By Type (5)

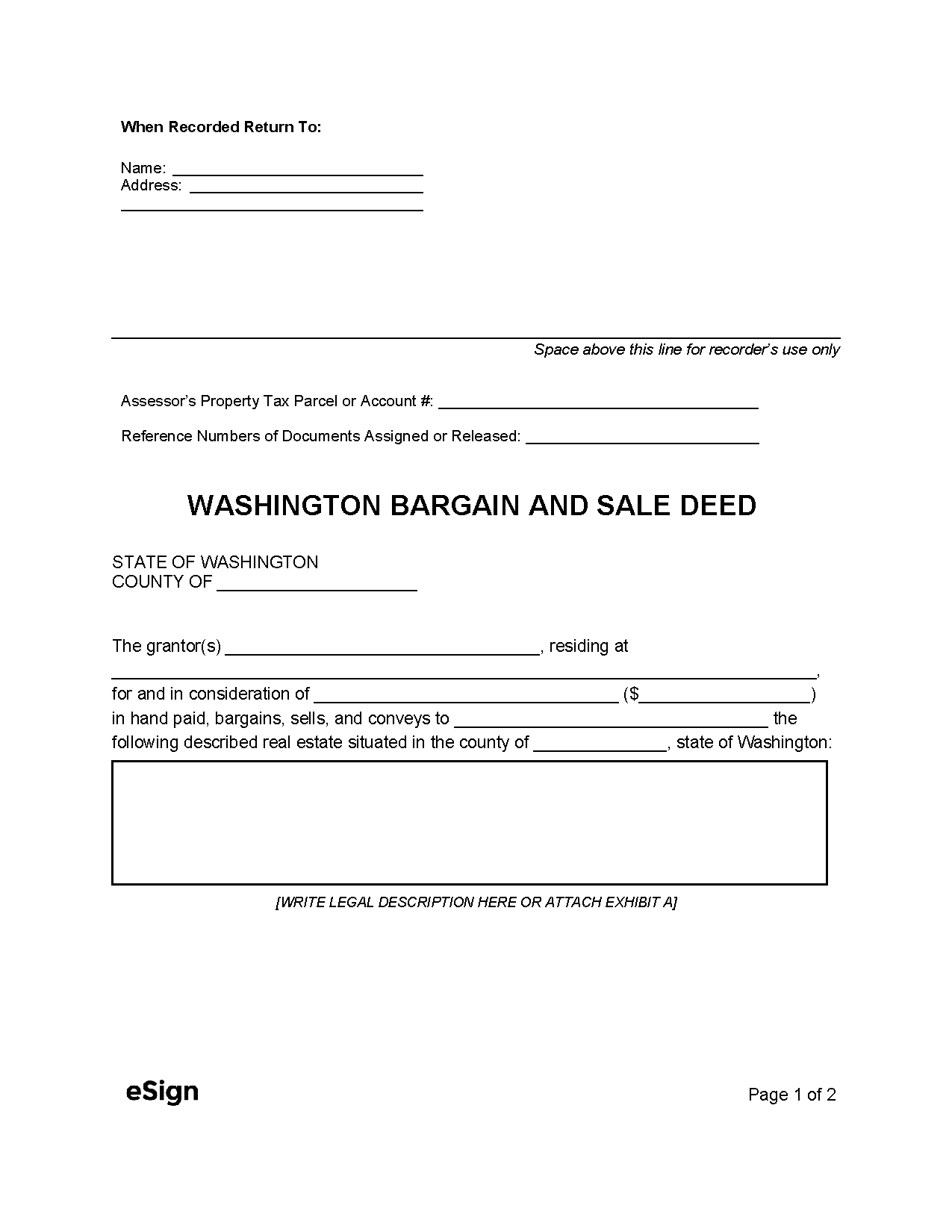

Bargain and Sale Deed – Promises that the grantor hasn’t encumbered or transferred the title during their ownership. Bargain and Sale Deed – Promises that the grantor hasn’t encumbered or transferred the title during their ownership.

