By Type (4)

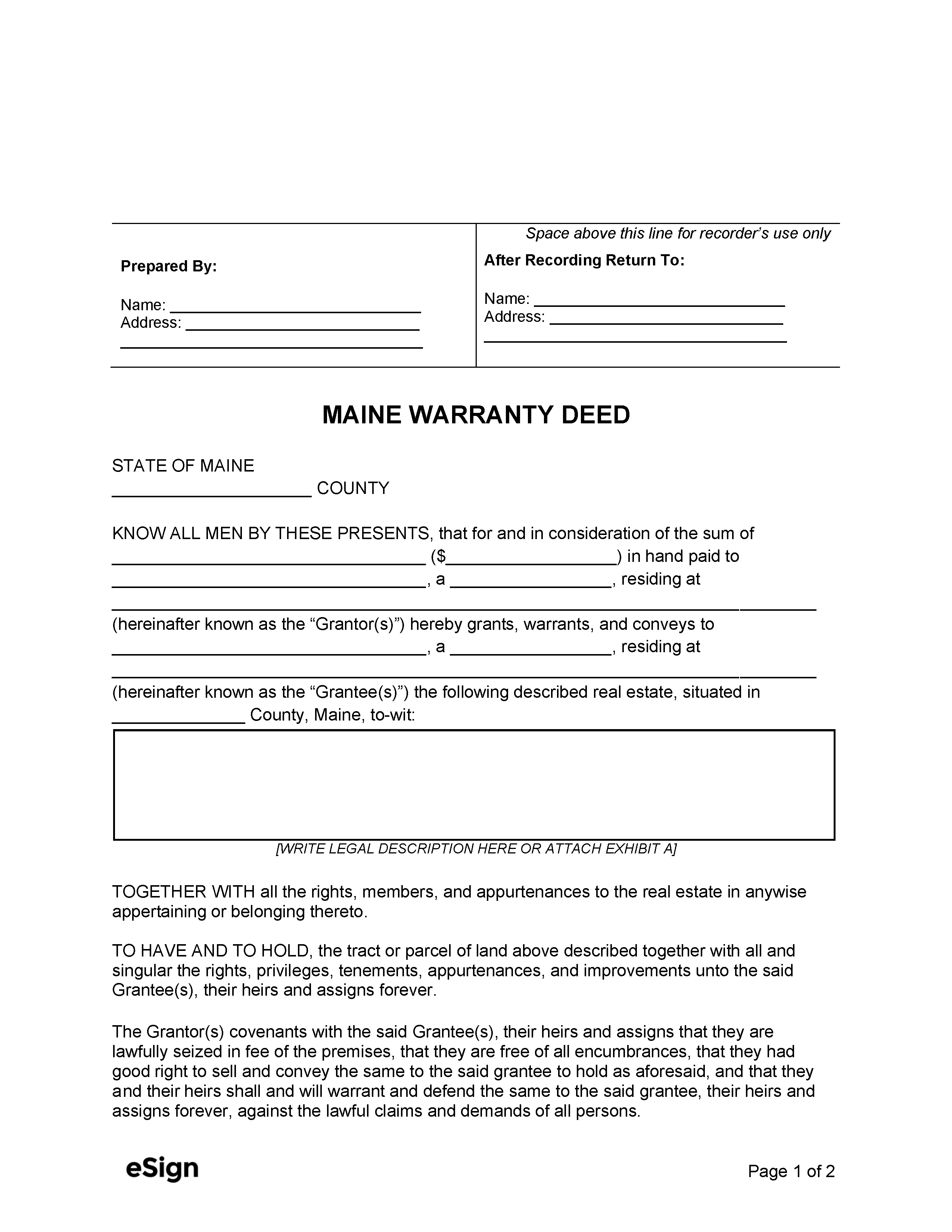

General Warranty Deed – Provides the grantee with the grantor’s promise that there are no liens or encumbrances on the title. General Warranty Deed – Provides the grantee with the grantor’s promise that there are no liens or encumbrances on the title.

