By Type (5)

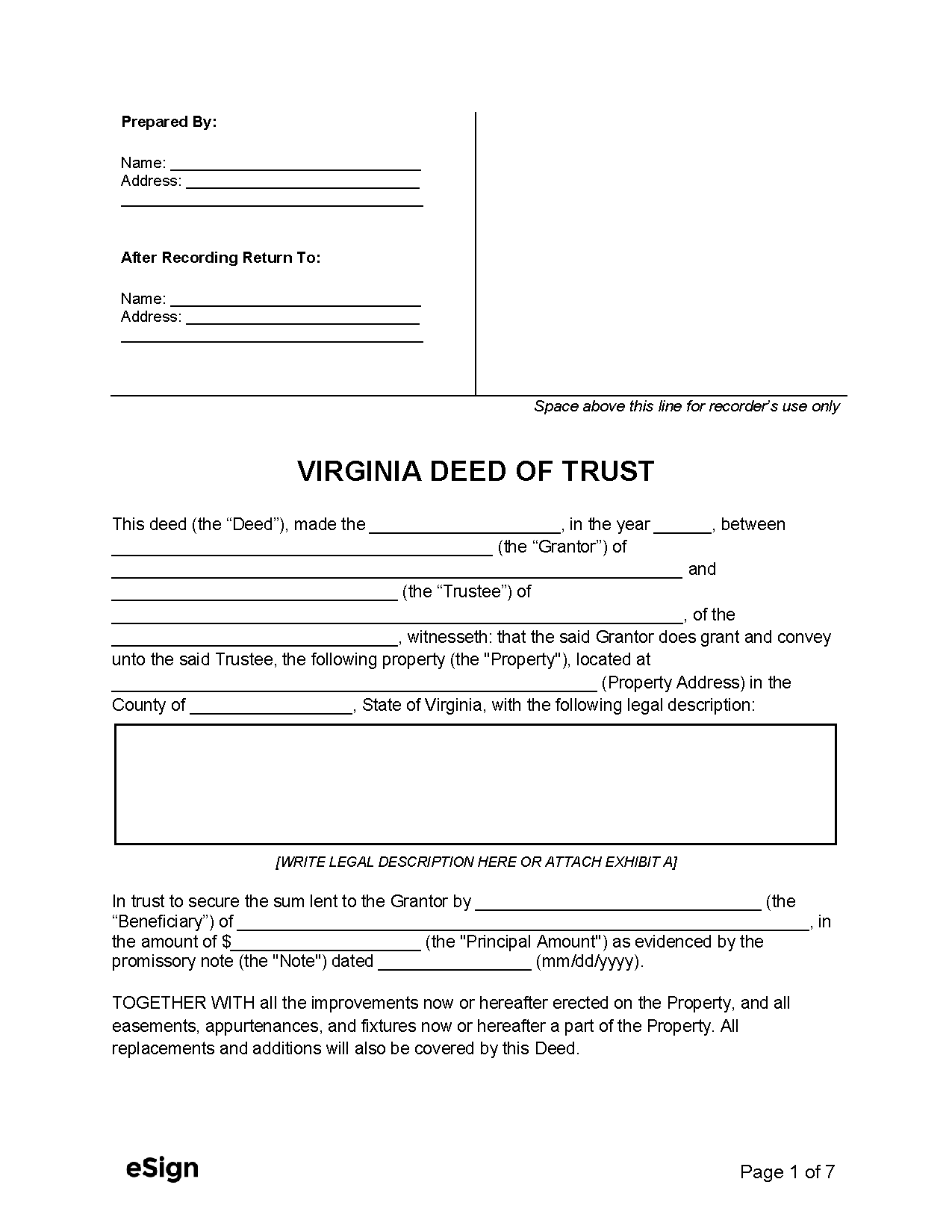

Deed of Trust – Appoints a third-party trustee to hold a property title until the owner pays off a loan. Deed of Trust – Appoints a third-party trustee to hold a property title until the owner pays off a loan.

