By Type (4)

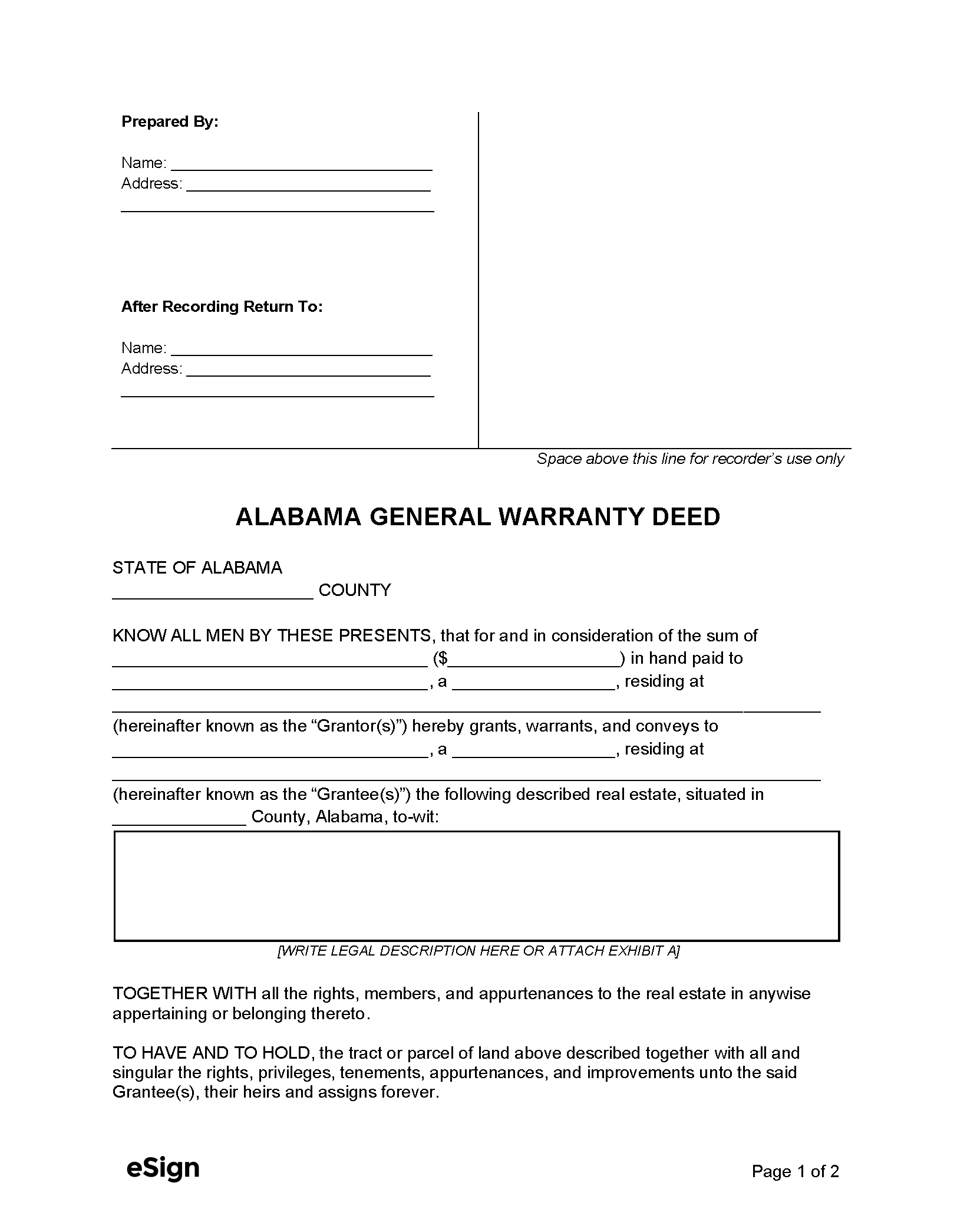

General Warranty Deed – Conveys property with a full guarantee that the title is clear. General Warranty Deed – Conveys property with a full guarantee that the title is clear.