|

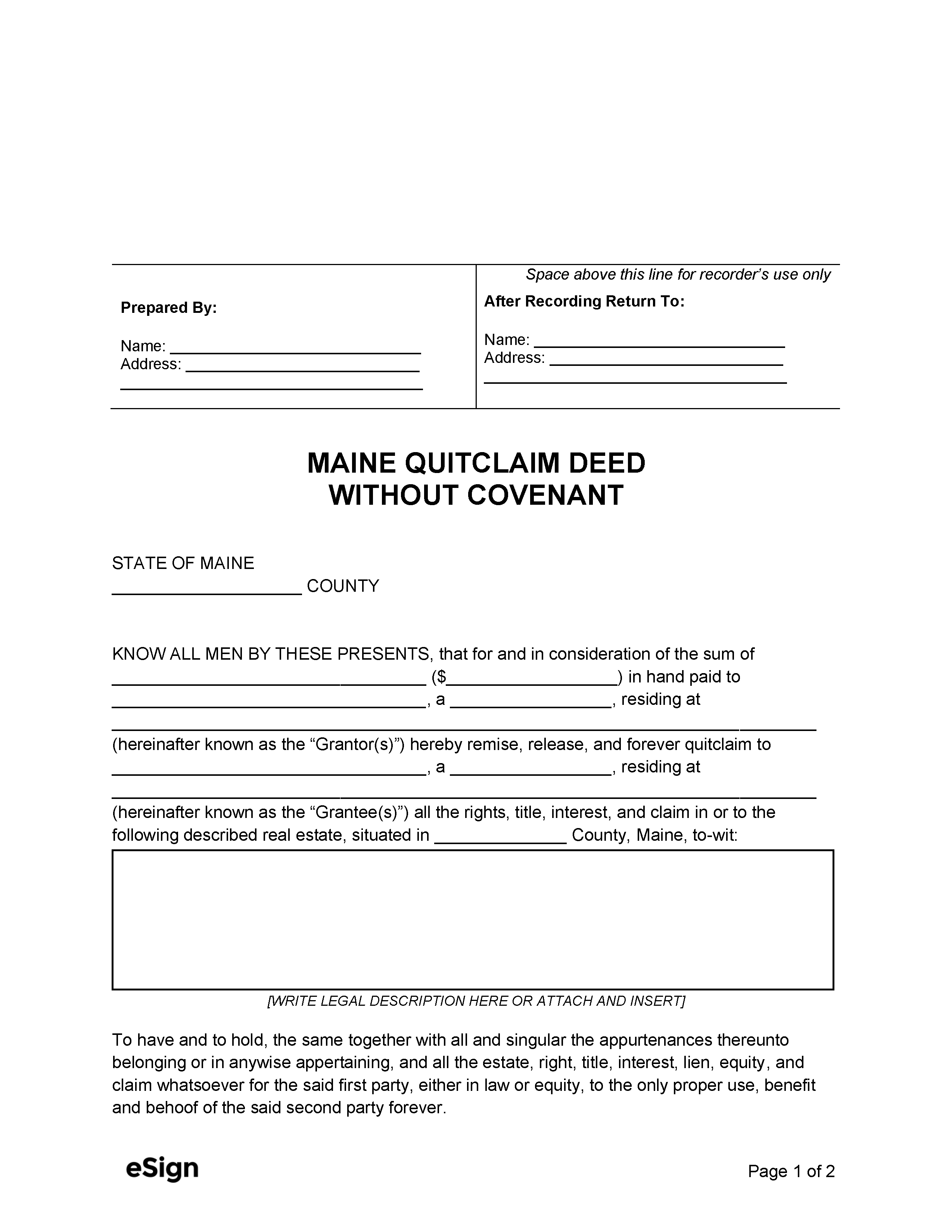

Quitclaim Deed without Covenant – A deed that doesn’t provide the grantee with any guarantee that the property title is clear. Quitclaim Deed without Covenant – A deed that doesn’t provide the grantee with any guarantee that the property title is clear.

