The form also relays each member’s voting rights, the manner in which the company deals with profit and loss, and what would happen in the event of the company’s dissolution/liquidation.

An LLC operating agreement is not a legal requirement; however, the drafting thereof is highly recommended as it serves to legitimize the company further and protect its owners from any company debts or litigation.

Contents |

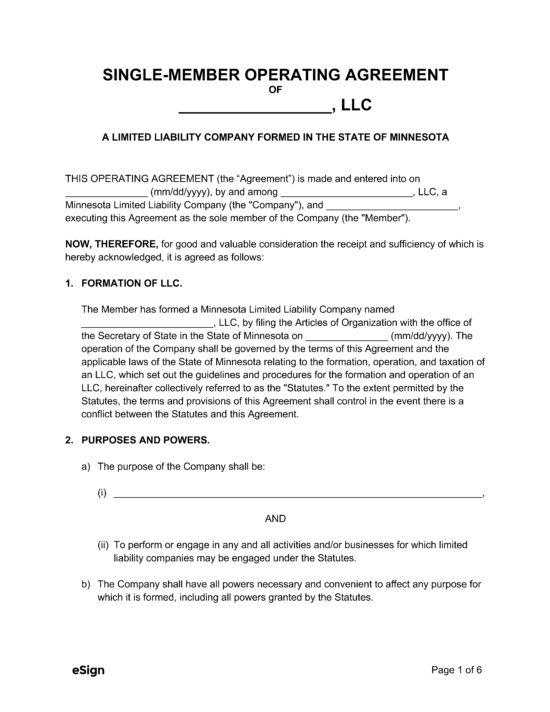

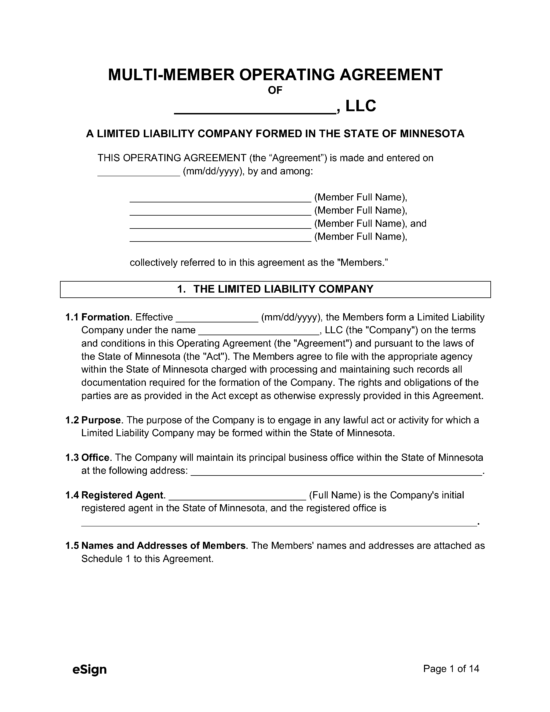

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 322C

- Definitions: § 322 C.0102

- Formation: § 322 C.0201

- Naming of LLCs: § 322 C.0108

How to File (6 Steps)

- Step 1 – Reserve the Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File Articles of Organization

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Renewal

Step 1 – Reserve the Entity’s Name

In the state of Minnesota, every LLC is required to have a unique name and must include “limited liability company,” or the abbreviation thereof. The words “incorporated” and “corporation” are NOT permitted.

Go to the Secretary of State website and use the Search Business Filings portal to verify the uniqueness of the company name.

Once a name has been chosen it may be reserved for a period of twelve (12) months using either of the methods detailed below:

- Online: Go to this page and create an account at the bottom of the page. Provide the required information and file the request.

- Cost: $55

- Mail or In-Person: Download and fill out the Request for Reservation of Name form. Once completed, you may file in-person or by mail to the below address.

- Cost: $35 by mail, $55 in-person.

Minnesota Secretary of State – Business Services

First National Bank Building

332 Minnesota Street, Suite N201

Saint Paul, MN 55101

Step 2 – Select a Registered Agent

Prior to registering with the Secretary of State, the LLC must select a registered agent to represent them for service of process. The LLC may not act as its own registered agent. The agent may be an individual who is a Minnesota resident or a business entity legally authorized to do business in the state.

Step 3 – Filing Articles of Organization

The members of an LLC must file the Articles of Organization with the Secretary of State in order to operate in Minnesota. This filing can be accomplished one of two ways.

Method 1 – File Online

- Navigate to the Secretary of State Business & Liens portal

- Scroll to the bottom of the list and select Create Online Account

- Once the online account has been created, the Articles of Organization (domestic) or Certificate of Authority (foreign) can be completed and filed through the portal

- Online Filing Fees:

- Domestic: $155.00

- Foreign: $220.00

Method 2 – Mail or In-Person

Domestic Companies

- Download the Articles of Organization Form.

- Complete and sign the form.

- Make a cheque or money order out to the MN Secretary of State, the fee for an in-person filing is $155, the fee for mail is $135.

- Submit the form by mail or in-person to: Minnesota Secretary of State -Business Services, First National Bank Building, 332 Minnesota Street, Suite N201, Saint Paul, MN 55101.

Foreign Companies

- Download the Certificate of Authority to Transact Business in MN (LLC) form.

- Complete and sign the document.

- Include a cheque or money order made out to the MN Secretary of State, a fee of $185 applies if submitted by mail, or $205 for in-person filings.

- Submit the form in-person or via mail to: Minnesota Secretary of State – Business Services, Retirement Systems of Minnesota Building, 60 Empire Drive, Suite 100, St Paul, MN 55103.

Step 4 – Create an Operating Agreement

It is recommended that LLCs create an operating agreement for their companies, even if it is not legally mandated by the state of Minnesota. It gives the owners the ability to determine how the company operates, outlines their responsibilities, and limits their liability should the company accrue debts or get sued. If the company chooses not to create an operating agreement, the operation of the company will be governed by state law.

Step 5 – Obtain an EIN

An Employer Identification Number (EIN) may be obtained free of charge either via the IRS Online Application or by filling out Form SS-4 and submitting by mail. The EIN is a requirement for any LLC that has at least two (2) owners, that has employees, or that wishes to be taxed as a corporation rather than a sole-proprietorship.

Step 6 – File Annual Renewal

Every LLC operating in Minnesota must file an Annual Renewal every calendar year before December 31st with the Minnesota Secretary of State. This begins the calendar year after the initial filing.

There are no fees if the entity is active and in good standing. This statement may be filed online, or by mail/in-person with the Annual Renewal Form.

ResourcesFiling Options: Online or by mail Costs:

Forms:

Links:

|