Types (2)

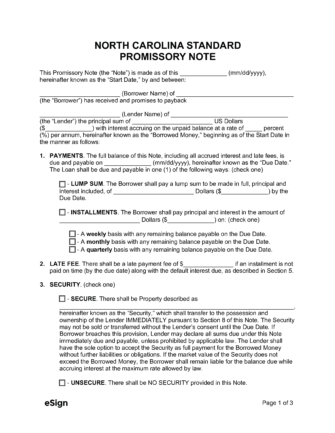

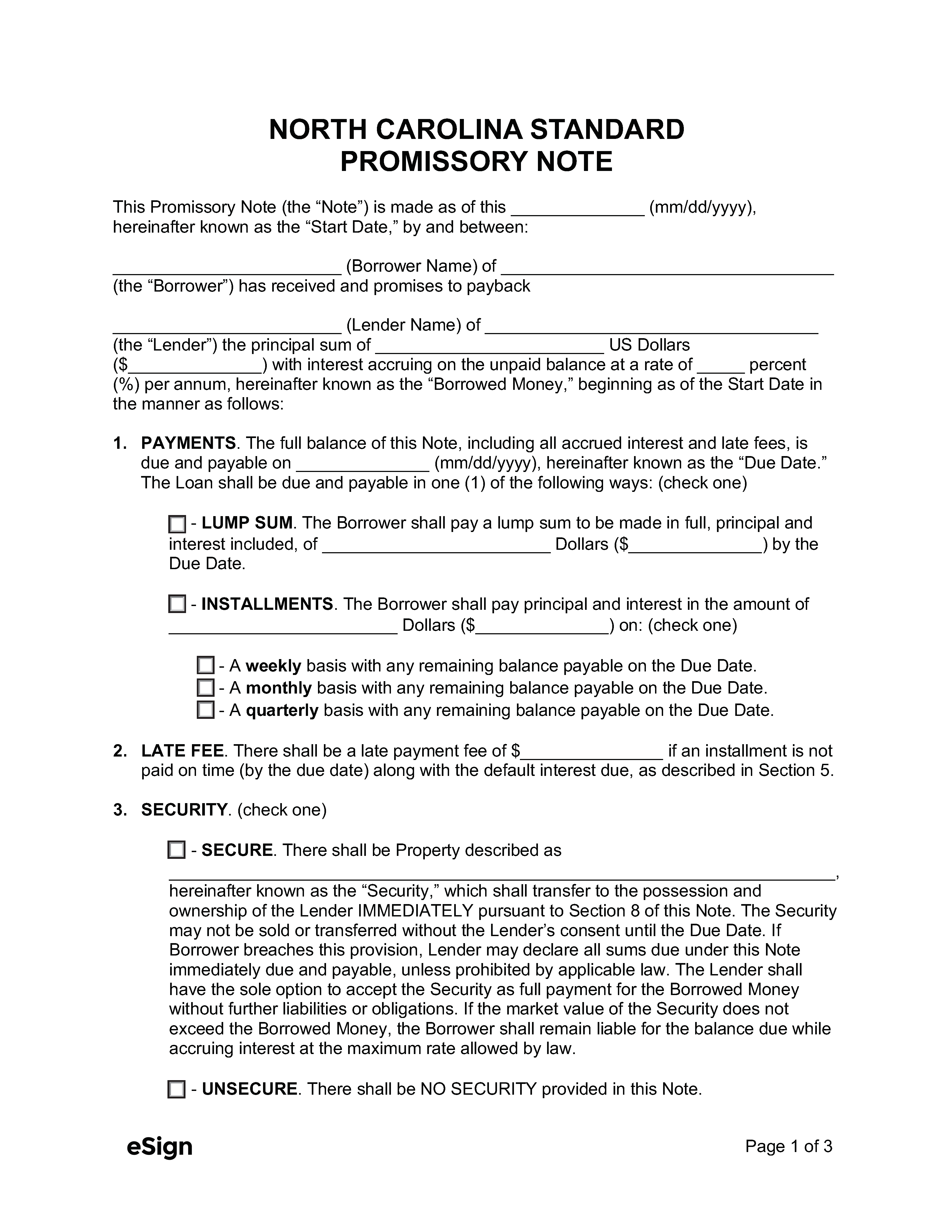

Download: PDF, Word (.docx), OpenDocument

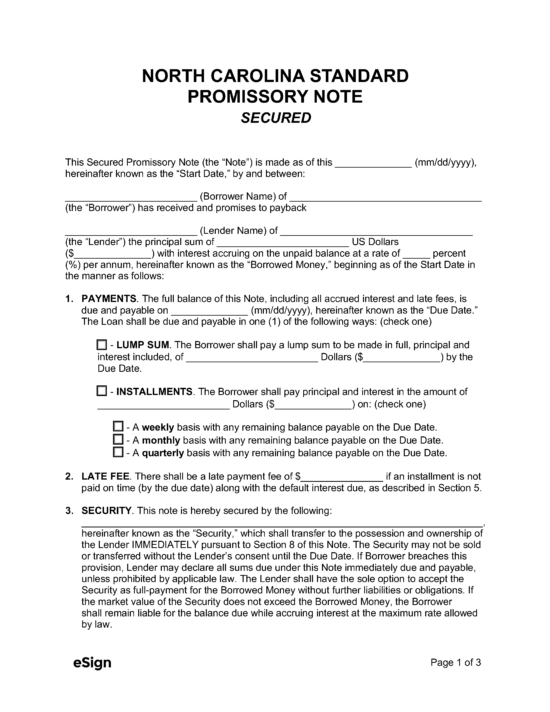

Download: PDF, Word (.docx), OpenDocument

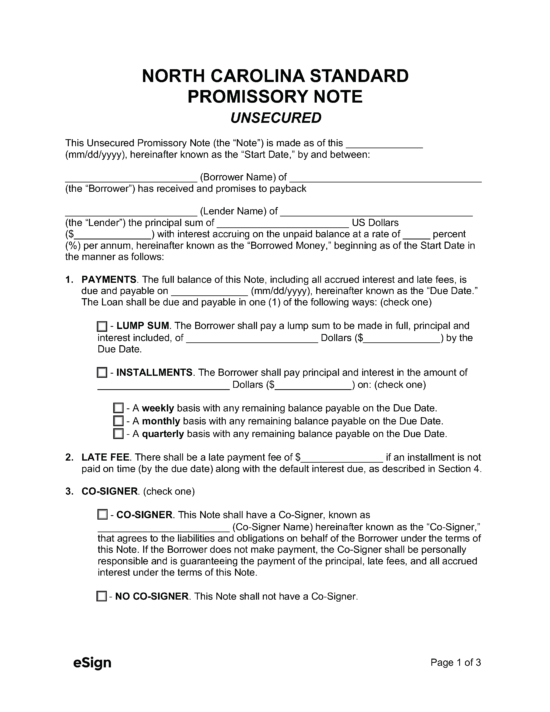

Laws

- Interest & Usury Laws: Chapter 24 – Interest

- Usury Rate with Contract (N.C. Gen. Stat. § 24-1.1(a)):

- For loans less than $25,000: Set by the North Carolina Association of Banks on the 15th of each month (it has been 16% since 1984).

- For loans more than $25,000: No limit

- Usury Rate without Contract (N.C. Gen. Stat. § 24-1): 8%

- Usury Rate for Monetary Judgments (N.C. Gen. Stat. § 24-5(a)): Contract rate, or 8% if no rate specified.