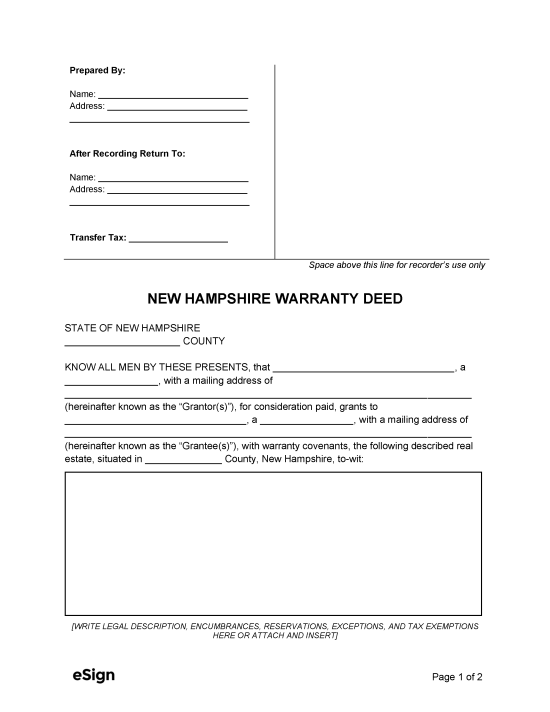

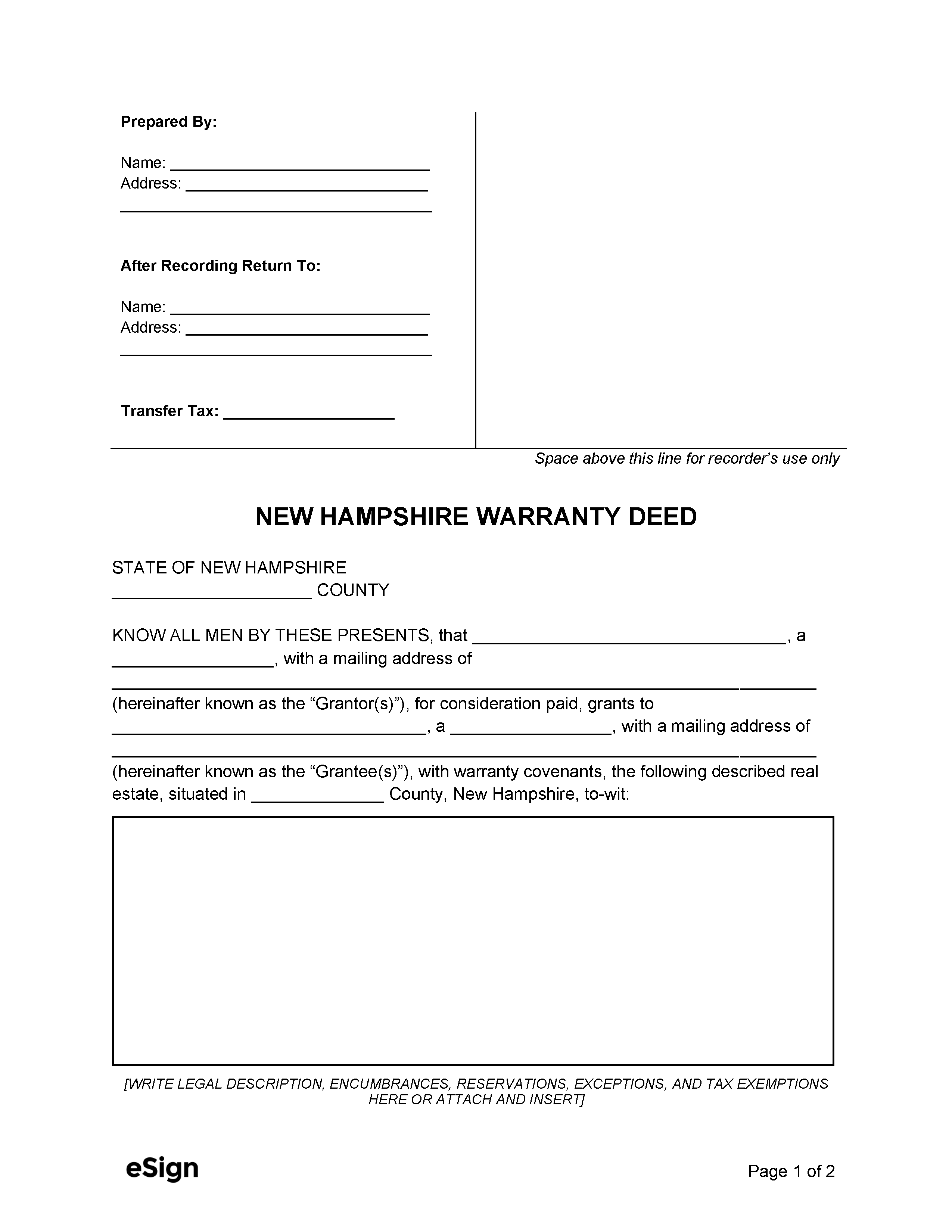

How to Format

Layout

While formatting varies by county, the following is generally required:

- The top right of the deed must have a blank 3″ space. Every other margin must be at least 1″.

- The writing must be 10-point and be in black or blue ink.

- Printed deeds must be on white paper with at least 20-pound weight. The pages must be single-sided and unbound, with no stapled attachments.[1]

To find out specific county formatting requirements, users can check the NH Deeds website.

Signatures

The deed must be signed and acknowledged by the grantor before a notary, justice, or commissioner.[2]

Recording

When the deed is completed and signed, it must be filed at the local Register of Deeds.[3] At the time of this writing, the recording fee is $10 for the first page and $4 for every other page, plus a $25 state LCHIP surcharge.[4]