|

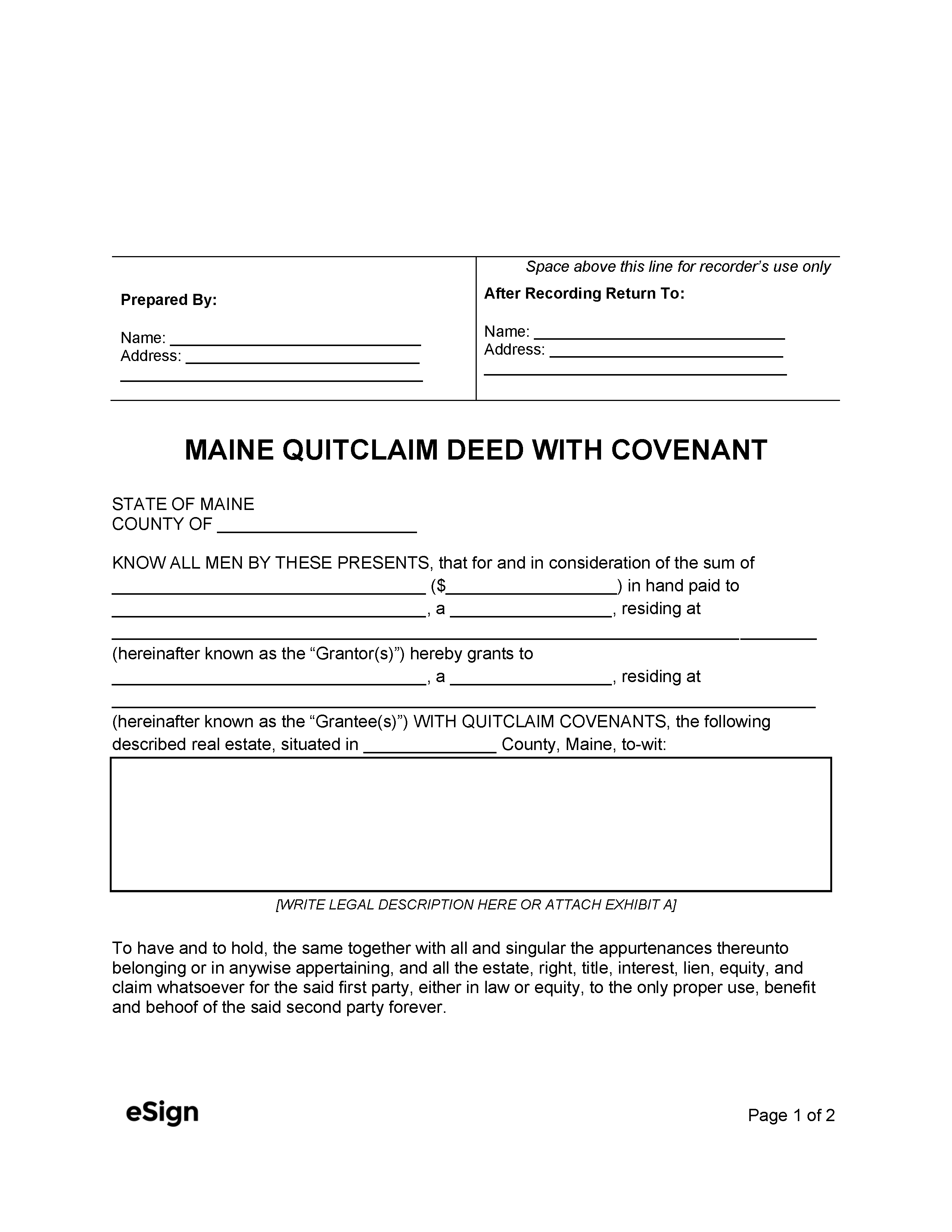

Quitclaim Deed with Covenant – Assures the grantee that no liens or claims were caused during the grantor’s ownership. Quitclaim Deed with Covenant – Assures the grantee that no liens or claims were caused during the grantor’s ownership.

