By Type (5)

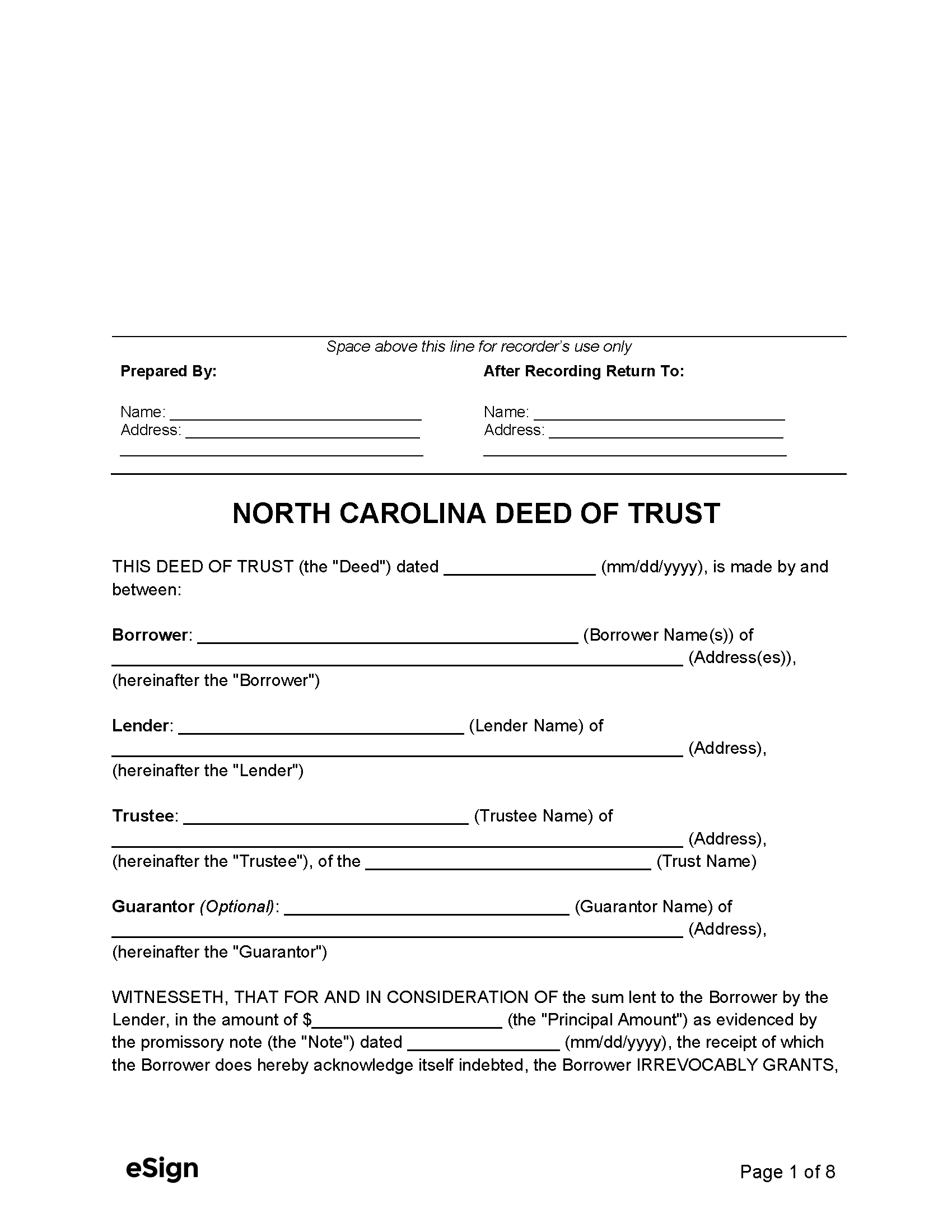

Deed of Trust – Conveys a property title to a trustee to hold until the grantor pays off a loan. Deed of Trust – Conveys a property title to a trustee to hold until the grantor pays off a loan.