|

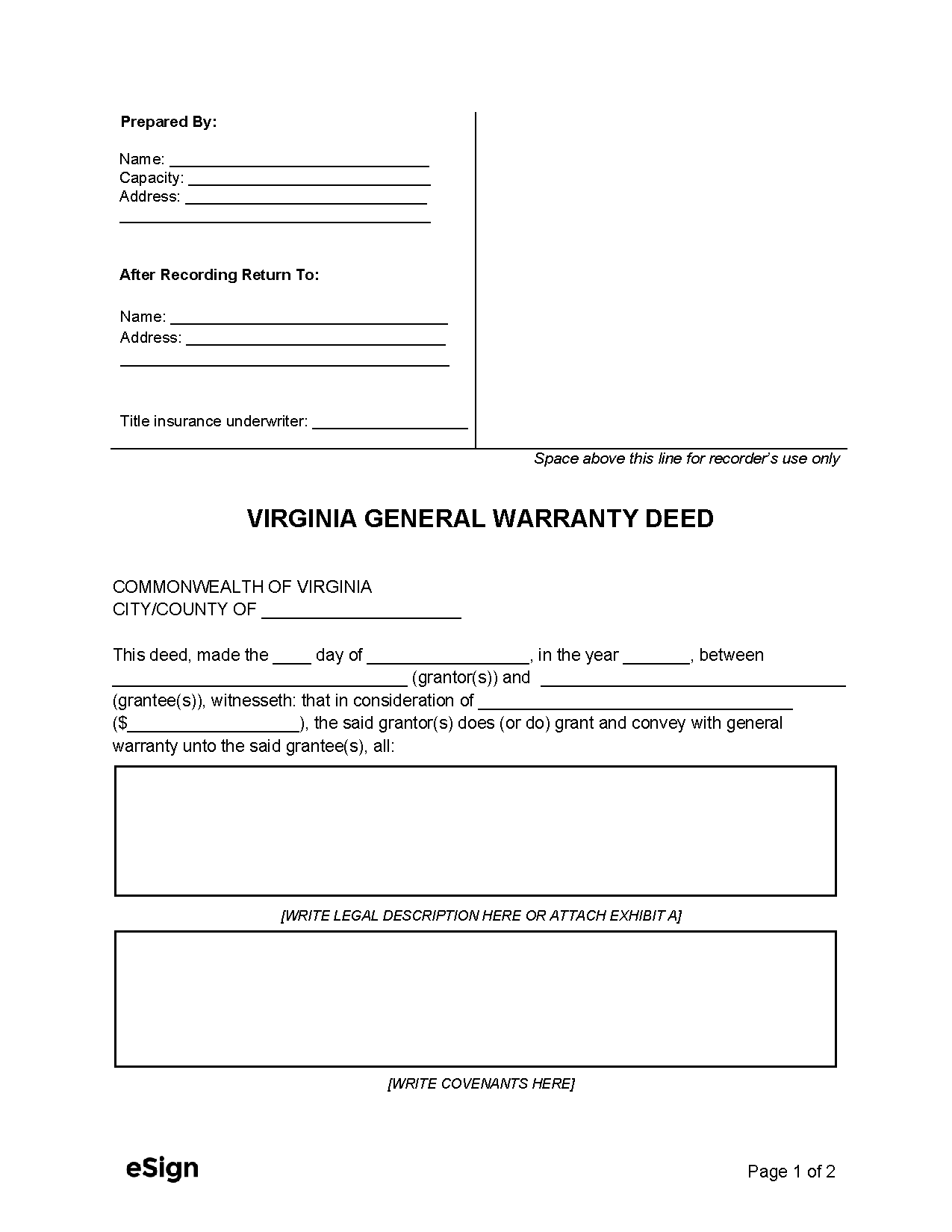

General Warranty Deed – Provides the strongest level of title protection and guarantees the owner’s right to transfer. General Warranty Deed – Provides the strongest level of title protection and guarantees the owner’s right to transfer.

