Types (2)

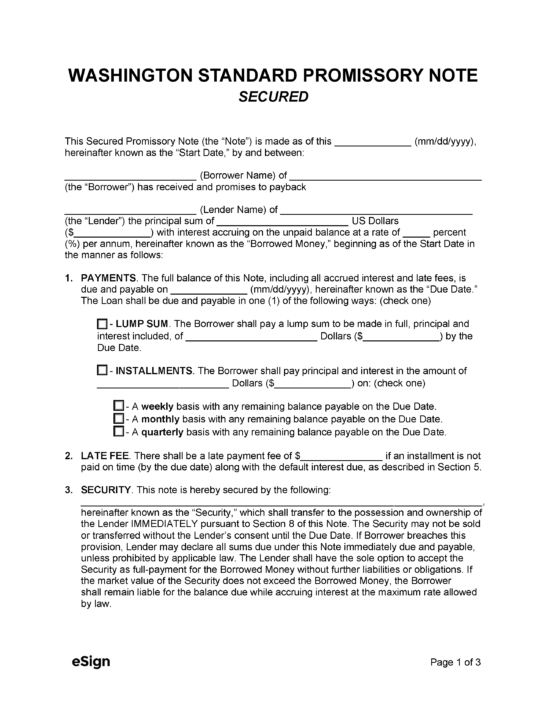

Download: PDF, Word (.docx), OpenDocument

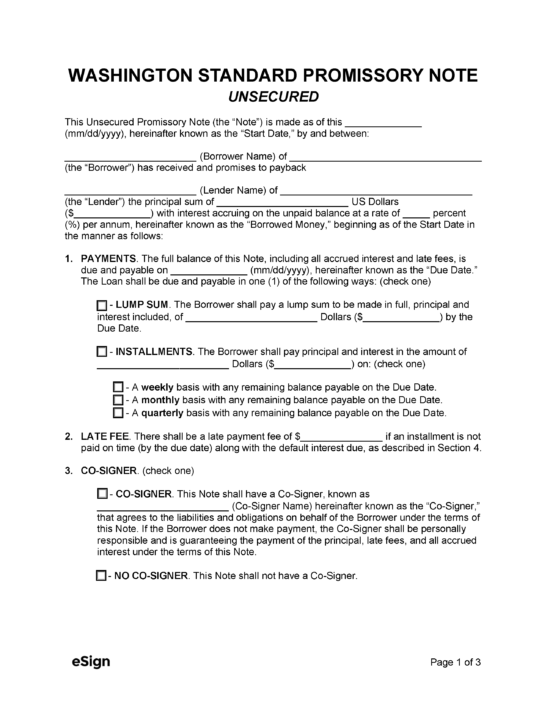

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 19.52 – Interest-Usury

- Usury Rate with Contract (§ 19.52.020(1)): 12% or 4% over the federal 26-week treasury bill rate, whichever is greater.

- Usury Rate without Contract (§ 19.52.010(1)): 12%

- Usury Rate for Loan Setup Charges (§ 19.52.020(2)(b)): 4% ($15 maximum)

- Usury Rate for Judgments with Contracts (§ 4.56.110(1)): The interest rate will be the same as agreed in the contract.

- Usury Rate for Child Support Judgments (§ 4.56.110(2)): 12%

- Usury Rate for Tortious Conduct of a Public Agency Judgments (§ 4.56.110(3)(a)): 2% over the federal 26-week treasury bill rate

- Usury Rate for Tortious Conduct of an Individual/Entity Judgments (§ 4.56.110(3)(b)): 2% over the federal prime rate

- Usury Rate for Unpaid Student Debt Judgments (§ 4.56.110(4)): 2% over the federal prime rate

- Usury Rate for Unpaid Consumer Debt Judgments (§ 4.56.110): 9%

- Usury Rate for Medical Debt Prejudgments (§ 19.52.010(2), § 19.52.020(4)): 9%