|

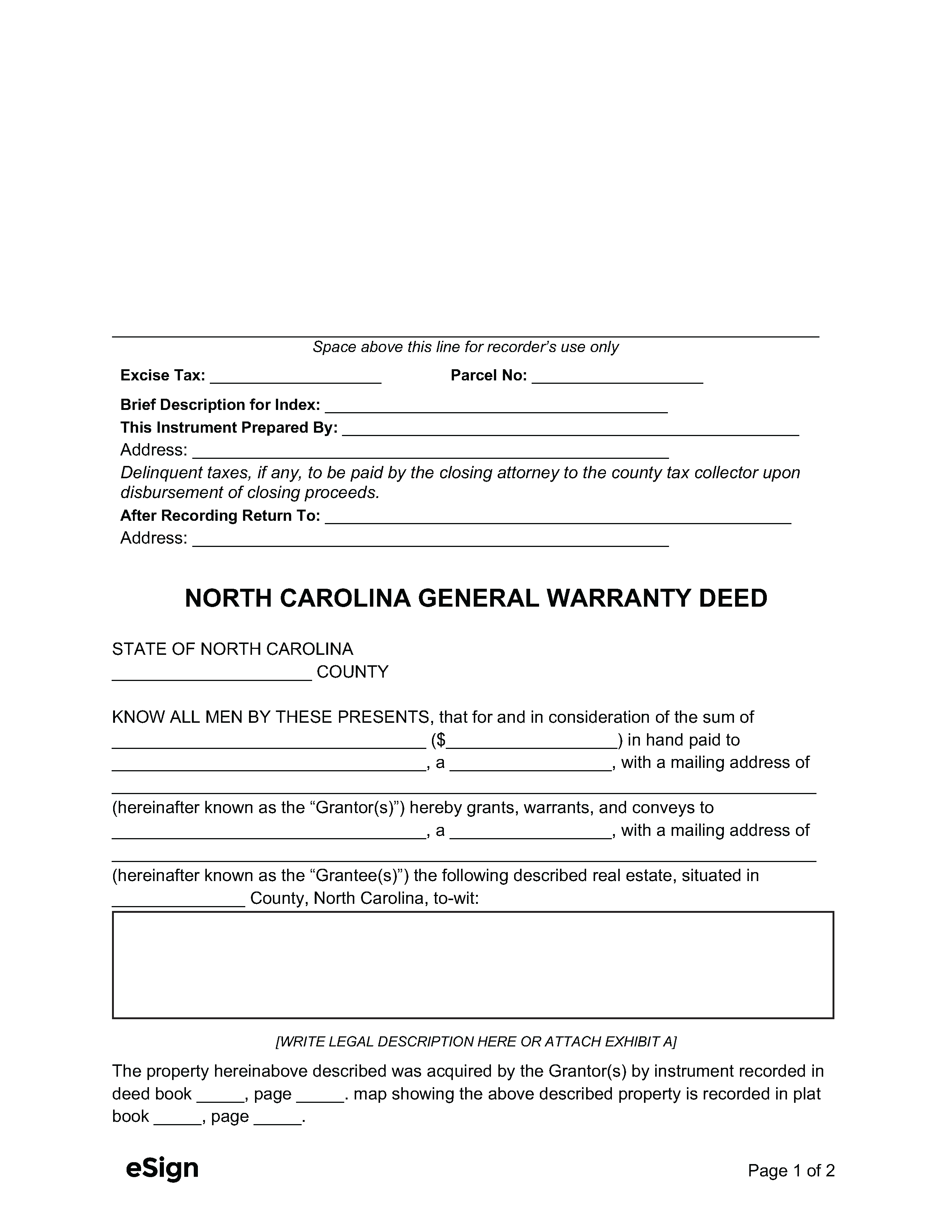

General Warranty Deed – Promises that the grantor’s ownership is valid and the title is free from all encumbrances. General Warranty Deed – Promises that the grantor’s ownership is valid and the title is free from all encumbrances.