|

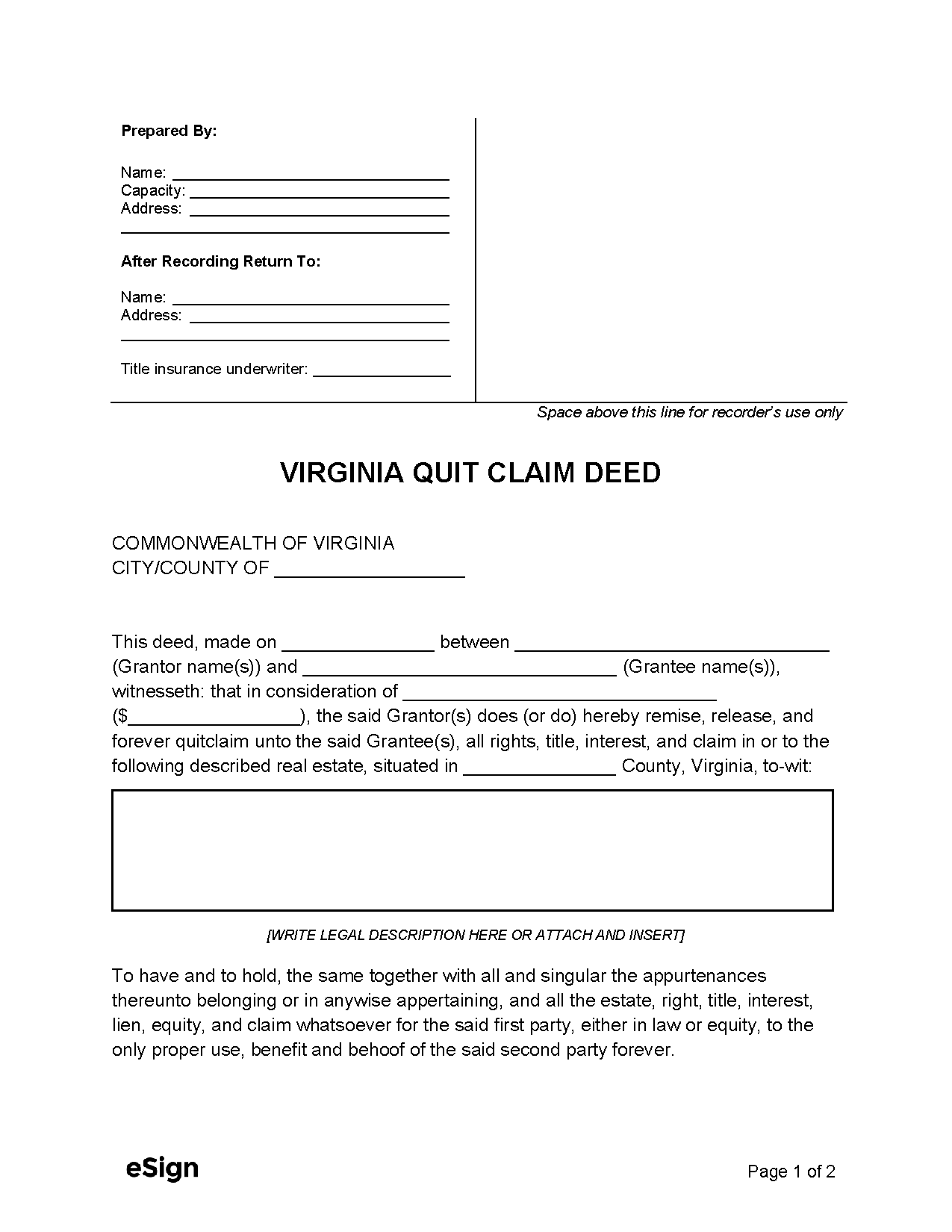

Quit Claim Deed – Includes no title warranties, leaving the new owner responsible for liens and all other title encumbrances. Quit Claim Deed – Includes no title warranties, leaving the new owner responsible for liens and all other title encumbrances.

