Related Forms

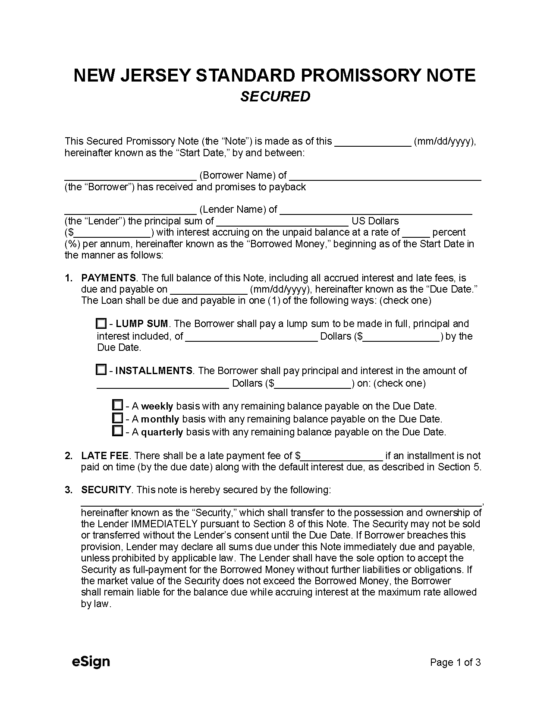

Secured Promissory Note – Under this agreement, the borrower is required to furnish the lender collateral before they may receive a loan.

Secured Promissory Note – Under this agreement, the borrower is required to furnish the lender collateral before they may receive a loan.

Download: PDF, Word (.docx), OpenDocument

A New Jersey unsecured promissory note allows two (2) individuals to agree on the terms of a non-collateralized loan transaction. A lender may draft a promissory note to ensure the borrowing party understands their obligations and the consequences of defaulting on payments. While the lender won’t be entitled to the collateral, they may incur delinquency fees, accelerate the payment due date, and increase the interest rate to the maximum lawful amount (16% (§ 31:1-1(a))). By completing a promissory note, the lender is generally well protected from financial loss, and the agreement will often suffice in ensuring a loan is returned without needing to resort to legal action.

A New Jersey unsecured promissory note allows two (2) individuals to agree on the terms of a non-collateralized loan transaction. A lender may draft a promissory note to ensure the borrowing party understands their obligations and the consequences of defaulting on payments. While the lender won’t be entitled to the collateral, they may incur delinquency fees, accelerate the payment due date, and increase the interest rate to the maximum lawful amount (16% (§ 31:1-1(a))). By completing a promissory note, the lender is generally well protected from financial loss, and the agreement will often suffice in ensuring a loan is returned without needing to resort to legal action.

Secured Promissory Note – Under this agreement, the borrower is required to furnish the lender collateral before they may receive a loan.

Secured Promissory Note – Under this agreement, the borrower is required to furnish the lender collateral before they may receive a loan.

Download: PDF, Word (.docx), OpenDocument