Types (2)

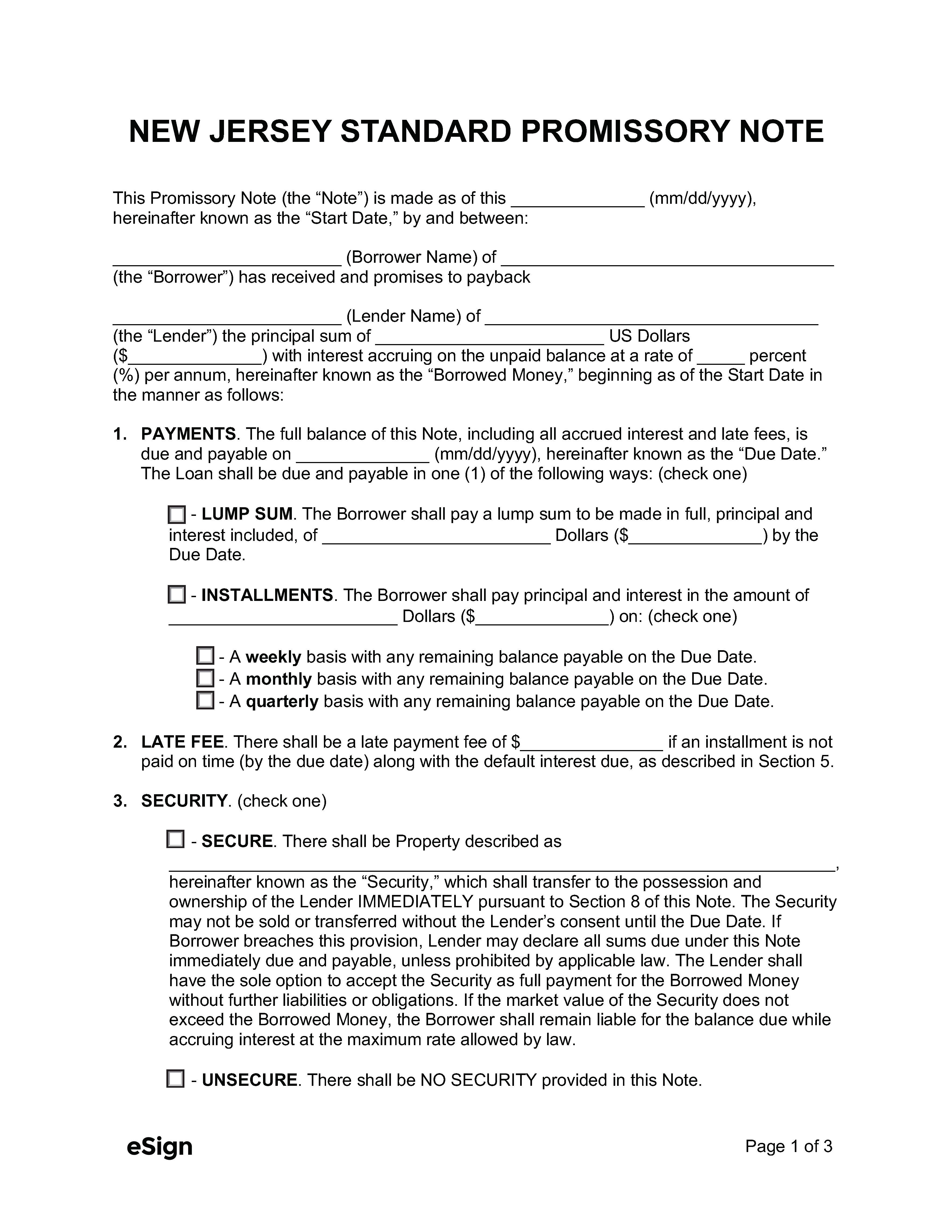

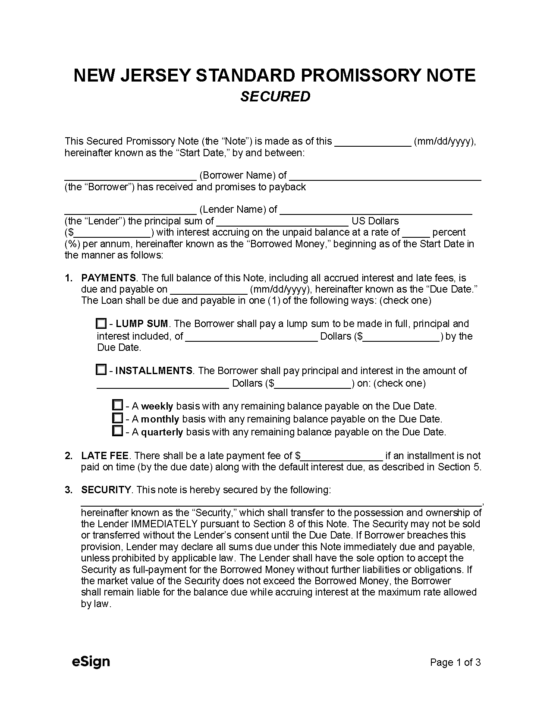

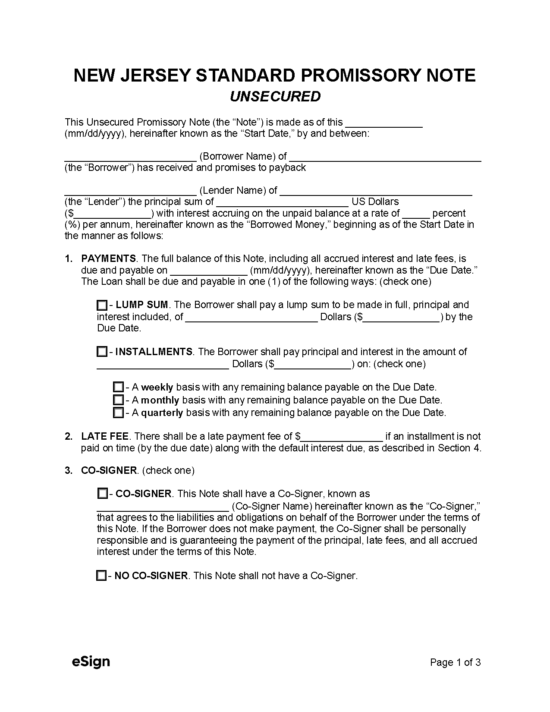

Secured Promissory Note – A promissory note wherein the borrower provides the lender collateral to encourage their repayment.

Secured Promissory Note – A promissory note wherein the borrower provides the lender collateral to encourage their repayment.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 31 – Interest and Usury

- Usury Rate with Contract (N.J. Stat. § 31:1-1(a)): 16%

- Usury Rate without Contract (N.J. Stat. § 31:1-1(a)): 6%

- Usury Rate for Monetary Judgments within Special Civil Part limit ($15,000 or less) (Rule 4:42-11(a)(ii)): Equal to the average rate of return of the New Jersey Cash Management Fund from the corresponding previous fiscal year.

- Usury Rate for Monetary Judgments above Special Civil Part limit (Rule 4:42-11(a)(iii)): Equal to the average rate of return of the New Jersey Cash Management Fund from the corresponding previous fiscal year + 2%.