Types (2)

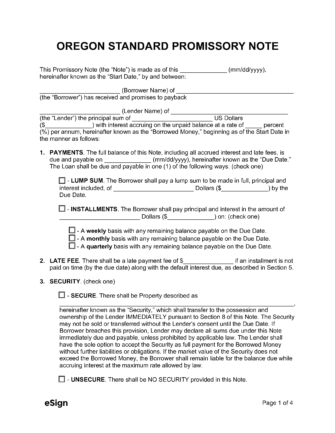

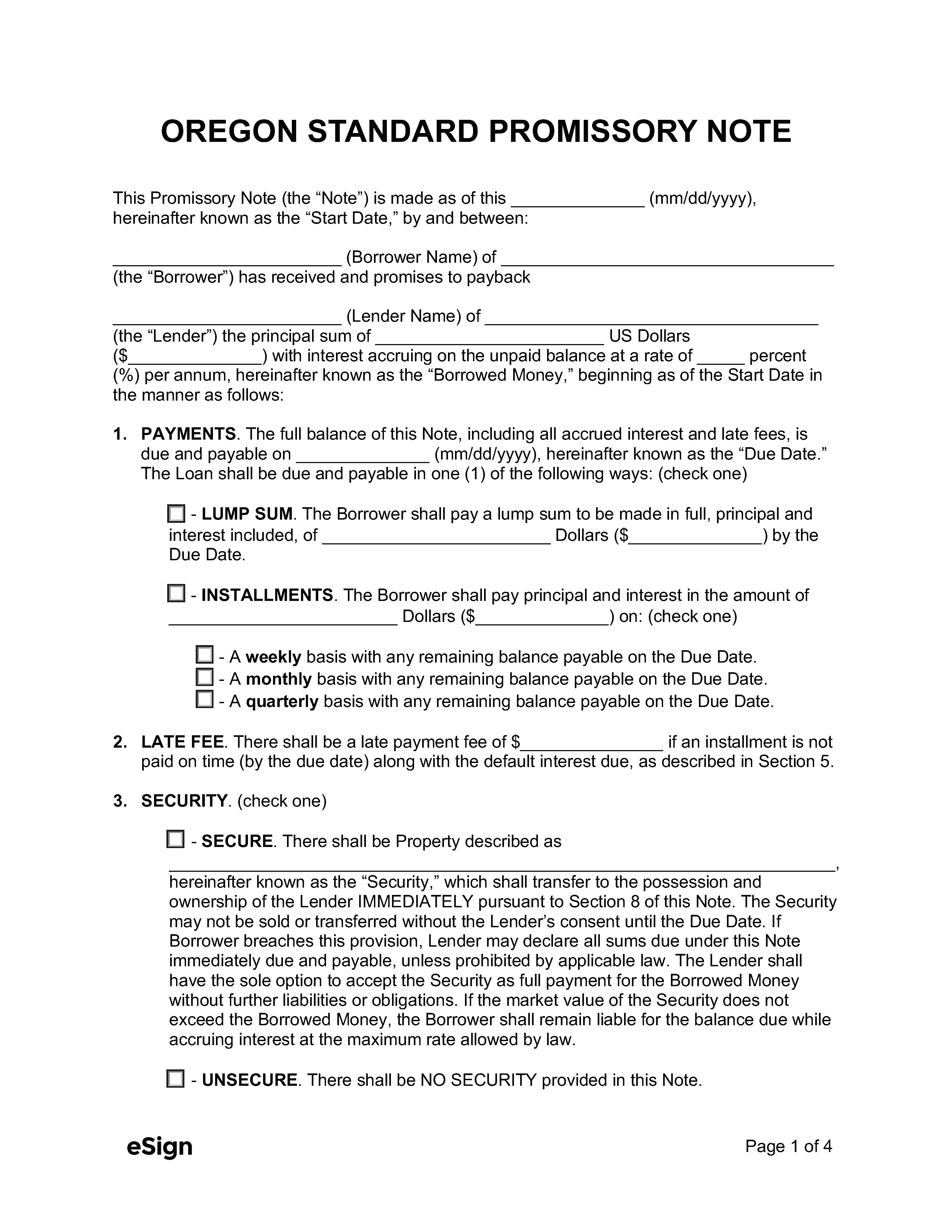

Download: PDF, Word (.docx), OpenDocument

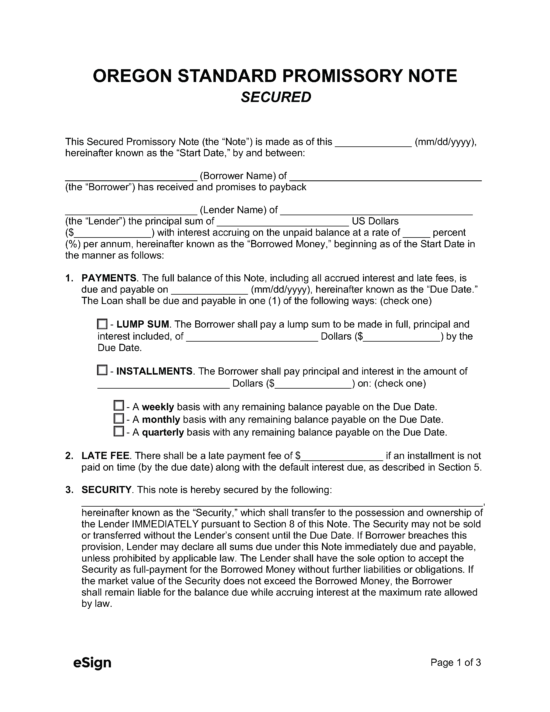

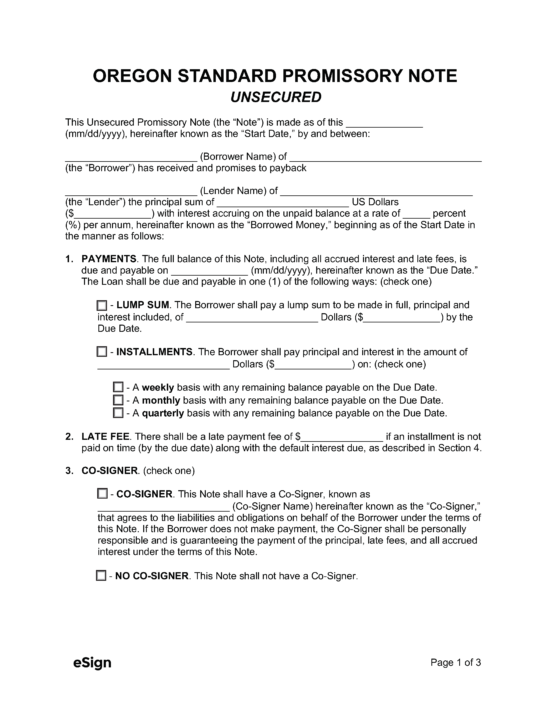

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 82: Interest; Repayment Restrictions

- Usury Rate in General (ORS 82.010(1)): 9%, unless otherwise agreed to by the parties.

- Usury Rate on Loans of $50,000 or less (ORS 82.010(3)(a)): 12% or 5% over the 90-day commercial paper discount rate in effect at the Federal Reserve Bank, whichever is greater.

- Usury Rate for Monetary Judgments (ORS 82.010(2)): 9%