By Type (3)

CONTENTS |

Insurance Verification Explained

Insurance verification is the process of contacting an insurance provider to confirm an individual’s coverage and benefits. Insurance details are generally provided over the phone by an insurance agent, who will relay the policy’s status and verify whether the insured individual is covered for the proposed services.

Some insurance companies offer automated services that allow immediate access to policy information online or through a mobile application.

What’s Included

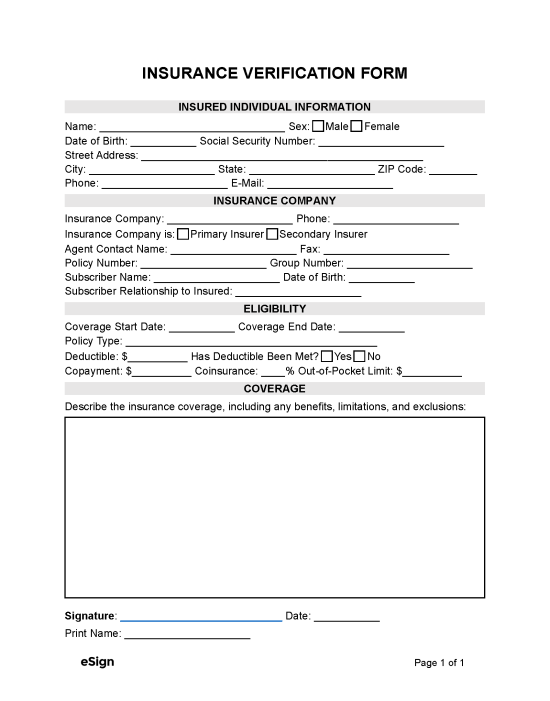

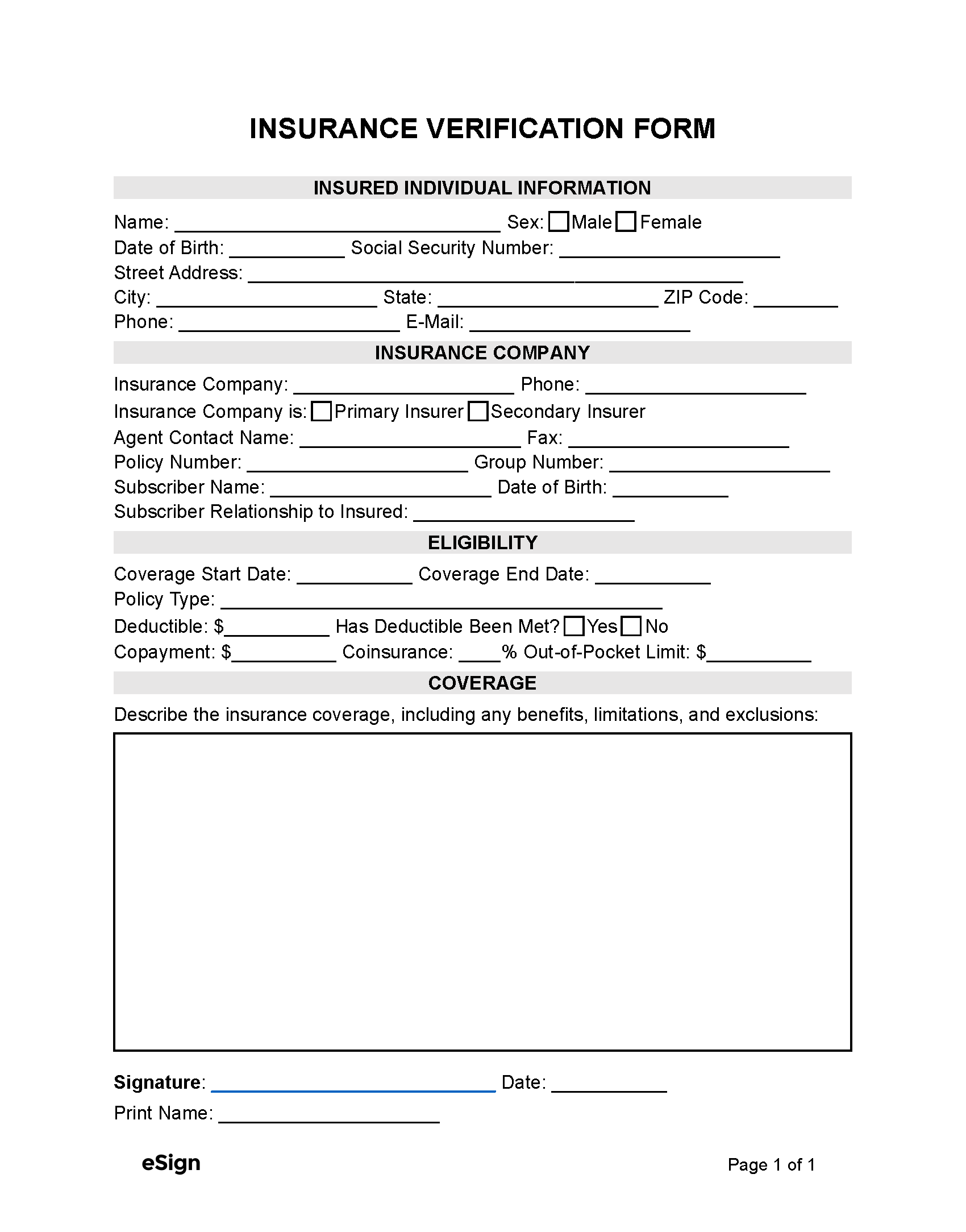

A verification form should be used to record the policy information collected from the insurance company. Each form will vary depending on its purpose, but in most cases, it will contain:

- Insured individual’s name and contact details

- Policy and group numbers

- Effective policy dates

- Deductibles

- Cost-sharing charges (copayments and coinsurance)

- Limitations and exclusions

Primary vs. Secondary Insurance

When confirming health coverage, the verification form must specify whether the insurance is the patient’s primary or secondary plan. This distinction is crucial because secondary claims won’t be processed until the primary insurer pays its share of the medical expenses.

When to Use the Verification Form

The following are some situations where an insurance verification form is typically used:

Healthcare

A verification form should be completed as soon as possible after scheduling an appointment or procedure. Acting quickly gives the healthcare provider’s staff enough time to prepare an accurate estimate, which they can then pass along to the patient before their visit.

It’s also important to verify insurance eligibility periodically to stay updated on any changes that could impact the patient’s coverage and benefits. Failing to monitor alterations in deductibles, copayments, or other terms can result in payment delays and claim denials.

Auto Industry

Before selling a vehicle, car dealerships will use a verification form to determine whether a client has valid auto insurance. This verification ensures that it’s legal for the buyer to drive the vehicle on public roads.

Rental Housing

Landlords might ask lease applicants to fill out a verification form to confirm their renters’ insurance. Doing so gives the landlord peace of mind, knowing the tenant has financial coverage for potential damages.