|

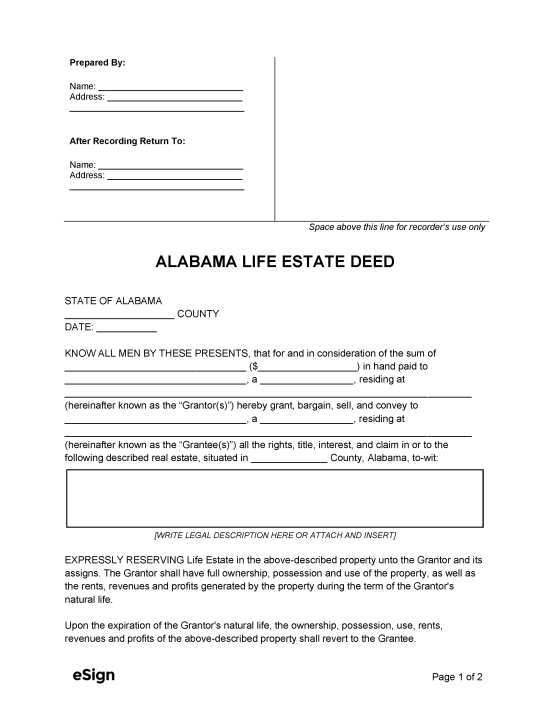

Life Estate Deed – Names a beneficiary (remainderman) to receive real estate after the grantor’s death. Life Estate Deed – Names a beneficiary (remainderman) to receive real estate after the grantor’s death.

|

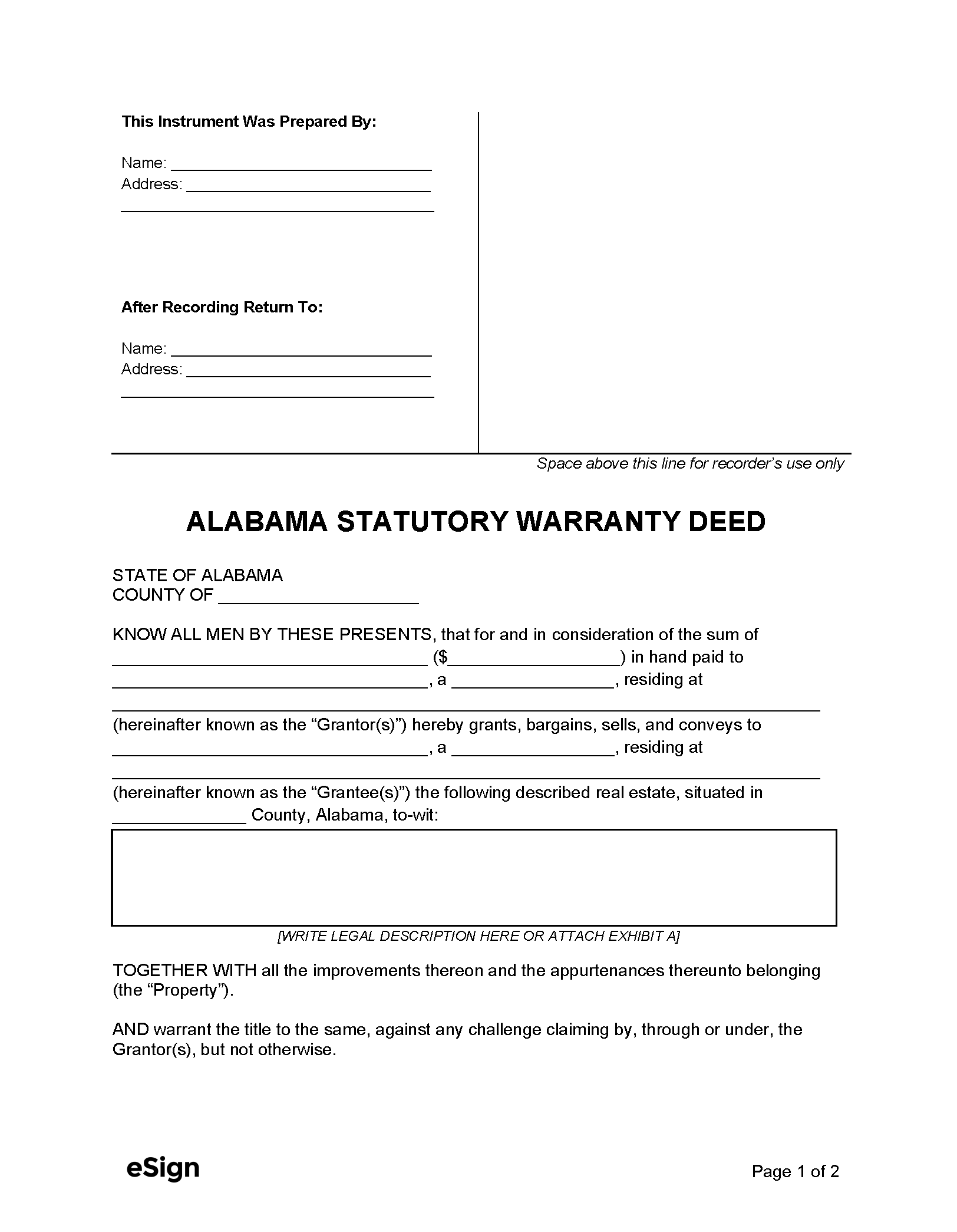

Special (Statutory) Warranty Deed – Guarantees that a property’s title is clear of encumbrances from the grantor’s period of ownership. Special (Statutory) Warranty Deed – Guarantees that a property’s title is clear of encumbrances from the grantor’s period of ownership.

