Types (2)

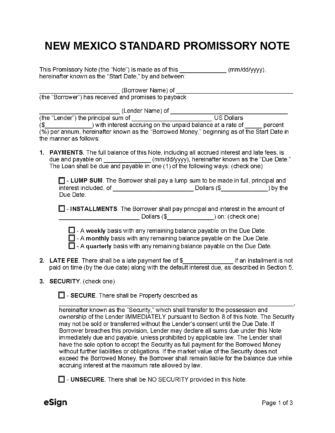

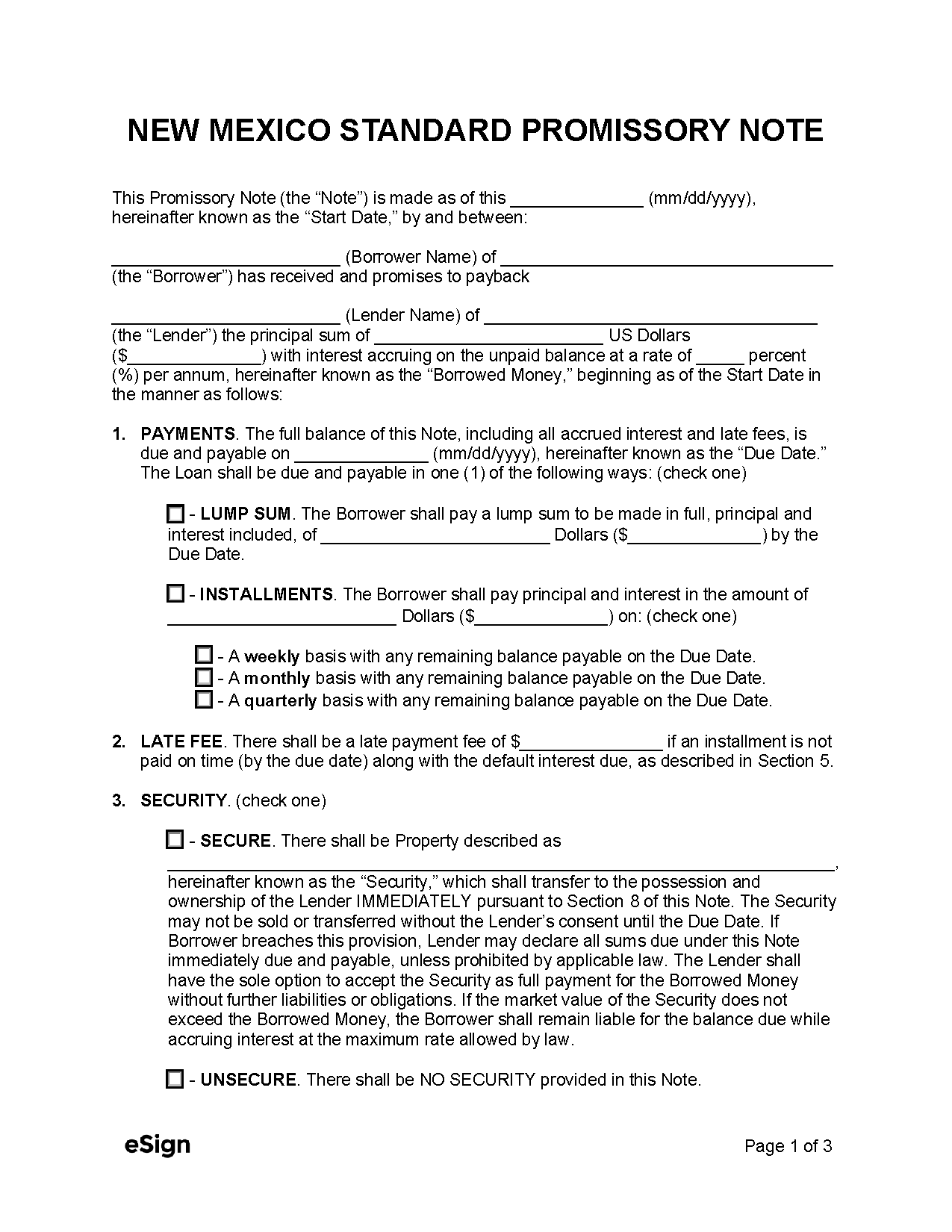

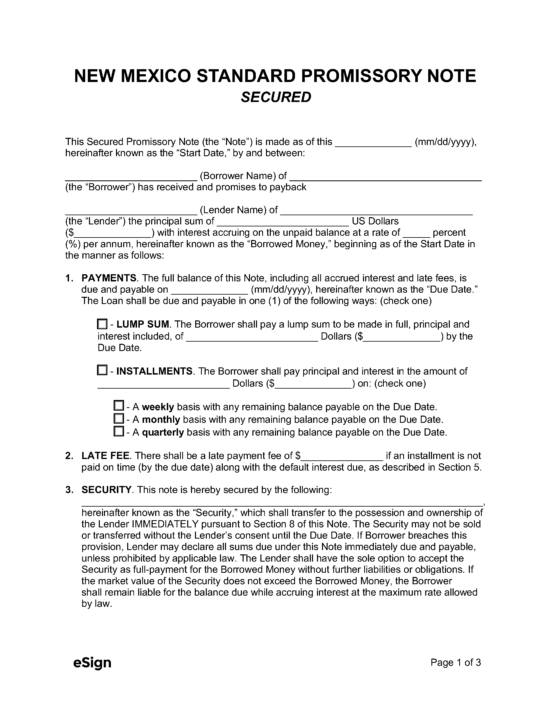

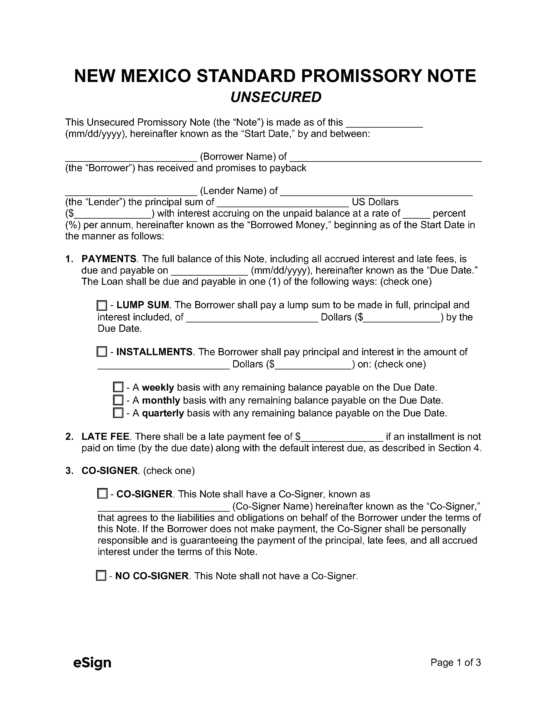

Secured Promissory Note – A debt repayment agreement between two (2) parties where the borrower pledges personal assets as collateral.

Secured Promissory Note – A debt repayment agreement between two (2) parties where the borrower pledges personal assets as collateral.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 56, Article 8

- Usury Rate in General (§ 56-8-3): 15%, in absence of written contract.

- Usury Rate for Loans to Corporations/Business Entities (§ 56-8-9(B)): No maximum except for loans made for mortgages relating to farms or agriculture (§ 56-8-10).

- Usury Rate for Judgments (§ 56-8-4): 8.75%, with the following exceptions*:

- Judgment rendered on written instrument with different rate

- Judgment due to tortious conduct, bad faith, intentional/willful acts (15%)

- Judgment wherein the plaintiff unreasonably delayed the trial’s adjudication (10%)

- Judgment after defendant made reasonable settlement offer to the plaintiff (10%)

- Usury Rate for Open Accounts (§ 56-8-5): 15%, unless higher rate is set by agreement.

*In all unpaid child support cases, the max rate is set at 8.75%.