|

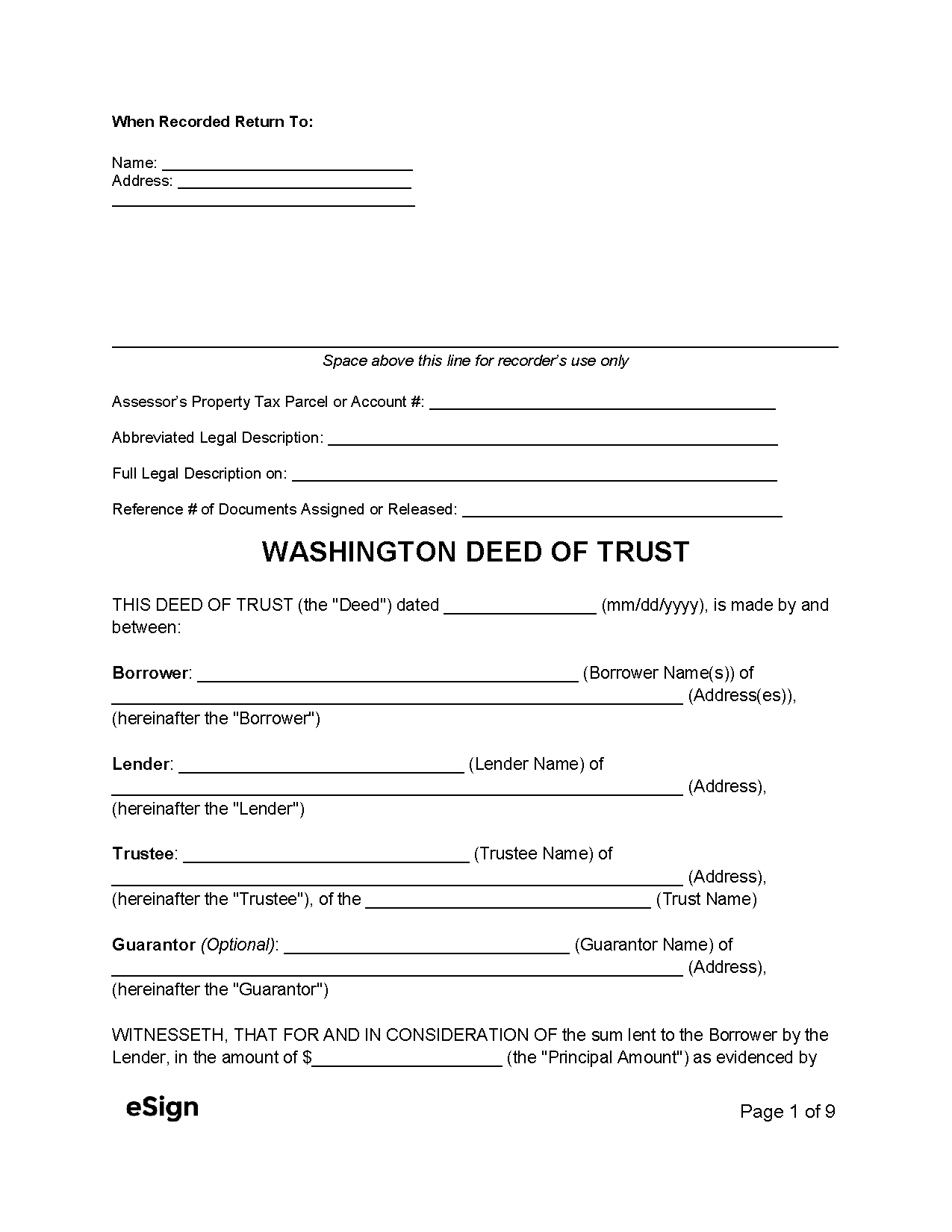

Deed of Trust – Secures a loan by conveying title to a trustee, who can foreclose the property if the loan isn’t repaid. Deed of Trust – Secures a loan by conveying title to a trustee, who can foreclose the property if the loan isn’t repaid.