|

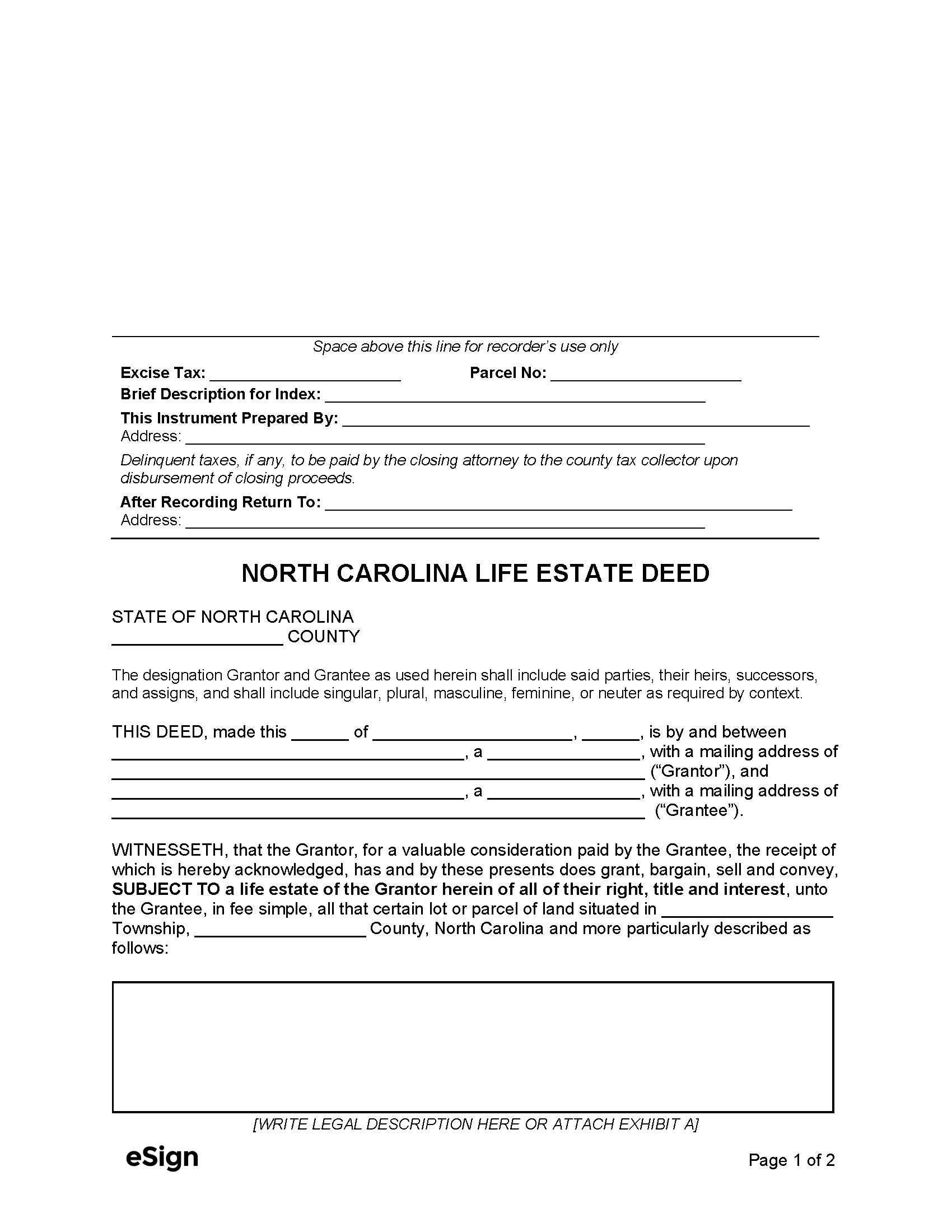

Life Estate Deed – Lets the grantor use the property for life, with ownership passing to the grantee upon the grantor’s death. Life Estate Deed – Lets the grantor use the property for life, with ownership passing to the grantee upon the grantor’s death.

