Types (2)

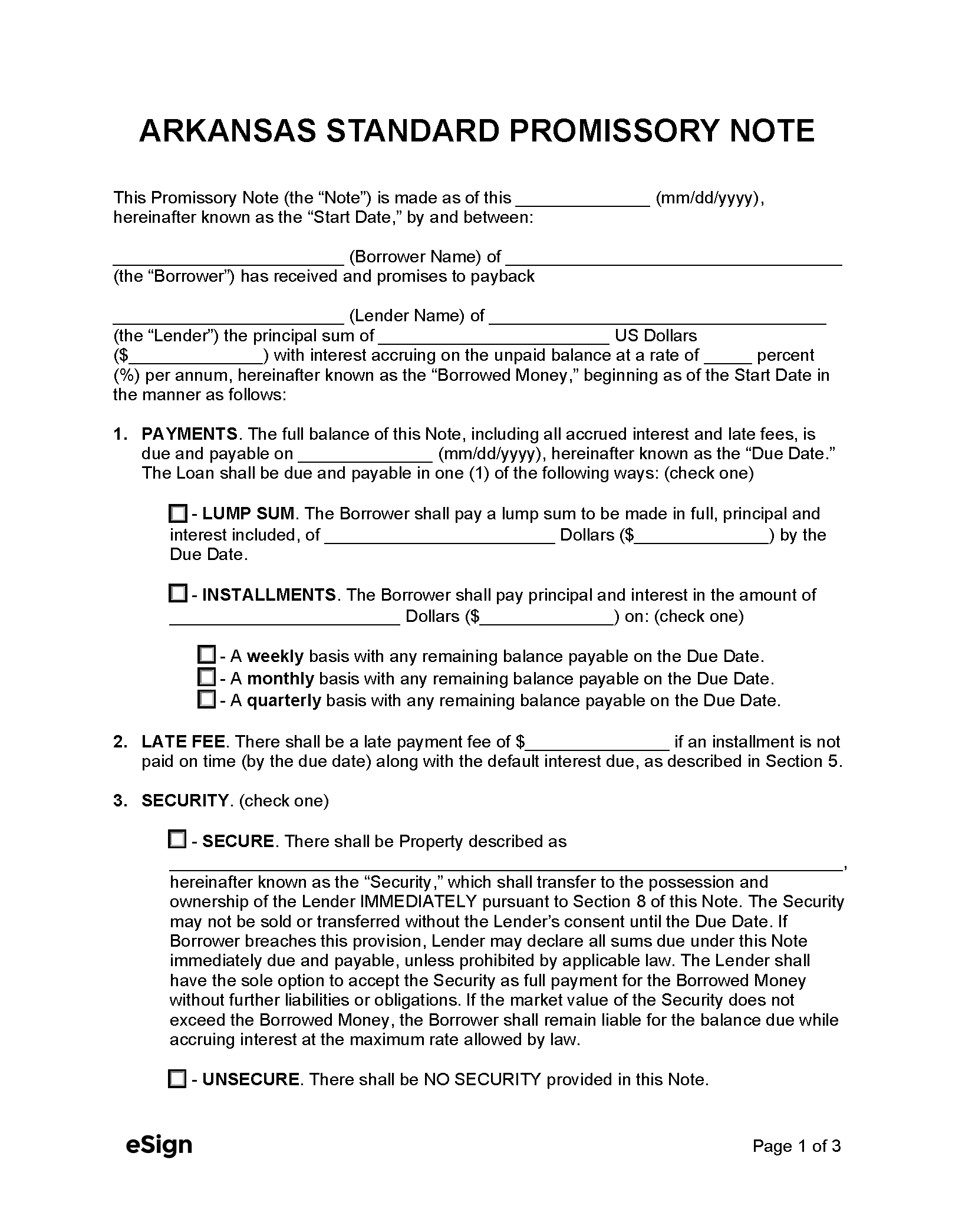

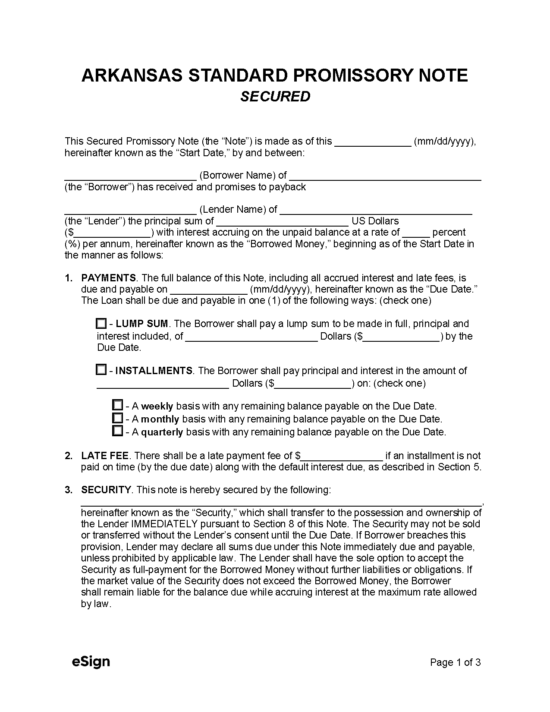

Secured Promissory Note – Used to record a loan transaction wherein the lender has a security interest in the borrower’s property.

Download: PDF, Word (.docx), OpenDocument

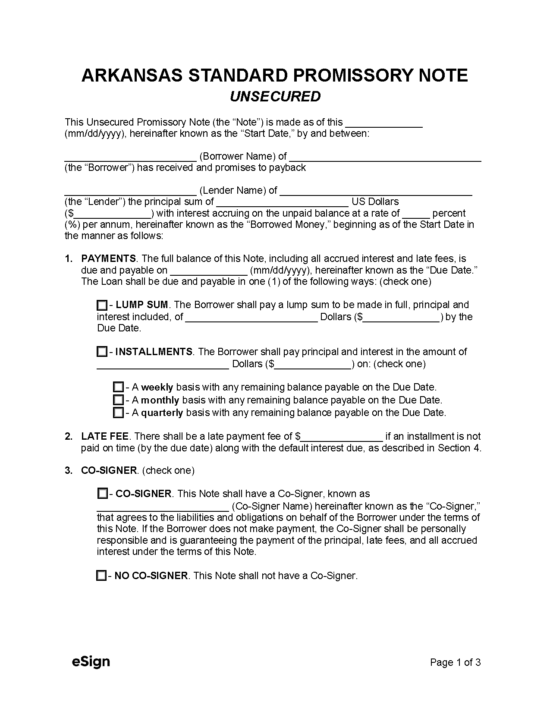

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 4, Chapter 57

- Usury Rate (§ 4-57-104): Arkansas Constitution, Amendment 89 sets the maximum lawful interest rate at 17%.

- Usury Rate Without Contract (§ 4-57-101(d)): 6%

- Usury Rate for Judgments (§ 16-65-114(a)(2)): 17% (Arkansas Constitution, Amendment 89).

- Usury Rate for Policy (Life Insurance) Loan (§ 23-81-109(c)(1)): 8% or an adjustable maximum interest rate subject to usury limitation.