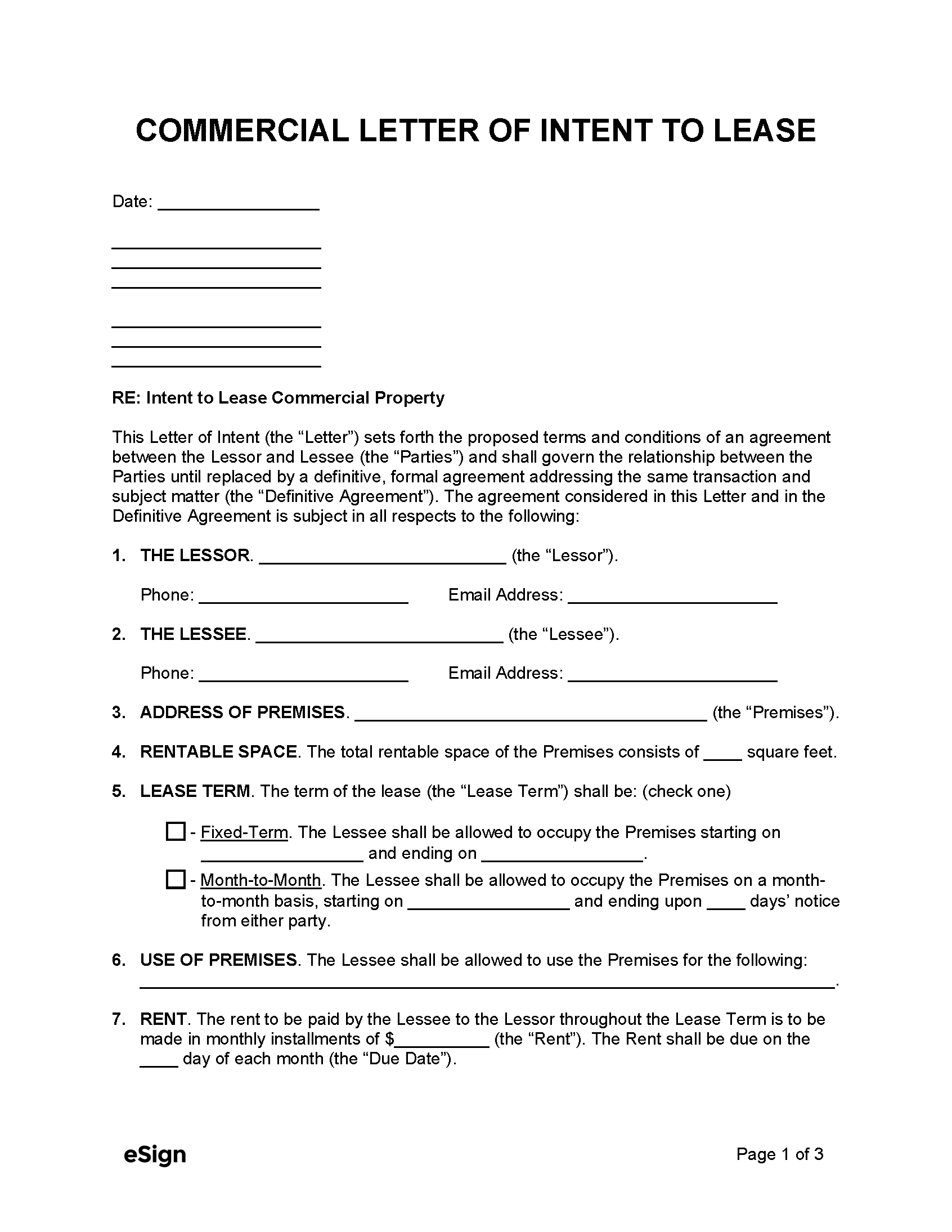

LOI to Lease Property

For lease letters of intent, the applicant will usually agree on basic terms after viewing the property. If they’re interested, they’ll draft their LOI and deliver it to the landlord.

To be considered for the lease, the applicant may be required to complete a rental application form and background check. There may also be an inspection period before drafting a final contract for commercial leases.