|

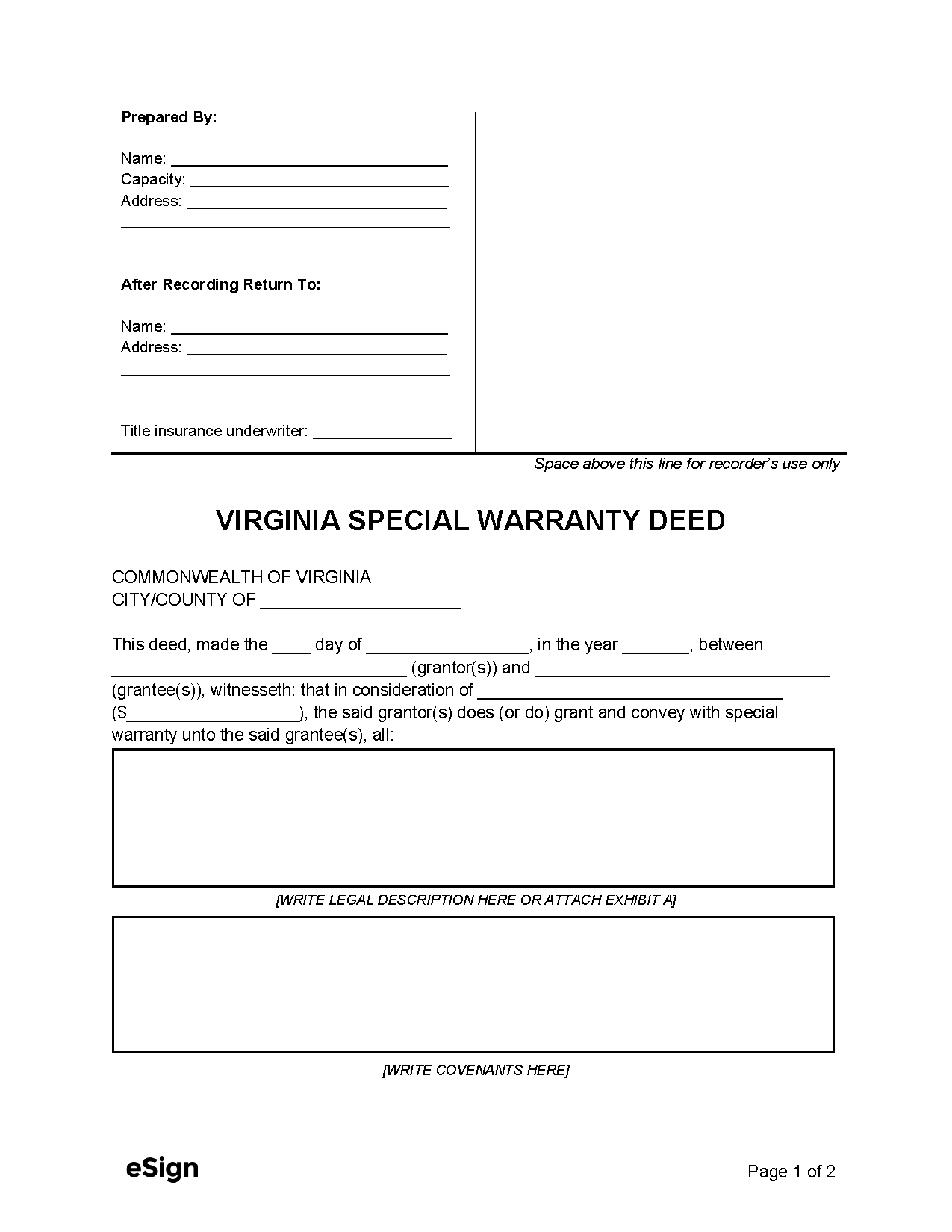

Special Warranty Deed – Contains a title warranty limited to the period when the grantor owned the property. Special Warranty Deed – Contains a title warranty limited to the period when the grantor owned the property.