|

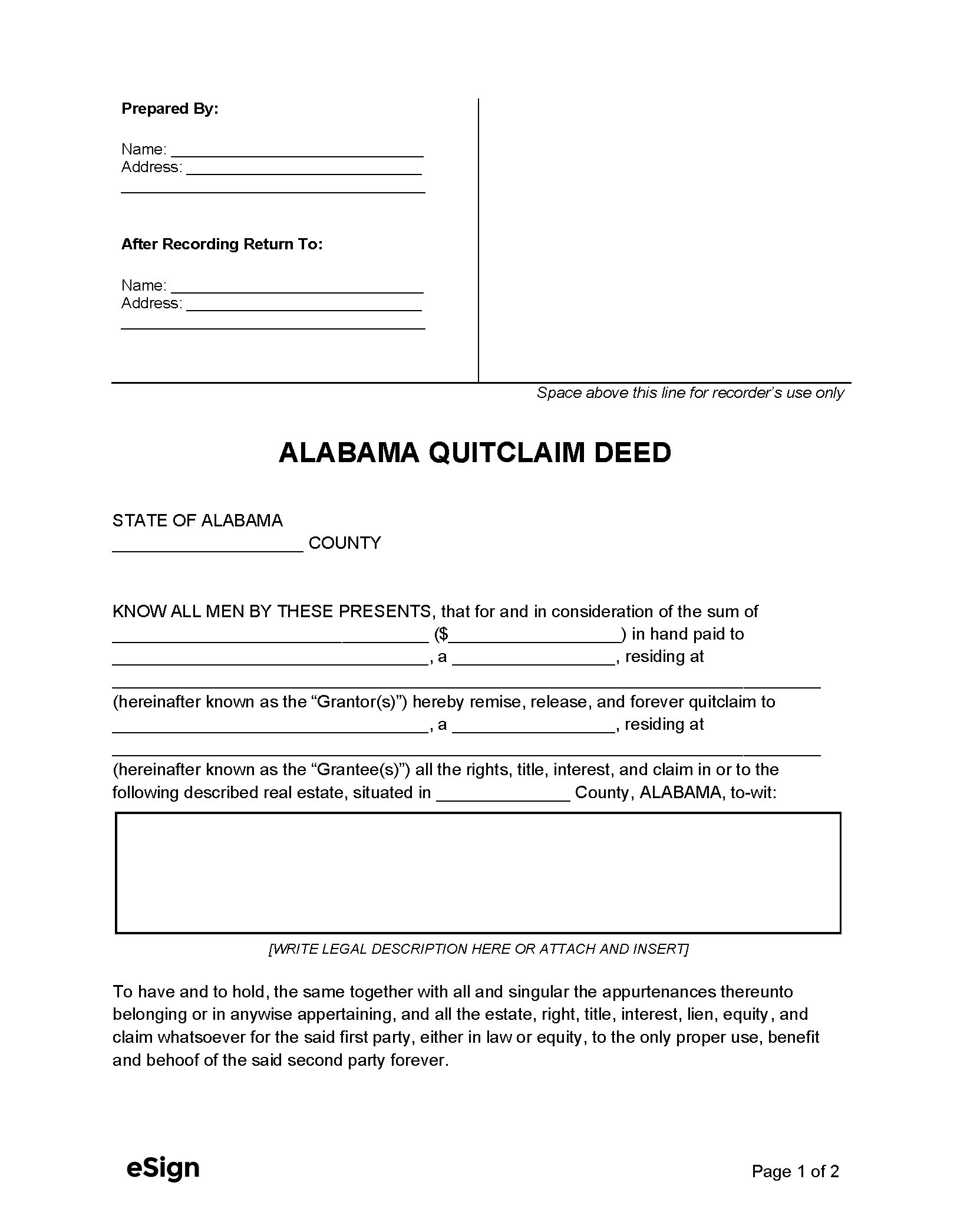

Quit Claim Deed – Transfers real estate ownership from a grantor to a grantee without warranties. Quit Claim Deed – Transfers real estate ownership from a grantor to a grantee without warranties.

|

Formatting

No state-wide formatting. Counties may have specific requirements.

Recording

Signing Requirements – Deeds must be signed by the grantor and either notarized or witnessed by one disinterested person. (Notarization is standard.)[1]

Where to Record – Alabama deeds must be filed at the Probate Court with jurisdiction over the property.[2]

Cost – Fees are set by the probate judge of each county.[3]

Additional Forms

Real Estate Sales Validation (Form RT-1) – Must be attached and filed with all deeds for property tax purposes.[4]