|

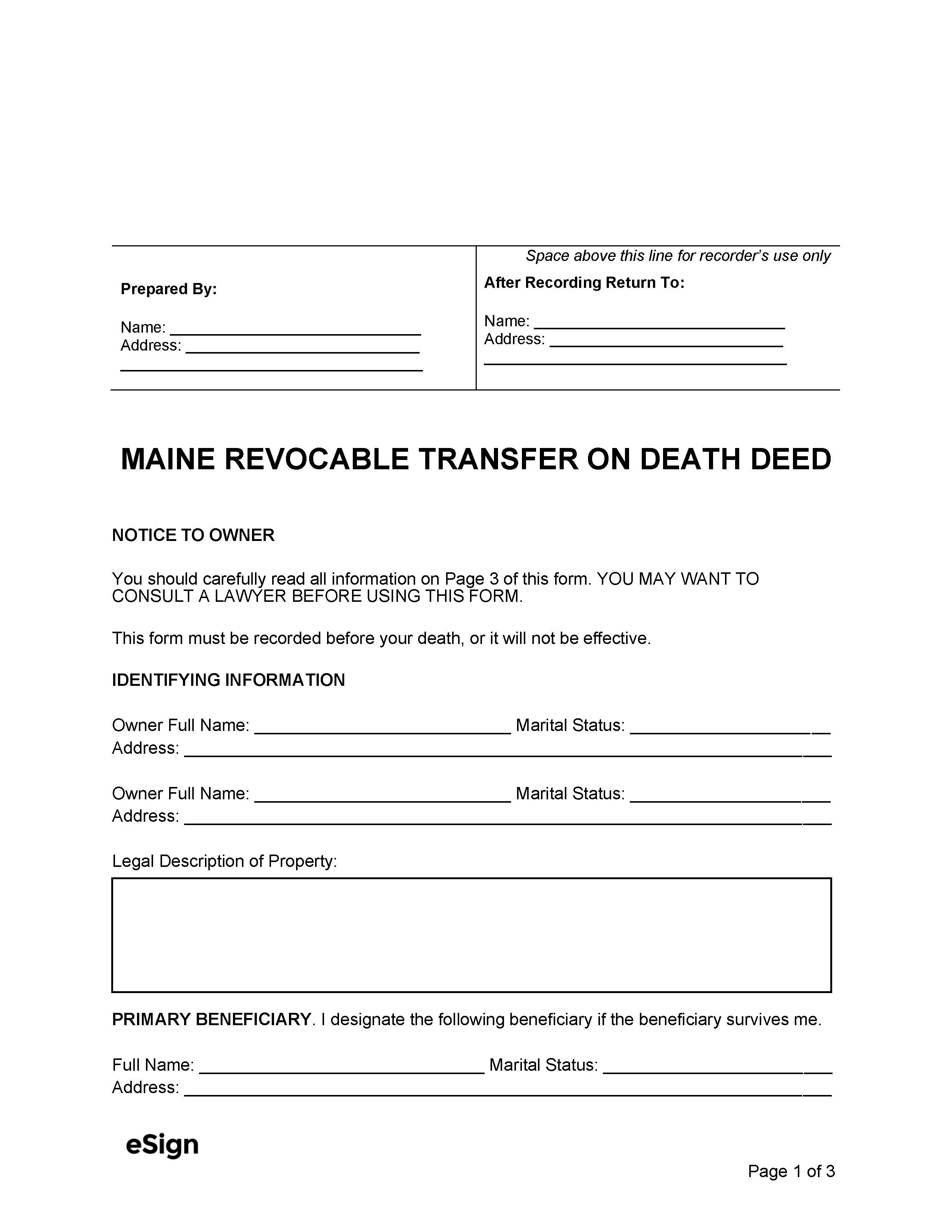

Transfer on Death Deed – Used to arrange for a property title to be transferred to a beneficiary at the time of the owner’s death. Transfer on Death Deed – Used to arrange for a property title to be transferred to a beneficiary at the time of the owner’s death.

|

Formatting

Paper – Max dimensions of between 8.5” x 11” – 8.5” x 14”

Margins – Deeds must have the following margins:

- 1.75″ first page top margin

- 1″ top margin on all other pages

- 1.5″ last page bottom margin

- All other margins: 0.75”

Font – At least 10pt[1]

Recording

Signing Requirements – The grantor’s signature must be signed and acknowledged before a notary public.[2]

Where to Record – Once a deed has been signed by the grantor, it must be recorded at the Registry of Deeds in the property’s jurisdiction.[3]

Cost – $22 for the first page and $2 for each additional page (as of this writing)[4]

Additional Forms

Real Estate Transfer Tax Declaration (Online Form): Must be filed along with the transfer tax payment and deed unless the transfer is exempt.[5]