|

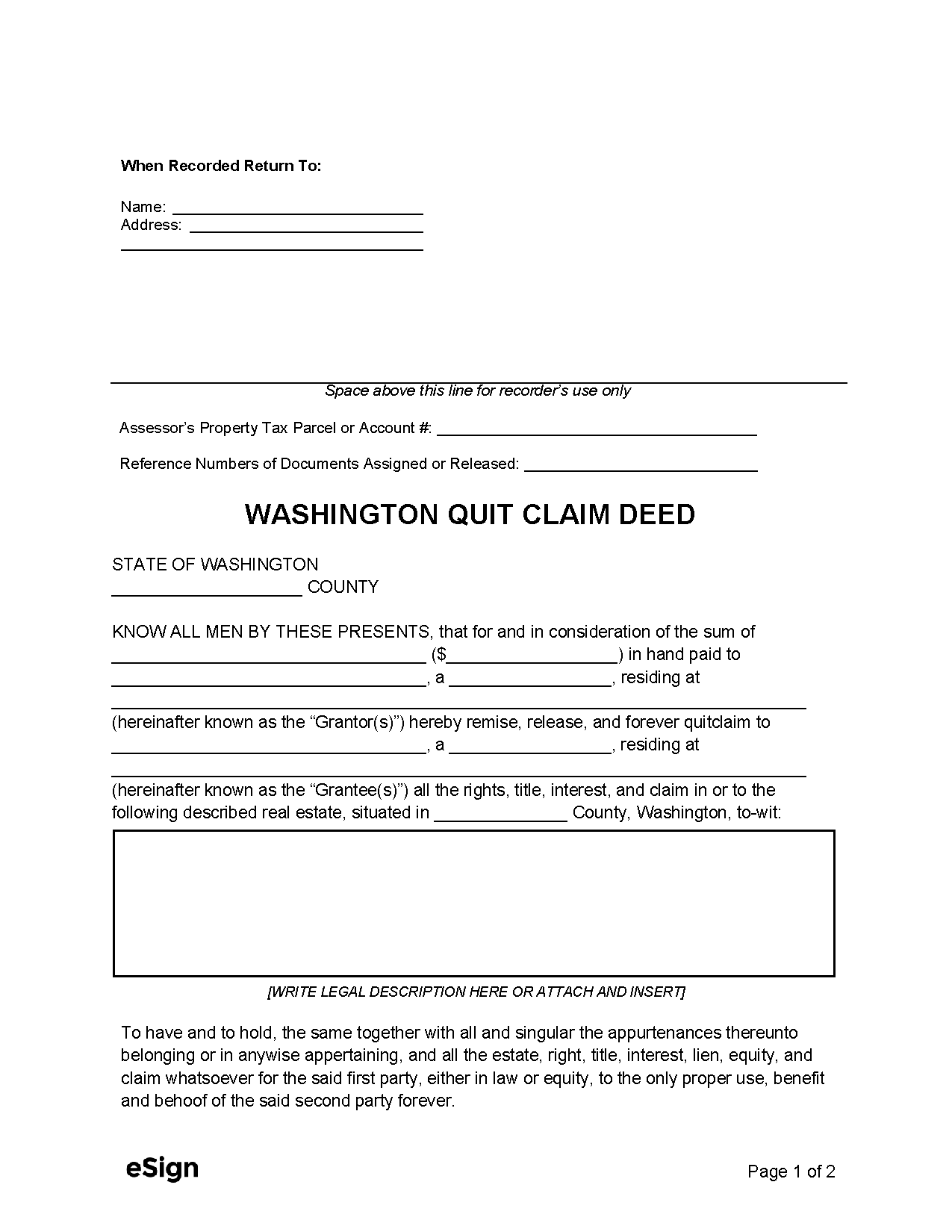

Quit Claim Deed – Relinquishes the grantor’s ownership and provides no warranties to the grantee. Quit Claim Deed – Relinquishes the grantor’s ownership and provides no warranties to the grantee.