Sample

Download: PDF, Word (.docx), OpenDocument

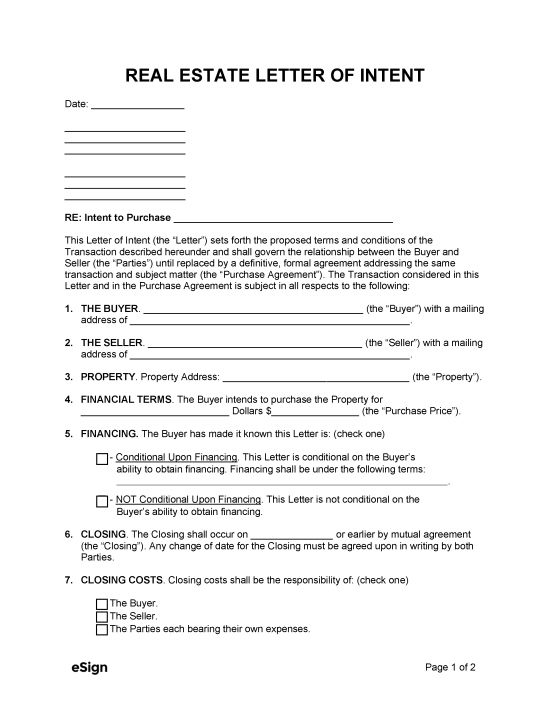

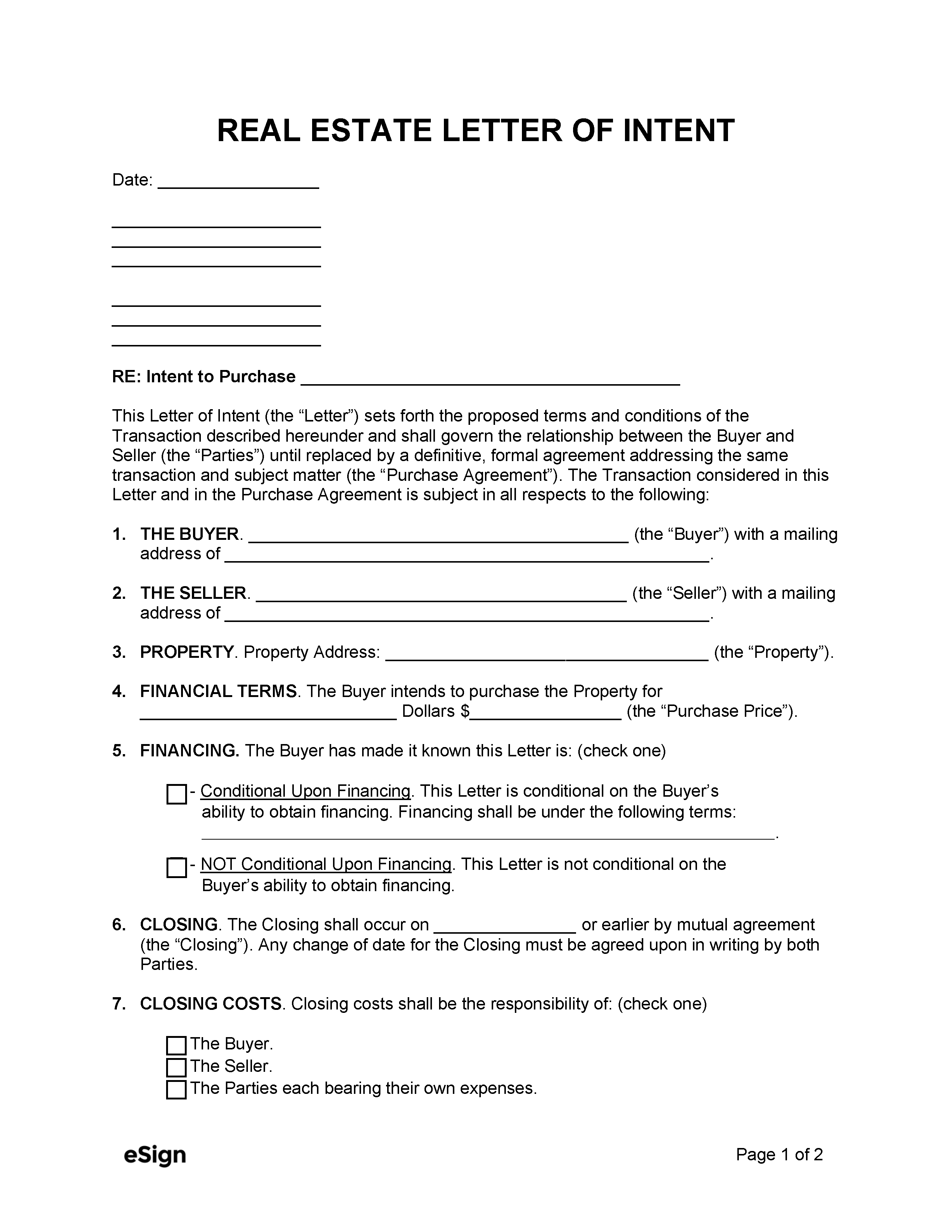

REAL ESTATE LETTER OF INTENT

Date: [DATE]

[SENDER (i.e., BUYER) NAME]

[SENDER STREET ADDRESS]

[SENDER CITY, STATE, ZIP]

[RECIPIENT (i.e., SELLER) NAME]

[RECIPIENT STREET ADDRESS]

[RECIPIENT CITY, STATE, ZIP]

RE: Intent to Purchase Property

This Letter of Intent (the “Letter”) sets forth the proposed terms and conditions of the transaction described hereunder and shall govern the relationship between the Buyer and Seller (the “Parties”) until replaced by a definitive, formal agreement addressing the same transaction and subject matter (the “Definitive Agreement”). The transaction considered in this Letter and in the Definitive Agreement is subject in all respects to the following:

Please note: Any sections that do not apply may be struck through or deleted.

1. THE BUYER. [BUYER NAME] (the “Buyer”) with a mailing address of [BUYER MAILING ADDRESS].

2. THE SELLER. [SELLER NAME] (the “Seller”) with a mailing address of [SELLER MAILING ADDRESS].

3. TRANSACTION This Letter is for the purchase of the Property located at [PROPERTY ADDRESS] (the “Property”) for $[AMOUNT] (the “Purchase Price”). The Property is defined as a ☐ commercial ☐ residential space.

4. FINANCING. This Letter is: ☐ – Conditional Upon Financing ☐ – Not Conditional Upon Financing.