|

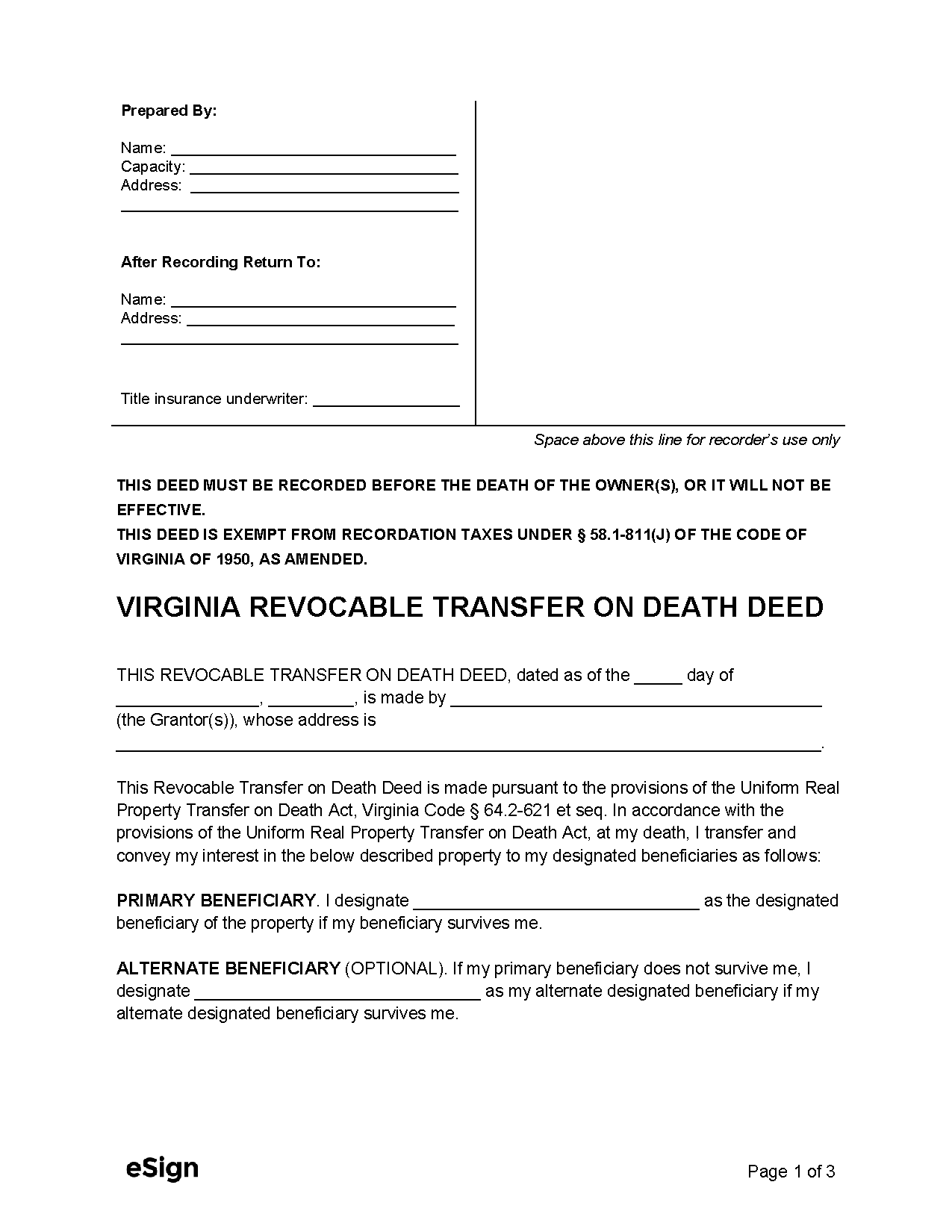

Transfer on Death Deed – Allows a person named in the deed to inherit property after the owner passes away. Transfer on Death Deed – Allows a person named in the deed to inherit property after the owner passes away.

|

Formatting

Virginia law doesn’t set deed formatting standards, but counties may have their own (see Fairfax County). Filers should check with their circuit court to ensure local requirements are met.

Recording

Signing Requirements – A grantor’s signature must either be acknowledged or proven by two witnesses before a notary public.[1]

Where to Record – Deed recording takes place in the office of the Circuit Court Clerk serving the county where the property lies.[2]

Cost – Fees start at $18 for the first 10 pages (as of this writing).[3] Exact costs can be determined using the fees and tax calculator.

Additional Forms

Cover sheets are required in certain counties.[4] Filers can create one on the circuit court website. For properties in Fairfax County, the designated cover sheet generator should be used instead.