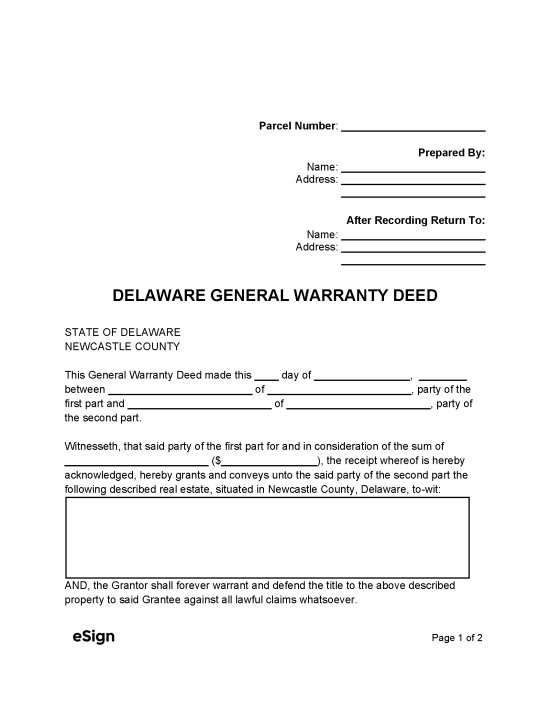

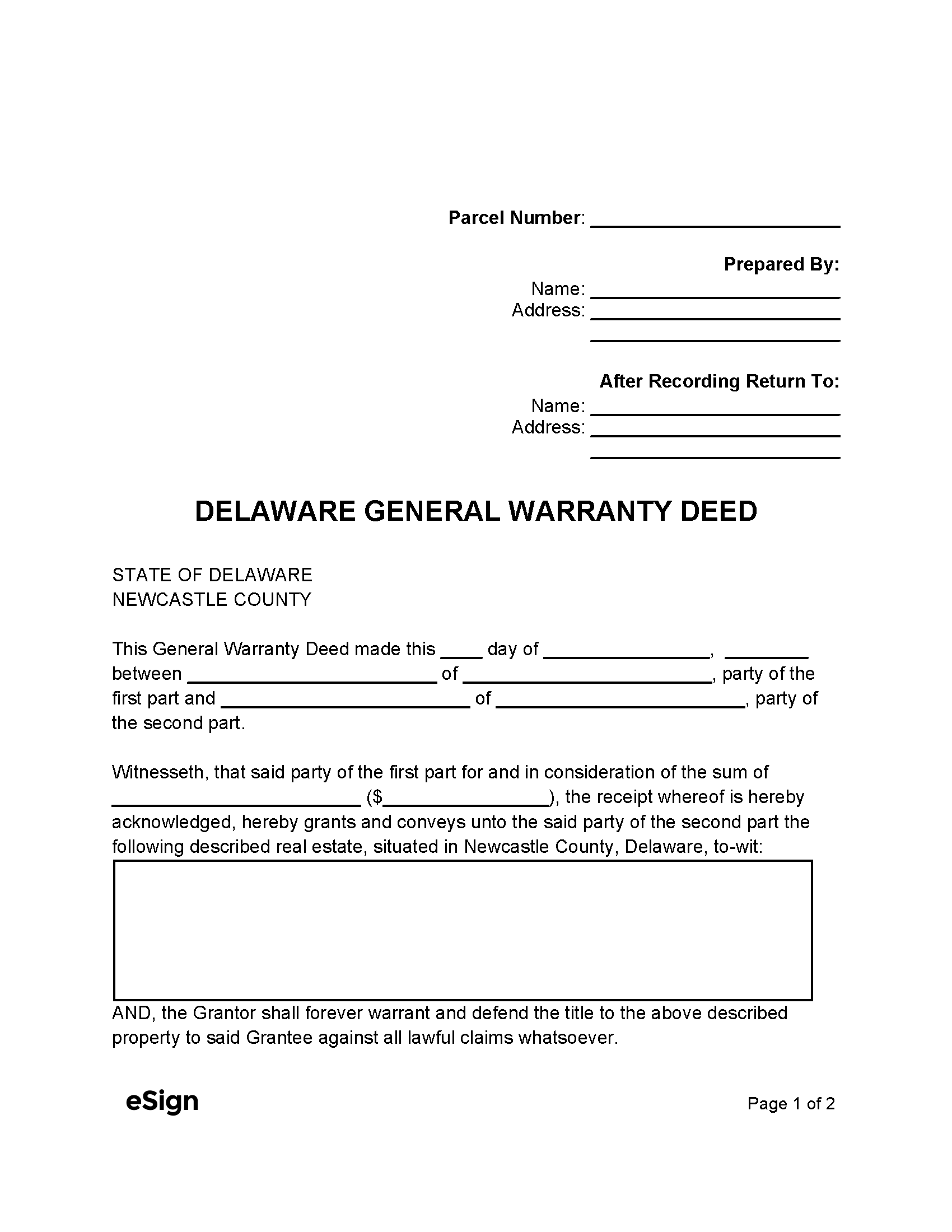

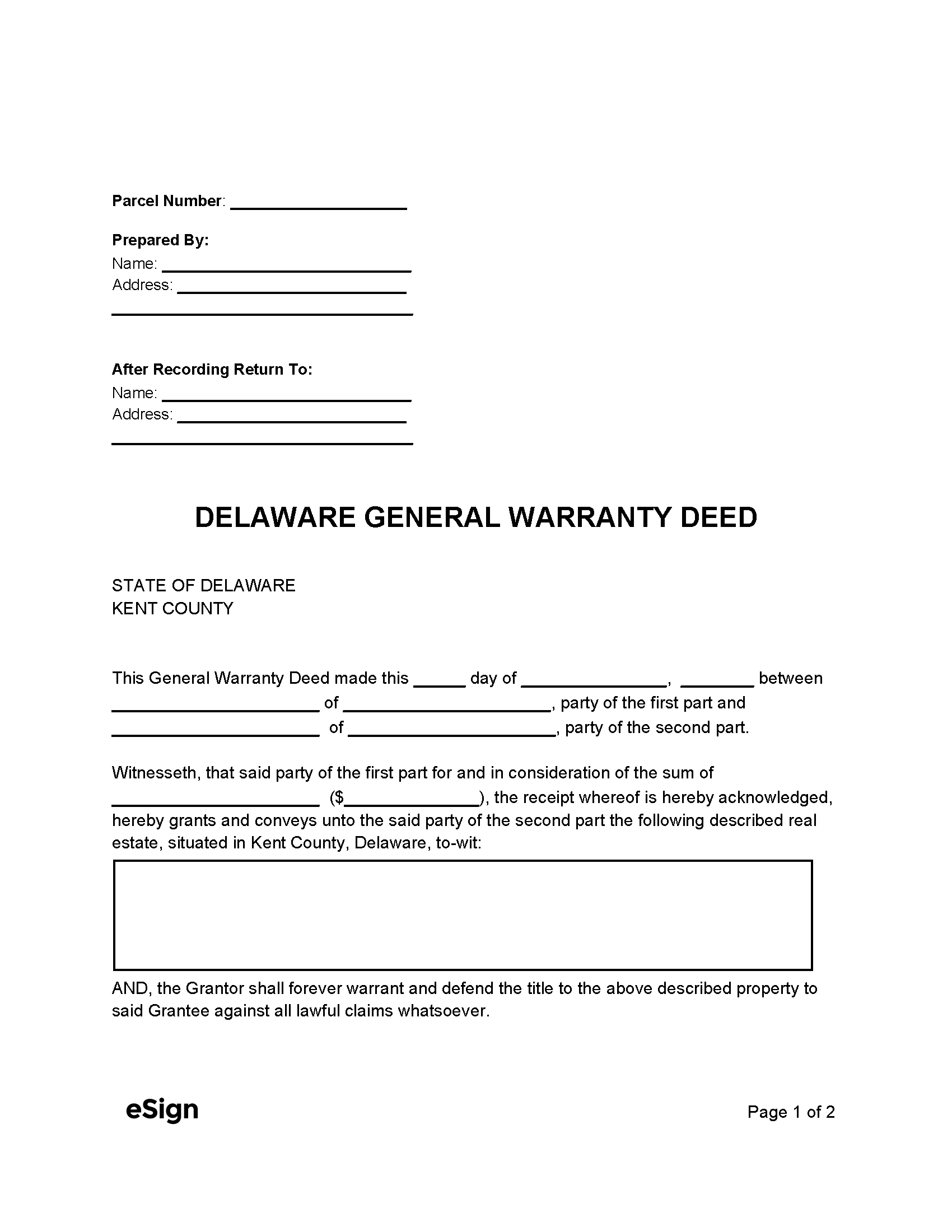

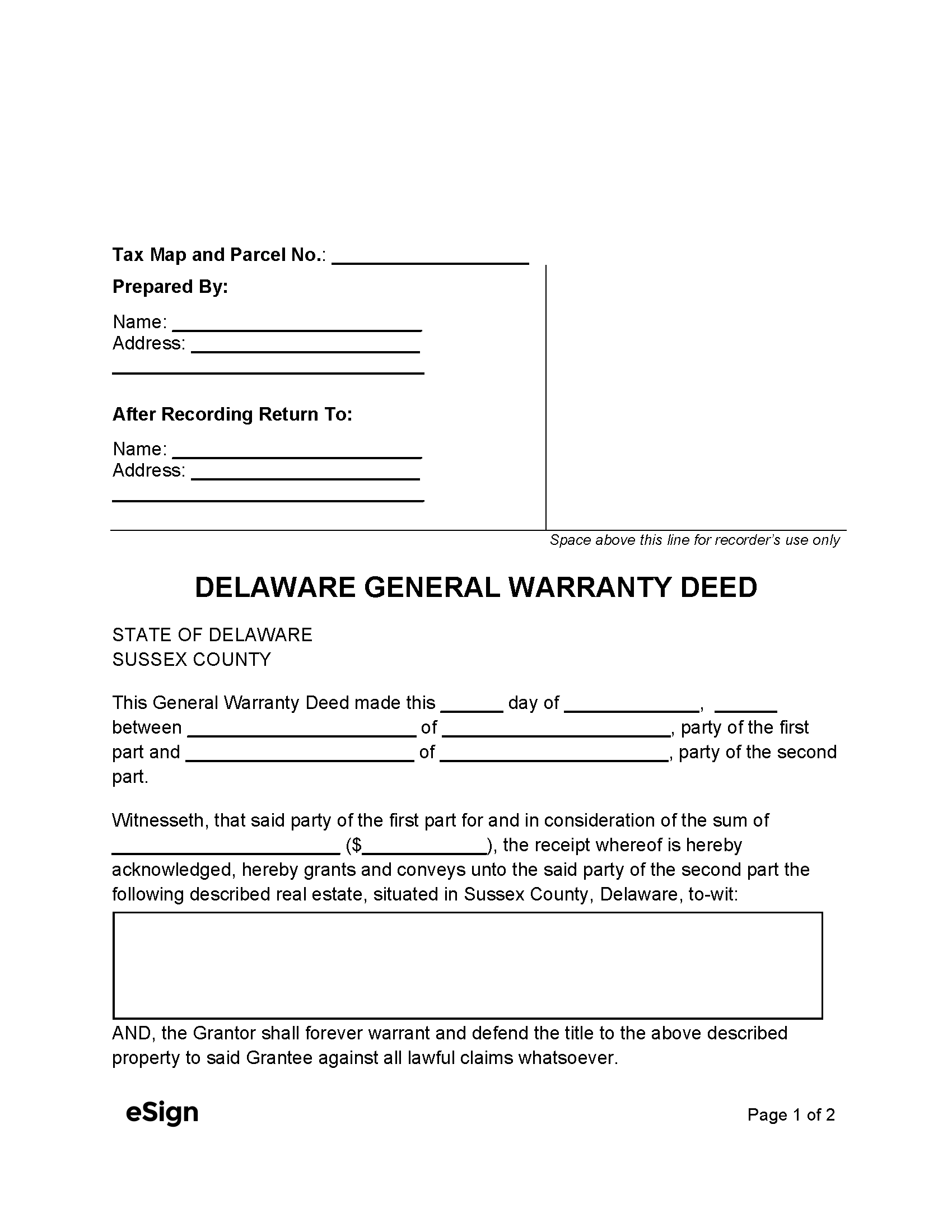

Forms by County

How to Format

Layout

As formatting requirements vary by county, it is important to follow the county guidelines to ensure that the deed is accepted by the recorder’s office.

View Recording Requirements by County |

| Kent County |

|

| Newcastle County |

|

| Sussex County |

|

Signatures

Notary acknowledgment is required for deeds.[4]

Recording

Once signed and acknowledged, the deed can be recorded at the County Recorder’s Office in Kent County, New Castle County, or Sussex County.[5] The recording fees per county are as follows:

Form REW-EST – This form for assessing any applicable income tax due on a conveyance must be presented when filing a deed.

Form RTT-SCH – First-time homebuyers can submit this form when filing a deed to claim credit towards their realty transfer tax.

Realty Transfer Tax Return and Affidavit of Gain and Value (Form RTT-TAX) – Must be recorded with any real estate transfer to report the transfer tax owed on the conveyance.

Kent County New Property Owner Information Form – All deeds recorded in Kent County must include this form to provide the new owner’s information.

Kent County First Time Homebuyer Certification Form – To be used by first-time homeowners in Kent County to apply for the realty transfer tax exemption.

Sussex County Transfer Tax Affidavit – Conveyances in Sussex County must include this affidavit when being recorded to calculate the applicable county-level tax.

Sussex County FHB Affidavit – The grantee must complete and submit this form with the deed if they are a first-time homebuyer and purchasing property in Sussex County.

General Information Sheet – Sussex County filings must include a sheet outlining the property’s details, which can be obtained through the county’s online property search.