By Type (4)

General Warranty Deed – Guarantees that there are no liens or encumbrances on the property from its current and previous owners. General Warranty Deed – Guarantees that there are no liens or encumbrances on the property from its current and previous owners.

|

Quit Claim Deed – Provides no assurance that the property being transferred is free of claims. Quit Claim Deed – Provides no assurance that the property being transferred is free of claims.

|

Special Warranty Deed – Guarantees that the grantor did nothing to encumber the property title. Special Warranty Deed – Guarantees that the grantor did nothing to encumber the property title.

|

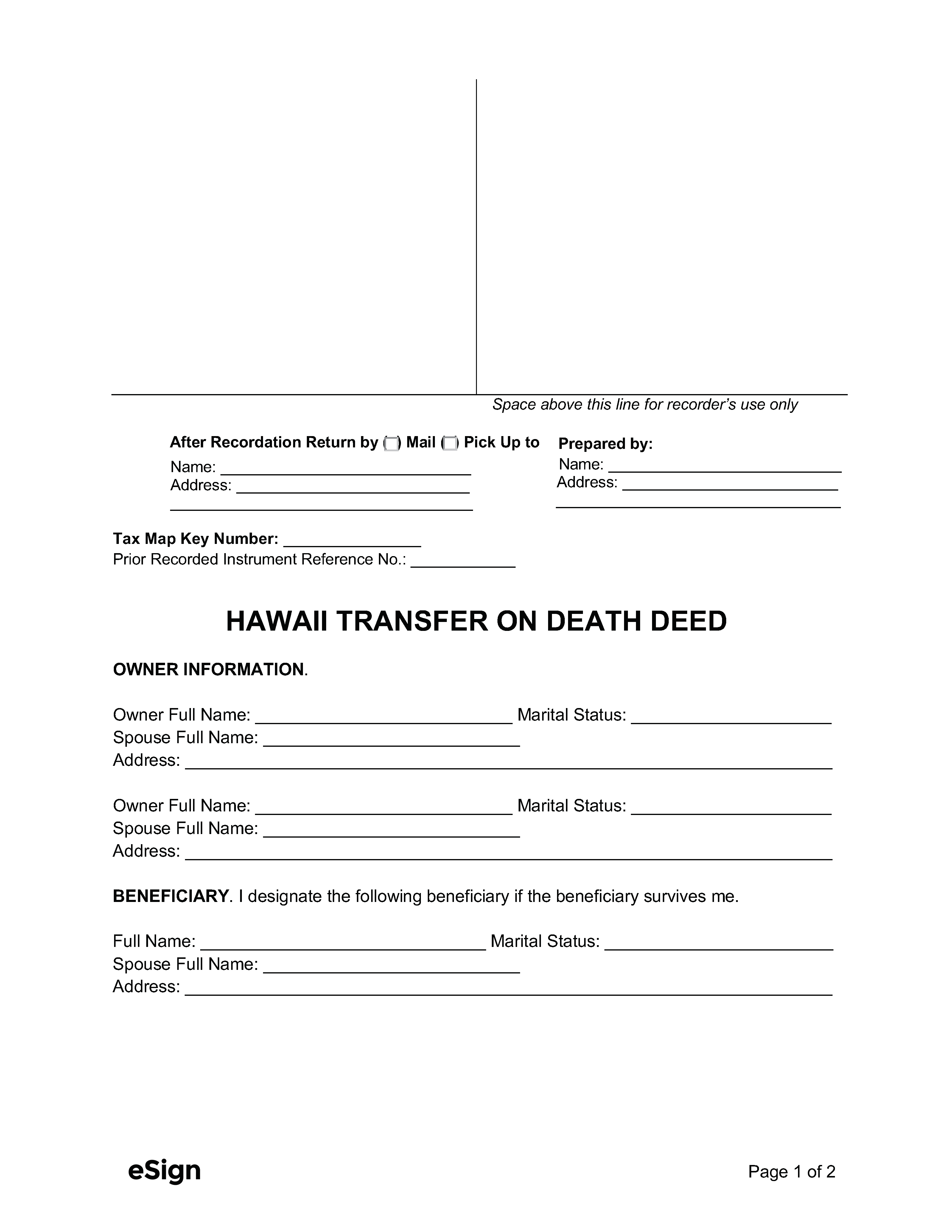

Transfer on Death Deed – Prepares the property transfer from an owner to a beneficiary. Transfer on Death Deed – Prepares the property transfer from an owner to a beneficiary.

|

Formatting

Paper – No greater than 8.5″ x 11″

Margins – 3.5″ top margin on first page[1]

Recording

Signing Requirements – Must be signed in the presence of a notary public.[2]

Where to Record – The Hawaii Bureau of Conveyances is responsible for recording deeds in the state.[3]

Cost – Deed recording fees are as follows (as of this writing)[4]:

- Land Court: $36

- Regular System: $41

Additional Forms

Deeds must be filed with a completed Conveyance Tax Certificate (Form P-64A) unless exempt.[5]

If the conveyance is exempt, a Conveyance Tax Exemption (Form P-64B) must be filed with the deed instead.

See Instructions for Form P-64A & Form P-64B for more details.