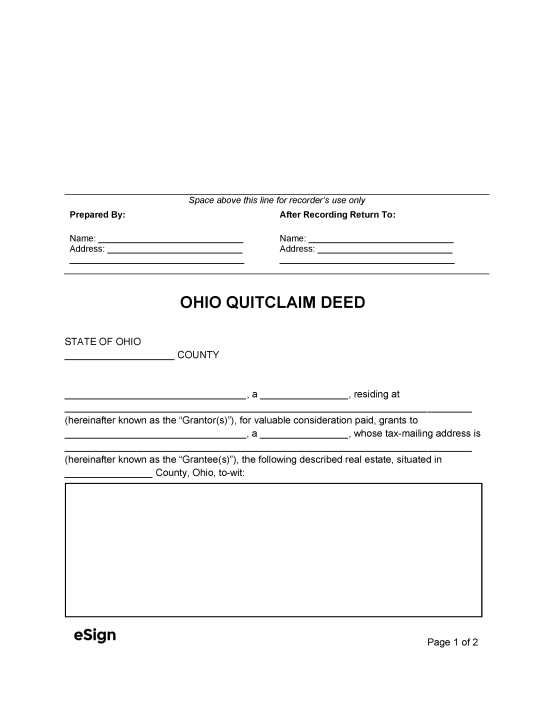

Recording Details

- Signing Requirements – The grantor and a notary public (or other authorized official) must sign the document.[1] If the grantor is married, their spouse will need to provide their signature to terminate all dower rights.[2]

- Where to Record – County Recorder[3]

- Recording Fees – $34 for the first two pages; $8 for each additional page (as of this writing)[4]

Formatting Requirements

- Margins:

- Top of the first page: 3″

- Top of every other page: 1.5″

- Sides: 1″

- Bottom: 1″

- Font: At least 10 point

- Paper: At least 8.5″ x 11″

- Ink: Black or blue, no highlighting

Required Forms

The grantee must submit one or more of the following documents to the County Auditor before the deed can be recorded:

- Real Property Conveyance Fee Statement of Value (DTE 100) – Determines conveyance fees for the transfer of ownership.[6]

- Statement of Reason for Exemption from Real Property Conveyance Fee (DTE 100EX) – If the transfer is exempt from conveyance fees, this document is used instead of DTE 100.

- Statement of Conveyance Homestead Property (DTE 101) – The grantor must sign this document if a homestead exemption is requested.