5. CLOSING. The Closing shall occur on [DATE] (the “Closing”). Any change of date for the Closing must be agreed upon in writing by both Parties.

6. CLOSING COSTS. All costs associated with the Closing shall be the responsibility of (check one) ☐ the Buyer ☐ the Seller ☐ the Parties each bearing their own expenses.

7. POSSESSION. Possession of the Property shall be given on [DATE] (the “Possession”). Any change of date for the Possession must be agreed upon in writing by the Buyer and Seller.

8. STANDSTILL AGREEMENT. Following the execution of this Letter, and until Closing, the Seller shall not negotiate for the sale of the Property with any other party unless either the Parties agree in writing to terminate this Letter, or the Parties fail to sign a Purchase Agreement by [DATE].

9. INTENTION OF THE PARTIES. This Letter sets forth the intentions of the Parties to use reasonable efforts to negotiate, in good faith, a Definitive Agreement with respect to all matters herein. Notwithstanding paragraphs 4 and 8 through 11, which shall be legally binding, any legal obligations with respect to all other matters shall only arise if and when the Parties execute and deliver a Definitive Agreement.

10. GOVERNING LAW. This Letter shall be governed under the laws of the State of [STATE NAME].

11. SIGNATURES.

Seller/Lessor Signature: ____________________________

Date: [MM/DD/YYYY] Print Name: [SELLER/LESSOR PRINTED NAME]

Buyer/Lessee Signature: ____________________________

Date: [MM/DD/YYYY] Print Name: [BUYER/LESSEE PRINTED NAME]