|

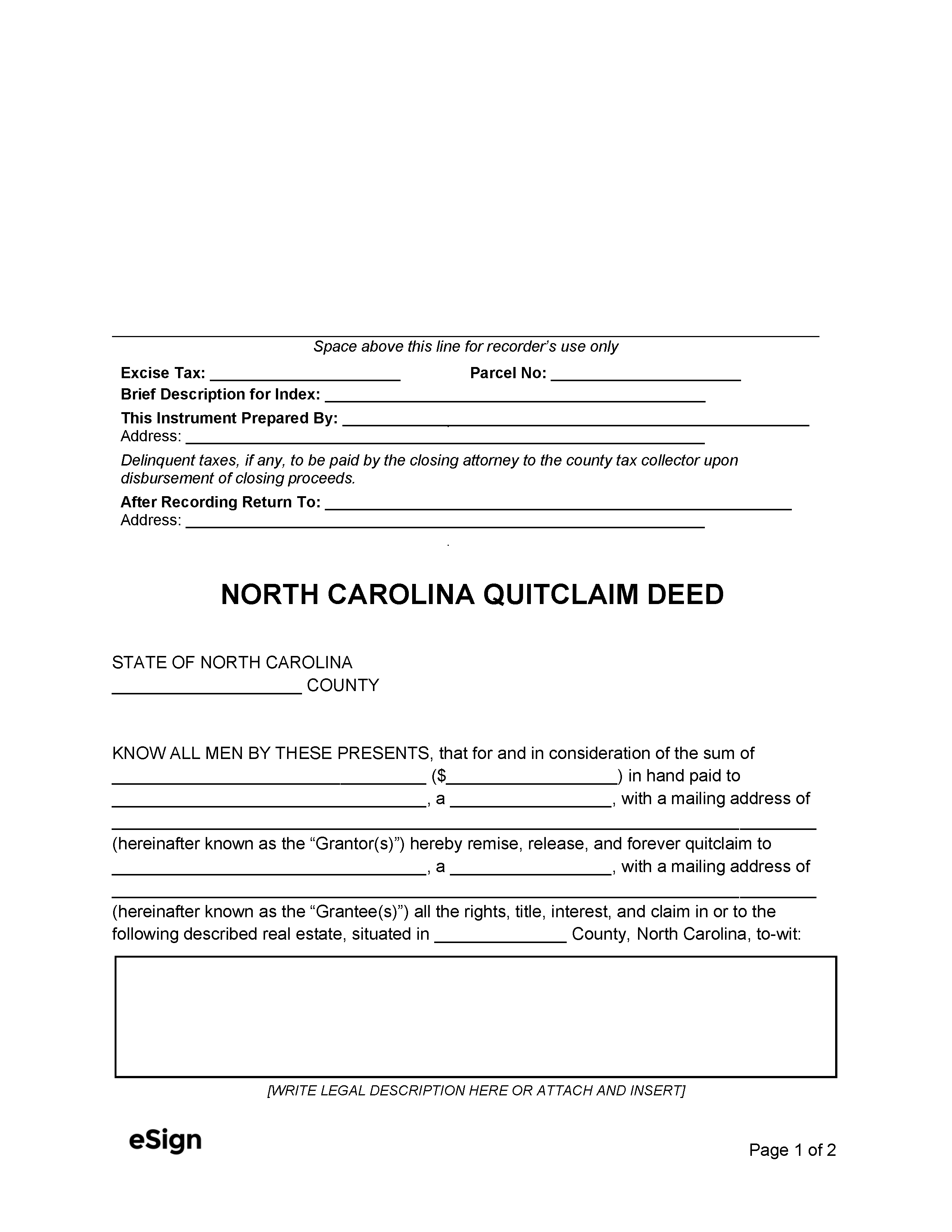

Quit Claim Deed – Provides no title warranties or covenants to protect the grantee. Quit Claim Deed – Provides no title warranties or covenants to protect the grantee.

