By Type (4)

Deed of Trust – Conveys a property title to a third-party trustee to hold as collateral for a loan between the grantor and a lender. Deed of Trust – Conveys a property title to a third-party trustee to hold as collateral for a loan between the grantor and a lender.

Download: PDF |

General Warranty Deed – Transfers the property’s ownership with the guarantee that there are no title defects whatsoever. General Warranty Deed – Transfers the property’s ownership with the guarantee that there are no title defects whatsoever.

|

Quit Claim Deed – A deed that does not offer any assurances regarding the quality of the property’s title. Quit Claim Deed – A deed that does not offer any assurances regarding the quality of the property’s title.

|

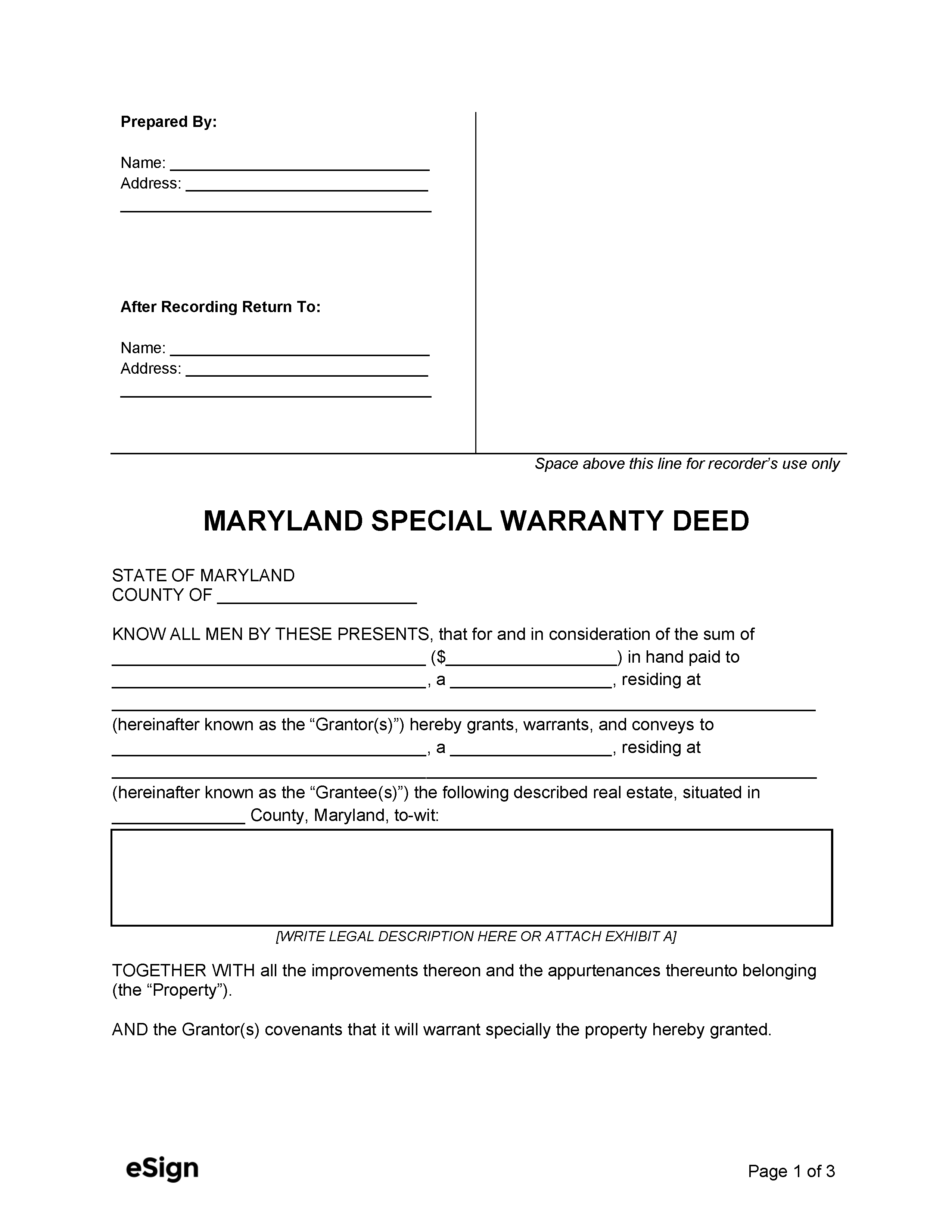

Special Warranty Deed – Guarantees that there are no title defects from the period during which the grantor was the owner. Special Warranty Deed – Guarantees that there are no title defects from the period during which the grantor was the owner.

|

Formatting

Paper – White paper of sufficient weight and thickness to be legible.

Font – Black and at least 8pt[1]

Recording

Signing Requirements – The grantor’s signature requires a notary acknowledgment.[2]

Where to Record – Deeds are filed with the Clerk of the Circuit Court where the property is located.[3]

Cost – $20 for deeds of up to 9 pages (as of this writing)[4]

Additional Forms

Land Instrument Intake Sheet – Must be completed and filed with the deed to provide the court clerk with all relevant details of the conveyance (see instructions).[5]