When Verification of Mortgage is Required

The two most common situations where a VOM is required are:

- When refinancing a mortgage with a new lender.

- When applying for a mortgage to buy a new home.

Sample

Download: PDF, Word (.docx), OpenDocument

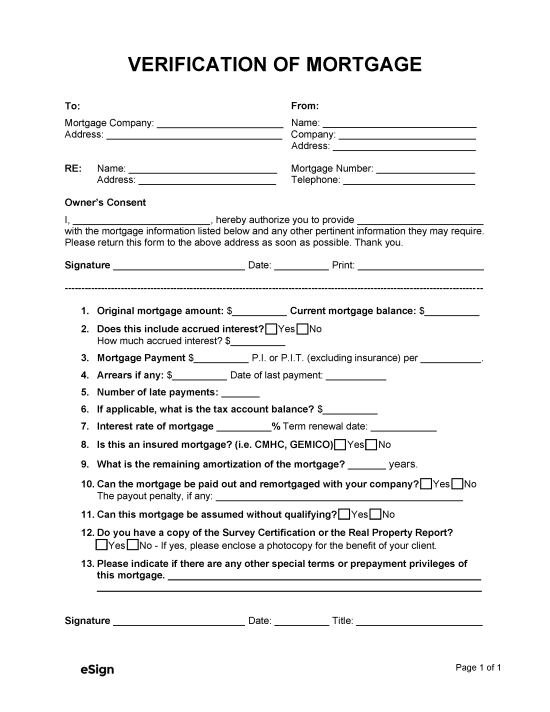

VERIFICATION OF MORTGAGE

From:

Mortgage Company [COMPANY NAME]

Address [ADDRESS]

To:

Name [REQUESTOR NAME]

Company [COMPANY NAME]

Address [ADDRESS]

RE: [OWNER NAME] Mortgage Number [MORTGAGE #]

Address [ADDRESS] Phone [PHONE #]

Owner’s Consent

I, [OWNER NAME], hereby authorize you to provide [REQUESTOR NAME] with the mortgage information listed below and any other pertinent information they may require. Please return this form to the above address as soon as possible. Thank you.

Signature ________________________ Date [MM/DD/YYYY] Print [OWNER NAME]

1. Original mortgage amount: $[#] Current mortgage balance: $[#]

2. Does this include accrued interest? ☐ Yes ☐ No

How much accrued interest? $[#]

3. Mortgage Payment $[#] P.I.T.I. or P.I.T. (excluding insurance) per [PAYMENT PERIOD].

4. Arrears if any $[#] Date of last payment [MM/DD/YYYY]

5. Number of late payments: [#]

6. If applicable, what is the tax account balance? $[#]

7. Interest rate of mortgage: [#]% Term renewal date: [MM/DD/YYYY]

8. Is this an insured mortgage? (i.e. CMHC, GEMICO) ☐ Yes ☐ No

9. What is the remaining amortization of the mortgage? [#] years.

10. Can the mortgage be paid out and remortgaged with your company? ☐ Yes ☐ No

The payout penalty, if any: [PAYOUT PENALTY]

11. Can this mortgage be assumed without qualifying? ☐ Yes ☐ No

12. Do you have a copy of the Survey Certification or the Real Property Report?

☐ Yes ☐ No – If yes, please enclose a photocopy for the benefit of your client.

13. Please indicate if there are any other special terms or prepayment privileges of this mortgage. [OTHER TERMS]

Signature ________________________ Date [MM/DD/YYYY]

Title [RECIPIENT TITLE]

VOM Defined

A VOM is one of the ways that lenders will assess a borrower’s payment history and existing mortgages. In the pre-approval process for a new home loan, a borrower will often be required to have the following forms completed and submitted to the mortgage company:

Obtaining third-party verification of the borrower’s payment history, income, and existing mortgage accounts helps the lender determine their loan eligibility.

How the Form is Used

A mortgage company can often verify a homeowner or buyer’s mortgage payment history by reviewing their mortgage statements or obtaining a credit report. The mortgage verification form is a third method lenders can use to obtain important information regarding the borrower’s account. The process is usually carried out as follows:

- The mortgage company requesting VOM fills out the contact and addressee information on the verification form.

- The borrower fills out and signs the Owner’s Consent.

- The form is sent to the borrower’s previous mortgage company.

- A mortgage company representative enters the requested information and signs the form.

- The mortgage company returns the form to the requesting company.

- The form is reviewed to determine if the borrower’s mortgage request can be approved.