Independent Contractor Status

A crucial function of the consulting agreement is to define the accounting consultant as an independent contractor, not an employee of the client. This makes it clear that the client is not responsible for withholding tax and the consultant can carry out their services as they see fit.

Accounting Consultant’s Role

Consultant Fees

Sample

Download: PDF, Word (.docx), OpenDocument

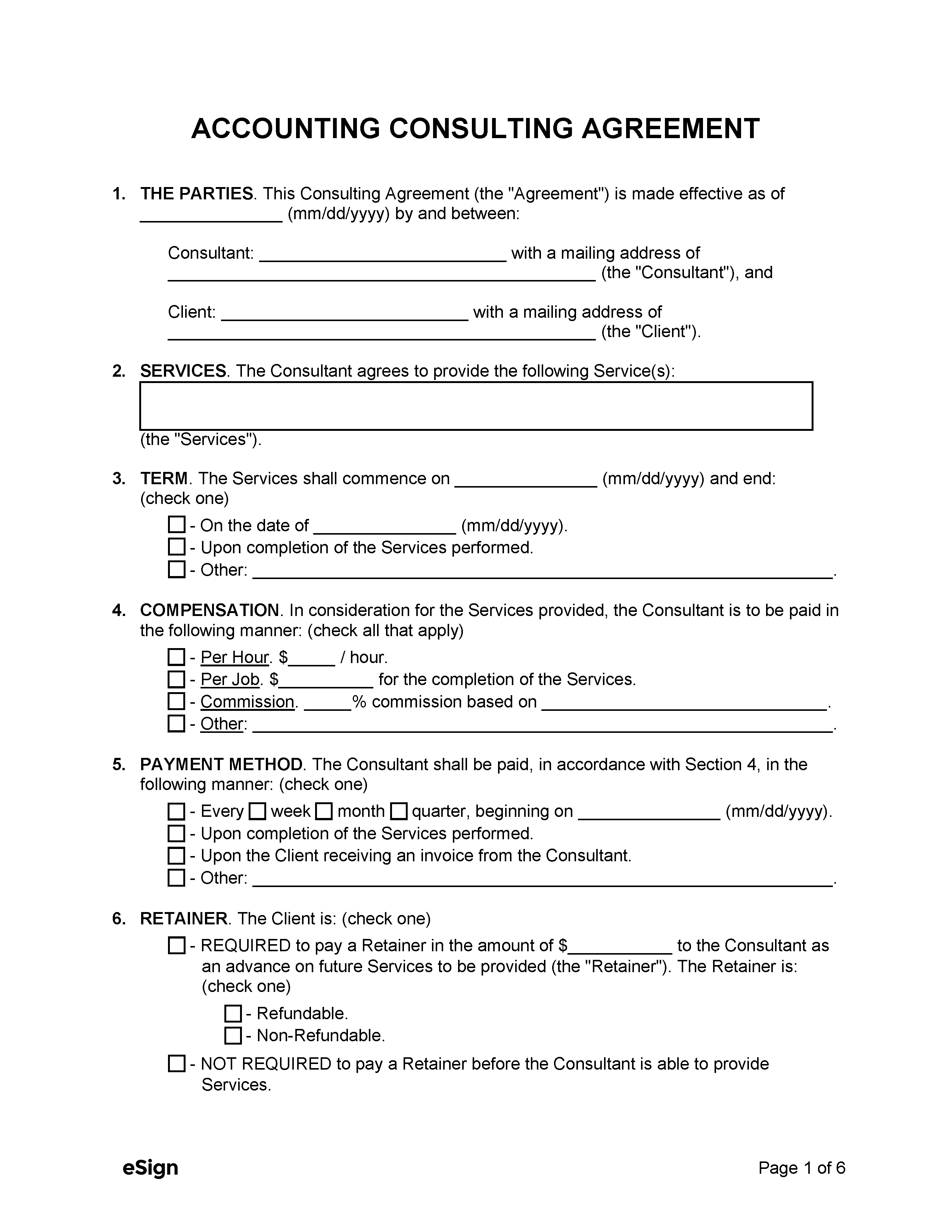

ACCOUNTING CONSULTING AGREEMENT

This Agreement is made between [CLIENT NAME] (the “Client”) and [ACCOUNTING CONSULTANT NAME] (the “Consultant”).

1. SERVICES. The Consultant shall provide consulting services related to accounting, including but not limited to bookkeeping, financial analysis, budgeting, tax preparation, financial planning, and [INCLUDE ANY OTHER SERVICES HERE] (the “Services”).

2. RETAINER. The Client shall pay the Consultant a flat retainer fee of $[AMOUNT] as an advance on future Services to be provided (the “Retainer”).

3. FEES AND PAYMENT. The Client shall pay the Consultant an hourly rate of $[RATE] for the Services provided. All payments shall be due within thirty (30) days of the date of invoice.

4. TERM AND TERMINATION. The term of this Agreement shall begin on [MM/DD/YYYY]. Either party may terminate this Agreement at any time by providing thirty (30) days’ written notice.

5. CONFIDENTIALITY. The Consultant agrees to keep confidential all personal and financial information provided by the Client or acquired in the course of providing the Services.

6. LIABILITY. The Consultant shall not be liable for any damages that may arise as a result of the Services provided.

7. ENTIRE AGREEMENT. This Agreement contains the entire understanding between the parties and supersedes all prior agreements and understandings, whether written or oral, between the parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date written below.

Client Signature: _______________ Date: [MM/DD/YYYY]

[CLIENT NAME]

Accounting Consultant Signature: _______________ Date: [MM/DD/YYYY]

[ACCOUNTING CONSULTANT NAME]