|

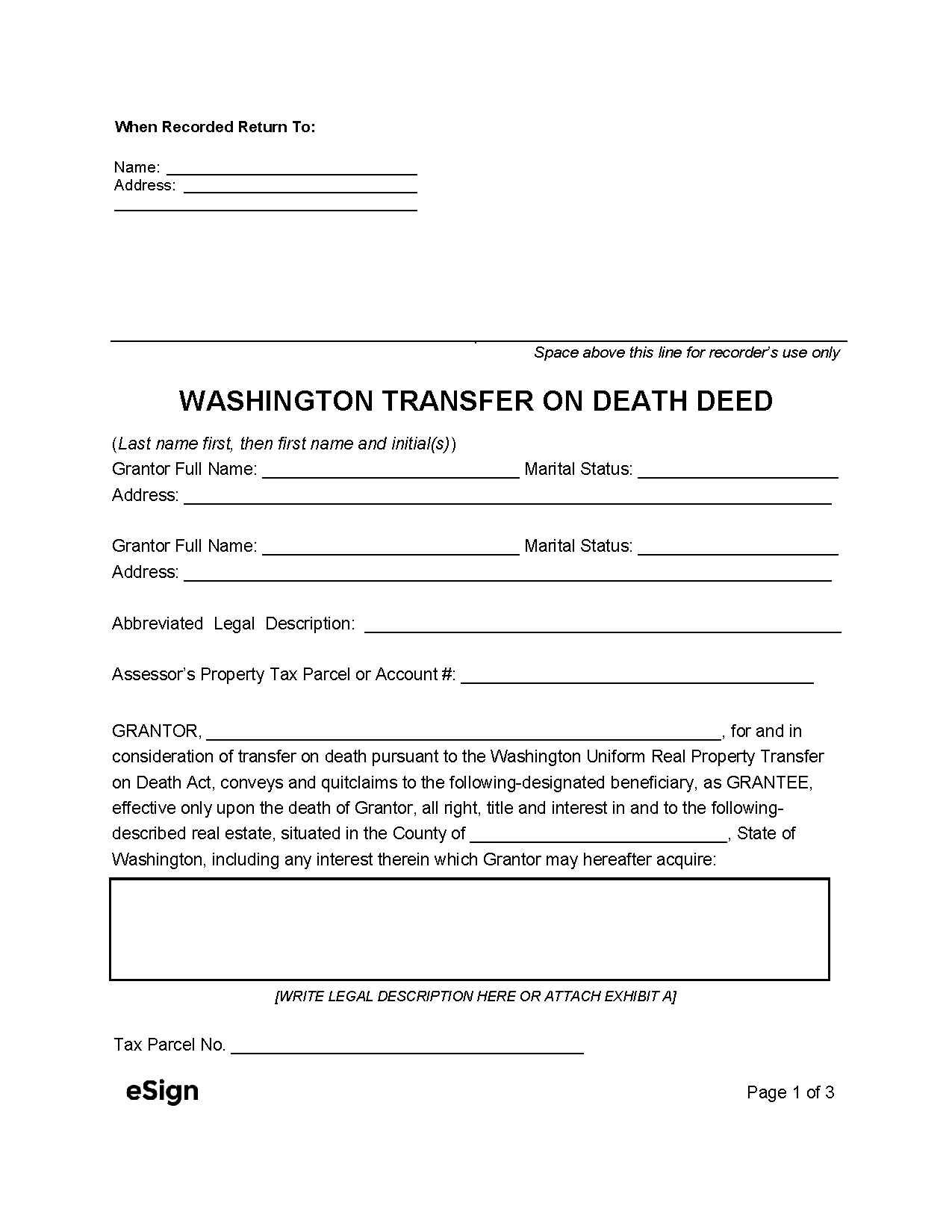

Transfer on Death Deed – Allows a property title to pass directly to a named beneficiary when the owner dies. Transfer on Death Deed – Allows a property title to pass directly to a named beneficiary when the owner dies.

|

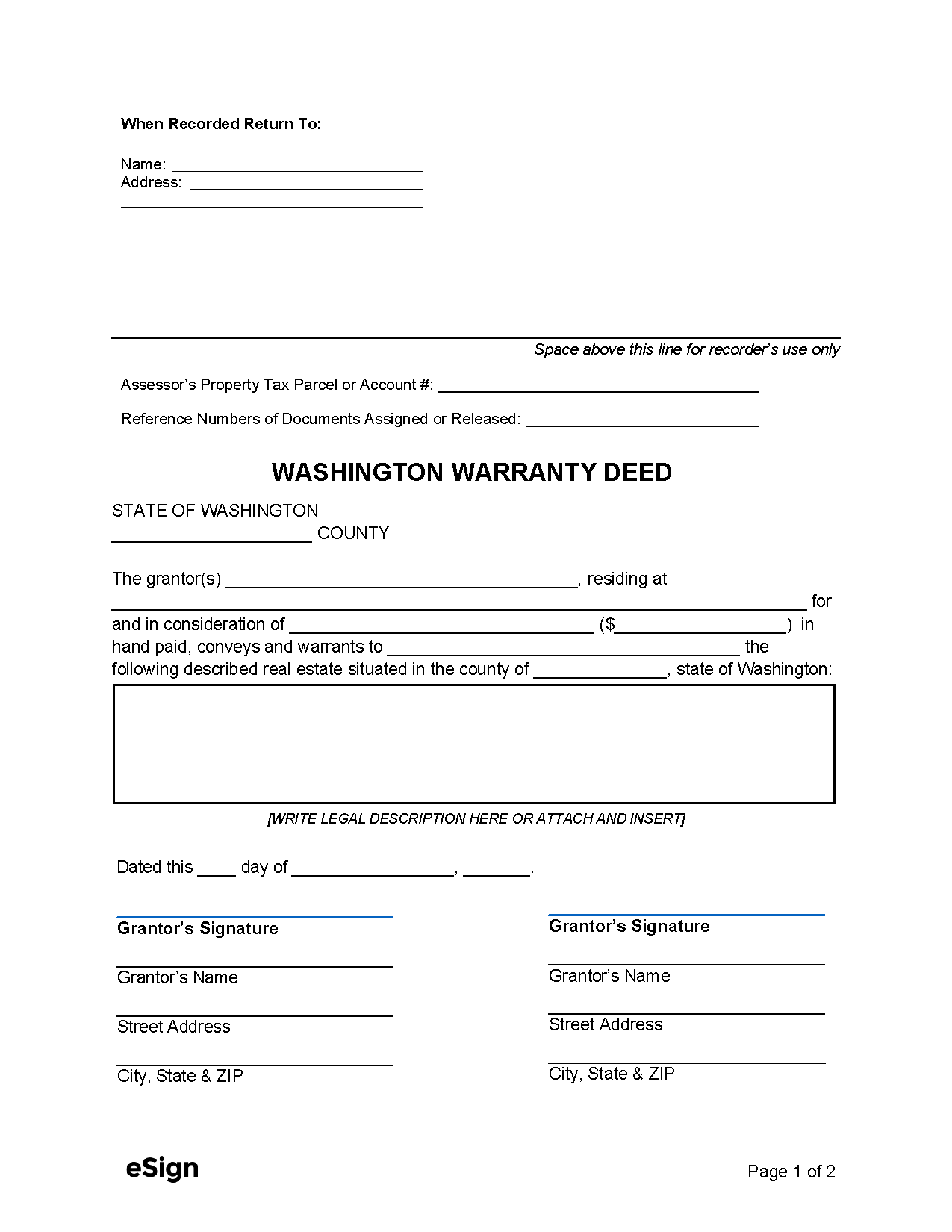

Warranty Deed – Guarantees the grantor will defend against current and past title encumbrances. Warranty Deed – Guarantees the grantor will defend against current and past title encumbrances.

|

Formatting

Paper – Maximum size of 8.5″ by 14″

Margins – 3″ top margin on first page, 1″ margins on all other sides and pages

Font – At least 8pt font in ink suitable for copying and scanning[1]

Recording

Signing Requirements – Each signature must be acknowledged by the signer before a notarial officer (e.g., notary public, court clerk).[2]

Where to Record – Recording is handled by the County Auditor or equivalent office.[3]

Cost – As of this writing, it typically costs $303.50 for the first page and $1 for each additional page.[4]

Additional Forms

Cover Sheet – Needed when the first page of a deed does not include the information outlined in § 65.04.045. Certain counties may require a specific cover sheet provided by their office.[5]