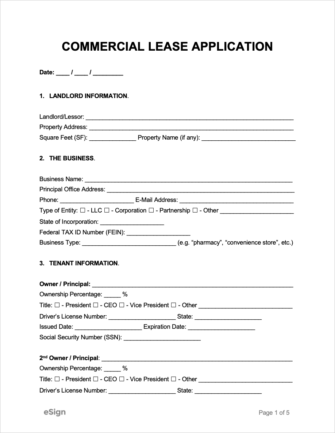

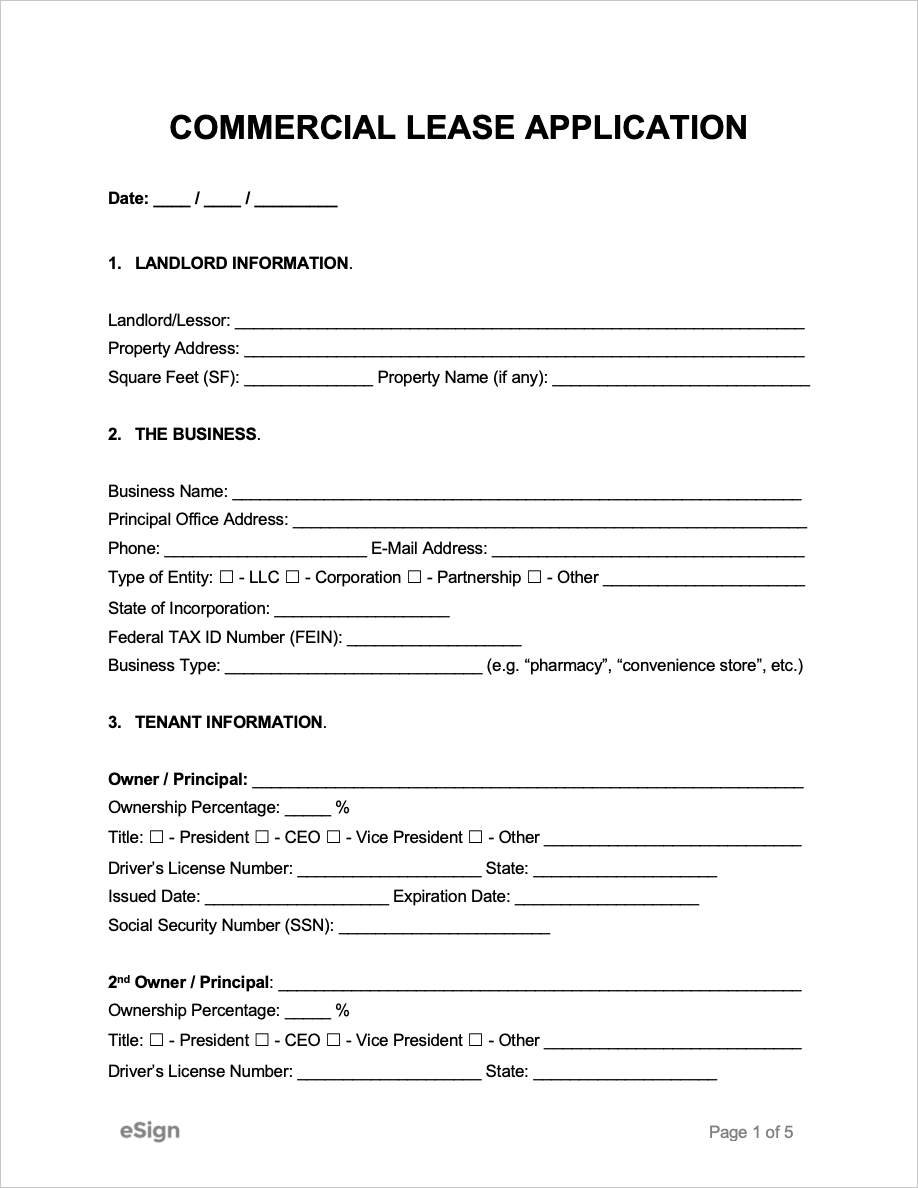

What’s Covered – A commercial lease application covers the following components:

- Landlord and property information

- Business and business owner details

- Guarantors of the lease

- Applicant’s rental history

- Financial references (banks, creditors, etc.)

- Business revenue, assets, and liabilities

- Consent for the landlord to run background checks

What can be Asked?

There aren’t many limitations on the type of questions a landlord can ask regarding a tenant’s business on a lease application.

However, certain types of information are off-limits when screening an individual, including any questions about the applicant’s:

- Nationality

- Religious affiliation

- Gender

- Sexual orientation

- Age

Any other aspects that don’t correlate to the tenant’s ability to honor their lease also can’t be demanded or used in screening tenants.

Warning Signs

1. Not Willing to Sign a Long-Term Lease

There are three common reasons a tenant would try to avoid signing a long-term lease:

- They anticipate their business will grow so fast that they’ll need to relocate to a larger space.

- They aren’t confident in the future of their company.

- They aren’t sure that the rental property will suit their needs.

2. No Financial Backing

Unless the main tenant is exceptionally wealthy, landlords should avoid leasing to tenants who aren’t willing to provide one or more guarantors.

3. Low Credit Score

A low credit score should be considered a major red flag. This signals that the tenant has had trouble paying their bills on time, holds a significant amount of debt, has declared bankruptcy, or has, in some other way, proved to be financially unstable.