|

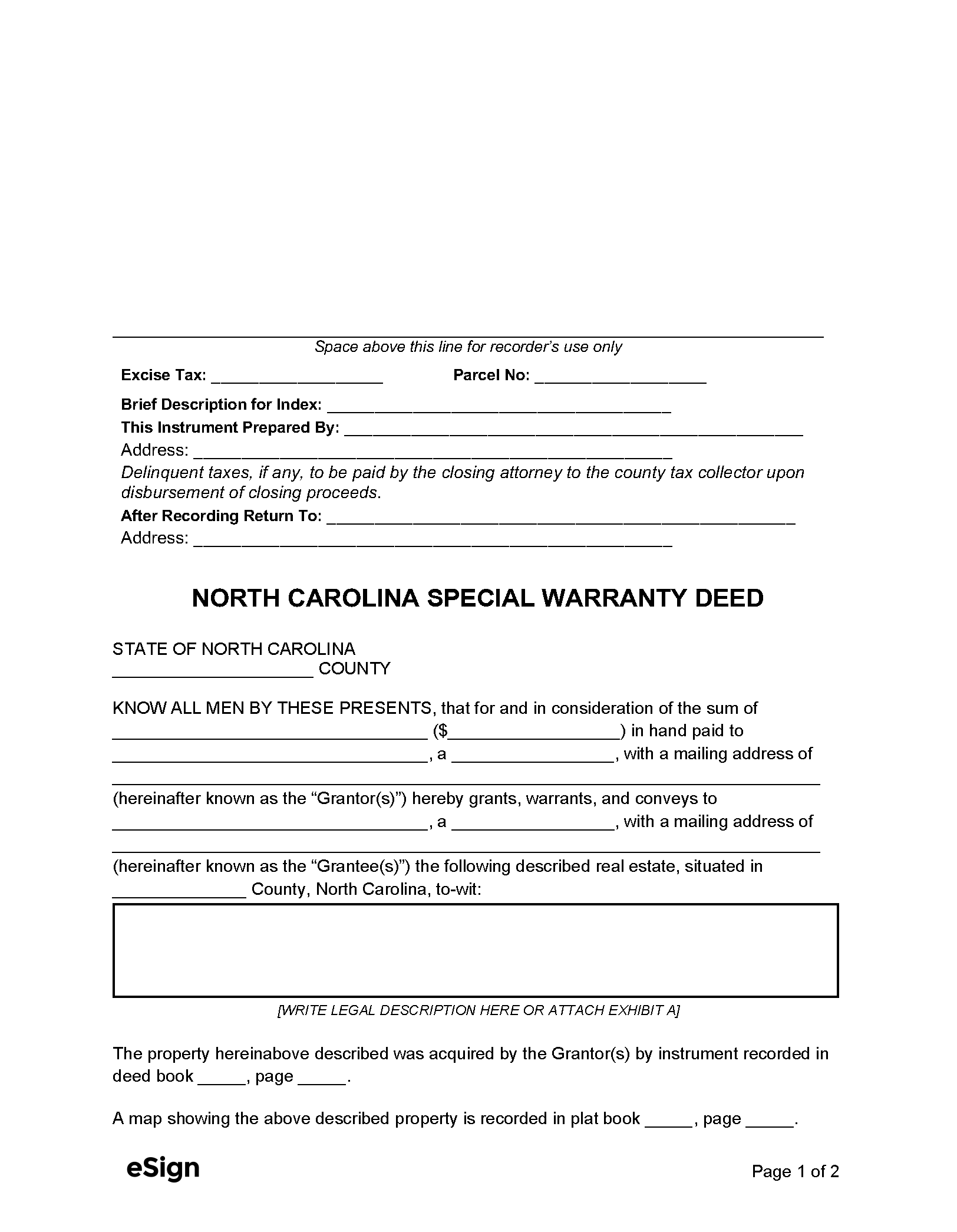

Special Warranty Deed – Guarantees no title encumbrances from the grantor’s ownership period, but not from prior owners. Special Warranty Deed – Guarantees no title encumbrances from the grantor’s ownership period, but not from prior owners.

|

Formatting

Paper – White paper, either 8.5″ x 11″ or 8.5″ x 14″

Margins – 3″ on top of the first page, 0.5″ on top of all other pages and all sides and bottoms

Font – 9 points, black ink[1]

Recording

Signing Requirements – The grantor must have their signature notarized.[2]

Where to Record – Deeds are recorded at the county office of the Register of Deeds.[3]

Cost – As of this writing, the Register of Deeds charges the following recording fees: